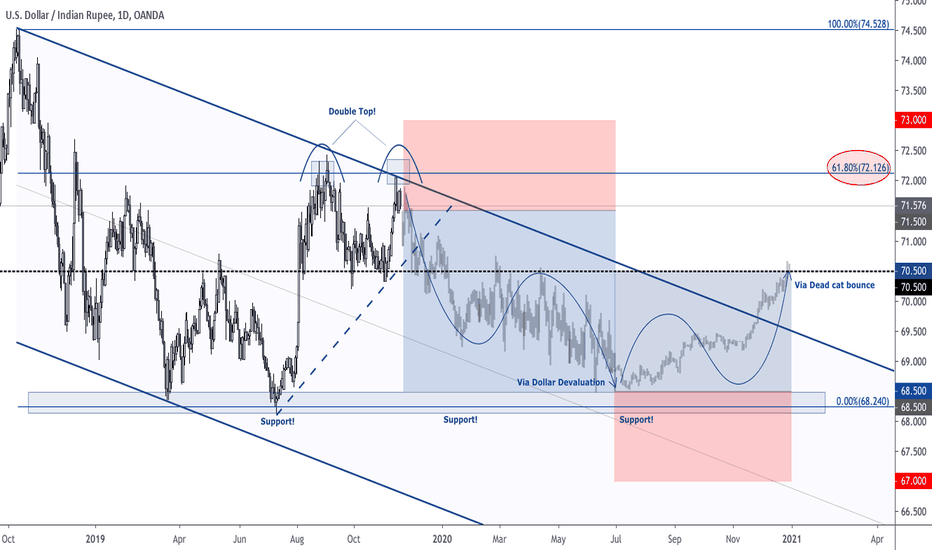

#USDINR | Double TopPlease support this idea with LIKE if you find it useful.

Price was rejected by the horizontal resistance which gives us a Double Top pattern, also we have an RSI is in an overbought zone. The price can retest the previous resistance of the Channel (currently support), so we can initiate a short position with a stop-loss above horizontal resistance

Thank you for reading this idea! Hope it's been useful to you and some of us will turn it into profitable.

Remember this analysis is not 100% accurate. No single analysis is. To make a decision follow your own thoughts.

The information given is not a Financial Advice.

USDINR

USDINR - CAN WE SEE INR TO APPRECIATE TO 40 IN NEXT 2 YEARSUSDINR - SELL @ 76 WITH A SL OF 80 AND A TARGET OF 40. TARGET SHOULD BE ACHIEVED IN NEXT 2 YEARS.

USDINR - GO SHORT FOR A GOOD RRUSDINR - SELL @ CMP WITH A SL OF 73.9 AND A TARGET OF 71.6. TARGET SHOULD BE ACHIEVED BY 6 MARCH

USD breakouts out against the Indian RupeeAn inverted H&S pattern has been completed. The target is 76.50

USDINR | Channel's Resistance BrokenPlease support this idea with LIKE if you find it useful.

Price broke the Channel's resistance zone. Price was trading with good volumes inside the channel, which points out it could be an accumulation. When price fixes above we can initiate a long position

Thank you for reading this idea! Hope it's been useful to you and some of us will turn it into profitable.

Remember this analysis is not 100% accurate. No single analysis is. To make a decision follow your own thoughts.

The information given is not a Financial Advice.

DOW -WaveTalks - Cracks 1900 points / Nifty - Ab tera kya hoga ?WaveTalks - DOW -Cracks 1900 points in 2 days / Nifty - Ab tera kya hoga ?

Welcome you all in the exciting update on WaveTalks !!!

As per the idea published on 12th Jan 2020 - Nifty : Stellium Effect (Stellium - Astro term)

Have Suggested Dow close to a primary top on 17th Jan 2020 & India Nifty made a top next week on 20th Jan 2020 - Looking for a fall close from 29500 which is psychological level update in later videos - just broke the channel convinced all bulls nothing is wrong & revisited - made new high above 29500 - Here's a catch !

Penultimate waves always have painful end. Time & again it has proved correctly - This time wasn't any surprise !

