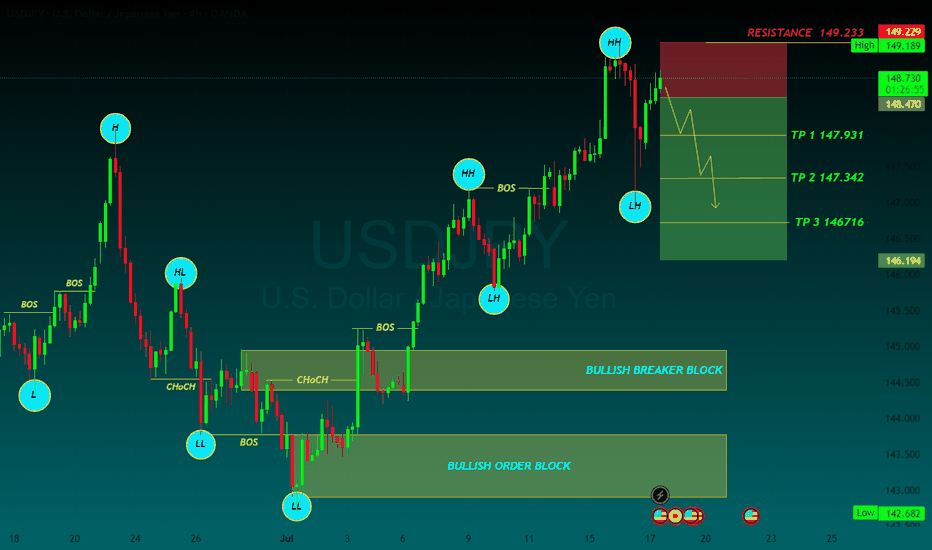

USDJPY SELLJapanese Yen adds to intraday losses; USD/JPY climbs to 148.80 amid broad-based USD strength

The Japanese Yen selling remains unabated through the early European session on Thursday, which along with a goodish pickup in the US Dollar demand, lifts the USD/JPY pair to the 148.80 region in the last hour. Data released earlier today showed that Japan clocked a smaller-than-expected trade surplus in June.

From a technical perspective, the USD/JPY pair showed some resilience below the 100-hour Simple Moving Average (SMA) on Wednesday, and the subsequent move up favors bullish traders. Moreover, oscillators are holding comfortably in positive territory and are still away from being in the overbought zone, suggesting that the path of least resistance for spot prices is to the upside. Hence, some follow-through strength back towards the 149.00 mark, en route to the overnight swing high near the 149.15-149.20 region, looks like a distinct possibility. The upward trajectory could extend further towards reclaiming the 150.00 psychological mark for the first time since late March.

On the flip side, the 148.00 round figure now seems to protect the immediate downside ahead of the Asian session low, around the 147.70 region. The latter nears the 100-hour SMA, below which the USD/JPY pair could retest sub-147.00 levels. Some follow-through selling might shift the bias in favor of bearish trades and drag spot prices to the 146.60 intermediate support en route to the 146.20 area, the 146.00 mark, and the 100-day SMA support, currently pegged near the 145.80 region\

