Fundamental Market Analysis for April 7, 2025 USDJPYThe Japanese Yen (JPY) began the week positively, as US President Donald Trump's extensive retaliatory tariffs heighten the risk of a global economic slowdown and continue to support traditional safe-haven assets. Concerns that the tightening of reciprocal tariffs by the US could negatively impact the Japanese economy have led investors to reduce their expectations of a faster increase in the discount rate by the Bank of Japan (BoJ). This has led to a positive impact on the yen, with the USD/JPY pair rebounding and returning to a six-month low during the Asian session. This level is below the psychological 145.00 mark reached on Friday.

Nevertheless, signs of rising inflation in Japan keep the door open for a further BoJ interest rate hike in 2025. Additionally, ongoing geopolitical tensions are expected to limit any significant depreciation in the yen. The US Dollar (USD) is attempting to capitalise on Friday's positive movement amid bets on more aggressive Federal Reserve (Fed) policy easing, fuelled by fears of a tariff-induced slowdown in the US economy. This, along with a further sharp decline in US Treasury yields, should provide a tailwind for the low-yielding Yen and halt any meaningful recovery movement in the USD/JPY pair.

Trade recommendation: BUY 147.000, SL 145.800, TP 148.150

USDJPY

USDJPY H4 | Falling from the 61.8% FiboBased on the H4 chart, the price is rising toward our sell entry level at 148.24, a pullback resistance that aligns with the 61.8% Fibo retracement.

Our take profit is set at 145.40, a support level.

The stop loss is set at 150.18, an overlap resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (fxcm.com/uk):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Stratos Global LLC (fxcm.com/markets):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Bullish bounce?USD/JPY is falling towards the pivot and could bounce to the 61.9% Fibonacci retracement.

Pivot: 144.13

1st Support: 142.17

1st Resistance: 148.59

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USDJPY Potential Pennant Triple ThreatFirst,

In the Higher Timeframes (4Hr - Weekly), we can see that USDJPY is traveling down a Descending Channel since Jan 10th. Price tried pushing higher in March but ultimately fell back within the Channel beginning of this month (April) resulting only in a False Breakout but also creating a Fair Value Gap from 148.698 - 147.429.

Now down on the Lower Timeframes (15min - 1Hr) we can see that Price has created a Fair Value Gap from 146.546 - 146.226 with current Price Action forming a Pennant Pattern just above this FVG which lines up with Previous Highs (Past Resistance Level) and with Volume Decreasing, suggests we could see a Breakout soon! Now Based on the Pennant Pattern being Neutral meaning can break either way, creates the first 2 Bullish Scenarios being either a Breakout and Retest of the Pennant pattern going Bullish OR Bearish.

*Breakout will be Validated if followed by an Increase in Volume!

Scenario 1 -If BULLISH BREAKOUT - The Retest will come at the Falling Resistance of the Pattern.

Scenario 2 -If BEARISH BREAKOUT - This could suggest Price is looking to "Fill The Gap" being the FVG

** If Scenario 2 happens, this Price Movement could be looking to fulfill a Fibonacci Retracement of the Swing Low @ 145.041 to the Swing High @ 146.904, where the 38.2% Level lays at the Upper Limit of the FVG and the 50% Level lays at the Lower Limit of the FVG with the Consequent Encroachment right in the middle @ 146.385.

—Both of this ideas suggest USD will need to gain strength which could mean fundamentally:

FOMC Meeting Minutes on Wednesday, April 9th & CPI (Consumer Price Index), the instrument used to measure Inflation, on Thursday, April 10th released results will be heavily relied on to see if there's anymore input on potential effects of Tariffs.

Scenario 3 - Fair Value Gap Inversion could suggest bad news fundamentally is released for USD and gives JPY Bears (Sellers) the ability to pull price down, keeping Price Consolidated further within the HTF Descending Channel.

USD/JPY 4H Chart Analysis:Trend Break & Support-Based Long Setup1. Previous Uptrend Channel

📈

Price moved in a rising channel

Lower trendline acted as support ✅

Then came the trend line break ⚠️ — signal of trend reversal

2. Major Drop

🔻💥

After breaking support, the price fell sharply

Strong bearish momentum took over

Sellers dominated the market

3. Support Zone Identified

🟦 Support Box (146.110 - 145.156)

Buyers stepped in at this level

Possible bounce or consolidation

Price currently at 147.014 — just above support

4. Trade Setup Idea

🛒 Buy Opportunity (if price holds support)

📌 Entry Zone: Around 146.110

🎯 Target: 150.260

🛑 Stop Loss: 145.156

📊 Risk:Reward = ~1:2 — solid R:R setup!

