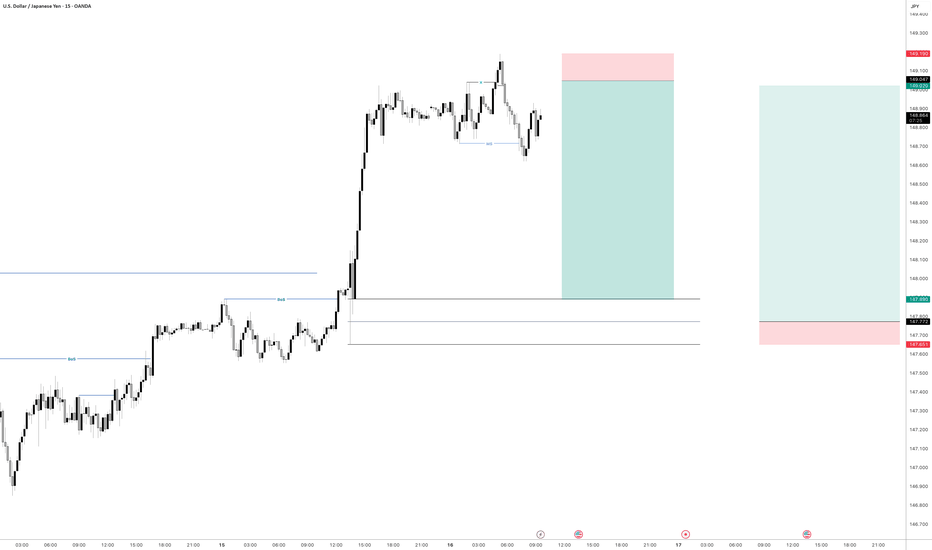

USDJPY

USDJPY H1 Support & Resistance Levels🚀 Here are some key zones I've identified on the 15m timeframe.

These zones are based on real-time data analysis performed by a custom software I personally developed.

The tool is designed to scan the market continuously and highlight potential areas of interest based on price action behavior and volume dynamics.

Your feedback is welcome!

Fundamental Market Analysis for July 16, 2025 USDJPYEvent to Watch Today:

15:30 EET. USD – Producer Price Index

USDJPY:

USD/JPY has stabilized around 148.900, maintaining upside potential due to:

Interest Rates: The Fed keeps yields elevated (10-year bonds at 4.46%), while the Bank of Japan maintains an ultra-loose policy, keeping real yields negative.

Political Uncertainty: Upcoming elections in Japan and possible fiscal tightening reduce the yen’s appeal.

Dollar Demand: Trade frictions and geopolitical risks drive safe-haven flows into the dollar.

A break above 149.000 could open the path to 149.500. Support at 148.600 remains a critical barrier for the bullish scenario.

Trade Recommendation: BUY 149.000, SL 148.700, TP 149.900

Bearish reversal?USD/JPY is reacting off the resistance level which is a pullback resistance that lines up with the 78.6% Fibonacci projection and slightly below the 127.2% Fibonacci extension.

Entry: 148.99

Why we like it:

There is a pullback resistance that lines up with the 78.6% Fibonacci projection and also slightly below the 127.2% Fibonacci extension.

Stop loss: 151.20

Why we like it:

There is an overlap resistance that aligns with the 161.8% Fibonacci extension.

Take profit: 147.08

Why we like it:

There is an overlap support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GOLD - SHORT TO $2,800 (1H UPDATE)Yesterday's entry hit SL, as price pushed up a little higher for liquidity, ahead of today's CPI data.

I have entered another sell entry today at $3,353. Couldn't send analysis straight away as I was out & didn't have my laptop on me. But re-trying this analysis one last time. If SL is hit, we will wait for $3,400 entry.

