USDJPY Technical AnalysisFenzoFx—USDJPY tested 150.25, a trading range below this level and the 50-period simple moving average. A close above 150.25 can trigger the uptrend, targeting 151.2.

Conversely, a dip below 148.2 invalidates the bullish outlook, with 148.2 as the first target and 147.43 as the secondary target.

Usdjpyanalysis

USD/JPY 30-Minute Trade Setup: Bullish Reversal from Key SupportEMA (30, close) - Red Line: 149.488 (shorter-term trend)

EMA (200, close) - Blue Line: 149.862 (longer-term trend)

Trade Setup:

Entry Zone: Around 149.000 (marked by the purple support area)

Stop Loss: 148.698 (below the key support level)

Target Point: 150.275 (potential profit level)

Analysis:

Price is currently testing a strong support zone (purple area), suggesting a possible bullish reversal.

The 30 EMA (red) is acting as local resistance.

The 200 EMA (blue) is positioned above, which may act as further resistance if price moves up.

The price action suggests a potential bounce from support, leading to a target around 150.275.

Risk-to-Reward Consideration:

Stop loss is placed slightly below the support zone for risk management.

Target price provides a favorable risk-to-reward ratio of approximately 1:3.

Conclusion:

A long (buy) trade is expected if price holds above the support zone.

If price breaks below 148.698, the bullish setup could be invalidated.

A break above 149.862 (200 EMA) would confirm a stronger bullish continuation.

USDJPY and GBPJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USD/JPY "The Ninja" Forex Bank Heist Plan (Day / Scalping Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Bank . Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (148.600) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 152.400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/JPY "The Ninja" Forex Bank Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

ShortYesterday, I opened a short position during the Asian session and published my trade set up , but I ended up manually closing the position before the US open becauseI was a bit anxious about US GDP data.

But the main concern was the price was hovering around the major support and resistance area and I could see valid reasons to go long as well.

The obvious reason for the long position was the price was forming big inverted head and shoulder patterns. So, if the price broke above the resistance area, there would have been a great upside potential.

However, after the US session opened, I ended up opening a short position. The reasons are written in the article I published yesterday. Please read that article that is linked below.

But another argument I would like to add for the bear scenario is this.

In Nov-Dec 2024, we had a very similar set up ( dark blue rectangular box in the chart.) At the time, the price was also forming the inverted head and shoulder at the same support/resistance zone. Once it broke the resistance line, it took off to the upside. And that same scenario can unfold this time as well.

However, what is different between Dec 2024 period and the current period are:

1) VWAP (volume weighted average price) drawn from the major low in 24th Sept was working as support but this time the same VWAP is working as resistance.

2) MACD and RSI were moving from bear zone to the bull zone, but this time they are moving to the downside from the bull zone.

Therefore, I think the momentum is to the downside this time. The only time will tell.

My current short position is quite small. However, once the direction becomes more clear I plan to add more position because the move to the downside from here can be quite significant.

USDJPY analysis week 14🌐Fundamental Analysis

The Federal Reserve (Fed) kept interest rates unchanged in the 4.25% - 4.50% range and forecast core PCE inflation to average 2.8% by year-end. The higher-than-expected inflation data reinforced expectations that the Fed will maintain current interest rates for an extended period. Investors are concerned that these tariffs could add to global inflationary pressures and trigger a recession.

In Japan, the Tokyo CPI rose sharply in March, boosting expectations that the Bank of Japan (BoJ) will continue to raise interest rates this year. The hot inflation data also supported the Yen's appreciation against other currencies.

🕯Technical Analysis

USDJPY is still in a bullish recovery. The pair is facing support at 149.200, preventing further declines. The weekly high around 151.100 is still acting as key resistance before the pair breaks out to 152.000. Conversely, if the trend breaks at 149.200, weekly support is seen at 148.300.