5. Indicators & Confirmations

🟠 DEMA (9): Sitting at 146.110 — aligns with support!

✅ Extra confluence for the bounce!

Summary

If price holds above support:

Buyers might push toward 150.260

If it breaks below 145.156:

Sellers may regain control

USDJPY: Bullish Continuation & Long Trade

USDJPY

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long USDJPY

Entry - 146.99

Sl - 146.07

Tp - 149.09

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDJPY - 4H more fall expectedFX:USDJPY - 4H Update 🔻

If you've traded USDJPY in recent years, you're no stranger to the significance of the 150.00 zone. This level has historically acted as a critical resistance and psychological barrier.

Now, the pair is trading below this key level and has also broken the ascending channel support on the daily timeframe, signaling that bulls are likely out of the game. The recent drop to 147.00 and bounce toward 151.00 could be setting up the next short opportunity.

📌 What to watch for:

A liquidity grab above the 151.50–152.00 zone could occur before the next fall.

This aligns with institutional behavior, hunting stops before continuing the trend.

We're now in a sell-the-rally phase, watching for confirmations around the red zone.

Remember, I previously signaled a short from the 157 zone, which played out beautifully. We’re now gearing up for the next big short, and this setup might just be it.

📉 Stay cautious, wait for price action signals, and trust the structure.

💸 If you’ve missed previous entries, don’t miss what’s coming next!

🔔 Follow for real-time updates and live trade ideas!

BTC/USD update on the drop!Good day traders, yesterday I posted the same set up on bitcoin and now I’ve decided I’m gonna update this setup till we hit our Daily lowest low.

1H TF yesterday before end of trading day we show price bounce off the the horizontal lines and that is used as my support area, going into the New York session we can expect price to retest the break after it breaks below the support which will than become my resistance.

Hopefully today we can see price run our liquidity resting below(equal lows).

My name is Teboho Matla but you don’t know me yet..#Salute

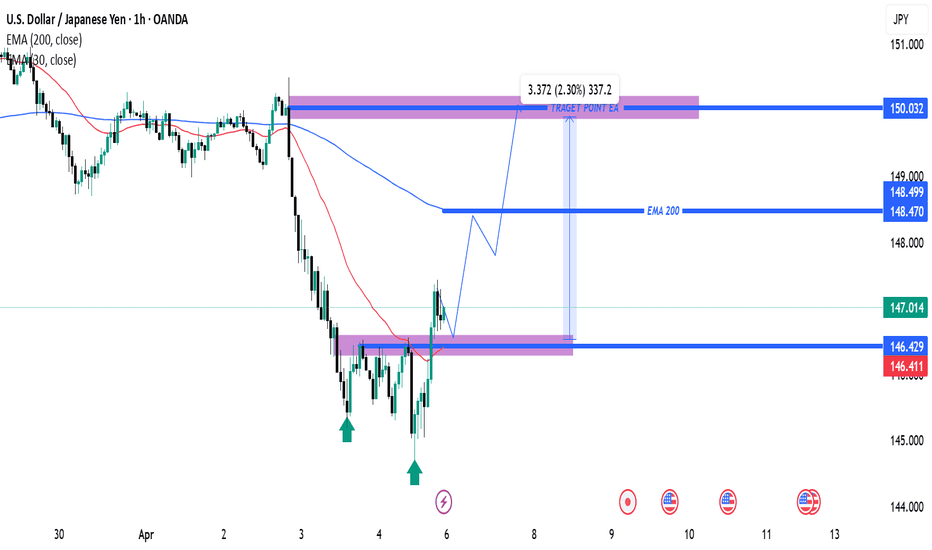

USD/JPY Bullish Reversal Setup with 2.30% Upside PotentialThis is a USD/JPY 1-hour chart analysis, and it looks like a bullish setup is being anticipated. Here's a breakdown:

Key Observations:

1. Support Zone (Purple Box - Around 146.411 - 146.429):

Multiple bullish rejections (green arrows) indicate a strong support level.

Price bounced off this support recently, forming a potential double bottom.

