USDINR Best sell signal you can find.The USDINR pair has been rising parabolically since the late September 2024 bottom. This rise has however most likely come to an end as the 1W RSI hit the top of its 16-year Resistance Zone.

This Zone has been holding since the October 2008 High and as you can see, it has offered 7 excellent sell signals. Most of those times, the rejection hit at least the 1W MA50 (blue trend-line), so if you are looking for a long-term short trade, you can consider this.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Usdinrsignals

USDINR The 2-year Rising Wedge is holding.The USDINR pair continues to respect the Rising Wedge that we mentioned more than 2 months ago (July 24, see chart below), giving us both excellent buy and sell signals:

This 2-year Rising Wedge pattern is approaching its top (Higher Highs trend-line) once more so we're preparing for a sell signal again. The confirmation to sell within this pattern is given when the 1W RSI breaks above its MA line (yellow trend-line).

Our Target is 83.7500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR Bullish break-out signalThe USDINR pair broke this week above Resistance 1 (83.700), the long lasting level since the week of March 18 and following a strong rebound on the 1W MA50 (blue trend-line), the break-out should technically lead higher.

The long-term pattern remains a Rising Wedge and we expect at least a symmetrical +1.29% Bullish Leg to price the Higher High, similar to the March High. Our Target is 84.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR Bearish unless it breaks that Resistance.The USDINR pair has been trading within a long-term Rising Wedge pattern since the November 11 2022 Low. The 1W MA50 (red trend-line) has been supporting all the way and in fact has made contact with the price and held on 3 occasions, with the most recent being on June 03.

We are currently bearish as the price remains within the Rising Wedge, targeting its bottom (Higher Lows trend-line) at 83.2150. If however the pair manages to close a 1D candle above Resistance 1 (83.7000), we will take the small loss and open a buy, targeting the Higher Highs at 84.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR Sell opportunity to the 1D MA50The USDINR pair made a direct hit on our 82.700 Target, which we set on our last analysis (January 10, see chart below):

Right now we see the price pulling back within a Channel Down. This is a standard pattern within the long-term Rising Wedge pattern, which as you see out of 7 Bearish Legs all broke below the 1D MA50 (blue trend-line) and only 1 managed to make just a hit-and-rebound.

As a result we are going for a moderate sell Target at 83.100 and then we will reverse to buying, targeting Resistance 1 at 83.700.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR Still bearish but we move our target a little higher.This is an update to our November 27 2023 idea on the USDINR pair where we issued a sell signal exactly at the top (Higher Highs trend-line) of the 1 year Rising Wedge pattern:

Our 82.600 Target hasn't yet been hit but due to the slower than expected decline, we have to modify our target and move it a little higher to 82.700, which marks a projected contact with the 1W MA50 (blue trend-line).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR Neutral but needs a medium-term pull-back.The USDINR pair has been practically ranged around the 1D MA50 (blue trend-line) since September but on a long-term perspective, close to the top (Higher Highs trend-line) of the Rising Wedge. This calls for a technical medium-term pull-back, especially with the Bearish Divergence on the 1D RSI, which is trading within a Channel Down. Our target is the 1D MA200 (orange trend-line) at the bottom of the Wedge at 82.600.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR Stuck in a Triangle. Trade the break-out.The USDINR pair is trading inside a 1.5 month Triangle (blue), following the upward break-out of the 1 year Ascending Triangle. The 1D MA50 (blue trend-line) has been supporting for 2 months and as long as it holds, buy when the price breaks above Resistance 1 (83.4200). The target can be 84.500, representing a +2.13% leg extension on a potential emerging Channel Up. If the 1D MA50 breaks, we will sell instead and target the 1D MA200 (orange trend-line) at 82.4500, which is marginally above Support 2.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR Triangle pattern on the 1D MA200. Trade the break-out.The USDINR pair is trading within a Triangle pattern with the 1D MA200 (orange trend-line) supporting on its bottom (Higher Lows trend-line). You can scalp inside the pattern for as long as it lasts (RSI also in a Triangle), but when a 1D candle closes outside the Triangle, trade the break-out's direction. Buy and target the 83.2900 Resistance in case of a bullish break-out, and the 80.500 Support in case of a bearish break-out.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

