DXY Eyes Breakout – Dollar Strength Gaining GroundThe U.S. Dollar Index (DXY) is testing its 50-day moving average on the daily chart, with bulls eyeing a potential breakout. A move above 98.75 could confirm a short-term trend reversal and open the path for further gains.

Stronger-than-expected U.S. economic data continues to support the greenback. Recent inflation prints, job market resilience, and solid retail spending have pushed back expectations for imminent Fed rate cuts. This shift in rate outlook provides fundamental support for the dollar.

In addition, strong U.S. corporate earnings are bolstering equity markets, attracting capital flows into U.S. assets and indirectly supporting dollar demand. Rising Treasury yields, especially on the short end, also offer more attractive returns for dollar-based investments.

Geopolitical uncertainties and trade tensions in Asia and Europe are prompting a rotation into the dollar as a safe-haven currency.

Meanwhile, some emerging market currencies are under pressure, increasing global demand for dollar liquidity.

Technically, a close above 98.75 could confirm bullish momentum, with 99.80 as the next upside target. As long as macro and risk dynamics lean in the dollar’s favor, DXY may continue its rebound from recent lows.

Usdindex

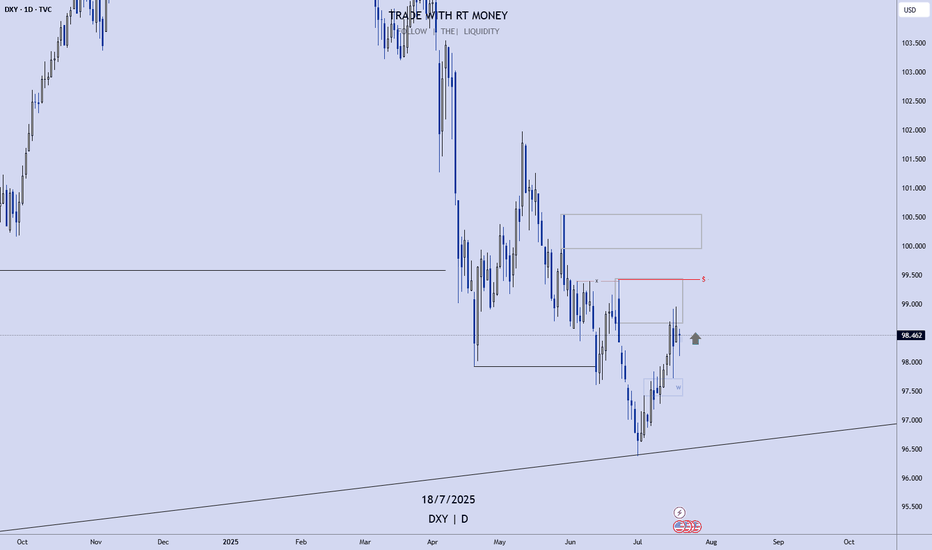

USD Is Still Bullish! Wait For Buys!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

USD

The DXY has run bullish last week, up into an area of Supply, where the momentum hesitates now. Next week may pull back a bit... before continuing higher to the buy side liquidity.

Look out for the short term pullback to the W +FVG for a high probability move higher!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

DXY Weekly Update — July 14, 2025⌛ Timeframe:

.

📆 Analysis Date: July 14, 2025

.

🎯 Weekly Bias: Bearish-to-Neutral (Potential for retracement or reversal)

🔎 Market Overview:

⬇️ Persistent USD Weakness:

DXY has dropped nearly 10% YTD, marking the steepest half-year decline since 1986.

📉 Rate Cut Expectations:

Markets are pricing in a potential 75bps rate cut by the Fed in H2 2025, pushing yields and the dollar lower.

📦 Trade War Fears:

Renewed tariff risks (targeting EU, Japan, Mexico, South Korea) aren't boosting demand for USD — a signal of lost safe-haven appeal.

⚖️ Central Bank Diversification:

Global reserve managers are rotating into gold and away from USD, weakening long-term structural demand.

🌀 Sentiment & Risk Appetite:

💸 Liquidity Demand is Soft:

DXY is retesting a 4H fair value gap (97.10–97.30), suggesting potential short-term consolidation or correction.

🌍 Risk-On Mood Returns:

According to Goldman Sachs, the USD is trading more like a "risk asset" than a haven, aligning with rising equity appetite.

📉 Technical Landscape:

🟠 4H Structure:

If DXY breaks below 97.00, next support lies at 96.37, followed by 95.50–96.00.

