Monthly Chart of USDINRMonthly Chart of USDINR:

As seen from the Monthly Chart of USDINR, the currency is trading in the Rising Channel pattern since 2013 to till date.

In the month of April-2020 the currency has hit the Upper part of Channel around the levels of 76.50-77.00 and retraced.

The currency has formed a Shooting star Candlestick pattern around the resistance levels on Monthly chart.

If this pattern is to hold then we may see appreciation in the Currency.

1st Support lies around the levels of 74.00-74.50 and if it is broken then 2nd support lies around the levels of 72.00-72.50.

Resistance lies around the levels of 76.50-77.00

For educational purpose

USDINR

Buystop @ 75.310Candles appear between Middle and Upper Band

RSI above 50 Level

Trend = Upward

Here is signal

Pair USDINR

Signal Buystop

Price 75.10940

SL 74.30940

TP1 75.30940

TP2 75.50940

TP3 76.10940

USDINR sell setup to look for.last leg of corrective structure is about to form. look for sell setup while going downhill for a while.

/TC/

ridethepig | India Closing the ChapterIn this positional chart, the INR is entering back into the game, whilst USD is nearer the end and thus already well-developed. That is decisive. So the more distant EM currencies like INR actually will act as a trump card and assist in diverting flows from the king, but like all trumps we must use them sparingly: do not jump the gun is the rule. The diverting exchange of Covid flows was simply the prelude to the king (USD) marching home, which will follow in the coming weeks/months.

Indian Equities were denied the advance as anticipated, the trip towards the lows was somewhat time-consuming and the travelling companion INR was too dilatory....As the currency devalued as did local stocks...

In any case, the correct procedure is getting our companion (INR) and using it as a weapon to wield influence and thank holders for their loyalty. We should make good use of the cheap currency and the move that now follows by looking to sell the highs in USDINR for a move not too late after. The trip we are planning for should be carefully prepared before pulling the trigger, if possible make use of any overshoots in USD (remember we still have the 1.05/1.06 unlocked in EURUSD for reference on G10). All that before playing the diversionary swing!

Softer oil will help Indian significantly as the deprecation pressure on INR was starting to crack through the economic defence. India will need an appetising fiscal policy and less reluctance from the CB to intervene. These are starting to enter into play and can be a major game changer for India in the coming months.

USD/INR: Trapping both buyers and sellersUSD/INR’s daily chart shows the currency pair is trapping both buyers and sellers.

A symmetrical triangle breakout confirmed on April 21 was short-lived. On similar lines, the breakdown confirmed on Thursday ended up trapping sellers on the wrong side of the market.

Thee daily RSI is now trapped in a bearish channel.

I would buy once the RSI breaches the top end of the falling channel. That will likely power a sustained break above 77.

Alternatively, Thursday’s low of 74.93 is now the level to beat for sellers. A violation there would confirm a bearish reversal.

USDINR Trading Plan BUY - Riks Reward 1:2 Max 1:2.5USDINR Trading Plan BUY - Riks Reward 1:2 Max 1:2.5

USD/INR: Consolidating in a narrowing price rangeUSD/INR looks to have charted a pennant pattern on the daily chart. A breakout would mean a continuation of the rally from the low of 71.40 and would open the doors a re-test of 77.42. Acceptance above that level would open the doors to 80.00.

A pennant breakdown would imply a bullish-to-bearish trend change.

USDINR 5th wave Contracting diagonal on weekly chartUSDINR is on the final wave on weekly chart. Should wait for the breakout for shorting. On long time view expecting to fall down. anyway we have time for this to happen.