📈📉Trading Signals

SELL USDJPY 151.300-151.100 SL 150.500

SELL USDJPY 152.000-152.200 SL 152.400

BUY USDJPY 149.300-149.100 SL 148.900

151.00 Cracks: Is USD/JPY’s Rally Over? Key Levels AheadFrom a fundamental perspective, the USD/JPY exchange rate retreated from around the 151.00 level. Despite the poor Japanese PMI data on Monday, investors bought the Japanese yen influenced by the hawkish outlook of the Bank of Japan (BoJ). The minutes of the January meeting showed that policymakers tend to tighten policies when appropriate. The BoJ governor also stated that the degree of monetary easing will be adjusted once the 2% inflation target is achieved.

Technically, the overnight breakout above the 150.00 psychological mark and the 200 - period Simple Moving Average (SMA) on the 4 - hour chart is a bullish signal. Indicators on the daily chart also support appreciation, and pullbacks may present buying opportunities. If the rate breaks below 150.00, it may accelerate its decline to support levels such as 149.30 - 149.25. Failure to hold these levels indicates that the rebound momentum has been exhausted and the trend may turn bearish. Conversely, if it stabilizes above 151.00, the upward resistance levels are successively 151.30, 151.75 (the 200 - day SMA), and it may even rise to 153.00.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

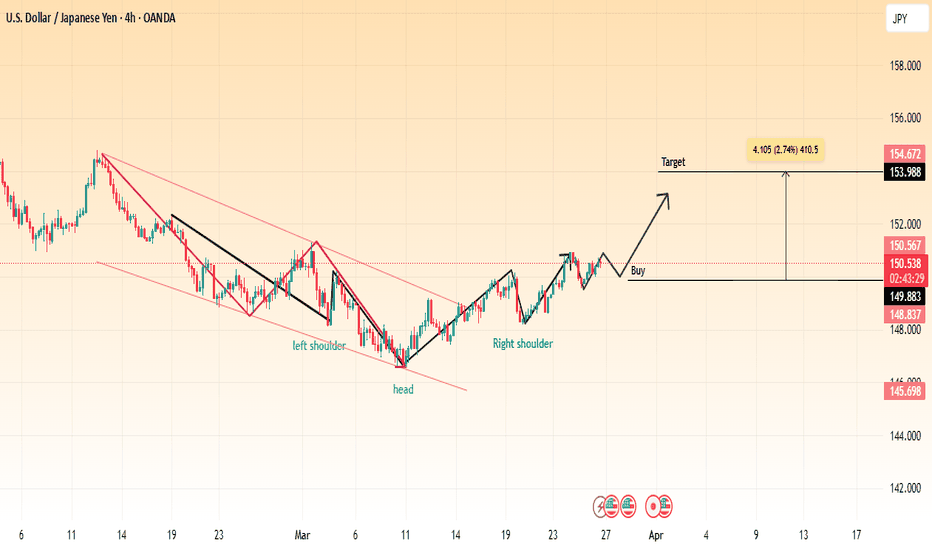

USD/JPY Bullish Reversal (Inverse Head & Shoulders)📌 Pattern: Inverse Head & Shoulders

📌 Analysis: The chart showcases an inverse head and shoulders pattern, a classic bullish reversal formation. The price has successfully broken out of the downward trendline, indicating potential upside movement.

🔹 Left Shoulder: Formed during the previous retracement.

🔹 Head: The lowest point of the pattern, marking strong support.

🔹 Right Shoulder: Completed with a breakout above resistance.

📈 Trading Plan:

✅ Entry (Buy): After a confirmed breakout and possible retest.

🎯 Target: 153.988 - 154.672 (2.74% potential gain).

🔻 Support: 149.883 - 148.837 (Stops should be placed accordingly).

📊 Conclusion:

If the price maintains above the breakout level, we may see a strong rally toward the resistance target. Watch for volume confirmation and pullback retests before entering a trade.

