The Hong Kong dollar remains strong against the US dollarThe Hong Kong dollar has endured a lot in the last year, yet it remains strong against the US dollar. However, the pair is expected to slightly rebound in the foreign exchange market as the Hong Kong dollar feels the pressure. Looking at the chart, the pair is widely bearish considering that the 50-day moving average remains significantly lower than the 200-day moving average. However, it’s worth noting that the HKD is pegged to the USD with the Hong Kong Monetary Authority maintaining it at its target rate. The Hong Kong dollar is also affected by the suffering US economy, which is currently facing its greatest economic crisis. To make matters even worse for Hong Kong, its economy might enter a tougher recession than prior projections. Hong Kong’s Finance Chief recently warned that the country’s gross domestic product for the first quarter could contract by 4% to 7% this year thanks to the ongoing coronavirus pandemic.

USDHKD

U.S. DOLLAR / HONG KONG DOLLAR (USDHKD) DailyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

U.S. DOLLAR / HONG KONG DOLLAR (USDHKD) WeeklyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

U.S. DOLLAR / HONG KONG DOLLAR (USDHKD) MonthlyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

The US dollar has slipped largely against the Hong Kong dollarThe US dollar has also slipped largely against the Hong Kong dollar, with the buck barely taking back its losses to the Asian currency amid the health crisis. The exchange rate has fallen to record lows as the buck loses its shimmer against the HKD. The Hong Kong dollar’s strength is largely due to the fact that the US central bank has slashed key interest rates to zero. The strengthening also follows the Hong Kong Monetary Authority’s decision last week to cut its base rate by 64 basis points to 0.86%, which is comparatively less aggressive than the Fed’s 100-point cut. And because of the gap, the higher-yielding Hong Kong dollar assets are more attractive for investors. In the past month, traders have been buying the US dollar to buy the Hong Kong dollar, making it among the most profitable carry trade in the realm of the forex market. There’s also higher liquidity for the HK currency, with banks hoarding cash for quarterly regulatory checks.

USDHKD Potential Bullish MovementUSDHKD Potential Bullish Movement

we are waiting for a momentum candle close above 7.760 to buy this one

Reason:

1- Regular Bullish Divergence on MACD (in red)

2- Objective Wedge (in blue)

3- Support / Demand Zone from Daily (in purple)

Three confluences are enough to consider Buying USDHKD, after a break below 7.760 (in gray)

USD/HKD will bounce back from a major support lineThe pair will bounce back from a major support line, sending the pair higher towards a major resistance line. Hong Kong’s gross domestic product (GDP) for the fourth quarter will continue to plunge. This was amid the continuous protest in the city and fears of coronavirus outbreak in the special administrative region (SAR). Since October 2019, the country’s GDP was on the negative territory. The SAR finally entered recession in November after two (2) consecutive negative GDP results. The negative growth will likely continue as Hong Kong faces another problem. The coronavirus outbreak in Wuhan, China has led to a mass migration from mainland China to Hong Kong. Chief Executive Carrie Lam rejects calls for her government to close border with China. This was despite major economies like the US and Australia closing their borders to any arrivals from mainland China. This will further put pressure on the already embattled country.

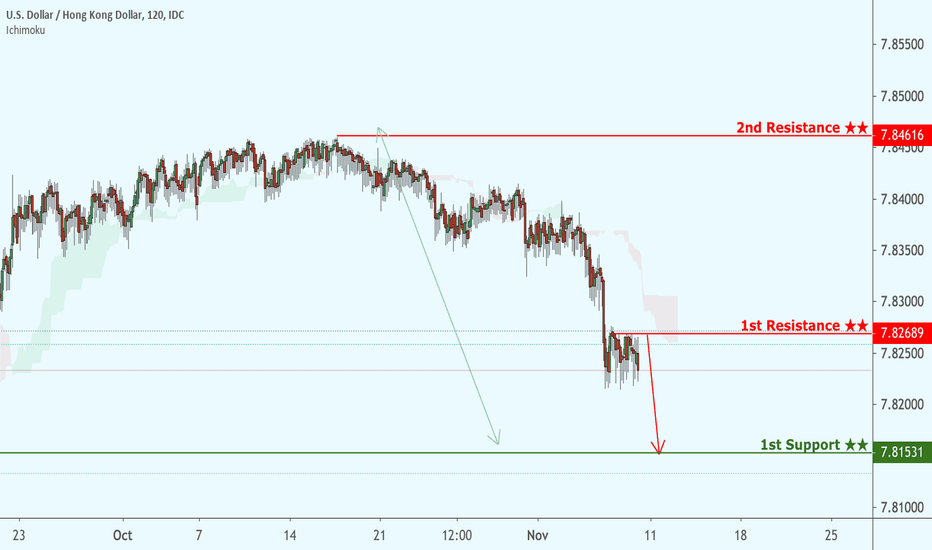

USDHKD: Best sell opportunity.The pair is trading near the 7.85000 1M Resistance which has been rejecting every upside break out attempt since April 2018. The RSI on 1D, 1W, 1M is surprisingly stable around 55.000 and last time that pattern formed on 1D a strong selling sequence followed. We are bearish on USDHKD aiming primarily at the 7.81700 1D Support.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Hong Kong Dollar Showing ExhaustionUSDHKD looks good on both the 4 and 2 hour charts.

