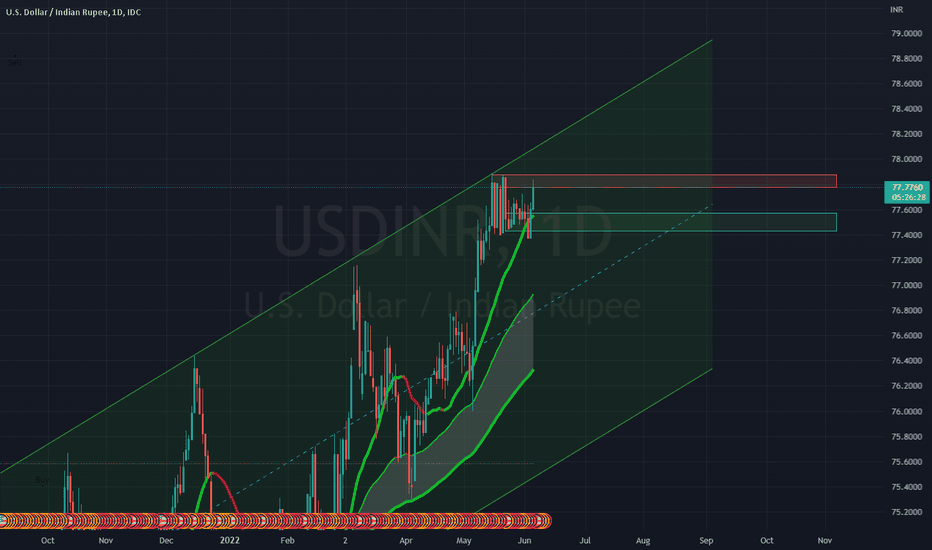

USDINR- forex- daily analysis1 DEC- Analysis:

Currency

Price is consolidating at the top

USDINR opens:

side: if it gives breakout buy(100)

gapup: buy (100)

gapdown: if opens near previous day reversal + immediate breaks 5 min high then buy(100)

if it cosolidate in first half after gapdown then we can sell in second half after 11:30 am (100)

Usdinrstrategy

USDINR looks strong on Daily & Weekly timeframe, heading to 77.8USDINR is rising on rising sharply due rising crude oil prices this week, as European nations has said No to Russian Oil.

USDINR is looking strong and can head to levels of 77.8 where it can face huge resistance.

If USDINR manages to trade above 77.8 levels on daily and weekly timeframes, then it is heading towards 78.5 levels.

If BEARS managed to hold USDINR further upward movement or if RBI intervenes, then it can fall back to retest 77.4 levels.

P.S. Most of this movement in USDINR this week would be dependent on how CRUDE OIL performs in global markets.

USDINR looks to be good short, heading down to 77.2 levelsUSDINR has been trading in an Upward Parallel Channel, since last year end till now. Recently it has hit the upper top of the channel at 77.88 levels.

Its a SELL till 77.4 and if it breaks 77.4 level with good volume, it can further drift down to 77.17 levels.

76.94 to 77.1 7 is a Buy Zone, where can be a bounce back but till that time, its a Short.

USD/INR Forecast: Indian Rupee on the RopesThe US dollar has gone back and forth during the trading session on Thursday as we hang around the ₹75 level. The ₹75 level in the past has been resistance, and it certainly looks as if it is the same situation now. I believe the market testing this major resistance barriers a sign of just how weak India is at the moment, as traders around the world continue to run away from risk. After all, with a new variant of coronavirus, a lot of people are a bit concerned as market participants continue to be worried about lockdowns.

The US dollar is strong not only do to that, but the fact that the US economy is one of the stronger economies in the world. As long as the US economy continues to strengthen in general, that will more than likely work against India, unless of course the global supply chain start to open up again. Ultimately, the market is likely to continue to see a lot of momentum chasing, but we need to break above the ₹75.20 level to clear the short-term resistance. At that point, then it is likely that we go looking towards the ₹75.50 level.

If we do break down from here, I see a significant amount of support underneath at the ₹74.50 level, where the 50 day EMA currently resides. Furthermore, it is starting to tilt to the upside, so that suggests that we are going to have more momentum from intermediate traders as well. It is not until we break down below that level that I think we might have a bit of trouble showing up in the market again. The market will continue to see a lot of noisy behavior based upon risk appetite, as the Indian rupee is of course an emerging market currency. EM currencies have struggled lately, as I have been observing in the South African Rand, Hungarian forint, and many others that I prefer to trade. Ultimately, I believe that the market will eventually go looking towards the ₹75.50 level, but it may take a while to get there. After all, this is a market that tends to be more of a grind than anything else, but as long as the US leads the world, it is difficult to imagine this market breaking down for any significant amount of time.