TP 1 147.931

TP 2 147.342

TP 3 146716

RESISTANCE 149.233

Usdjpyanalysis

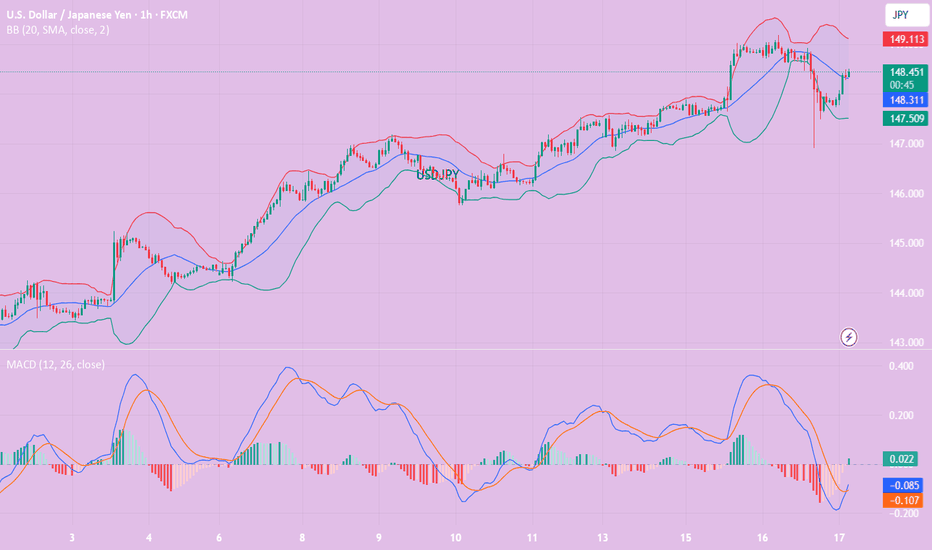

USD/JPY(20250717)Today's AnalysisMarket news:

The annual rate of PPI in the United States in June was 2.3%, lower than the expected 2.5%, the lowest since September 2024, and the previous value was revised up from 2.6% to 2.7%. Federal Reserve Beige Book: The economic outlook is neutral to slightly pessimistic. Manufacturing activity declined slightly, and corporate recruitment remained cautious.

Technical analysis:

Today's buying and selling boundaries:

147.97

Support and resistance levels:

150.23

149.38

148.84

147.11

146.56

145.72

Trading strategy:

If it breaks through 147.97, consider buying in, and the first target price is 148.84

If it breaks through 147.11, consider selling in, and the first target price is 146.56

Market Analysis: USD/JPY RisesMarket Analysis: USD/JPY Rises

USD/JPY is rising and might gain pace above the 149.20 resistance.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY climbed higher above the 147.50 and 148.40 levels.

- There is a key bullish trend line forming with support at 148.40 on the hourly chart at FXOpen.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a fresh upward move from the 145.75 zone. The US Dollar gained bullish momentum above 146.55 against the Japanese Yen.

It even cleared the 50-hour simple moving average and 148.00. The pair climbed above 149.00 and traded as high as 149.18. The pair is now consolidating gains above the 23.6% Fib retracement level of the upward move from the 145.74 swing low to the 149.18 high.

The current price action above the 148.50 level is positive. There is also a key bullish trend line forming with support at 148.40. Immediate resistance on the USD/JPY chart is near 149.20.

The first major resistance is near 149.50. If there is a close above the 149.50 level and the RSI moves above 70, the pair could rise toward 150.50. The next major resistance is near 152.00, above which the pair could test 155.00 in the coming days.

On the downside, the first major support is 148.40 and the trend line. The next major support is visible near the 147.90 level. If there is a close below 147.90, the pair could decline steadily.

In the stated case, the pair might drop toward the 147.50 support zone and the 50% Fib retracement level of the upward move from the 145.74 swing low to the 149.18 high. The next stop for the bears may perhaps be near the 146.55 region.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