USDJPY 30Min Engaged ( Buy Entry Detected )➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish From now Price : 147.900

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

USDJPY 30Min Engaged ( Buy Entry Detected )

USDJPY 30Min Engaged ( Buy & Sell Entrys Detected ) ➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish From now Price : 147.350

🩸 Bearish Reversal Price : 147.850

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

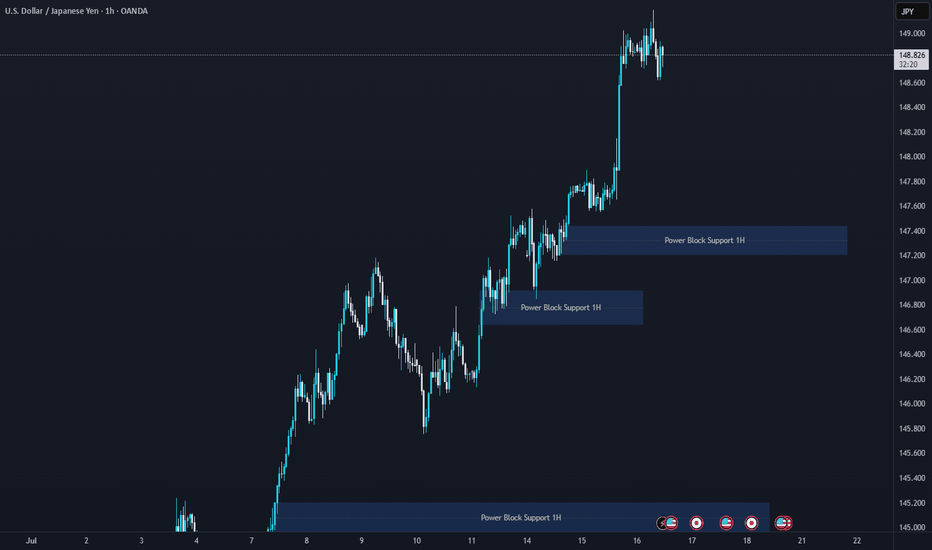

USDJPY 1H - market buy with a confirmed structureThe price has bounced from a key support zone and is showing early signs of recovery. A clear base has formed, and the MA50 is starting to turn upward, indicating a shift in short-term momentum. While the MA200 remains above the price, the overall structure suggests a potential continuation of the bullish move.

Trade #1 — entry at market, target: 145.939, stop below recent local low.

Trade #2 — entry after breakout and retest of 145.939, target: 148.000, stop below the retest zone.

Volume has stabilized, and the reaction from support is clear. As long as price holds above the last swing low, buying remains the preferred strategy.

USDJPY Analysis : Bullish Channel Strategy & FMFR Zone Reaction🧩 Market Structure Overview

USDJPY has been in a strong bullish market structure, forming consistent higher highs and higher lows since the beginning of July. The pair recently created a rising ascending channel, where price action has respected both the upper and lower bounds with clean impulsive and corrective moves.

From the 11th to 15th July, USDJPY moved steadily within this bullish channel, forming minor consolidation zones and reacting to short-term supply-demand levels. However, on the 15th, we witnessed a pullback from the upper channel resistance, indicating short-term profit-taking or internal bearish liquidity sweep.

🧠 Current Price Action

Now, price is pulling back and approaching a high-confluence demand zone, marked as:

FMFR (Fair Market Fill Range): A zone where unfilled buy-side orders are likely resting.

SR Flip (Support-Resistance Interchange): A previous resistance zone, now turned into a potential support base.

This area (between 146.80 – 147.00) has multiple confirmations:

Past supply zone → broken and retested

Strong impulsive bullish move originated here

Mid-point of the current bullish channel

Psychological level (147.00 round number)

The market is now offering a potential buying opportunity from this zone, provided a bullish confirmation pattern is printed on lower timeframes (1H or 30M).

🔍 Key Technical Confluences

Bullish Ascending Channel:

Clearly respected — suggesting institutional accumulation. Price is now retesting mid-level or base structure of this channel.

FMFR Zone:

Typically used to spot unbalanced price areas where limit buy orders may rest. Smart money often returns to fill these zones before moving further.

