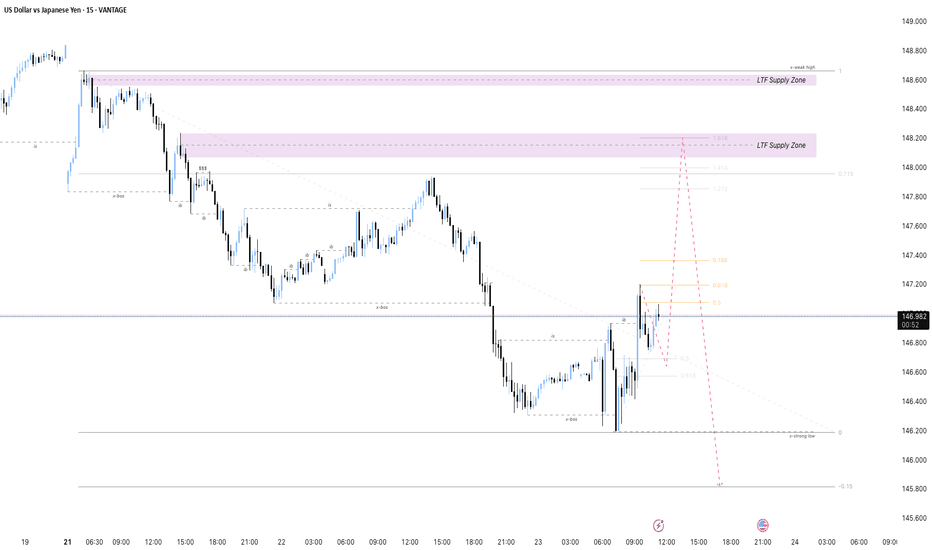

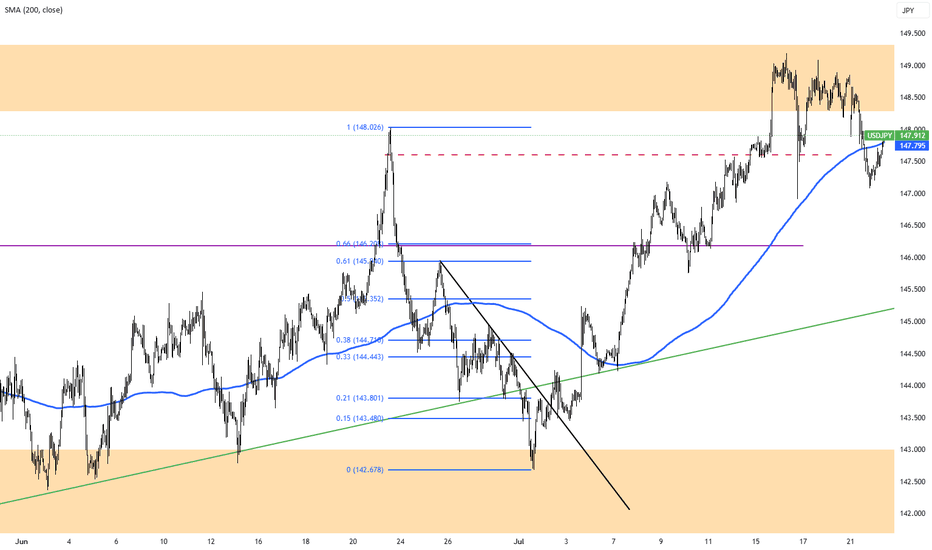

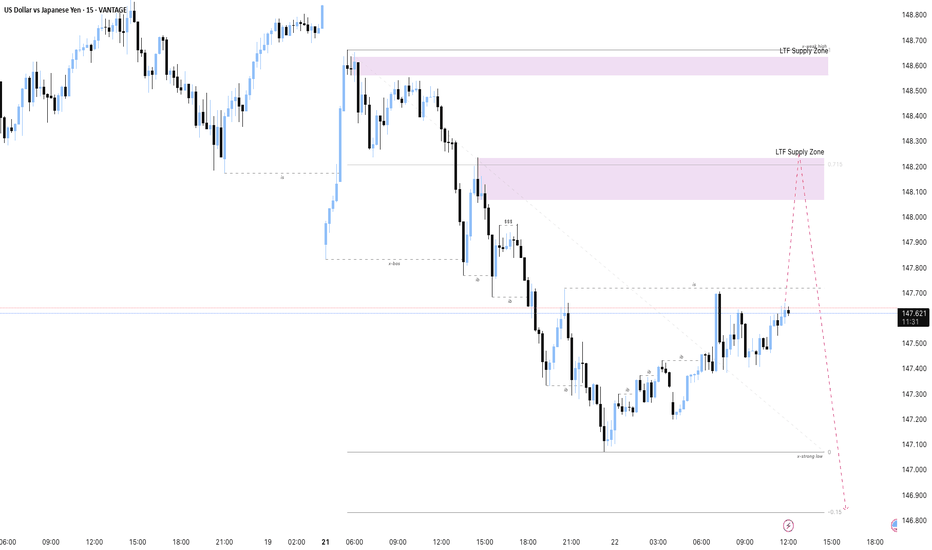

USDJPY - Bearish BiasThe USD/JPY market currently shows a clear downtrend, as indicated by the break of structure (x-bos) and lower lows formation. The price is expected to retrace upwards towards key smart money areas defined by Lower Time Frame (LTF) Supply Zones highlighted in purple.

Using Fibonacci retracement from the recent swing high to the swing low, key Fibonacci levels—especially around the 0.618 and 0.786 zones—align with these LTF Supply Zones, creating high-probability entry areas for short positions.

The trading plan anticipates a retracement into these supply zones, where bearish price action signals can confirm entries. The ultimate target is set near the previous strong low (around 145.821), aiming to ride the next leg down in alignment with the market structure.

Risk management should involve placing stop losses slightly above the upper boundary of the LTF Supply Zones to protect against false breakouts. Patience is emphasized by waiting for price to reach these confluence zones, combining Smart Money concepts and Fibonacci levels for optimal timing and risk-to-reward profile.

