Usdinrpricetrendanalysis

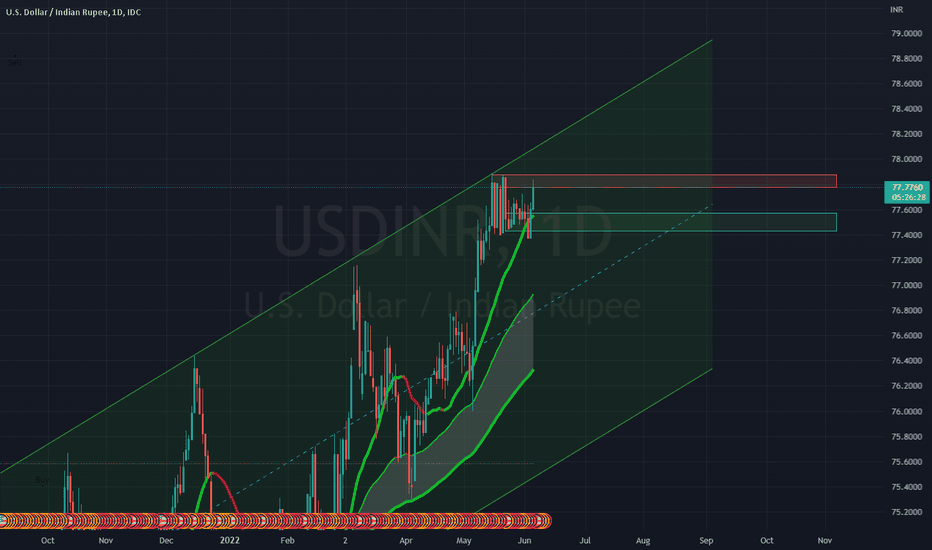

USDINR looks strong on Daily & Weekly timeframe, heading to 77.8USDINR is rising on rising sharply due rising crude oil prices this week, as European nations has said No to Russian Oil.

USDINR is looking strong and can head to levels of 77.8 where it can face huge resistance.

If USDINR manages to trade above 77.8 levels on daily and weekly timeframes, then it is heading towards 78.5 levels.

If BEARS managed to hold USDINR further upward movement or if RBI intervenes, then it can fall back to retest 77.4 levels.

P.S. Most of this movement in USDINR this week would be dependent on how CRUDE OIL performs in global markets.

USDINR looks to be good short, heading down to 77.2 levelsUSDINR has been trading in an Upward Parallel Channel, since last year end till now. Recently it has hit the upper top of the channel at 77.88 levels.

Its a SELL till 77.4 and if it breaks 77.4 level with good volume, it can further drift down to 77.17 levels.

76.94 to 77.1 7 is a Buy Zone, where can be a bounce back but till that time, its a Short.

USD/INR Forecast: Indian Rupee on the RopesThe US dollar has gone back and forth during the trading session on Thursday as we hang around the ₹75 level. The ₹75 level in the past has been resistance, and it certainly looks as if it is the same situation now. I believe the market testing this major resistance barriers a sign of just how weak India is at the moment, as traders around the world continue to run away from risk. After all, with a new variant of coronavirus, a lot of people are a bit concerned as market participants continue to be worried about lockdowns.

The US dollar is strong not only do to that, but the fact that the US economy is one of the stronger economies in the world. As long as the US economy continues to strengthen in general, that will more than likely work against India, unless of course the global supply chain start to open up again. Ultimately, the market is likely to continue to see a lot of momentum chasing, but we need to break above the ₹75.20 level to clear the short-term resistance. At that point, then it is likely that we go looking towards the ₹75.50 level.

If we do break down from here, I see a significant amount of support underneath at the ₹74.50 level, where the 50 day EMA currently resides. Furthermore, it is starting to tilt to the upside, so that suggests that we are going to have more momentum from intermediate traders as well. It is not until we break down below that level that I think we might have a bit of trouble showing up in the market again. The market will continue to see a lot of noisy behavior based upon risk appetite, as the Indian rupee is of course an emerging market currency. EM currencies have struggled lately, as I have been observing in the South African Rand, Hungarian forint, and many others that I prefer to trade. Ultimately, I believe that the market will eventually go looking towards the ₹75.50 level, but it may take a while to get there. After all, this is a market that tends to be more of a grind than anything else, but as long as the US leads the world, it is difficult to imagine this market breaking down for any significant amount of time.

USDINR - Reaching solid support zoneThe current structure of USDINR is still weak and is probably moving towards 72.65 levels.

The current chart shows two technical possibilities that suggest goos support zone in the 72-73 range.

At First, there is trendline support, that the prices broke in April 2021, and the same trendline would now act as a support.

Secondly, there is also a harmonic pattern probability whose support also coincides with the trendline support.

So keep your eyes on price action, and be ready to take advantage of solid support.

If you are trading this, you are trading at your own risk

USDINR ::: SHORT07 MAY 2021

INSTRUMENT: USDINR

TREND: SELL

TIME FRAME: DAY

CMP: 73.54

SELL BELOW: 73.424

STOP LOSS: 73.752

TGT 01: 73.298

TGT 02: 73.196

TGT 03: 73.058

DISCLAIMER:

We are not S E B I registered analyst. Please consult your personal financial advisor before investing. We are not responsible for your profits/losses whatsoever.

USDINR ::: SHORTRISK DISCLOSURE

Futures and options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Trade with risk capital only. The past performance of any trading strategy or methodology is not necessarily indicative of future results. Past performance is no guarantee of future results and should not be interpreted as a forecast of future performance. We make no promise as to the performance of the account and while the investment objective is major capital appreciation over time no representation is being made or implied that any account will or is likely to achieve profit. The value of your investments can decrease as well as increase and, as such, funds invested should constitute risk capital. The risk of loss in trading commodities and options can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. You should carefully consider whether your financial condition permits you to participate in futures trading. In so doing, you should be aware that futures and options trading can quickly lead to large losses as well as gains. Such trading losses can sharply reduce the value of your investment. All information provided on these pages is for fair use. Normal copyright protections apply to all commercial use of any documents or information. We are not responsible for any loss due to inaccuracies in the information provided. Nothing presented here should be construed as investment advice or recommendations.