Consolidation expected if price remains within the FVG.

🔻 Key Resistance:

97.70–98.20 zone. A break above this area could change the tone to bullish.

📌 Summary:

🔷 Fundamentals show long-term dollar weakening (rates, trade tension, reserve shifts)

🔷 Sentiment aligns with risk-on appetite and reduced USD demand

🔷 Technicals at critical level; break below 97.00 opens room for correction, break above 97.70 shifts bias bullish

.

.

.

.

🟠 Bias: Bearish to Neutral

Watch Levels: 97.00 support, 97.70–98.20 resistance

⚠️ Note: This analysis is for educational purposes only and is not financial advice. Always apply risk management.

✅ If you like this analysis, don't forget to like 👍, follow 🧠, and share your thoughts below 💬!

Tariff Wars Pushing USD HigherThis is the Weekly FOREX Forecast for the week of July 14 - 18th.

In this video, we will analyze the following FX market: USD Index

The latest headlines tell the story. The tariffs are triggering a slow run to the USD safe haven, but the inflows from investors are moving the needle. The previous week closed strong, with buyers in control. There's a good chance we'll see more of the same this coming week.

Look for the strength in USD to continue to be supported by fundamental news, and outperform the other major currencies.

Buy USDxxx

Sell xxxUSD

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

DXY Tests Key Support – What’s Next for the Dollar?

The U.S. Dollar Index (DXY), which tracks the dollar’s performance against a basket of major currencies, recently broke below its 50-month moving average based on the monthly chart —a significant technical signal. After this drop, the index is now bouncing off a key support zone near 96.50.

This area has acted as a pivot point in past cycles, and a sustained bounce could indicate the dollar regaining strength. If risk sentiment fades—due to weaker equity markets, geopolitical tensions, or stronger U.S. data—the dollar might find new momentum.

On the flip side, failure to hold 96.50 could open the door toward the 90.00 zone, a major long-term support level. Such a move would likely reflect expectations of looser U.S. monetary policy or further deterioration in economic confidence.

For now, price action near 96.50 will be decisive. A rebound could shift sentiment back in favor of the dollar, while a deeper decline may trigger broader adjustments in FX markets. Traders should closely monitor upcoming macro data and risk sentiment for cues on the next leg.

U.S. Dollar Index (DXY) Weekly 2025Summary:

The U.S. Dollar Index (DXY) has corrected down to the key 38.60% Fibonacci retracement zone and is currently showing signs of a potential bullish reversal, bolstered by a clear hidden bullish divergence on the MACD. This may signal a renewed rally toward key upside targets, especially if the 93.3–99.9 support Zone holds.

Chart Context:

Current Price: 98.864

Key Fib Support: 38.60% @ 99.906, 48.60% @ 93.310, 61.80% @ 87.476

Support Zone: 93.3–99.9 USD

Hidden Bullish Divergence: Observed both in 2021 and now again in 2025 on the MACD

Trendline Support: Long-term ascending trendline holding since 2011

Fib Extension Targets (Trend-Based):

TP1: 115.000

TP2: 120.000

TP3: 126.666

Key Technical Observations:

Fibonacci Confluence: DXY is bouncing from a strong Fib cluster between 93.310 and 99.906, historically acting as a reversal zone.

Hidden Bullish Divergence: Suggests potential upside despite price weakness.

Downtrend Retest: Price may revisit 93.3–87.4 before confirming full reversal.

Breakout Pathway: Green dashed arrows outline the likely recovery trajectory toward 114–126 range.

Indicators:

MACD: Showing hidden bullish divergence and potential signal crossover.

Trendline Support: Holding intact from 2021 low.

Fib Levels: Used for retracement and trend-based extension.

Fundamental Context:

Interest Rate Outlook: If U.S. inflation remains controlled and Fed signals future hikes or sustained high rates, DXY strength may persist.

Global Liquidity & Recession Risk: If risk aversion returns, the dollar may rise as a safe haven.

Geopolitical Risks: Conflicts, trade tensions, or BRICS dedollarization efforts may create volatility.

Our Recent research suggests the Fed may maintain higher-for-longer rates due to resilient labor markets and sticky core inflation. This supports bullish USD bias unless macro shifts rapidly.