SR Flip:

The prior supply zone from July 8–10 was broken decisively, and price is now using this same level as support.

Liquidity Sweep & Trap:

The current rejection from the channel top may have liquidated early longs. That opens room for a smart-money reversal from the deeper FMFR zone.

📌 Trading Plan (Execution-Based Strategy)

🔽 Entry Criteria:

Wait for a clear bullish reversal candle within the FMFR zone (e.g., bullish engulfing, pin bar, morning star).

Entry can be refined on the 1H or 30M timeframe using a BOS (Break of Structure) signal.

🟢 Buy Zone:

Between 146.80 – 147.00

🔴 Stop Loss:

Below 146.40, well below the FMFR zone and recent wick lows

🎯 Take Profits:

TP1: 148.20 – Retest of the central channel zone

TP2: 149.60 – Next Major Reversal Zone

TP3 (Optional): 150.00 psychological round level (if bullish continuation breaks structure)

⚠️ Risk Management Tips:

Wait for confirmation — don’t rush into the zone without candle proof.

Risk only 1-2% per trade idea.

Adjust lot size according to stop-loss distance.

Avoid chasing if price closes below 146.40 — structure will be invalid.

🔮 What Could Invalidate This Setup?

Clean break below 146.40 support with bearish structure forming (LL, LH)

Bearish fundamentals from USD side (e.g., CPI, FOMC impact)

A tight channel breakdown without bullish volume

📅 Fundamental Backdrop:

USD is currently reacting to macro data and rate expectations.

JPY remains weak structurally, unless BOJ introduces surprise tightening.

US CPI & Fed commentary may influence short-term volatility and liquidity grabs.

🧠 Conclusion:

USDJPY is presenting a high-probability buy setup as it revisits a strong confluence zone formed by FMFR + SR flip. Smart money often re-engages at these levels after liquidity hunts, especially within a bullish structure. Watch for confirmation on lower timeframes, and manage risk responsibly.

This trade idea is based on price action, structure, and institutional concepts, aiming for a trend continuation with clear invalidation levels.

USDJPY - Trade The Range!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈USDJPY has been trading within a range between $140 and $150 round numbers and it is currently retesting the upper bound of the range.

📚 As per my trading style:

As #USDJPY is around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

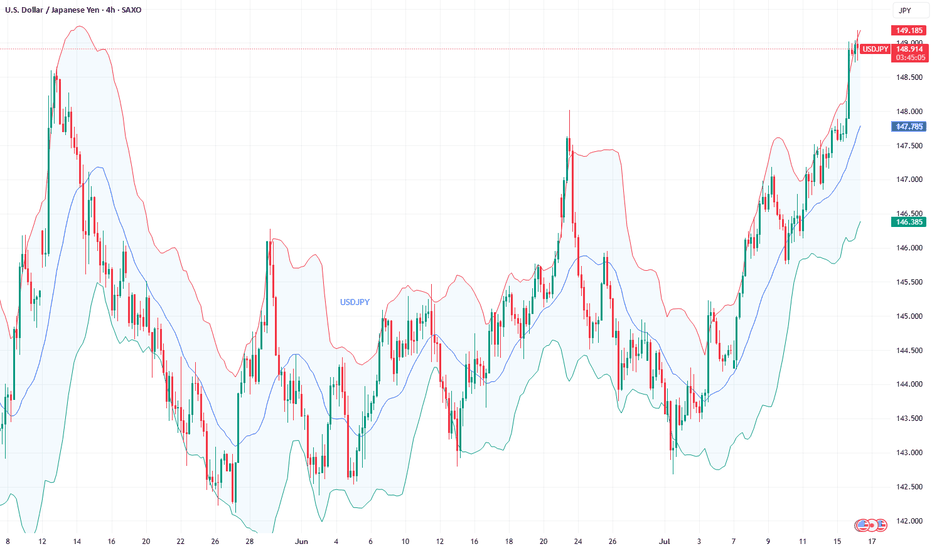

USDJPY – Tactical Short in Weekly Supply or Bullish Breakout?COT & MACRO FLOW (Commitment of Traders)

USD INDEX

Non-commercials still biased short: Longs 16,208 vs Shorts 20,194 (slightly improved, but still negative).