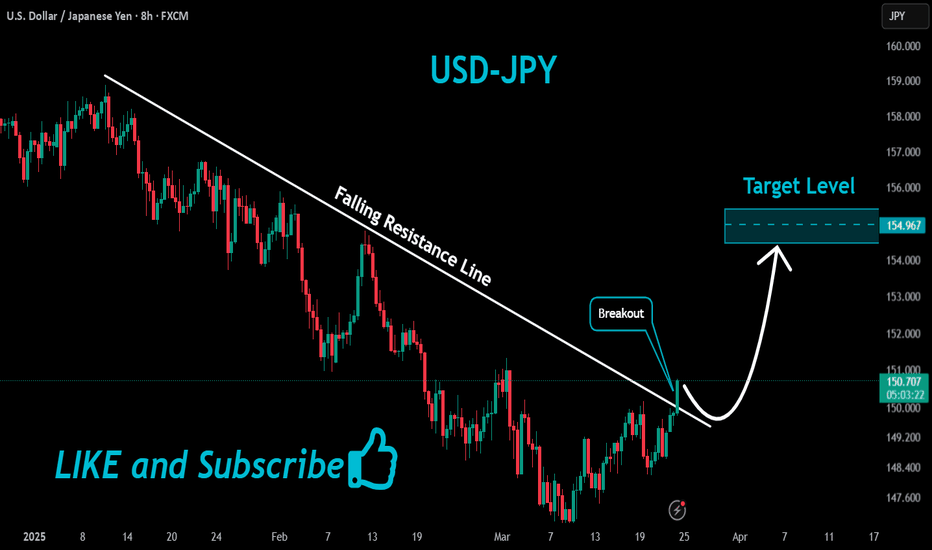

Market Analysis: USD/JPY Eyes Fresh SurgeMarket Analysis: USD/JPY Eyes Fresh Surge

USD/JPY is rising and might gain pace above the 151.00 resistance.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY climbed higher above the 149.55 and 150.00 levels.

- There is a connecting bullish trend line forming with support at 150.30 on the hourly chart at FXOpen.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a fresh upward move from the 148.20 zone. The US Dollar gained bullish momentum above 148.80 against the Japanese Yen.

It even cleared the 50-hour simple moving average and 149.55. The pair climbed above 150.00 and traded as high as 150.94. It is now consolidating gains and there was a move below the 23.6% Fib retracement level of the upward move from the 148.18 swing low to the 150.94 high.

The current price action above the 150.00 level is positive. Immediate resistance on the USD/JPY chart is near 150.95. The first major resistance is near 151.20. If there is a close above the 151.20 level and the RSI moves above 70, the pair could rise toward 152.50.

The next major resistance is near 153.20, above which the pair could test 155.00 in the coming days. On the downside, the first major support is 150.30 and a bullish trend line, below which the bears could gain strength.

The next major support is visible near the 149.55 level and the 50% Fib retracement level of the upward move from the 148.18 swing low to the 150.94 high.

If there is a close below 149.55, the pair could decline steadily. In the stated case, the pair might drop toward the 148.40 support zone. The next stop for the bears may perhaps be near the 147.50 region.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/JPY 4H Analysis – Potential Bearish RetestThe USD/JPY pair has been in a clear downtrend, trading within a descending channel for an extended period. Recently, price action has broken above the channel, but it is now facing resistance around the 150.35 level.

Retest Zone: The pair is currently retesting the broken trendline, and if it fails to sustain above this level, a rejection could lead to further downside.

Bearish Expectation: If the price fails to reclaim 150.35, a move towards the 147.00 support zone is likely.

Confirmation: A strong bearish candle from this level could indicate a reversal, confirming the downward move.

Traders should watch for price action signals at the retest level before making decisions.

USD/JPY Trade Setup & Analysis – Bullish Reversal from 200 EMAThe 200 EMA (blue line) at 149.701 acts as a strong support level.

The 30 EMA (red line) at 150.458 represents a short-term trend guide.

Trade Setup:

Entry Point: Around 150.120 (near the 200 EMA).

Stop Loss: Below 149.496, protecting against downside risk.

Take Profit Levels:

TP1: 150.287

TP2: 150.533

TP3: 150.886

Final Target: 151.377

Strategy:

Buy Position: The expectation is for the price to bounce from the 200 EMA and move upwards toward the targets.

Risk-Reward: Favorable, as the trade has multiple profit-taking levels.

