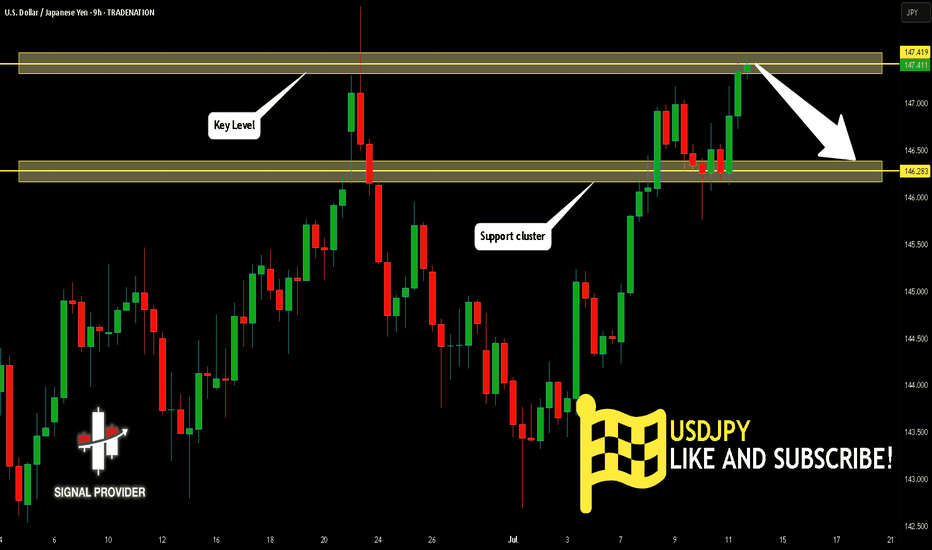

USDJPY Is Very Bearish! Short!

Take a look at our analysis for USDJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 147.419.

Taking into consideration the structure & trend analysis, I believe that the market will reach 146.283 level soon.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDJPY

USDJPY: More Growth Ahead! 🇺🇸🇯🇵

USDJPY broke and closed above a minor daily resistance

with a confirmed BoS.

The next strong resistance is 148.0

It is going to be the next goal for bulls.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD/JPY - H1- Wedge Breakout (07.07.2025)The USD/JPY pair on the H1 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 148.00

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-JPY Short From Resistance! Sell!

Hello,Traders!

USD-JPY keeps growing but

A strong horizontal resistance

Is ahead around 148.500

So after the retest we will

Be expecting a local

Bearish correction on Monday!

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY 30Min Engaged ( Bullish Entry Detected )➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish From now Price : 146.350

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

USDJPY The Target Is DOWN! SELL!

My dear friends,

Please, find my technical outlook for USDJPY below:

The price is coiling around a solid key level - 147.41

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 146.00

Safe Stop Loss - 148.14

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Fundamental Market Analysis for July 11, 2025 USDJPYThe dollar is holding steady at 146.500 against the yen: another rise in US yields and stable demand for safe US assets following comments from the Fed are fueling appetite for the USD, while demand for the JPY remains sluggish.

The tariff front exacerbates the imbalance: the White House has already imposed 25% tariffs on Japanese goods, and new ideas for “umbrella” tariffs are heightening fears of a trade war, forcing investors to flow into financing currencies. Reuters notes that the yen weakened to 146.400, recording a weekly decline of more than 1%.

At the same time, the Bank of Japan is not yet ready for aggressive tightening: a decline in inflation to 1.8% y/y and weak real wage dynamics make it difficult to raise rates above 0.5%. The divergence in monetary policy and expectations for Japanese macro data (machine tool orders, industrial production) until July 14 form the fundamental basis for the pair's growth to 147.500 and above, while the risks of correction are limited to the 145.900 zone.

Trading recommendation: BUY 146.500, SL 145.900, TP 147.500

GBPJPY - Multi Year SHORTS Coming! (Over 10,000pips)Here we have the 2 month chart of GBPJPY. We can see that we're in a massive ending diagonal made up of 5 waves.

We are currently on wave 4 and have almost completed. At the moment we are working within the parameters of a channel however we must be aware that we may exceed the channel. The channel is just there for us to use as a guideline.

In 2007, we have a really nice ending diagonal (expanding) before we made that ridiculous +13k pip drop.

See below for the 2D GBPJPY chart from 2007:

We can see that the lower timeframe diagonal broke down beautifully.

We are anticipating something similar this time round!