Commercials remain net long, but the open interest is declining → no strong conviction from smart money.

JPY

Non-commercials added significantly to their short exposure (+6,751), while cutting longs (-4,432).

Commercials also cut long exposure heavily (-20,405).

The structure shows institutional bias is clearly bearish on JPY.

Conclusion: JPY weakness confirmed by both commercial and non-commercial flows. USD slightly weaker, but JPY is weaker → supports USDJPY bullish bias.

SEASONALITY (JULY)

USD/JPY tends to be weak in July across most historical averages (5y, 10y, 15y, 20y).

July is historically bearish for USDJPY, especially in the second half of the month.

This seasonality contrasts with COT flows → mixed bias.

RETAIL SENTIMENT

60% of retail traders are SHORT → supports contrarian long view.

Retail volume shows imbalance in positioning, another contrarian bullish signal.

📈 TECHNICAL ANALYSIS (DAILY CHART)

Price is testing a key weekly FVG zone between 148.4 and 149.2.

RSI has re-entered the overbought region, suggesting potential exhaustion.

Price bounced from the monthly bullish order block (143.5–144.0).

A clear move above 149.50 could invalidate short setups.

🧩 TRADE IDEA (SETUP)

Watch for price to retest 148.4–149.50 zone and react.

RSI divergence + seasonality could offer a short opportunity with confirmation (e.g. engulfing on Daily/H4).

If price breaks above 149.5 with volume → look for continuation to 152.00.

✅ FINAL BIAS

Macro and institutional flows remain in favor of USDJPY longs, but:

Seasonality turns bearish in the second half of July

Price is reaching strong resistance

Retail sentiment supports the long thesis

→ Tactical Short from 149-150 only with confirmation. Otherwise, long continuation above 150.

Market Watch UPDATES! FOREX Major PairsWelcome to the Market Watch Updates for Monday, July 14th.

In this video, we will give the forecast updates for the following markets:

USD Index, EURUSD, GBPUSD, AUDUSD, NZDUSD, USDCAD, USDCHF and USDJPY.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Could the price reverse from here?USD/JPY is rising towards the pivot which is a swing high resistance and could reverse to the 1st support which acts as an overlap support.

Pivot: 148.53

1st Support: 145.89

1st Resistance: 149.73

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USD/JPY) Bullish trend analysis Read The captionSMC trading point update

Technical analysis of USD/JPY on the 4-hour timeframe, signaling a breakout and possible rally toward the 151.016 target zone. Here's the detailed breakdown:

---

Technical Analysis – USD/JPY (4H)

1. Bullish Structure Breakout

Price has broken above a long-term resistance trendline, indicating a bullish breakout from a rising wedge or ascending channel.

The breakout is confirmed by bullish momentum and sustained price action above the previous highs.

2. Trendline + EMA Confluence

Price remains well above the 200 EMA (145.143), reinforcing the bullish bias.

A clear higher low was formed at the inner trendline (support), followed by strong upside moves.

3. RSI Strength

RSI is around 63.16, indicating strong bullish momentum without being overbought yet.

Suggests more upside potential while maintaining healthy trend conditions.

4. Price Target Projection

The chart shows two upward extensions:

First move projected ~+2.20%, indicating a measured move target around 149.7.

Final target point is 151.016, based on previous price action extension and resistance level.

Mr SMC Trading point

---

Summary

Bias: Bullish

Current Price: 147.366

Key Support: Rising trendline + 145.143 EMA

Targets:

Short-term: ~149.7

Final: 151.016

RSI: Strong but not overbought (63.16)

Invalidation: Break below the inner trendline support and EMA (below 145.00)

Please support boost 🚀 this analysis)

USDJPY. 14.07.2025. The plan for the next few days.The nearest interesting resistance zones have already been worked out at night and have given a good reaction. Let's mark the others where we can expect a reaction. It's not certain that there will be a major reversal, but I believe we will see a correction that can be monetized. We are waiting for a reaction and looking for an entry point.