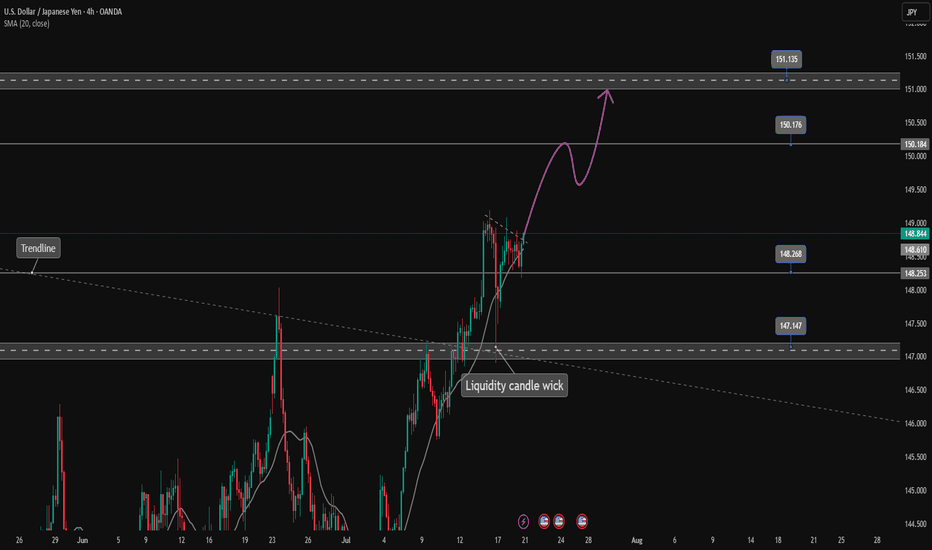

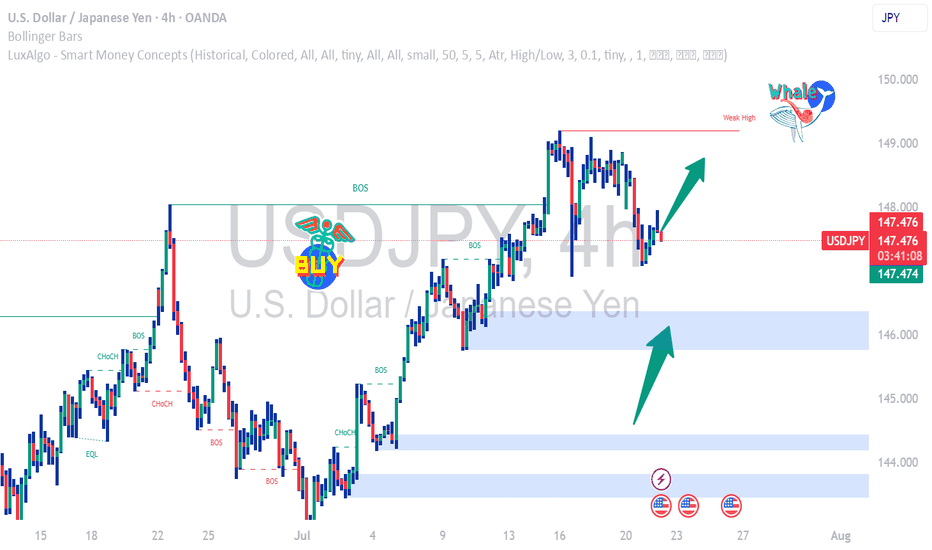

USDJPY

USDJPY is continuing its uptrend, let's BUY✏️ OANDA:USDJPY broke the price channel and continued its uptrend at 151,000. The previous h4 candle wick had a liquidity sweep to 147,000, showing that the buyers are dominating the market. The USDJPY trading strategy will mainly BUY to the old peak around 151,000. When the price breaks 147,000, a corrective downtrend will begin to form.

📉 Key Levels

Support: 148.200 - 147.200

Resistance: 150.100 - 151.100

Buy trigger: Breakout above 148,800

BUY 147,200 (buyer liquidity zone)

Target: 145,000

Leave your comments on the idea. I am happy to read your views.