See below for the 2D GBPJPY chart of the current diagonal:

We've got an almost identical price action as 2007. We just got to wait a little and watch for the break of the red trendline and enter and hold.

See below for the 2week chart of GBPJPY:

Trade Idea:

- Watch for a break of the ending diagonal

- Alternatively, you can wait for a pullback after the ending diagonal breaks

- stop loss above highs once entry trendline breaks

- Swing Target: 100 (10,000pips)

What do you guys think?

Goodluck and as always, trade safe!

GBPJPY - Multi-Year Short Update! In our last setup for GBPJPY, we identified a massive diagonal pattern, with price completing wave 4 and preparing for a multi-year drop into wave 5.

Since then, price has played out exactly as forecasted — we've seen a clean impulse lower for wave 1, followed by an ABC correction for wave 2, which looks to have now completed.

This sets the stage for the next major leg — wave 3 of 5 — which historically carries the most power and momentum.

📉 See monthly chart here:

📊 GBP/JPY Wave‑3 Trade Idea

Background:

We’ve completed wave 1 down and wave 2 up (ABC correction).

GBPJPY is now positioned to start a powerful wave 3 down — the most impulsive leg in an Elliott sequence.

🔍 Current Price Action:

Price is rejecting major resistance (previous wave A high + shaded zone)

Structure shows a completed 5-wave move up within C, suggesting exhaustion.

A clean ascending trendline (red) has formed under wave v — a break here signals the first confirmation.

Option 1 – Aggressive Entry:

- Trigger: Break and close below the red trendline (~198.00–197.80 zone) on the daily.

- Entry: On candle close below trendline

- Stop Loss: Above recent high ~199.80 and then breakeven once we move lower

Option 2 – Conservative Entry (preferred):

- Trigger: Trendline break + correction

- Entry: On bearish confirmation and then a correction to indicate further downside

- Stop Loss: Above recent high ~199.80 and then breakeven once we move lower

Take Profit Levels:

- TP1: 192

- TP2: 180

- TP3: 175

- Final Target: Trail for extended move toward wave (3) lows (could be 10,000+ pips over long term)

🔐 Invalidation:

Daily close back above 200.00 or impulsive rally beyond the pink resistance zone invalidates the short bias in the short term.

✅ Summary:

This is a high-conviction, structure-backed setup with:

- Wave count + Fib confluence

- Bearish structure at key resistance

- Confirmation-based trigger (trendline break + retest)

- Excellent long-term risk-to-reward profile

📂 Previous GBPJPY Setups (Track Record):

📌 Free Setup (Big Picture Outlook) – Multi-Year Shorts Incoming (Wave 4 Completion)

✅ Swing 1 – 1,200 Pips (VIP GBPJPY Long)

✅ Swing 2 – 1,000 Pips (VIP GBPJPY Short)

✅ Swing 3 – 1,100 Pips (VIP GBPJPY Short)

✅ Swing 4 – 700 Pips (VIP GBPJPY Short)

Bearish drop off pullback resistance?USD/JPY has rejected off the resistance level which is a pullback resistance that aligns with the 50% Fibonacci retracement and could drop from this level to our take profit.

Entry: 146.50

Why we like it:

There is a pullback resistance that lines up with the 50% Fibonacci retracement.

Stop loss: 147.17

Why we like it:

There is a pullback resistance.

Take profit: 145.21

Why we like it:

There is a pullback support that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Japan PPI slips to 10-month lowThe Japanese yen is showing limited movement on Thursday. In the North American session, USD/JPY is trading at 146.45, up 0.10% on the day.

Japan's Producer Price Index rose 2.9% y/y in June, down from an upwardly revised 3.3% in May and matching the consensus. This marked the lowest increase since August 2024. On a monthly basis, PPI fell 0.2%, a second straight decline after a 0.1% decline in May.

The PPI report signals that underlying inflation pressures are dropping at the producer level, which could delay the BoJ's plans to hike rates and normalize policy. The BoJ has been in a wait-and-see stance since it raised rates in January, exercising caution in a turbulent economic environment. The Bank of Japan held rates in June and meets next on July 31.

The FOMC minutes indicated a broad consensus that the Fed will deliver additional rate cuts this year. The pace of those cuts, however, is up for debate. Some members favored cutting as soon as the July meeting, while others were more cautious and wanted to see where inflation and employment were headed. President Trump's tariffs have not boosted inflation so far, but the tariff effect on inflation could be felt in the following months and the Fed remains cautious. Fed Chair Powell has stuck to his guns, pushing back against persistent calls from President Trump to lower rates.