USDINRUDSINR CMP 75.72 spot is poised for initial leg of up move until 78/78.6. However long term target remains at 80+ Levels

The Indian rupee remains on the defensive against the US dollar As India becomes paralyzed and the situation there continues to worsen, the Indian rupee remains on the defensive against the US dollar in the market. The USD/INR pair recently reached its all-time highest as the Indian rupee fails to defend itself. Unfortunately for bearish traders, the pair is still widely expected to continue to climb in the coming sessions. Looking at the pair, it’s seen that the 50-day moving average remains significantly farther away from the 200-day moving average. The Indian rupee will remain under pressure as the damage of the coronavirus pandemic to India’s economic activities becomes more evident. Just recently, the HIS Markit India services business index dropped below the 50-mark that separates contraction from expansion. Economists believe that the worse has yet to come to the country as their lockdown there has just begun following the announcement of Narendra Modi, the Indian Prime Minister.

History of the Indian Rupee (from the 1980's to 2020)The History of the Indian Rupee from the 1980's to 2020.

This graph is relative with the other major world currencies with "yellow" indicator lines for major (historical start date) problems in the History of the Indian Currency going back to the 1980's.

The Indian Rupee is has a market-determined exchange rate. However, the RBI trades actively in the USD/INR currency market to impact effective exchange rates. Thus, the currency regime in place for the Indian rupee with respect to the US dollar is a de facto controlled exchange rate. This is sometimes called a "managed float". Other rates (such as the EUR/INR and INR/JPY) have the volatility typical of floating exchange rates, and often create persistent arbitrage opportunities against the RBI (if the USD is not stable)

Note: China is the light blue graph in this study.

USDINR Short TradeUSD/INR has broken and sustained below Ichimoku cloud in hourly charts.

Short trade can be initiated with SL @ 75.20

Tgt 74.25.

With Job less claims sky rocketing we can see dollar weakness in the coming sessions.

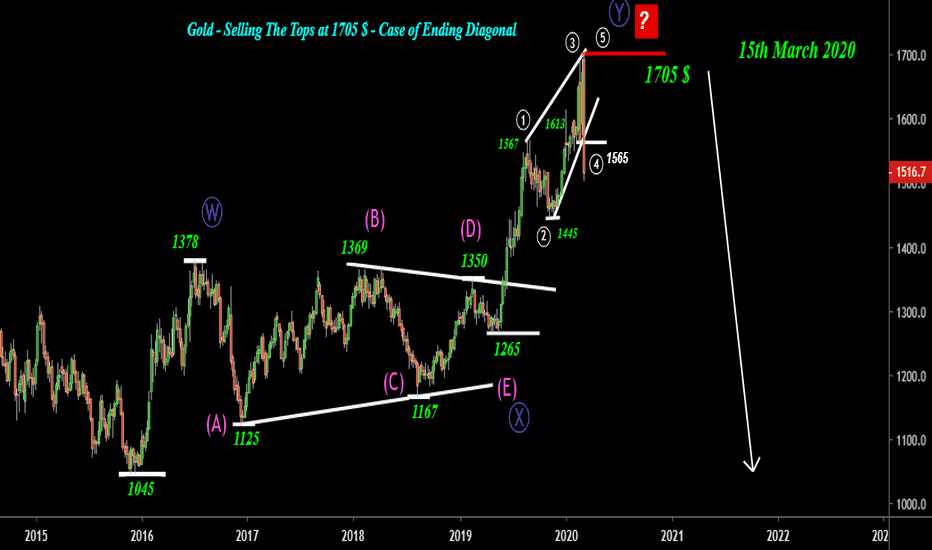

Comex Gold - Selling The Tops at 1705 $-Case of Ending DiagonalDisclaimer

-----------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Happy to get the clue straight from the yellow metal & to see it unfolding as expected on 7th March 2020 video idea which was published on Indian Version - Nifty / Gold / USDINR - The important Juncture.

Video Idea (Click the Idea Below)

------------------------------

Long Term Outlook

-------------------------------

A possible case of Ending Diagonal which suggest that the rally which started from 1045$ to 1705$ has completed & we look for downside Targets - 1045$ / 900$ / 750$

Short Term Outlook

Wait for some bounce above 1500$ in the zone 1590 - 1625$ zone - If you see the commodity getting rejected in the suggested zone then putting stops above 1635$ could be an opportunity for selling the commodity for

Targets - 1500$ / 1445$

Thanks for watching the video & stay classy till next idea.