The post will be adjusted based on changes.

Don't forget to click on the Rocket! =)

XAU/USD : Gold at a Turning Point – Rejection or Breakout Ahead?By analyzing the TVC:GOLD (XAUUSD) chart on the 4-hour timeframe, we can see that price climbed to $3330 today, entering a key supply zone, which triggered a pullback down to $3310. Gold is now trading around $3317, and I’m watching several potential setups closely.

Scenario 1:

If gold stabilizes below $3320, we could see a bearish move toward $3296.

Scenario 2:

If price breaks above the $3333 resistance, it may enter the next supply zone between $3341 and $3351, which could trigger a strong rejection—potentially offering a 100 to 400 pip move.

Now let’s break down the key levels to watch:

Supply zones: $3320, $3333, $3342, $3358

Demand zones: $3303, $3296, $3289, $3278

Monitor how price reacts to each of these zones — they may provide excellent opportunities.

Heading into pullback resistance?The USD/JPY is rising towards the pivot, which is a pullback resistance and could reverse to the 1st support.

Pivot: 148.44

1st Support: 143.24

1st Resistance: 151.23

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USDJPY 4Hour TF - July 13th, 2025USDJPY 7/13/2025

USDJPY 4Hour Neutral Idea

Monthly - Bullish

Weekly - Bearish

Daily - Bearish

4Hour - Bullish

Finally UJ is looking more clear. We’re now able to drop to the 4Hour instead of the Daily TF due to price action reaching a major zone of anticipated reactions.

As always we’re looking at two trade scenarios going into the week ahead:

Bullish Continuation - UJ is currently sitting at 147.500 resistance and closed there last week. Going into this week we could see the bullish trend continue but we would need to see a clear break of 147.500 resistance to gain confidence. Look for a higher low confirmed above 147.500 followed by strong bullish setups to enter long on. Look to target higher toward major resistance levels like 149.250 area.

Bearish Reversal: Despite the strong bullish momentum we saw from last week, a reversal is still possible as price action is near our 147.250 zone. In order to consider bearish setups we would need to see strong rejection from the current level of resistance. Look to target lower toward 145.000 support.

USD/JPY) LOGN TIME Analysis Read The captionSMC trading point update

Technical analysis of USD/JPY on the daily timeframe, highlighting a long-term downtrend reversal with potential for significant upside.

---

Analysis Summary

Pair: USD/JPY

Timeframe: Daily

Current Price: 147.442

Bias: Bullish breakout from a descending wedge structure.

---

Key Technical Insights

1. Descending Trendline Break:

Price has broken above the long-term downtrend line, signaling a reversal.

Breakout area is circled in yellow, confirming bullish intent.

2. Trendline & Structure Support:

Multiple rejections from the ascending support trendline (marked by green arrows) confirm accumulation and higher lows.

3. 200 EMA as Dynamic Resistance/Support:

Price is now above the 200 EMA (147.920) — a bullish signal, turning resistance into support.

4. RSI (14):

RSI at 62.99, approaching overbought territory, but still has room to push further.

---

Target Point

Target: 158.951

Based on measured move from wedge breakout and historical resistance level.

---

Trade Setup Idea

Direction Entry Stop-Loss Target

Buy 147.40–147.60 Below 145.80 158.95

Mr SMC Trading point

---

Summary

This chart signals a major bullish breakout on USD/JPY, with the break of a year-long downtrend structure, reclaiming the 200 EMA. If this breakout sustains, price could aim for 158.95 in the coming weeks.