Fed policymakers are keeping a close eye on the US labor market, which has softened but not deteriorated. Earlier, unemployment claims dropped to 227 thousand, down from a revised 232 thousand in the previous release and below the consensus of 235 thousand.

USDJPY downtrend resistance at 147.30The USDJPY pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 147.30, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 147.30 could confirm the resumption of the downtrend, targeting the next support levels at 145.60, followed by 145.10 and 144.65 over a longer timeframe.

Conversely, a decisive breakout and daily close above 147.30 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 147.70, then 148.14.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 145.30. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USD/JPY bears getting trapToday's main data release was the weekly jobless claims figures, which came out better than expected at 227K vs. 236K eyed, down from 232K the week before.

In response, the dollar extended its rebound, and the USD/JPY has turned positive on the day after yesterday's reversal.

In recent days the UJ has been pushing higher, thanks to a weakening JPY amid threats of tariffs from the US. But we have also seen some support for the dollar owing to expectations that the tariffs will prove inflationary and that could limit Fed rate cuts.

The UJ has been forming a few bullish price signals and now finds itself above the 21-day exponential average. Stops resting above those inverted hammer candles from yesterday and June 23 could be in trouble. Can we see price rally towards those liquidity pools?

Support at 146.00 held firm after a brief dip below it. Next support is around 145.00 then 144.25 and 144.00 thereafter.

By Fawad Razaqzada, market analyst with FOREX.com

USD/JPY Made H&S Reversal Pattern , Short Setup Valid !Here is my 15 Mins Chart on USD/JPY , We have a very clear reversal pattern , head & shoulders pattern and we have a confirmation by closure below our neckline so we can enter direct now or waiting the price to go back and retest the neckline and this is my fav scenario .

USDJPY Analysis : Bearish Setup from Reversal Zone + Target⚠️ Overview:

The USDJPY 4H chart reveals a smart money-driven bearish setup, unfolding precisely from a major Reversal Zone, which aligns with a key supply area. Price action is now offering high-probability short trade opportunities, supported by structural breaks, clear CHoCHs (Change of Character), and BOS (Breaks of Structure).

🔎 Detailed Technical Breakdown:

🔹 Bearish Pattern + Channel Formation:

The pair formed a bearish price pattern earlier, which initiated the previous downtrend. This move developed into a well-formed descending channel, showing controlled distribution from the institutional side. The channel break marked a liquidity grab below previous lows, trapping retail sellers before shifting structure.

🔹 Channel Insider Demand + Breakout:

After reaching the Channel Insider Demand, USDJPY made a strong bullish push, causing a Minor BOS — a sign of temporary bullish pressure. However, this move served to rebalance price into a premium zone, which is the current Reversal Zone. This zone lies near previous imbalance/fair value gaps and coincides with a supply structure, making it a high-reaction area.

🔹 Reversal Zone (Premium Area):

Price tapped the Reversal Zone and began rejecting aggressively. This reaction indicates the presence of large sellers and order blocks. The current price action now displays a Minor CHoCH, suggesting a short-term bearish shift in order flow.

This is a textbook case of premium vs. discount pricing, where price seeks liquidity above recent highs before reversing to more balanced zones.

🔹 Price Flow Expectations (Downside Targets):

The first confirmation of bearish continuation will come with a clean break below the Minor CHoCH level (~144.400). Following that, momentum is expected to carry USDJPY toward:

🥇 Target 1: 144.00 – Local support / liquidity pocket

🥈 Target 2: 143.00 – Key psychological & structural support

🥉 Target 3: 142.00–142.50 Zone – Marked as the Next Reversal Zone, which could act as demand

This setup remains valid as long as the price remains below 147.200, which is the high of the Reversal Zone. A breakout above this invalidates the bearish thesis.

🧠 MMC (Mind Market Curve) Interpretation:

The chart clearly respects Mind Curve Theory structure:

CHoCH/BOS confirms internal order flow

Reversal zone is placed at a curve top (premium)

Support base (discount zone) is yet to be revisited

The curve shape guides a possible rounded rejection scenario, pushing price down into the major support, aligning with smart money liquidity grab behavior.

📊 Strategic Insight:

This is a classic smart money trap — fake bullish breakout, quick grab of early breakout traders’ stops, followed by a decisive turn from supply.