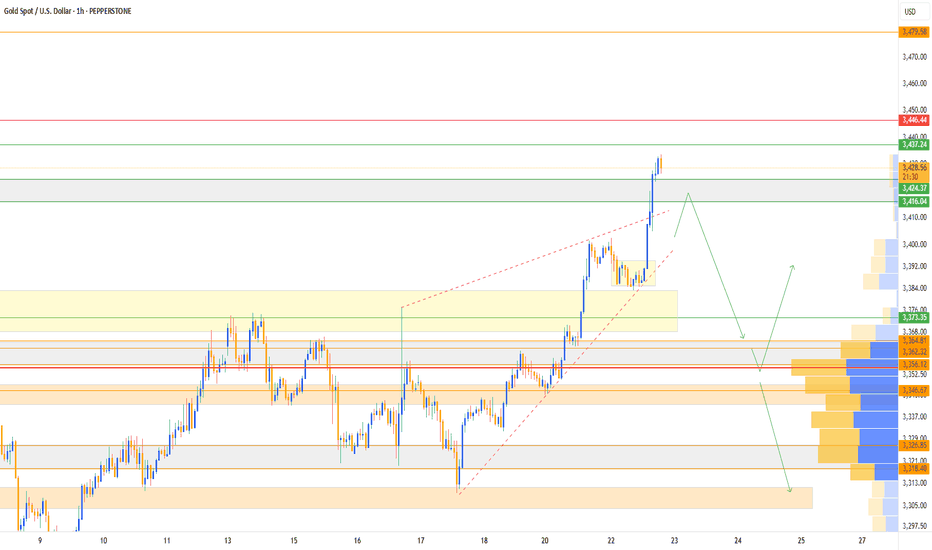

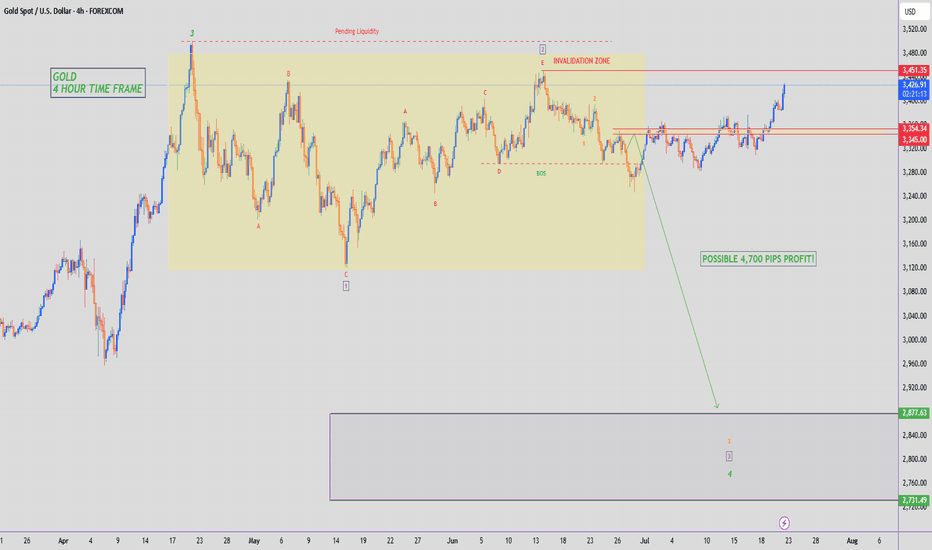

GOLD - SHORT TO $2,800 (UPDATE)Price has pushed up as expected back into the $3,400 zone, where we had a lot of pending liquidity that needed to be wiped out. Now that liquidity is collected I am patiently waiting for some form of 'distribution price action' to play out, before I consider selling. Until then I'm sitting on the sideline.

If Gold takes out Wave 2 high ($3,451) then bearish structure is invalidated & we can start looking at buy trades.

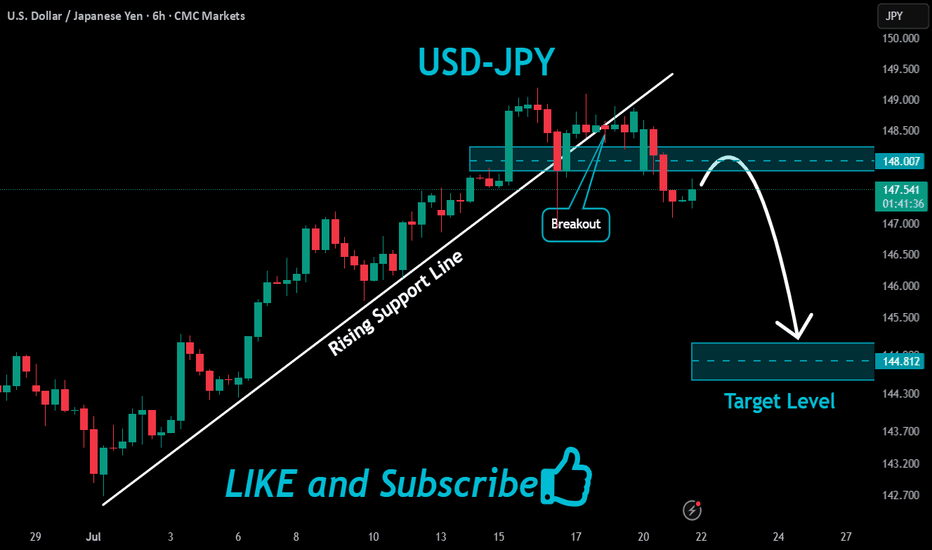

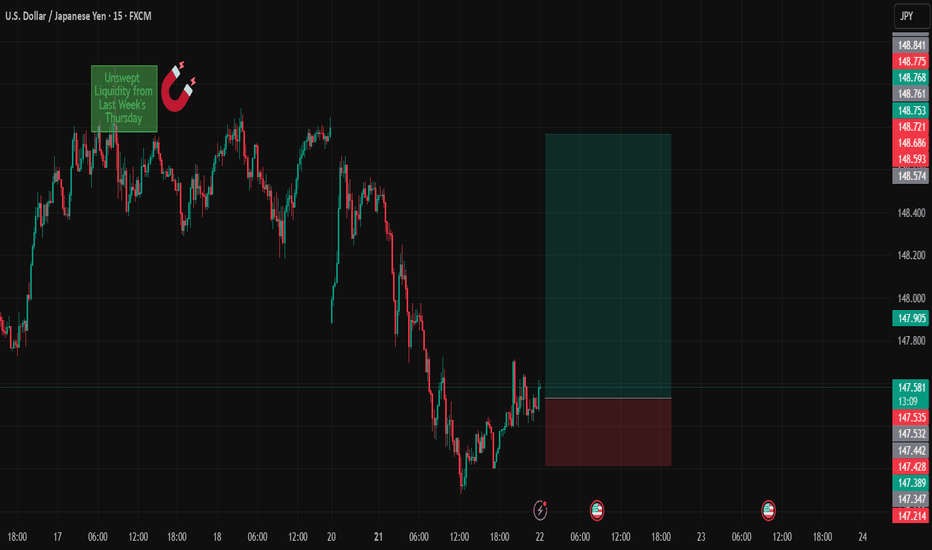

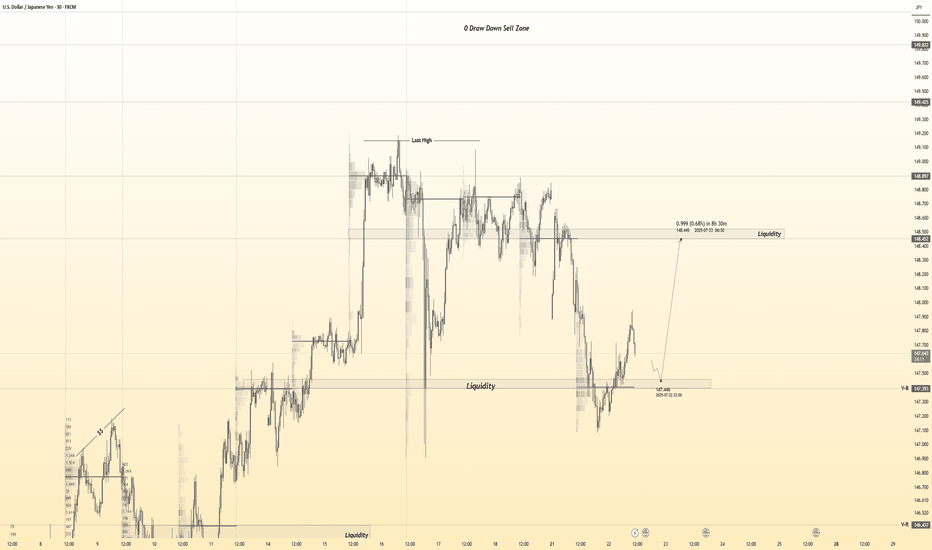

USDJPYDate:

July 22,2025

Session:

Tokyo and London session

Pair:

USDJPY

Bias:

Long

1. Clean liquidity pool left unswept from last week's NYC Open (Thursday).

Took this trade earlier today but looks like price wanted to consolidate in the liquid pool its currently in. I still hold the same idea and think the sweep will definitely take place sometime this week. Now looks like the perfect time to enter. If Asia session cant get it done its up to London and New York session.

Entry:147.534

Stop Loss:147.215

Target:148.768

RR:3.89

USDJPY Under Pressure! SELL!

My dear friends,

Please, find my technical outlook for USDJPY below:

The instrument tests an important psychological level 148.46

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 147.15

Recommended Stop Loss - 149.17

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

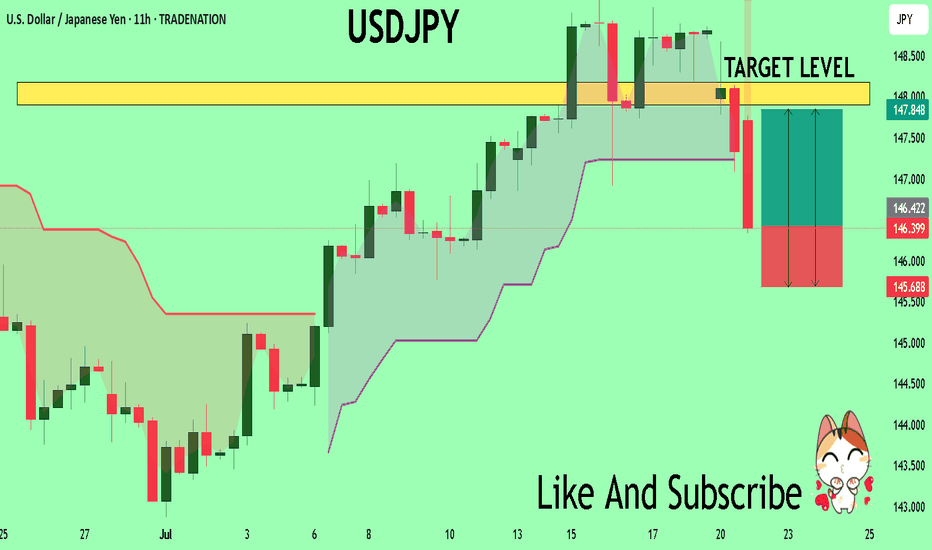

USDJPY Sellers In Panic! BUY!

My dear subscribers,

My technical analysis for USDJPY is below:

The price is coiling around a solid key level - 146.36

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 147.90

My Stop Loss - 145.68

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

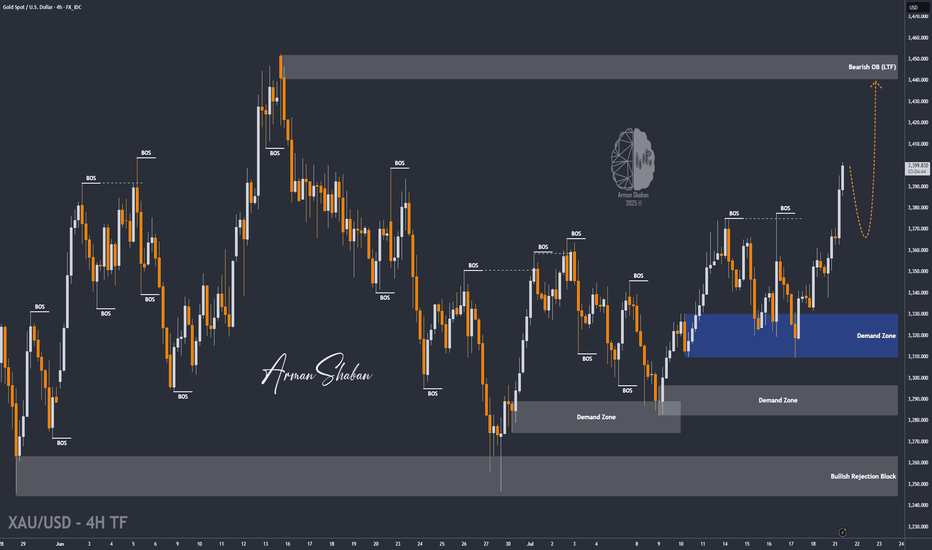

XAU/USD | Get Ready for Another Bullrun, $3500 is Coming!By analyzing the gold chart on the 4-hour timeframe, we can see that on Friday, the price finally closed at $3350. After the market opened today, we saw an initial correction down to $3339 (exactly as expected), followed by another strong bullish wave, pushing gold above $3400 just moments ago. If the price stabilizes below $3398 within the next 4 hours, I expect a potential rejection toward $3388 and $3377. However, if gold holds above $3400, the next target will be $3409. Key demand zones are $3365–$3375, and levels $3355, $3344, and $3336.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

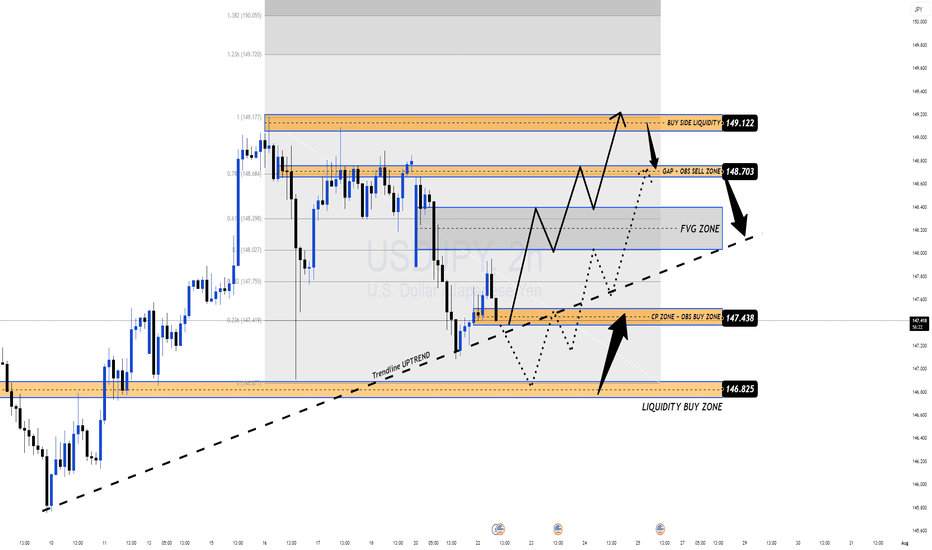

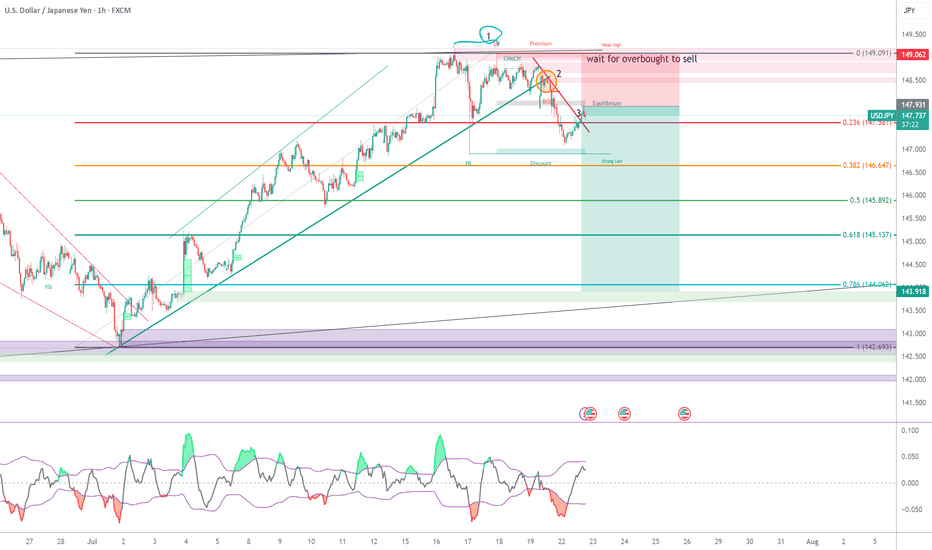

USDJPY Correction Complete, Is the Bullish Trend Back in play?After pulling back from the recent high near 149.17, USDJPY has shown signs of strength again, rebounding off the confluence support at the ascending trendline. The bullish narrative is supported by a hawkish FOMC tone and news that a U.S. federal court temporarily blocked Trump-era tariffs. The pair now awaits upcoming U.S. economic data for further directional clarity.

🔍 Technical Outlook – Structure & Momentum

✅ Primary trend: Bullish

✅ Correction phase: Completed near CP zone and trendline

✅ Key structural areas: FVG Zone, CP Zone, and trendline remain intact

Price has responded positively from the CP Zone + OBS Buy Zone around 147.438, aligning with the uptrend line. As long as this structure holds, buyers may push the market toward the next resistance zones.

🧭 Trade Scenarios

🔸 Bullish Bias (preferred scenario):

As long as price holds above 147.438, we expect continuation toward the FVG zone, with immediate targets at the GAP + OBS Sell Zone (148.703) and extended potential to the Buy-side Liquidity zone at 149.122.

A clean breakout above 149.122 opens the door to Fibonacci extensions: 149.72 and 150.05.

🔹 Bearish Scenario (if invalidated):

If price breaks below 147.438 and loses the trendline, we may see a deeper drop toward the Liquidity Buy Zone at 146.825, where strong buying interest is expected to re-enter the market.

⚠️ Macro Risk Drivers

Hawkish FOMC minutes continue to support USD strength

Paused trade tariffs reduce political headwinds, improving risk sentiment

Upcoming U.S. economic data could trigger sharp intraday moves → watch closely

📌 Key Price Zones

Liquidity Buy Zone 146.825 Major long re-entry zone

CP + OBS Buy Zone 147.438 Current active support

FVG Zone 148.20 – 148.68 Intraday bullish target

GAP + OBS Sell Zone 148.703 Short-term resistance

Buy-side Liquidity Zone 149.122 Final bullish objective

💬 Structure remains bullish unless the trendline breaks. Stay patient, wait for confirmations at key zones, and follow your plan with disciplined risk management.

Japan's coalition loses majority, yen higherThe Japanese yen has started the week with strong gains. In the European session, USD/JPY is trading at 147.71, down 0.07% on the day.

Japanese Prime Minister Ishiba's ruling coalition failed to win a majority in the election for the upper house of parliament on Sunday. The result is a humiliating blow to Ishiba, as the government lost its majority in the lower house in October.

The stinging defeat could be the end of the road for Ishiba. The Prime Minister has declared he will remain in office, but there is bound to be pressure from within the coalition for Ishiba to resign.

The election result was not a surprise, as voters were expected to punish the government at the ballot box due to the high cost of food and falling incomes. The price of rice, a staple food, has soared 100% in a year, causing a full-blown crisis for the government, which has resorted to selling stockpiled rice from national reserves to the public.

The election has greatly weakened Ishiba's standing, which is bad news as Japan is locked in intense trade talks with the US. President Trump has warned that he will impose 25% tariffs on Japanese goods if a deal isn't reached by August 1. Japan is particularly concerned about its automobile industry, the driver of its export-reliant economy.

The Bank of Japan meets on July 31 and is widely expected to continue its wait-and-see stance on rate policy. The BoJ has been an outlier among major central banks as it looks to normalize policy and raise interest rates. However, with the economic turbulence and uncertainty due to President Trump's erratic tariff policy, the Bank has stayed on the sidelines and hasn't raised rates since January. Japan releases Tokyo Core CPI on Friday, the last tier-1 event before the rate meeting.

There is resistance at 148.39 and 149.08

147.95 and 147.70 are the next support levels

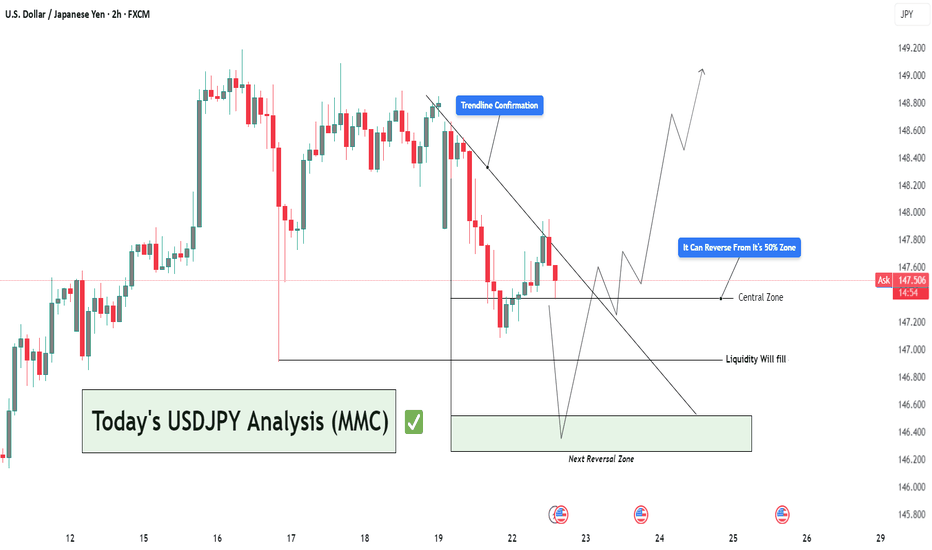

USDJPY Analysis : Trendline Breakout, Liquidity Trap & MMC Zone🔍 Full Technical Breakdown:

In today’s USDJPY 2H chart, the market is unfolding exactly as per Mirror Market Concepts (MMC). We’ve identified a clean trendline breakout, and now price is reacting between the Central Zone (50%) and the Next Reversal Zone, where liquidity is expected to be filled. Let's break down each zone and movement to understand how price is being manipulated and where we can take action.

🔵 1. Trendline Confirmation – The First Sign of Strength

The trendline was tested multiple times from the top, acting as resistance. But recently, price broke above this line with strength, signaling a potential bullish reversal. You've rightly marked it as "Trendline Confirmation" — this is where structure shifted from bearish to bullish.

This is a classic MMC principle — breakout above manipulated resistance, followed by a pullback for re-entry.

The breakout wasn’t just a wick; it had body strength, indicating real buyer presence.

Now, price is pulling back to retest the trendline from above, a typical MMC behavior before continuing upward.

⚖️ 2. Central Zone – The 50% Trap

This zone represents the midpoint of the last major impulsive move. It's where most traders get confused, and institutions re-balance their entries.

You've highlighted: “It Can Reverse From Its 50% Zone” – and that’s accurate.

According to MMC, this is where smart money traps late sellers, takes liquidity, and initiates the next bullish leg.

If price holds above the 147.200–147.500 zone, we could see buyers stepping in aggressively.

🟩 3. Liquidity Fill – Next Reversal Zone

If price doesn’t hold the Central Zone, we don’t panic — this is where MMC becomes powerful.

Beneath current structure lies liquidity — previous stop hunts and unfilled orders.

That area is your Next Reversal Zone around 146.200–146.400.

It’s a liquidity trap — market might dip there just to manipulate emotional traders, then reverse with force.

This is exactly where you’ve written “Liquidity Will Fill” — meaning smart money might fill orders there before moving up.

🧭 Possible Price Paths:

🔼 Bullish Scenario (High Probability):

Trendline retest holds as support.

Price bounces from the 50% Central Zone.

Targets: 148.800 – 149.200 (previous highs and clean breakout zone).

Confirmation: Bullish engulfing candle or strong wick rejection at Central Zone.

🔽 Bearish Trap Scenario (MMC-Based):

Price dips below Central Zone into liquidity zone.

Traps sellers and triggers stop-losses.

Reverses sharply from Next Reversal Zone (Liquidity Zone).

This is where smart money positions themselves for the real move up.

🧠 MMC Insight:

This structure is textbook MMC – clean manipulation zones, false breakout traps, and a trending bias powered by smart liquidity plays.

Trendline breakout = initial intent

Central zone = confusion zone

Liquidity trap = entry for smart money

📢 The goal is not to predict, but to react with precision when the market reveals its hand.

🕒 Timeframe: 2H

📌 Strategy: Mirror Market Concepts (MMC) | Trendline + Liquidity + Midpoint Trap

📈 Bias: Bullish, but waiting for confirmation at either Central or Liquidity Zone

🔍 Sentiment: Cautiously Optimistic

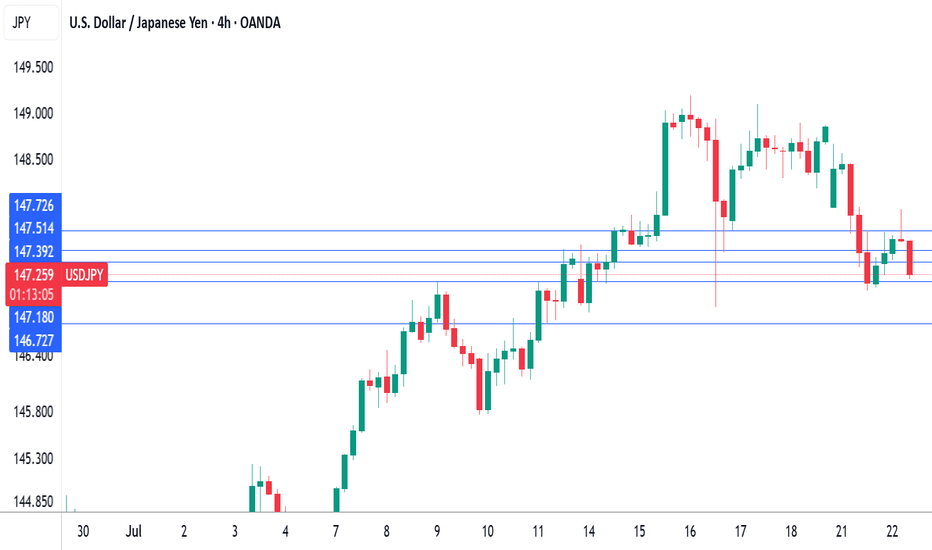

USDJPY Falling Fast Bearish Momentum or Reversal Zone?USDJPY has dropped significantly and is now trading around 147.730, nearing a key historical support zone near 147.20 – 147.00.

This area previously acted as a strong demand zone and may trigger a bounce or a breakdown depending on market sentiment.

🔹 Technical Overview (4H Chart):

• Current Price: 147.73

• Support Zone: 147.20 – 147.00

• Resistance: 149.00

• Breakdown Target: 145.80

• Possible Bounce Target: 148.80 – 149.30

📊 Bias:

I'm watching this zone closely.

• If price holds above 147.00 with bullish candle – Long Setup toward 149.00

• If price breaks below 147.00 and closes on 4H – Short Setup toward 145.80

⚠️ Use tight SL below support zone if buying.

USDJPY 30Min Engaged ( Bullish Entry Detected )————-

➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish From now Price : 147.450

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

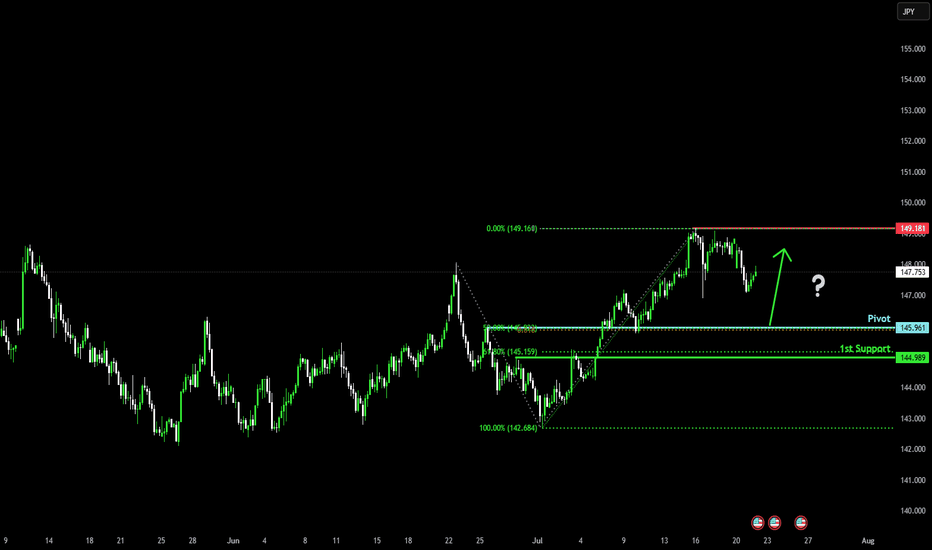

Bullish bounce off major support?USD/JPY is falling towards the pivot, which acts as an overlap support and could bounce to the 1st resistance, which is a swing high resistance.

Pivot: 145.96

1st Support: 144.98

1st Resistance: 149.18

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Yen Holds Firm as Ishiba Stays in OfficeThe yen hovered around 147.5 per dollar on Tuesday, holding its 1% gain as markets digested Japan’s election outcome. Despite the ruling coalition losing its upper house majority, Prime Minister Shigeru Ishiba is likely to stay in office, easing political concerns. Ishiba confirmed his continued involvement in US trade negotiations. Meanwhile, opposition parties are expected to advocate for fiscal stimulus and tax cuts, which could pressure the yen and push bond yields higher. Trade discussions with the US remain on schedule for the August 1 deadline.

Resistance is at 147.75, with major support at 146.15.

USD/JPY Possible Bear Scenario🔍 Analysis Summary:

USDJPY has failed to close above 146.1 on the weekly for the past 13 candles, showing clear signs of price exhaustion at this level. Price has also tapped into a marked 8HR bearish order block and printed a Daily Pin Bar — a strong reversal signal indicating potential downside.

📍Key Technicals:

• Resistance Holding: 146.1–146.6 zone

• Bearish Rejection: Pin Bar off resistance + order block

• Risk Area (Stop Zone): Above 147.16

• Target Zones: 144.2 (interim) → 142.4 (swing level)

🛠 Confluence:

• Order block rejection

• Multi-week resistance

• Clean structure with defined R:R

• Bearish candlestick confirmation

📊 Timeframe: 8HR

📉 Bias: Short

🔐 Risk Management: Proper stop loss in place above structure. Use personal risk limits.

⸻

⚠️ Disclaimer:

This setup is for educational and informational purposes only. It is not financial advice or a recommendation to trade. Always conduct your own analysis and use risk management based on your personal trading plan.

USDJPY - M15 Downtrend with Supply Zone RetestThe USD/JPY market currently exhibits a downtrend with price rebounding slightly from recent lows. The key focus is the Lower Time Frame (LTF) Supply Zone around 148.2, which acts as a strong resistance level.

The trading plan anticipates the price to rise into this LTF Supply Zone, where selling pressure is expected to resume, leading to a continuation of the downward trend. The ultimate target is near the previous strong low around 146.8, representing a potential demand zone and support level.

This plan suggests watching for price action signals such as rejection wicks or bearish candlestick patterns within the supply zone to confirm entries for short positions. Managing risk involves placing stop losses just above the supply zone to protect against unexpected breakouts.

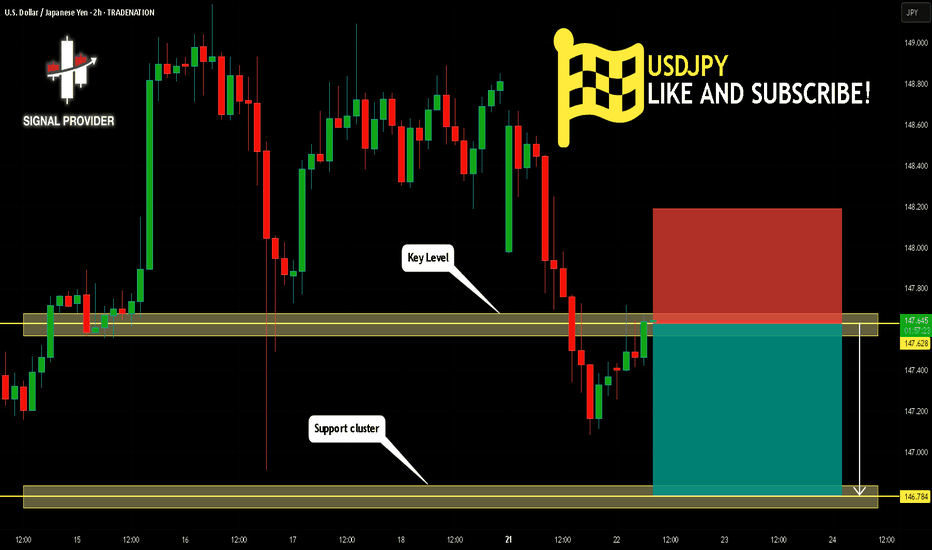

USDJPY Will Fall! Sell!

Take a look at our analysis for USDJPY.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 147.628.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 146.784 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

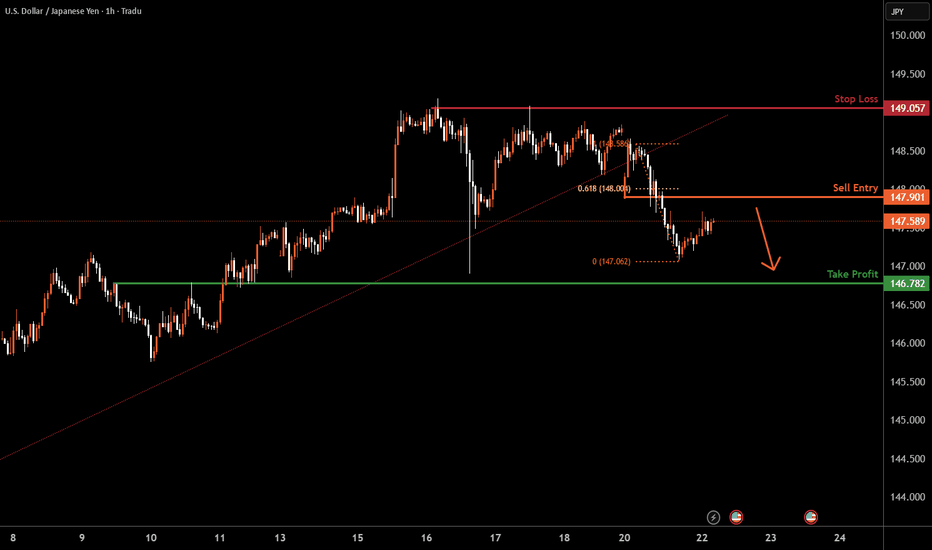

USDJPY H1 I Bearish Reversal off the 61.8%Based on the H1 chart, the price is rising toward our sell entry level at 147.90, a pullback resistance that aligns closely with the 61.8% Fib retracement.

Our take profit is set at 146.78 an overlap support.

The stop loss is set at 149.05, a swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

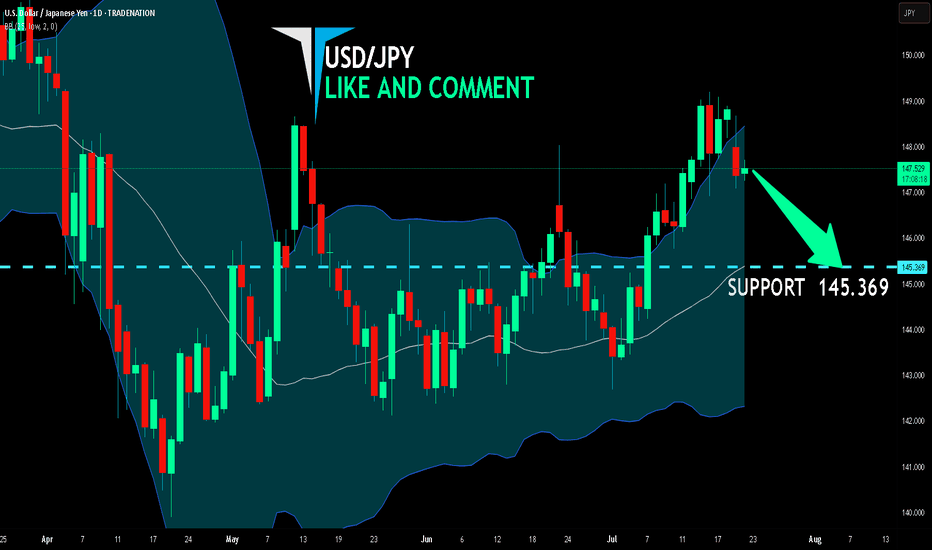

USD/JPY SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

USD/JPY pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 1D timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 145.369 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