Please support boost 🚀 this analysis)

USD/JPY "The Ninja Heist" – Bullish Loot Grab!🌟 Hey, Thieves & Market Bandits! 🌟

💰 Ready to raid the USD/JPY "The Gopher" vault? 💰

Based on 🔥Thief Trading Style🔥 (technical + fundamental heist analysis), here’s the master plan to swipe bullish profits before the market turns against us! Escape near the high-risk Yellow MA Zone—overbought, consolidation, and bear traps ahead! 💸 "Take the money and run—you’ve earned it!" 🏆🚀

🕵️♂️ Heist Strategy:

📈 Entry (Bullish Raid):

The vault’s unlocked! Buy any price—this heist is LIVE!

Pullback lovers: Set buy limits at recent/swing lows for extra loot.

🛑 Stop Loss (Escape Route):

Thief SL at recent/swing low (4H/Day trade basis).

Adjust based on your risk, lot size, and multiple orders.

🎯 Target (Profit Escape):

147.500 (or flee earlier if bears ambush!)

⚔️ Scalpers’ Quick Strike:

LONG ONLY! If rich, attack now. If not, join swing traders & rob slowly.

Trailing SL = Your bodyguard! 💰🔒

💥 Why This Heist?

USD/JPY "The Ninja" is bullish due to key factors—check:

📌 Fundamental + Macro + COT Report

📌 Quantitative + Sentiment + Intermarket Analysis

📌 Future Targets & Overall Score (Linkks In the profile!) 🔗🌍

🚨 Trading Alert (News = Danger!):

Avoid new trades during news—volatility kills!

Trailing SL saves profits on running positions.

💖 Support the Heist Team!

💥 Smash the Boost Button! 💥

Help us steal more money daily with Thief Trading Style! 🏆🚀

Stay tuned—another heist is coming soon! 🤑🎯

USD/JPY Profit Heist – Are You In or Missing Out?"🔥💰 "USD/JPY NINJA HEIST: Bullish Loot Before the Trap! (Thief Trading Style)" 💰🔥

🌟 Attention Market Robbers & Profit Takers! 🌟

🚨 Thief Trading Alert: USD/JPY "The Ninja" is primed for a BULLISH HEIST!

Based on our stealthy technical & fundamental analysis, we’re locking in a long entry strategy. The plan? Loot profits before the RED ZONE danger hits! Overbought? Maybe. Risky? Sure. But the real robbery happens before the bears wake up! 🏴☠️💸

🎯 ENTRY: The Vault is OPEN!

Buy Limit Orders: Swipe the dip on pullbacks or jump in at key swing lows.

Aggressive? Enter now & ride the wave!

🛑 STOP LOSS (Thief-Style Escape Plan):

Swing Low (5H TF): 143.600 (Adjust based on your risk & lot size!)

Multiple orders? Scale SL wisely—don’t get caught!

🎯 TARGETS:

Main Take-Profit: 151.000 (Or escape earlier if the trap triggers!)

Scalpers: Only play LONG—trail your SL & lock in quick loot!

📢 SCALPERS & SWING TRADERS:

Got deep pockets? Ride the wave now!

Small account? Join the swing heist & rob the trend slowly!

📈 WHY USD/JPY?

Bullish momentum + Macro/Fundamental tailwinds!

COT Report, Sentiment, & Intermarket Analysis all hint at more upside! go ahead to check 👉🔗🌏

⚠️ WARNING: NEWS = VOLATILITY!

Avoid new trades during high-impact news!

Trailing SL = Your best friend! Protect profits & avoid jail (stop-out)!

💥 BOOST THIS IDEA TO SUPPORT THE HEIST!

More boosts = More robberies = More profits for YOU!

Stay tuned—next heist coming soon! 🚀💰

🔥 Like, Share, & Follow for Daily Steals! 🔥

USDJPY M15 Support & Resistance Levels🚀 Here are some key zones I've identified on the 15m timeframe.

These zones are based on real-time data analysis performed by a custom software I personally developed.

The tool is designed to scan the market continuously and highlight potential areas of interest based on price action behavior and volume dynamics.

Your feedback is welcome!