As usual Bulls convince themselves nothing is wrong & bears get excited but unfortunately market never listens anyone be it a bull or a bear - it just does what it likes the best!!! - Don't trade with emotions else you are calling for trouble.

Most Important clue suggested for proposed India Nifty Fall from channel top at 12350-12450 are mentioned below

DJIA - Dow Jones Industrial Average

Dollar Rupee - Expected move above 70.50 for 72.25 & above 72.50 for 74.50+

Nifty - Ab tera kya hoga ??? ( I still suggest don't be a bull neither a bear -never get excited in trades - control your emotions & trade what market tells you )

13th Jan 2020 - Dow Jones

25th Feb 2020 - Dow at 27081

10th Jan 2020 - Dollar Rupee Expected to fall on smooth talks post Geo-political tension between U.S. & Iran - meanwhile -both Global Markets & Indian markets rallied for new highs. India Nifty rallied from 11930 to 12375-12430- where caution was already suggested as channel top.

Nifty - Ab Tera Kya Hoga ???

Check the TradingView profile page for previous ideas at in.tradingview.com

Thanks for reading the update, your precious time & be careful in trading - don't listen anyone -neither bulls nor bears only practice hearing what price talks.

USDINR Price expected to rise from hereUSDINR pair is range-bound since 1 year and before a major move price expected to touche the resistance around 71.800 mark

USDINR LONG Longer term chart also indicates Long , just like short term chart.

Looking like a good setup. Wait for current triangle being formed to be broken.

Weekly Chart of USDINROn Weekly chart USDINR Currency pair is forming the Cup and Handle Pattern. 70.00-70.50 on downside and 71.75-72.25 on upside are significant levels to watch. Also it is trading near to trend-line resistance. It seems that USDINR will break out on upside.

USD/INR moves up against the downtrendThe main trend is a downtrend; however, it does not mean we cannot take a little profit in a downtrend. As it is against the steam, we put our stop tight here.

Entry: 70.5

Stop: 70.2

Final target: 71.22

Have a good week. Follow to hear more.

Large Swing In Play For USDINR in 2020Here we are tracking the 2020 macro map for USDINR, a high yielding EM currency. The expansion in volatility here will come from CB coordination, and being short USDINR which generally would also support a view for better risk appetite means it acts a great portfolio hedge for those looking for high carry.

On the INR side, macro figures are starting to indicate further upside although still stuck in low gears. The tax cuts from the fiscal side doing some of the heavy lifting thanks to Modi (India's version of Trump). Inflation is subdue with a lot more slack left in the labour market and a cheap commodity board.

Should investors see the deficit handled appropriately then all boxes are checked for capital flows into India. Demand for INR looks set to improve and combined with the USD devaluation theme it makes a great few months for INR to see some appreciation.

Risks to my thesis come from US-China protectionism, private capex not picking up (low odds after the attractive tax cuts) and to a lesser extent if RBI push the INR down by accumulating.

USDINR Long Term Technical AnalysisOANDA:USDINR

Just a simple symmetric triangle.

So the rupee is currently trading at 71.248 per 1 USD. It may go till level of around 69.5 to 70.5 levels and then shoot up to 72 and above.

But this is a very very long term strategy.

Just a learner so i may be wrong, please share any corrections or recommendations in the comment.

Thank You

Short and then long on USDINRUSDINR is looking to complete a flat pattern. The forecast has been shown.

USDINR neutral (Options Nov end expiry)Long term support at 70.40

Descending triangle being formed

Price touching the top of the triangle

If it breaks then go long or it can come back to 70.40 again

USDINR GETTING TANKED> USDINR touched the upper 100-MA and it is tumbling down which will attract new short positions.

> 70.6 seems the first target to aim at.

> downside is, if the price gets above the MA it might lose the momentum.

USD/INR: Uptrend about to resume?The USD/INR (Indian Rupee) pair triggered a bullish wedge pattern recently and entered into a consolidation.

The price is now trading near the 38.2% Fib level which aligns with a horizontal support level, signaling a potential continuation of the underlying downtrend.

Notice that the pair hasn't reached the profit target projected by the wedge pattern yet, which lies around the 73.50 level.

We are following this setup in our Telegram group and wait for a buy confirmation