2. EMA Levels:

50 EMA (Red Line) is currently at 146.411.

200 EMA (Blue Line) is at 148.499, acting as dynamic resistance.

Price has crossed above the 50 EMA, a bullish sign, and might aim for the 200 EMA next.

3. Projected Bullish Path:

The path drawn suggests a pullback to the support zone around 146.429, followed by a bullish continuation.

Target zone is marked around 150.032, showing a projected gain of 2.30% (337.2 pips).

4. Resistance Levels:

Minor resistance at the 200 EMA (~148.5).

USD/JPY "The Ninja" Forex Bank Heist Plan (Swing/Scalping Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. It's Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average 151.500 (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the nearest / swing low level Using the 5H timeframe (149.500) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 155.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💵💰USD/JPY "The Ninja" Forex Bank Heist Plan (Swing/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Tariffs, Stagflation, and Yen Strength Set the Stage for a CleanAlright degenerates, here’s your clean macro breakdown.

Pair with strongest directional bias right now: USD/JPY

Bias: SHORT USD/JPY (Bearish USD / Bullish JPY)

WHY? Because the U.S. just tripped over its own tariffs and dragged the dollar with it.

1. U.S. melting down:

• Trump went full trade-war goblin: 10% base tariffs on everything, up to 100% on certain countries.

• Fed now cornered — inflation UP, growth DOWN = stagflation vibes.

• Powell already out here looking like he wants to cut rates yesterday.

• S&P nuked -4.9%, $2.5 trillion gone in a day. This is not a drill.

2. Japan not looking great, but better than the U.S.:

• BOJ possibly delaying hikes, but inflation’s been above 2% for 3 years.

• Tokyo CPI still hot.

• Plus: classic safe-haven flow kicking in thanks to all the macro chaos.

• Yen doing what yen does—acting like gold in a suit.

3. Geopolitical backdrop:

• EU & Japan both throwing shade at U.S. tariffs.

• Retaliation incoming? Risk-off vibes continue.

• Markets shifting to JPY like it’s 2020 all over again.

4. Central Bank energy:

• Fed: Shaky, reactive, duck-and-cover mode.

• BOJ: Holding back, but not out. Inflation gives them ammo.

⸻

TL;DR:

• USD is getting wrecked by its own government.

• JPY benefiting from safe-haven flows + stable inflation.

• Every major factor (macro, policy, geopolitics, sentiment) leans one way.

• USD/JPY short looks clean AF from a fundamental standpoint.

Not financial advice. I don’t care what you do. Just don’t long this trash.

Now go slap some fibs and RSI on this thing and pretend you knew it all along.

USD/JPY "The Ninja" Forex Bank Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 1H timeframe (148.250) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 152.300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/JPY "The Ninja" Forex Bank Heist Plan (Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/JPY Ready for Liftoff? Catch This Potential Rebound! Hi traders! , Analyzing USD/JPY on the 1H timeframe, spotting a potential long entry:

🔹 Entry: 145.44

🔹 TP: 146.78

🔹 SL: 144.115

USD/JPY has formed a consolidation zone after a sharp downtrend, indicating a potential bullish reversal. If buyers step in, we could see a move towards 146.78. RSI is recovering from oversold levels, supporting the upside scenario.

⚠️ DISCLAIMER: This is not financial advice. Every trader makes their own decision.