Traders should monitor:

Candle structure at current levels

Reaction to minor CHoCH zone (~144.400)

USD/JPY: A High-Clarity Setup in a Coiling MarketFor weeks, the market has been choppy and difficult, grinding accounts down with indecisive price action. Many traders are getting stomped by the noise. This post is designed to cut through that chaos with a single, high-clarity trade idea based on a powerful fundamental story and a clean technical picture.

The focus is on the USD/JPY, where a major catalyst (US CPI) is about to meet a tightly coiling chart pattern.

The Fundamental Why 📰

Our entire thesis is now supported by both qualitative and quantitative analysis. The core driver is the profound monetary policy divergence between the U.S. and Japan, which manifests as a powerful Interest Rate Differential.

The Core Driver: The Bank of Japan maintains its ultra-easy policy while the Fed is in a "hawkish hold," creating a significant interest rate gap of over 400 basis points that fuels the carry trade.

Quantitative Validation: Our new analysis confirms this is the primary driver. We found a strong positive correlation of 0.54 between the USD/JPY exchange rate and this Interest Rate Differential. This provides a robust, data-backed reason for our long bias.

This creates a fundamental chasm between the two currencies, representing a compelling long-term tailwind for USD/JPY.

The Technical Picture 📊

The 4-hour chart perfectly visualizes the market's current state.

The Coiled Spring: Price is consolidating in a tight symmetrical triangle. This represents a balance between buyers and sellers and a build-up of energy. A breakout is imminent.

The Demand Zone: Our entry is not random. We are targeting a dip into the key demand zone between 144.50 - 144.80. This area is significant because it aligns with the 50-day moving average, a level that offers a more favorable risk/reward ratio.

The Underlying Conflict: It's important to note the long-term bearish "Death Cross" on the daily chart (50 MA below 200 MA). Our thesis is that the immense fundamental pressure—now validated by our quantitative study—will be strong enough to overwhelm this lagging technical signal.

The Plan & Setup 🎯

This is a conditional setup, and our analysis confirms the proposed levels are well-reasoned. We are waiting for the market to confirm our thesis before entering.

The Setup: 📉 Long (Buy) USD/JPY. We are looking for price to dip into our demand zone and then break out of the triangle to the upside.

Entry Zone: 👉 144.50 - 144.80. Watch for a 4H candle to show support in this area.

Stop Loss: ⛔️ 144.00. A break below this level would signal that the immediate bullish structure has failed and invalidates the trade thesis.

Take Profit: 🎯 149.50. This target is strategically set just below the major 150.00 psychological handle, a level where institutional orders are likely clustered.

This setup provides a clear, logical plan to engage with the market's next big move. It's all signal, no noise. Trade smart, and manage your risk.

USD/JPY H4 | Approaching a swing-high resistanceUSD/JPY is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 147.03 which is a swing-high resistance.

Stop loss is at 147.75 which is a level that sits above the 127.2% Fibonacci extension and a swing-high resistance.

Take profit is at 145.85 which is an overlap support that aligns closely with the 50% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USDJPY 30Min Engaged (Bearish Reversal Entry Detected )➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bearish Reversal From : 146.400

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

USD/JPY: Still a Safe-Haven Tug of WarUSD/JPY had surged past 147 on the back of Trump’s tariff letter to Japan—but quickly pulled back as risk appetite stabilized and Treasury yields softened. Price action now sits around the low-146s.

Technically, the 100-day SMA is providing key support just below 146.00. If bulls hold this level, we could see another push toward 147.20–148.00. On the downside, any surprise from upcoming Fed speakers or Japanese trade negotiations could send the pair testing the 144.00 zone again. Traders are watching Osaka closely, U.S. Treasury Secretary Scott Bessent is expected to meet Japanese officials at the World Expo, which could shape sentiment fast.

Bullish bounce off major support?USD/JPY has bounced off the pivot and could rise to the pullback resistance.

Pivot: 145.92

1st Support: 145.23

1st Resistance: 147.14

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

$UJ (USDJPY) 1HPrice tapped into a 4H FVG (gray zone 146.800–146.300), a high-probability reversal zone when paired with liquidity sweep and break of structure.

The bullish internal trendline was cleanly broken, signaling a short-term shift in momentum.

Prior to the drop, price ran buy-side liquidity resting above previous highs (marked $$$), fulfilling liquidity objectives before reversing.

The move into the 4H-FVG occurred in premium territory, ideal for institutional distribution.

As long as price holds below 146.300 (top of the FVG), the bearish leg remains valid.

Next liquidity target is around 145.240, where previous sell-side liquidity (lows marked $$$) is resting.