We have had an uptrend with higher lows and higher highs and then we stopped making new higher highs. This range and even double top here shows us the trend may be exhausting.

From here, we need to see a break and close below 7.8360 zone. First target would be 7.8300 zone.

Also want to share some information from hedge fund manager Kyle Bass. He has come out saying in a recent interview that he still expects things in Hong Kong to get worse. He used the term "bloody".

October 1st is the Communist Partys 70th anniversary. Big celebrations planned. Military parade too of course.

Kyle Bass has said that the CCP cannot afford to have protests in Hong Kong for this celebration. He has said that he thinks the CCP will do something about it. Let us see what happens in the next 24 hours.

USDHKD Short/Sell IdeaUSDHKD Short/Sell Idea

waiting for a momentum candle close below 7.8325 to sell this one

Reason:

1- Regular Bearish Divergence on MACD (in red)

2- Ascending Triangle (in blue)

3- Resistance/Supply zone from Daily/H4 (in blue)

Three confluences are enough to consider Selling USDHKD, after a break below 7.8325 (in gray)

US and China make back room deal on Hong Kong?Just want to update on the USDHKD peg idea I spoke about awhile back. A bit controversial I know, but I gave reasons on why this is likely to happen. Hong Kong does not have the US Dollars to maintain the peg. The PLA marching into Honk Kong may be what breaks the peg.

Looking at the chart, you can see where the buyers are stepping in. We are seeing buyers at the 7.83500 zone indicated by the long wicks. Buyers are still there. Just this analysis indicates that perhaps we will be seeing this break of the Peg.

I am hearing from sources that there has been a deal between the US and China behind the scenes. That the CCP will allow President Trump to sell the trade war as a minor victory for the US...meanwhile the Americans will give the CCP a carte blanche when it comes to what they do in Hong Kong. If they decide to send in the army, the US will look away. This is what I am hearing.

The 4 hour chart can also give us a short signal if we do break below the mentioned zone. We have had a nice uptrend, and now a range displaying 2/3 market structures.

On a side note, I just watched the documentary "Banksters" on Amazon Prime which is about HSBC , Hong Kong and China. It really explains what is REALLY going on in Hong Kong currently.

There was a twitter rumour that was substantiated by many solid minds including Kyle Bass, about the PBoC needing to borrow money from HSBC to maintain the Yuan where it is at. The HSBC President was fired and other high up executives were fired. Rumours have it that the CCP will look to control HSBC ...the documentary gives evidence about this already happening in 2017.

Hong Kong to break US Dollar Peg?What a week so far. This week we saw the USDCNH break above the 7.00 level, something I have mentioned in my posts for Bitcoin strength.

China has said this was normal, due to tariffs and fundamental reasons, while President Trump and the US Treasury think it is an act of currency manipulation.

I have spoken about the US and China trade war on my blog. China is in it for the long game. They will be patient for a weaker US President from the Democrat side. They know the US stock markets are President Trump's Achilles Heel. He needs them up to win re-election ('Keeping America Great"). If markets continue to tumble it will be President Trump who is forced to the trade table to take a China dictated deal. China does not need to worry about elections.

So as the Yuan devalues, Chinese money is running into Gold and Bitcoin as mentioned in my previous posts. All governments are devaluing their currencies. New Zealand just cut rates 50 basis points yesterday!

Mainland China has been coming down hard on Hong Kong, attempting to get rid of the British Law. This is a way to stop money leaving from China (generally money from mainland goes to Hong Kong and then from there to Australia or Canada etc) and was also a way for China to get away from tariffs by shipping from Hong Kong (not under tariffs).

Hong Kong is in trouble. It is the most expensive city in the world with a large real estate bubble and there are some credit and debt problems there now.

If you listen to Kyle Bass, he has said that Hong Kong has used 80% of their US Dollar reserves to maintain the peg under 7.85. Will this peg be broken? Many think so. They are running out of US Dollars and not in the best position to buy more Dollars.

If the Chinese army does march into Hong Kong, which is probable, expect the HKD peg to break. Probably will peg to the Yuan. As Kyle Bass has said, shorting Hong Kong is the best play right now. Many hedge fund managers have spoken on this as well. Shorting the Hang Seng and the Hong Kong Dollar are ways to play this trade.

Why will China march into Hong Kong? If the people are up in arms due to Yuan devaluation, and the Chinese Communist Party feels threatened, they will go to war. The CCP will not give up control over China. War is the best way to unify the people and also blame others for domestic problems. When all else fails, they take you to war.

When this peg breaks, I expect MORE Hong Kong money to run into Bitcoin and Gold and Silver. So I am still bullish on Bitcoin but remember, as discussed previously, it is all about CHINESE MONEY.