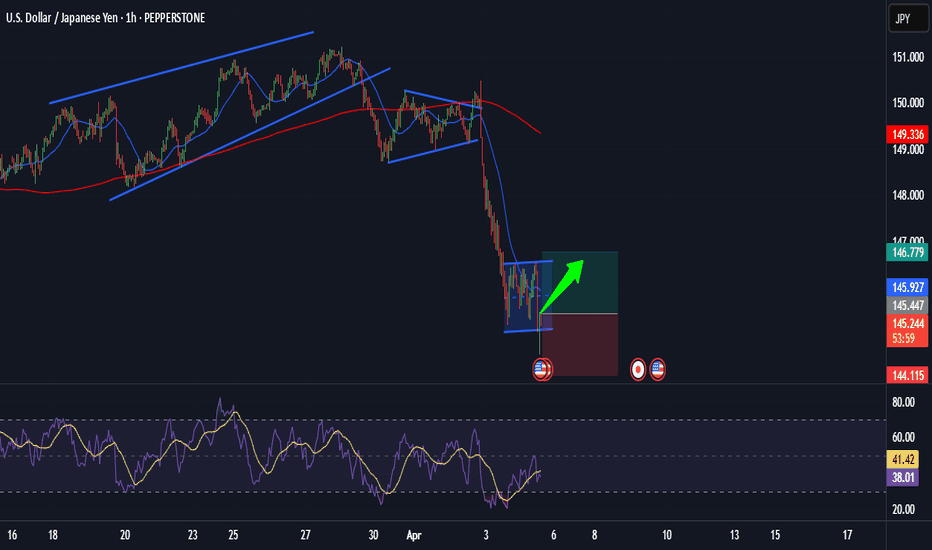

USD/JPY - Bearish breakdown signals further downside potential!The USD/JPY pair has been experiencing a clear daily downtrend, characterized by a bearish market structure and strong downward momentum. Sellers have remained in control, pushing prices lower as the pair continues to respect the prevailing bearish trend. With each failed attempt at recovery, the market structure reinforces the dominance of sellers, signaling that the path of least resistance remains to the downside.

Despite this overall downtrend, the 4-hour timeframe recently exhibited a rising channel, where price action formed higher highs and higher lows, suggesting a temporary bullish retracement within the larger bearish structure. However, this channel has now been broken, signaling a potential shift back toward the primary trend. A break of this nature often suggests that the bullish correction has exhausted its strength, and sellers are regaining control to push the price lower once again.

Following the breakdown of this rising channel, the price has failed to reclaim previous highs, instead forming a lower high—a strong indication that bearish pressure is resuming. Given this development, there is a significant possibility that USD/JPY could retrace toward key technical levels, such as the Golden Pocket (between the 0.618 and 0.65 Fibonacci retracement levels) or even the 4-hour Fair Value Gap (FVG) around 145.00.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

USDJPY POTENTIAL LONG UPON Q2 W14 Y25 FRIDAY 4TH APRIL 2025USDJPY POTENTIAL LONG UPON Q2 W14 Y25

Weekly Orderblock long

Higher time frame Exponential moving averages pulling price action

We do however need to see clear breaks of structure on the 15' to really prove that price is ready to turn around this early into the weekly order block.

With larger higher time frame order blocks, there will always be the concern that so many voids within are below. why does my speculation favour a pull back deeper before then looking long.

For those reason, we await breaks of internal structure below looking to risk capital.

More to come on this.

FRGNT X

Falling towards Fibo confluence?USD/JPY is falling towards the pivot which is a pullback support and could bounce tot he 1st resistance.

Pivot: 143.94

1st Support: 142.19

1st Resistance: 147.13

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Short All weekly momentum indicators IMACD, RSI and Stochastic) are all bearish, so I have been looking for a short opportunity in 4H and daily charts.

$151.85 is the major resistance and support zone (black horizontal line in the chart).

On Feb 6, USD/JPY broke and closed below the area, but it failed to continue to the downside.

In the following few days, it retraced to Fib 0.5 area but started to move down. Today the price broke below Fib 0.236. I like the yesterday's strong red candle, cancelling all the buy pressure from the previous day.

I opened a short position this morning.

Entry at $152.83.

Stop Loss: $155.145

Target 1: $149.52 (move stop loss to the entry level once it hits this level)

Target 2: $147.395

Is it time for a relief for the Yen?After a severe beating by the USD especially the tumultous rise inflation, Japans currency is gonna look for some relief as Tariifs will clearly lead to an economic slowdown of U.S economy, as more cheap stuff from China and the emerging market will clearly look to rise and that may weigh on consumer sentiment.

🟨 - Head abd Shoulders

🟥🔘 - Price/RSI Deviation

USDJPY Reversal: Bearish Momentum Builds Below Key ResistanceUSDJPY pair is showing signs of a bearish reversal after rejecting a key resistance zone near 151.241. The price has failed to sustain bullish momentum and has formed a potential double-top/wedge structure, indicating a shift in trend.

Key Resistance: 151.241 - 152.097 (Strong supply zone)

Bearish Confirmation: Break below 149.592 confirms downside continuation.

Key Downside Targets: 148.195, 146.990, and 145.855 as major support zones.

If sellers maintain pressure, a deeper pullback toward the 145.855 - 145.824 region could be expected. However, a break above 152.097 would invalidate the bearish setup and could push the price toward 154.090.