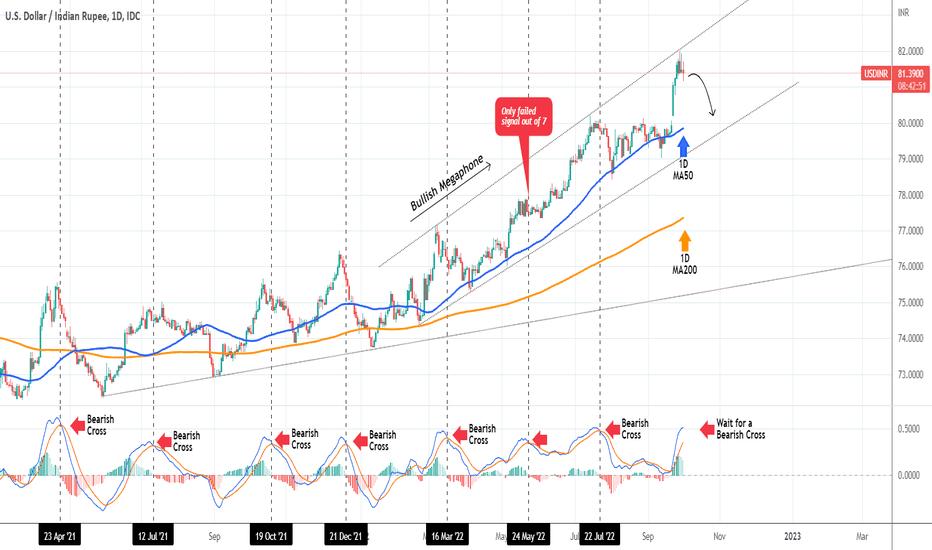

USDINR Sell when the MACD gives a Bearish CrossThe USDINR pair has been trading within a Bullish Megaphone since February 21 2022. Just 2 days ago, the price hit the top (Higher Highs trend-line) of this pattern and got rejected. We may see a pull-back towards the 1D MA50 (blue trend-line) or even the bottom of the Megaphone.

The best confirmation to take that sell trade would be to wait for the 1D MACD to form a Bearish Cross. As you see, since April 23 2021 all seven MACD Bearish Cross occurrences have delivered substantial Lower Lows on the short-term, except for one time (May 24 2022).

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR ::: SHORT07 MAY 2021

INSTRUMENT: USDINR

TREND: SELL

TIME FRAME: DAY

CMP: 73.54

SELL BELOW: 73.424

STOP LOSS: 73.752

TGT 01: 73.298

TGT 02: 73.196

TGT 03: 73.058

DISCLAIMER:

We are not S E B I registered analyst. Please consult your personal financial advisor before investing. We are not responsible for your profits/losses whatsoever.

USDINR ::: LONGDATE: 5 SEPTEMBER 2020.

INSTRUMENT: USDINR.

TIME FRAME: DAY.

TRADE TYPE: POSITIONAL.

INDICATORS:

PSAR: BULLISH

STOCHASTIC: BULLISH DIVERGENCE.

PRICE ACTION:

CMP: 73.164

BUY ABOVE: 73.550

SL: 72.80

TARGET: 75.540

RISK DISCLOSURE

Technical analysis of FOREX and INDIAN MARKETS. We are not SEBI REGISTERED ANALYSTS The views expressed here are for our record purposes only. Please consult your personal financial advisor before investing. We are in no way responsible for your profits/losses what so ever.

USDINR Long-term Sell SignalPattern: Channel Up on 1W.

Signal: Bearish as the price is reversing after a Higher High on the Channel Up, with the MACD making a bearish cross on significant downside potential.

Target: 71.500 (expected Higher Low on a roughly -8.40 decline).

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **