#USDJPY:1351+ Bullish Move One Not To Miss| Three TPs| JPY has been bullish since the dollar strengthened, potentially leading to a trade war that would make the Japanese yen more valuable to global investors. However, we may see a strong correction on all XXXJPY pairs, potentially returning stronger with a major bullish correction. We’re not sure if the price will hit all three take profit zones, but we’re interested in how far it goes.

Use accurate risk management. This analysis is purely for educational purposes only. Use your own knowledge and analysis before taking any entries.

Team Setupsfx_

Usdjpyanalysis

USD/JPY(20250409)Today's AnalysisMarket news:

The U.S. Customs and Border Protection Agency reiterated that the specific tax rates for each country will be announced at 12:01 a.m. on April 9.

Technical analysis:

Today's buying and selling boundaries:

146.77

Support and resistance levels

148.90

148.10

147.59

145.95

145.43

144.63

Trading strategy:

If the price breaks through 145.95, consider buying, the first target price is 146.77

If the price breaks through 145.43, consider selling, the first target price is 144.63

USDJPY Double Bottom PatternFenzoFx—USDJPY formed a double bottom pattern, which is a bullish signal. The immediate support is at 144.56. If this level holds, the currency pair could rise toward 148.2. Traders should monitor this level for bearish signals.

Please note that the bullish outlook should be invalidated if USD/JPY dips below the immediate support.

USD/JPY) Bullish reversal analysis Read The ChaptianSMC Trading point update

This chart is for USD/JPY on the 1-hour timeframe, and it presents a bullish trade setup. Let’s break down the idea

---

Key Observations:

1. Current Price:

USD/JPY is trading around 146.281.

2. Overall Bias:

Bullish setup expecting a bounce from demand into a higher target zone.

3. EMA 200:

Price is currently below the 200 EMA (147.942), which usually suggests a bearish trend — but this setup is aiming for a short-term bullish retracement.

4. Demand Zone (Buy Area):

Marked in yellow between 145.822 and slightly above.

Labeled as "FVG orders" (Fair Value Gap), suggesting institutional interest or imbalance fill.

5. Trendline Support:

The price is approaching a rising trendline, adding confluence for a potential bounce.

6. Expected Move:

Price is expected to bounce from the demand zone, form a higher low, and then move up toward the target zone at 148.221.

Two upside targets are drawn:

First Move: ~1.12% (30.6 pips)

Full Target: ~1.76% (256.1 pips)

Mr SMC Trading point

7. RSI (Relative Strength Index):

RSI is around 37.66, nearing oversold territory, supporting a bullish reversal idea.

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: Around 145.822 (fair value gap & trendline support)

Target Zone: 148.221

Stop Loss: Likely just below the demand zone or trendline

Confluence Factors:

Trendline support

RSI nearing oversold

Fair value gap zone

EMA 200 overhead (target acts as resistance)

---

Pelas support boost 🚀 analysis follow

USDJPY Breakdown?Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USD/JPY) bullish trend analysis Read The ChaptianSMC Trading point update

This chart is an analysis of the USD/JPY currency pair on a 2-hour timeframe, and it presents a possible bullish scenario. Here’s a breakdown of the idea:

---

Key Points of the Analysis:

1. Support Level & Change of Character (ChoCH):

Price found strong support around 144.556.

A ChoCH (Change of Character) is noted, indicating a potential shift from a bearish to a bullish trend.

2. Bullish Reversal Setup:

The price is forming higher lows, suggesting the start of a "New Up Trend".

There's a clear zig-zag bullish projection, suggesting potential long opportunities.

3. Target Zones:

The first target point is in the range of 149.692 – 150.493.

This area is also marked with a resistance zone, making it a logical TP (Take Profit) level.

4. Risk/Reward Ratio:

The risk is around -3.75% (-564.8 pips), and the reward is around +3.94% (+569.2 pips), suggesting a 1:1.05 R/R ratio.

5. RSI Indicator (Below):

RSI is showing a bullish divergence (price made lower lows while RSI made higher lows).

This divergence supports the idea of a possible bullish reversal.

6. 200 EMA:

The 200 EMA is at 148.767, acting as a dynamic resistance. Price may react around that level before hitting the final target zone.

Mr SMC Trading point

---

Conclusion:

This analysis suggests a potential long trade setup on USD/JPY based on:

A support zone,

Bullish RSI divergence,

Market structure shift (ChoCH),

And projected movement toward 149.692–150.493.

Idea: Buy near the support zone (~144.556) and target the resistance zone (~150.493) while managing risk carefully.

---

Pales support boost 🚀 analysis follow)

USD/JPY Bullish Reversal: Order Block & EMA 200 TargetSMC Trading point update

This chart presents a technical analysis of USD/JPY on the 1-hour timeframe. The key insights from this analysis are:

1. Order Block & Potential Reversal

The price has dropped significantly and reached a highlighted order block zone (a key demand area).

A potential inverse head and shoulders pattern is forming, indicating a possible bullish reversal.

2. Expected Bullish Movement

The price is expected to bounce from the order block, creating a bullish structure.

The projected move suggests a retracement toward a resistance zone, which aligns with previous price action.

Mr SMC Trading point

3. Target Zone & EMA 200

The target zone is around 148.946 - 149.178, aligning with the 200 EMA, a significant resistance level.

4. RSI Indicator

The RSI is currently low (~38.93), indicating potential for a reversal as the market may be oversold.

Conclusion

The chart suggests a bullish retracement after the recent drop, targeting the resistance zone near the 200 EMA. However, confirmation is needed (e.g., bullish price action, volume increase) before taking a trade. Keep an eye on fundamental news that may impact USD/JPY volatility.

Pales support boost 🚀 analysis follow)

DeGRAM | USDJPY decline from the channel boundaryUSDJPY is in a descending channel below the trend lines.

The price is moving from the upper boundary of the channel and has already broken the lower trend line.

We expect the decline to continue after consolidation under the 50% retracement level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

USD/JPY 4H Chart Analysis:Trend Break & Support-Based Long Setup1. Previous Uptrend Channel

📈

Price moved in a rising channel

Lower trendline acted as support ✅

Then came the trend line break ⚠️ — signal of trend reversal

2. Major Drop

🔻💥

After breaking support, the price fell sharply

Strong bearish momentum took over

Sellers dominated the market

3. Support Zone Identified

🟦 Support Box (146.110 - 145.156)

Buyers stepped in at this level

Possible bounce or consolidation

Price currently at 147.014 — just above support

4. Trade Setup Idea

🛒 Buy Opportunity (if price holds support)

📌 Entry Zone: Around 146.110

🎯 Target: 150.260

🛑 Stop Loss: 145.156

📊 Risk:Reward = ~1:2 — solid R:R setup!

5. Indicators & Confirmations

🟠 DEMA (9): Sitting at 146.110 — aligns with support!

✅ Extra confluence for the bounce!

Summary

If price holds above support:

Buyers might push toward 150.260

If it breaks below 145.156:

Sellers may regain control

USDJPY - 4H more fall expectedFX:USDJPY - 4H Update 🔻

If you've traded USDJPY in recent years, you're no stranger to the significance of the 150.00 zone. This level has historically acted as a critical resistance and psychological barrier.

Now, the pair is trading below this key level and has also broken the ascending channel support on the daily timeframe, signaling that bulls are likely out of the game. The recent drop to 147.00 and bounce toward 151.00 could be setting up the next short opportunity.

📌 What to watch for:

A liquidity grab above the 151.50–152.00 zone could occur before the next fall.

This aligns with institutional behavior, hunting stops before continuing the trend.

We're now in a sell-the-rally phase, watching for confirmations around the red zone.

Remember, I previously signaled a short from the 157 zone, which played out beautifully. We’re now gearing up for the next big short, and this setup might just be it.

📉 Stay cautious, wait for price action signals, and trust the structure.

💸 If you’ve missed previous entries, don’t miss what’s coming next!

🔔 Follow for real-time updates and live trade ideas!

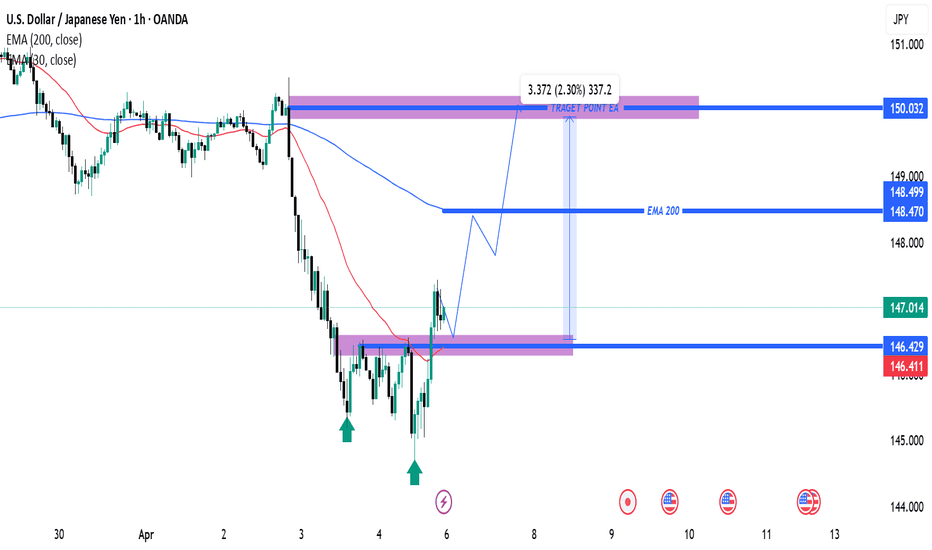

USD/JPY Bullish Reversal Setup with 2.30% Upside PotentialThis is a USD/JPY 1-hour chart analysis, and it looks like a bullish setup is being anticipated. Here's a breakdown:

Key Observations:

1. Support Zone (Purple Box - Around 146.411 - 146.429):

Multiple bullish rejections (green arrows) indicate a strong support level.

Price bounced off this support recently, forming a potential double bottom.

2. EMA Levels:

50 EMA (Red Line) is currently at 146.411.

200 EMA (Blue Line) is at 148.499, acting as dynamic resistance.

Price has crossed above the 50 EMA, a bullish sign, and might aim for the 200 EMA next.

3. Projected Bullish Path:

The path drawn suggests a pullback to the support zone around 146.429, followed by a bullish continuation.

Target zone is marked around 150.032, showing a projected gain of 2.30% (337.2 pips).

4. Resistance Levels:

Minor resistance at the 200 EMA (~148.5).

USD/JPY "The Ninja" Forex Bank Heist Plan (Swing/Scalping Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. It's Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average 151.500 (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the nearest / swing low level Using the 5H timeframe (149.500) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 155.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💵💰USD/JPY "The Ninja" Forex Bank Heist Plan (Swing/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Tariffs, Stagflation, and Yen Strength Set the Stage for a CleanAlright degenerates, here’s your clean macro breakdown.

Pair with strongest directional bias right now: USD/JPY

Bias: SHORT USD/JPY (Bearish USD / Bullish JPY)

WHY? Because the U.S. just tripped over its own tariffs and dragged the dollar with it.

1. U.S. melting down:

• Trump went full trade-war goblin: 10% base tariffs on everything, up to 100% on certain countries.

• Fed now cornered — inflation UP, growth DOWN = stagflation vibes.

• Powell already out here looking like he wants to cut rates yesterday.

• S&P nuked -4.9%, $2.5 trillion gone in a day. This is not a drill.

2. Japan not looking great, but better than the U.S.:

• BOJ possibly delaying hikes, but inflation’s been above 2% for 3 years.

• Tokyo CPI still hot.

• Plus: classic safe-haven flow kicking in thanks to all the macro chaos.

• Yen doing what yen does—acting like gold in a suit.

3. Geopolitical backdrop:

• EU & Japan both throwing shade at U.S. tariffs.

• Retaliation incoming? Risk-off vibes continue.

• Markets shifting to JPY like it’s 2020 all over again.

4. Central Bank energy:

• Fed: Shaky, reactive, duck-and-cover mode.

• BOJ: Holding back, but not out. Inflation gives them ammo.

⸻

TL;DR:

• USD is getting wrecked by its own government.

• JPY benefiting from safe-haven flows + stable inflation.

• Every major factor (macro, policy, geopolitics, sentiment) leans one way.

• USD/JPY short looks clean AF from a fundamental standpoint.

Not financial advice. I don’t care what you do. Just don’t long this trash.

Now go slap some fibs and RSI on this thing and pretend you knew it all along.

USD/JPY "The Ninja" Forex Bank Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 1H timeframe (148.250) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 152.300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/JPY "The Ninja" Forex Bank Heist Plan (Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

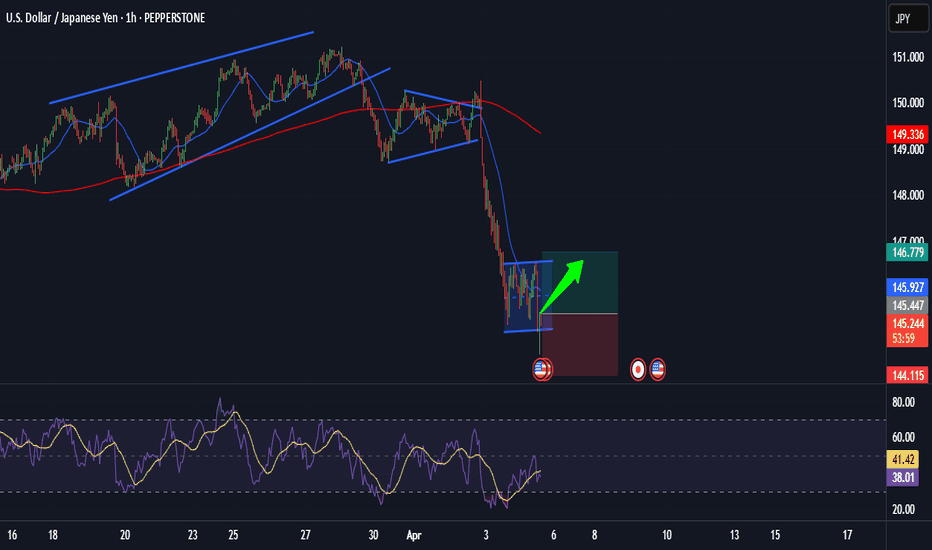

USD/JPY Ready for Liftoff? Catch This Potential Rebound! Hi traders! , Analyzing USD/JPY on the 1H timeframe, spotting a potential long entry:

🔹 Entry: 145.44

🔹 TP: 146.78

🔹 SL: 144.115

USD/JPY has formed a consolidation zone after a sharp downtrend, indicating a potential bullish reversal. If buyers step in, we could see a move towards 146.78. RSI is recovering from oversold levels, supporting the upside scenario.

⚠️ DISCLAIMER: This is not financial advice. Every trader makes their own decision.

USDJPY POTENTIAL LONG UPON Q2 W14 Y25 FRIDAY 4TH APRIL 2025USDJPY POTENTIAL LONG UPON Q2 W14 Y25

Weekly Orderblock long

Higher time frame Exponential moving averages pulling price action

We do however need to see clear breaks of structure on the 15' to really prove that price is ready to turn around this early into the weekly order block.

With larger higher time frame order blocks, there will always be the concern that so many voids within are below. why does my speculation favour a pull back deeper before then looking long.

For those reason, we await breaks of internal structure below looking to risk capital.

More to come on this.

FRGNT X

Short All weekly momentum indicators IMACD, RSI and Stochastic) are all bearish, so I have been looking for a short opportunity in 4H and daily charts.

$151.85 is the major resistance and support zone (black horizontal line in the chart).

On Feb 6, USD/JPY broke and closed below the area, but it failed to continue to the downside.

In the following few days, it retraced to Fib 0.5 area but started to move down. Today the price broke below Fib 0.236. I like the yesterday's strong red candle, cancelling all the buy pressure from the previous day.

I opened a short position this morning.

Entry at $152.83.

Stop Loss: $155.145

Target 1: $149.52 (move stop loss to the entry level once it hits this level)

Target 2: $147.395

USDJPY Reversal: Bearish Momentum Builds Below Key ResistanceUSDJPY pair is showing signs of a bearish reversal after rejecting a key resistance zone near 151.241. The price has failed to sustain bullish momentum and has formed a potential double-top/wedge structure, indicating a shift in trend.

Key Resistance: 151.241 - 152.097 (Strong supply zone)

Bearish Confirmation: Break below 149.592 confirms downside continuation.

Key Downside Targets: 148.195, 146.990, and 145.855 as major support zones.

If sellers maintain pressure, a deeper pullback toward the 145.855 - 145.824 region could be expected. However, a break above 152.097 would invalidate the bearish setup and could push the price toward 154.090.

USD/JPY Ready to Take Off: Golden Opportunity on 1H!Hi traders! Analyzing USD/JPY on the 1H timeframe, spotting a potential entry:

🔹 Entry: 150.08

🔹 TP: 150.589

🔹 SL: 149.547

USD/JPY is breaking out of a bullish pennant pattern, suggesting a potential upward move. The RSI is holding above 50, indicating bullish momentum building up. If the price sustains above 150.08, we could see a push toward 150.589. Keep your eyes on price action and manage your risk!

⚠️ DISCLAIMER: This is not financial advice. Trade responsibly.

USDJPY DOWNWARDhello fellow traders, we wait for another down/retracements on this pair FX:USDJPY , but this is only my view, you can share yours if you have any idea.

1st target 148.6,

Long zone 145 . this idea base on my own understanding, on my other pairs that posted, still valid folks. GU, GJ, XAU. are we all connected?

this is not a financial advice,

follow for more swing trades. swing it....