USDJPY; Heikin Ashi Trade IdeaOANDA:USDJPY

In this video, I’ll be sharing my analysis of USDJPY, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

UJ Price Analysis: Key Insights for Next Week Trading DecisionThe USD/JPY pair is currently in a temporary uptrend within a broader consolidation, following a strong bearish move that started at the beginning of the year. The Y149.000 level will be a key zone for our trading decisions.

📌 Key Technical Outlook:

🔹 Price faced selling pressure around Y150.000, leading to a pullback.

🔹 As long as price holds above the ascending trendline & Y149.000, I’ll be looking for buying opportunities in the short term.

🔹 A breakdown and retest of Y149.000 and the trendline would confirm a resumption of the long-term bearish structure.

📌 Major Market Drivers:

🔹 Federal Reserve’s Policy Stance: Powell reiterated that rate cuts are not urgent, keeping the USD supported.

🔹 Trump’s Trade Tariffs: Expected to drive US inflation higher, adding strength to the Dollar.

🔹 Bank of Japan’s Hawkish Expectations: Japan’s largest trade union group (Rengo) secured a 5.4% pay rise, reinforcing expectations that the BoJ will tighten policy further this year.

🔹 Japan’s CPI Cooling Down: Lower inflation in Japan could weaken the Yen and offer USD/JPY support.

📅 Key Economic Events on Our Radar Next Week:

🗓 Tuesday: US S&P Global PMI – A key sentiment indicator for economic conditions.

🗓 Thursday: US GDP (Q4 Final) – A major market mover influencing the Fed’s policy direction.

🗓 Friday: Tokyo CPI & US Core PCE Index – The BoJ and Fed’s preferred inflation measures, critical for future rate decisions.

I’ll be watching how USD/JPY behaves around Y149.000 for confirmation of trend continuation or a bearish continuation. We’ll discuss this in-depth during Forex Morning Mastery tomorrow—stay tuned! 🔥📈 #USDJPY #Forex #MarketAnalysis

USDJPY Short from ResistanceHello Traders

In This Chart USDJPY HOURLY Forex Forecast By FOREX PLANET

today USDJPY analysis 👆

🟢This Chart includes_ (USDJPY market update)

🟢What is The Next Opportunity on USDJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

USD/JPY Bullish Outlook – Targeting Key Resistance at 150.155USD/JPY Technical Analysis – Bullish Outlook Toward Resistance

Chart Insights:

The price is currently in a recovery phase after a significant drop.

A Fair Value Gap (FVG) zone has been identified, suggesting a potential pullback before further movement.

The target point aligns with the resistance level around 150.155, which acts as a key supply zone.

Potential Scenario:

Price may retrace into the FVG zone around 148.704 – 148.956.

A bullish rebound from this level could drive price toward the resistance at 150.155.

If price reaches the resistance level, further rejection or continuation will depend on market conditions.

Key Levels:

Support Zone: 148.167 – 148.315

FVG Area: 148.704 – 148.956

Resistance Zone: 150.007 – 150.155 (Target area)

Conclusion:

The current structure suggests a bullish bias if price respects the FVG zone for a push higher. However, a break below the FVG could signal further downside movement.

USDJPY Short from ResistanceHello Traders

In This Chart USDJPY HOURLY Forex Forecast By FOREX PLANET

today USDJPY analysis 👆

🟢This Chart includes_ (USDJPY market update)

🟢What is The Next Opportunity on USDJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

USD/JPY(20250321)Today's AnalysisToday's buying and selling boundaries:

148.63

Support and resistance levels:

149.40

149.11

148.92

148.33

148.14

147.85

Trading strategy:

If the price breaks through 148.92, consider buying, the first target price is 149.11

If the price breaks through 148.63, consider selling, the first target price is 148.33

USDJPY DAILY ANALYSISHello traders here is my setup for USDJPY for the week as you can see the price has been on a down trend, and now you can see that the price have done a retracement and it is now on the level of structure that was recently broken and it is likely to act as resistance now I have to wait for confirmations like bearish engulfment then I would look to short the USDJPY.

NP: This is not a financial advice its just my prediction, what do you think?