U.S. DOLLAR / HONG KONG DOLLAR (USDHKD) DailyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

Usdhkdshort

U.S. DOLLAR / HONG KONG DOLLAR (USDHKD) WeeklyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

U.S. DOLLAR / HONG KONG DOLLAR (USDHKD) MonthlyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

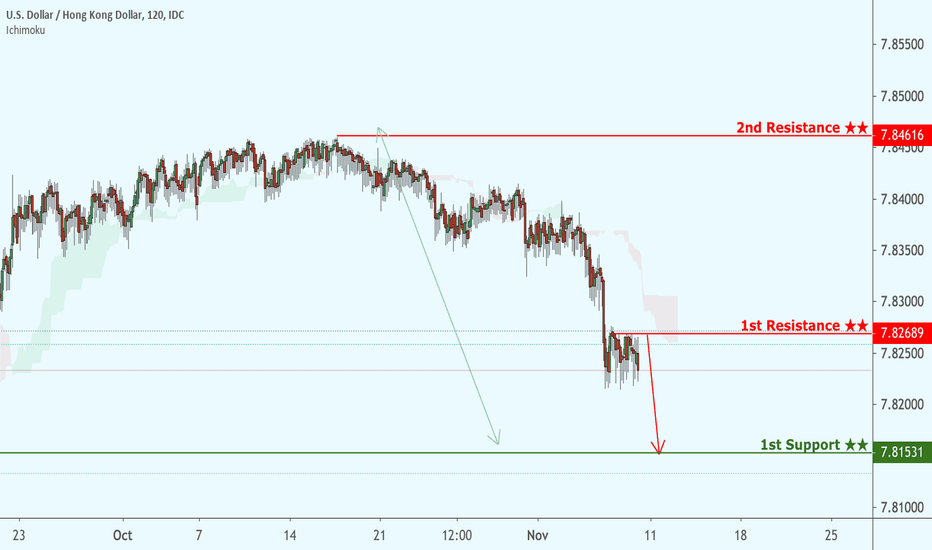

USDHKD formed a bearish BAT pattern | A good short opportunityPriceline of US Dollar / Hong Kong Dollar forex pair has formed a bearish BAT pattern and entered in potential reversal zone.

MACD turned weak bullish from strong bullish.

Stochastic has given bear cross.

I have used Fibonacci sequence to set the targets.

The long position can be taken between 0.382 to 0.786 Fibonacci projection of A to D leg coz we have a strong support of 200 SMA withing that zone however soon i will post a buy back plan soon insha Allah.

Sell between: 7.83560 to 7.84230

Enjoy your profits and regards,

Atif Akbar (moon333)

Only One Way To GoThe Value of this currency pair is at an all-time high. A level that has never been breached and exhibits an unnaturally potent downward force on price. Buying at this level would most likely turn out to be a giant mistake. As such, selling is the only option. Wait for RSI crossover and place stop above resistance. If this coincides with spring equinox then a drastic move could occur.

[Signal] USDHKD: Low-Risk Opportunity Arises AgainUSDHKD

Timeframe: 1D

Direction: Short

Confluences for Trade:

- Pegged currency @ 7.85

- Stochastic Overbought momentum

- Price action at Horizontal Resistance Trendline (Central Bank defends at this level)

- The opportunity appears again similarly to our previous USDHKD trade; minimal risk involved)

Suggested Trade:

Entry @ Area of Interest 7.8450 - 7.8500

SL: 7.8572

TP1: 7.8350

TP2: 7.8210

RR: Approx. 2.72 (Depending on Entry Level)

May the pips move in our favor! Good luck! :D

*This trade suggestion is provided on an advisory basis. Any trade decisions made based on this suggestion is a personal decision and we are not responsible for any losses derived from it.

USDHKD (1D): Take Advantage of the PegUSDHKD

Timeframe: 1D

Direction: Short

Confluences for Trade:

- Pegged currency, strongly defended at 7.85 (Limited risk; any break above the 7.85 levels is gonna be a crisis issue)

- Stochastic Overbought momentum

- Not directly related but Double Top Resistance for the DXY, helps support the drop in USD strength

Suggested Trade:

Entry @ Area of Interest 7.8365 - 7.8499

SL: 7.8573

TP: 7.7935

RR: Approx. 2.91 (Depending on Entry Level)

May the pips move in our favor! Good luck! :D

*This trade suggestion is provided on an advisory basis. Any trade decisions made based on this suggestion is a personal decision and we are not responsible for any losses derived from it.