USDINRThe US dollar has enjoyed a relatively large move to the upside against multiple currencies for the last couple of months. It has been no different againts the Indian rupee, as emerging markets in general have struggled. With concerns about increasing coronavirus figures, global growth slowing down, and simple inflation, the US dollar has been what most people have been willing to bet on.

Recently, we have seen the interest rates in America rise, only to turn back around as traders trying to figure out what the Federal Reserve is about to do. With the concern about supply chain issues, it has made trading the markets very difficult over the last couple of months. However, the Reserve Bank of India keeps a close eye on this exchange rate, thereby setting a nice opportunity for those looking to trade a range-bound market. Nonetheless, we have certainly seen quite a bit of upward pressure as of late, and sooner or later the US dollar should prevail.

As things stand currently, the 75.50 rupee level seems to be very difficult to break above. We had tried to break out during the previous month but failed. You can see there is a weekly shooting star right at that level, which will attract a certain amount of attention by technical traders. Another thing to pay attention to is that we have seen a significant amount of support near the 73.50 rupee level, so I think this will be your range for the month. It certainly looks as if there is more of an upward tilt in this market, which makes sense considering just how well the US dollar has done against multiple other currencies. All one has to do is look at the euro, pound, or even the Japanese yen over the last several weeks. In a scenario where the US dollar is acting like a wrecking ball against so many of those currencies, a smaller one like the Indian rupee certainly stands no chance. Ultimately, I believe this will be a “buy on the dips” scenario over the next several weeks. Also, the market has the 50-week EMA just below, so that could give a little bit of psychological and technical support to the greenback. If we can break out to the upside and above 75.50, then 76 will be targeted.

USDINRThe USD/INR is trading near the 74.9000 juncture in early trading today, after actually trading above the 75.0000 juncture briefly yesterday. Volatility in the USD/INR has increased as resistance levels have proven vulnerable and reversal off highs occur in swift choppy motions. After breaking through the 74.7000 level yesterday, the USD/INR saw an impetus of buying. While the pair has come off yesterday’s highs, the USD/INR continues to traverse within its upper price band.

Yesterday’s higher values fractionally surpassed the upper mark achieved on the 19th of July of approximately 74.0300. Experienced traders within the USD/INR remember the higher range achieved in April when an apex of nearly 75.5700 was briefly touched on the 21st of April. The higher prices achieved in April occurred during a wave of coronavirus concerns hitting India. This time around the bullish momentum is likely being caused by a complex mix of a stronger USD due to nervous global investment sentiment and US central bank pronouncements.

Technically, the 75.0000 may appear to be a key psychological resistance level. If this barrier is penetrated and prices are maintained above this juncture, it would likely be signaling that additional buying momentum will be generated short term. Speculators who believe the USD/INR is overbought and want to seek selling positions are advised not to be overly ambitious with their wagers and target limited downside movement.

Current support looks to be around the 74.8300 level. Market conditions for the USD/INR are fast and traders need to be aware of the velocity of price changes that are potentially liable to happen if market conditions remain nervous globally. Speculators are urged to used solid entry price orders to make sure that their ‘fills’ meet their expectations.

The USD/INR is certainly traversing the higher realms of its long-term price range. However, conservative traders are reminded the Forex pair has traversed these heights before. Trading above the 75.0000 is not out of the question and speculators who doubt higher moves will occur may want to look at a one-year price chart.

Buying the USD/INR on slight moves downward and then looking for upside price action may be a worthwhile wager. Traders should be cautious, but current resistance levels may prove vulnerable. Traders may be tempted to buy the USD/INR around the 74.8700 to 74.8400 levels and seek limited upside momentum too for quick-hitting wagers.

USDINR - Reaching solid support zoneThe current structure of USDINR is still weak and is probably moving towards 72.65 levels.

The current chart shows two technical possibilities that suggest goos support zone in the 72-73 range.

At First, there is trendline support, that the prices broke in April 2021, and the same trendline would now act as a support.

Secondly, there is also a harmonic pattern probability whose support also coincides with the trendline support.

So keep your eyes on price action, and be ready to take advantage of solid support.

If you are trading this, you are trading at your own risk

USDINR in a consolidation / distribution phase?Currently after the recent run-up OANDA:USDINR is in a consolidation phase.

But if it breakdowns, then it could re-visit it's previous demand zone, before resuming it's uptrend again.

USDINR Price expected to rise from hereUSDINR pair is range-bound since 1 year and before a major move price expected to touche the resistance around 71.800 mark

USDINR TGT 72.20SEEMS USDINR Targetting 72.5 and more.........

if Closes Below 71.2 Reverses

Strict SL 70.30

Be Carefull Have a Watch on RSI also..