Why DXY Could Continue Strengthening:

Robust U.S. economic performance & monetary policy divergence

U.S. GDP growth (~2.7% in 2024) outpaces developed peers (~1.7%), supporting stronger USD

The Fed maintains restrictive rates (4.25–4.50%), while the ECB pivots to easing, widening the policy and yield gap .

Inflation resilience and Fed hawkishness

Labor markets remain tight, keeping inflation “sticky” and delaying expected rate cuts; market-implied cuts for 2025 have been pushed into 2026

Fed officials (e.g. Kugler) emphasize ongoing tariff-driven inflation, suggesting rates will stay elevated.

Safe-haven and yield-seeking capital flows

With global risks, capital favors USD-denominated assets for yield and stability

Why the Dollar Might Face Headwinds

Fiscal expansion & trade uncertainty

Ballooning U.S. deficits (~$3.3 trn new debt) and erratic tariff policy undermine confidence in USD

Wall Street’s consensus bearish position.

Major banks largely expect a weaker dollar through 2025–26. However, this crowded bearish sentiment poses a risk of a sharp rebound if data surprises occur

barons

Tariff policy risks

Trump's new tariffs could dampen dollar demand—yet if perceived as fiscal stimulus, they could unexpectedly buoy the USD .

Synthesis for Our Biases

A bullish DXY thesis is well-supported by:

Economic and policy divergence (U.S. growth + Fed vs. peers).

Hawkish Fed commentary and sticky inflation.

Safe-haven capital inflows.

Conversely, risks include:

Deteriorating fiscal/trade dynamics.

Potential Fed pivot once inflation shows clear decline.

A consensus that could trigger a short squeeze or reversal if overstretched.

Philosophical / Narrative View:

The dollar remains the world’s dominant reserve currency. Periodic dips often act as strategic re-accumulation phases for institutional capital—especially during global macro uncertainty. A return toward 120+ reflects this persistent demand for USD liquidity and safety.

Bias & Strategy Implication:

1. Primary Bias: Bullish, contingent on support at 93.3–99.9 holding.

2. Risk Scenario: Breakdown below 93.3 invalidates bullish thesis and targets 87.4–80 zones.

Impact on Crypto & Gold and its Correlation and Scenarios:

Historically, DXY has had an inverse correlation to both gold and crypto markets. When DXY strengthens, liquidity tends to rotate into dollar-denominated assets and away from risk-on trades like crypto and gold. When DXY weakens, it typically acts as a tailwind for both Bitcoin and gold.

Correlation Coefficients:

DXY vs. Gold: ≈ -0.85 (strong inverse correlation)

DXY vs. TOTAL (crypto market cap): ≈ -0.72 (moderate to strong inverse correlation)

Scenario 1: DXY Rallies toward 115–126 then, Expect gold to correct or stagnate, especially if yields rise. Crypto likely to pull back or remain suppressed unless specific bullish catalysts emerge (e.g., ETF flows or tech adoption).

Scenario 2: DXY ranges between 93–105 then Gold may consolidate or form bullish continuation patterns. Then Crypto may see selective strength, particularly altcoins, if BTC.D declines.

Scenario 3: DXY falls below 93 and toward 87 Then Gold likely to rally, possibly challenging all-time highs. Crypto could enter a major bull run, led by Bitcoin and followed by altcoins, fueled by increased liquidity and lower opportunity cost of holding non-USD assets.

Understanding DXY’s direction provides valuable insight for portfolio positioning in macro-sensitive assets.

Notes & Disclaimers:

This analysis reflects a technical interpretation of the DXY index and is not financial advice. Market conditions may change based on unexpected macroeconomic events, Fed policy, or geopolitical developments.

A Contrarian View On the US DollarI don't recall the last bullish headline I saw for the US dollar, bearish sentiment may be stretched, and I'm seeing plenty of clues across the US dollar index and all FX majors that we could at least be looking at a minor bounce. Whether it can turn into a larger short-covering rally is likely down to Trump's trade deals. Either way, I'm, on guard for an inflection point for the dollar.

Matt Simpson, Market Analyst at City Index and Forex.com

Mid-Week FOREX Forecast: Will The USD Remain Weak?In this video, we will update Sunday's forecasts mid-week, and look for valid setup for the rest of the week ahead. The following FX markets will be analyzed:

In this video, we will analyze the following FX Majors markets:

USD Index

EUR

GBP

AUD

NZD

CAD

CHF

JPY

The expected short term bearishness in the USD came, but will it continue for the rest of the week? Wait patiently for the market to tip its hand, and trade accordingly. Have a plan in place if the protected low at 99.172 holds or folds.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

STRAP IN FOR A TURBULENT WEEK DXY- USD INDEX FORECAST Q2 W21 Y25DXY USD INDEX FORECAST Q2 W21 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

✅ U.S. dollar index is a measure of the value of the dollar against a basket of six foreign currencies.

✅The currencies are the Euro, Swiss franc, Japanese yen, Canadian dollar, British pound, and Swedish krona.

💡Here are some trade confluences📝

✅ Break an d close below July 2023 key 100.00 levels.

✅ Foresee a pull back to, weekly imbalance, daily order block, daily 50ema, weekly order block and or weekly 50 ema.

✅ Awaiting to identify a significant break of structure bullish to use the DXY as confluence for our trading week 18 of Q2 toward key points of interest mentioned above.

✅ Forecasting continued bearish pressure long term.

✅Initially bullish outlook however upon price turn around. DXY to break 100.000 level again.

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

Pairs to look out for -

EURUSD

USDCHF

USDJPY

USDCAD

GBPUSD

Simply an opinion -

We always trade what we see and not what were think BUT, with that said it just feels... Unnatural to place too many bets against the USD. For that reason, our points of interest are not based on order black from too far in the distant weeks and month. We have identified more conservative targets for the DXY for the week 21 in Q2.

We foresee that with the deals that have been brokered alongside the steadiness of USD market sentiment, THE DXY MAY RISE AGAIN.

We forecast continued bearish sentiment of the DXY to the key points of interest area 98.000, weekly lows/daily lows BEFORE creating a monthly higher high inline with USD strength and Trumps seeks to sure up US ambitions.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

DXY Ready to Pop – Watch That 100 Break!After breaking below the key psychological level at 100 and making a low just under 98, the Dollar Index ( TVC:DXY ) has entered a consolidation phase.

Over the past three weeks, price has developed an inverted head and shoulders pattern, with the neckline perfectly aligning with the horizontal resistance at 100 — a strong zone of confluence from both a technical and psychological standpoint.

Despite the current hesitation under resistance, the structure suggests bullish potential. I believe we are approaching a breakout above 100, and once that happens, an acceleration to the upside is likely to follow.

🎯 Target: 102

🔒 Invalidation: A break below 98 would cancel the bullish bias.

As long as the price stays above the 98 area, I remain bullish and expect the dollar to strengthen.

🚀 The breakout hasn’t happened yet — but the pressure is building.

Look To Sell USD and Buy EUR, GBP, NZD and AUD!This is the FOREX outlook for the week of May 5 - 9th.

In this video, we will analyze the following FX markets:

USD Index

EUR

GBP

AUD

NZD

CAD

CHF

JPY

USD Index has tapped the W -FVG. I expect it to sweep the last week's high before heading down. Short term strength for longer term weakness.

Look to buy xxxUSD pairs. Sell USDxxx pairs.

Wait for valid setups. FOMC is Wednesday! Don't just jump into trades without confirming the bias first!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

$USD Breaks Down – “Mission Accomplished” or Just Getting📉 The US Dollar Index ( AMEX:USD / TVC:DXY / $USINDEX) has officially broken beneath the multi-year support zone from 2020, right as Trump prepares to declare "Mission Accomplished".

From Inauguration to Liberation Day, and now the final stage: Meltdown.

🧭 Key Events Marked:

🟥 Inauguration

🟥 Trade War

🟥 Liberation Day

🟩 Mission Accomplished

🔻 Meltdown incoming?

📊 The breakdown aligns with a sharp spike in Nasdaq down volume (see chart). This isn't just a currency move — it's a market-wide stress signal.

Watch closely:

TVC:DXY below 99 = structural weakness.

Risk-on assets may melt up temporarily, but volatility could snap back fast.

Global currency pairs ( FX:EURUSD , FX:USDJPY , FX:GBPUSD ) are all on alert.

USD Index: A Possible Reversal in Sight?Since early February, right after Trump’s inauguration, the USD Index (DXY) has been under pressure, falling sharply by over 10%.

However, after hitting the 98.00 level, things seem to have stabilized. We're seeing the early signs of a relief rally.

🔍 Technical Perspective:

- This week’s candlestick pattern suggests a bullish reversal.

- The dip on Wednesday was quickly bought, showing buyer interest.

- A minor correction occurred yesterday, but dips are being well supported.

- Currently, the DXY trades around 99.60, just under the psychological level of 100.

🎯 Outlook:

As long as 98 remains intact, the bias shifts towards a potential rebound.

First target: 102 – a logical resistance zone and prior support.

This is not yet a confirmed trend reversal, but the price action is shifting. The key now is how the market reacts around the 100 level. A break above could trigger further bullish momentum.

Weekly FOREX Forecast: Mid-Week UPDATES! In this video, we will update Sunday's forecasts for the following FX markets:

USD Index

EURUSD

GBPUSD

AUDUSD

NZDUSD

USDCAD

USDCHF

USDJPY

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or other wise. In this video, we will update the forecasts for the following FX markets:

How low Can the Dollar Go? And What It Could Mean for EUR/USDThe US dollar index has handed back all of its Q4 gains with traders betting that Trump's trade war will do more damage than good to the US economy. I update my levels on the US dollar index and EUR/USD charts then wrap up market exposure to USD index futures.

Weekly FOREX Forecast: Wait To Buy JPY vs USD!In this video, we will analyze JPY futures and USDJPY. We'll determine the bias for the upcoming week, and look for the best potential setups.

The Yen is strong, and will outperform the USD in times of uncertainty. It is the worlds' safe haven of choice.

Look for a small retracement before JPY pushes higher.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

$DXY suffers worst day since Nov 10, 2022 – What does it mean?💵 The US Dollar Index just posted its biggest daily drop in nearly 2.5 years, crashing through the 100 level with strong volume. This breakdown signals weakness in the dollar that could have massive implications across all asset classes:

📉 Why it matters:

A weak dollar makes US exports more competitive globally, but also reflects investor fear or policy shifts.

Commodities like gold, oil, and crypto tend to rally when the dollar drops.

Could indicate a pivot in monetary policy, potential rate cuts, or macroeconomic concerns.

🧠 From a technical standpoint, this break of support could trigger further downside. The last time this happened, we saw a significant shift in risk appetite.

📊 What to watch:

Upcoming Fed statements

Inflation & jobs data

Reaction in equities and crypto

👇 Is this the start of a larger trend, or just an overreaction?

Let’s discuss!

#DXY #USD #DollarIndex #Forex #Macro #MarketUpdate #Commodities #Gold #Crypto #TradingView

Mid-Week Analysis March 27-28: USD FX Majors Stock Indices, ...In this video, we look back on the forecasts from this past weekend, and check how they are playing out to this point in the week.

USD Index, S&P500, Nasdaq ,Dow Jones, Gold, Silver, Platinum, Copper, EUR, GBP, AUD, NZD, CAD, CHF, JPY.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Weekly FOREX Forecast March 17-21: Wait to Sell USD, Buy Majors!This is an outlook for the week of Feb 17-21st.

In this video, we will analyze the following FX markets:

USD Index

EURUSD

GBPUSD

AUDUSD

NZDUSD

CAD, USDCAD

CHF, USDCHF

JPY, USDJPY

The structure on the majors is simple and obvious. USD looks to move higher in the short term, into a bearish FVG, and then continue its bearish ways. The EUR, GBP will take advantage and move higher. The AUD and NZD are in consolidation, so waiting for a breakout is the best course of action. The CHF should outperform thee USD.

Be mindful there is a lot of red folder news items coming up for the week ahead, to include FOMC on Wednesday.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

DXY Dollar Index at Key Support: Is a Major Retrace Coming? 💹📉

In this video, we dive deep into the DXY and analyze the current market conditions. 📊 At the moment, the pair is overextended and trading into a critical weekly support level. 🔄 Join me as we break down the trend, price action, and market structure, and explore a potential trade idea based on these insights. 🧠💡 Whether you're a seasoned trader or just starting out, this analysis will give you valuable perspectives on how to approach key levels in the market. ⚠️ This is not financial advice—always trade responsibly! ⚠️ Don't forget to comment, and boost my video if you find value in the content! 👍📈✨

USD | USD INDEX Weekly FOREX Forecast: March 10 - 14thIn this video, we will analyze the USD through the USD INDEX (DXY). We'll determine the bias for the upcoming week, and look for the best setups to take.

The USD is bearish, and there is plenty of economic news coming up this week. Should be plenty of opportunities from Tues through Friday.

Short term bullishness, in the form of a pullback, is potentially there. But longer term bearishness is likely to continue.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.