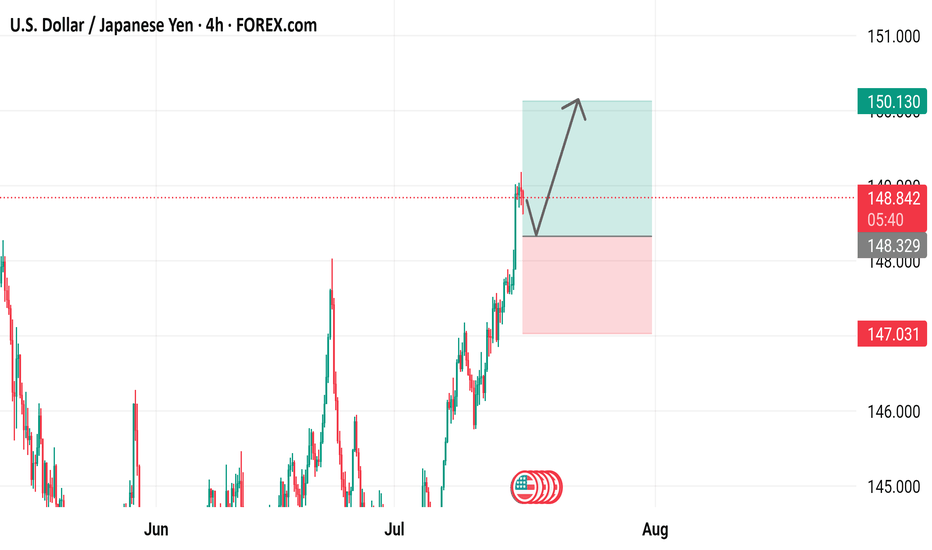

USD/JPY 4-Hour Chart Analysis4-hour chart displays the price movement of the U.S. Dollar against the Japanese Yen (USD/JPY) from June to August 2025. The chart shows a significant upward trend in July, followed by a correction. Key levels are highlighted, including support at 147.031 and resistance at 150.130, with the current price at 148.809. The chart suggests a potential bullish continuation, as indicated by the upward arrow and green box, targeting higher levels above 150.000.

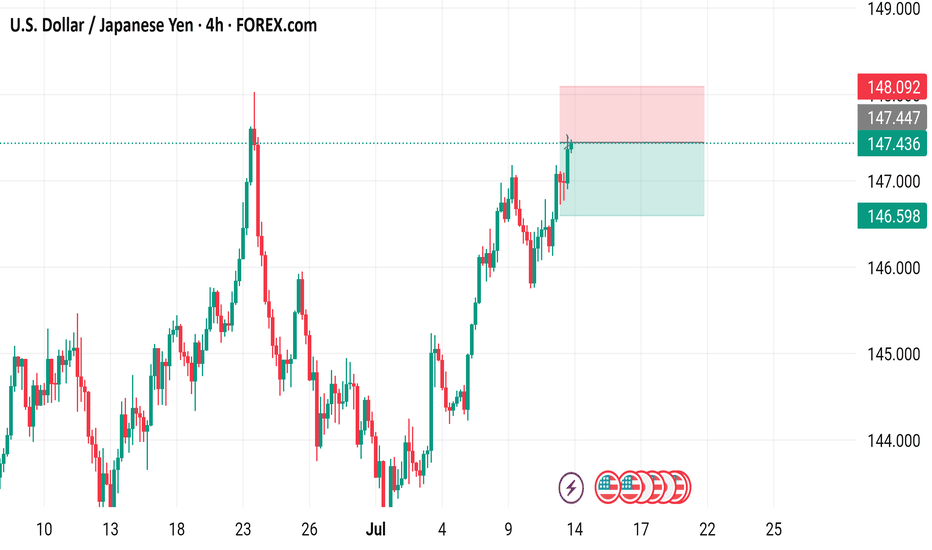

USD/JPY 4-Hour Forex Chart4-hour performance of the U.S. Dollar (USD) against the Japanese Yen (JPY) from late June to mid-July 2025, sourced from FOREX.com. The current exchange rate is 147.436, with a 1.178 (+0.81%) increase. Key levels include a sell price of 147.393 and a buy price of 147.479. The chart shows a recent upward trend with a resistance zone highlighted between 147.436 and 148.092, and support around 146.598. Candlestick patterns indicate volatility, with notable price movements around early July.

USDJPY LONG & SHORT – DAILY FORECAST Q3 | D15 | W29 | Y25💼 USDJPY LONG & SHORT – DAILY FORECAST

Q3 | D15 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

USDJPY is currently reaching for a key higher time frame supply zone, looking for price action to show weakness at premium levels. Structure and momentum are now aligning for a short opportunity backed by multi-timeframe confluence.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Looking for Strong reaction and early signs of distribution.

✅ 4H Order Block

Break of internal structure (iBoS) confirms a short-term bearish transition.

✅ 1H Order Block

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

The confluences are stacked.

Let execution follow discipline, not emotion.

USD/JPY) Bullish trend analysis Read The captionSMC trading point update

Technical analysis of USD/JPY on the 4-hour timeframe, signaling a breakout and possible rally toward the 151.016 target zone. Here's the detailed breakdown:

---

Technical Analysis – USD/JPY (4H)

1. Bullish Structure Breakout

Price has broken above a long-term resistance trendline, indicating a bullish breakout from a rising wedge or ascending channel.

The breakout is confirmed by bullish momentum and sustained price action above the previous highs.

2. Trendline + EMA Confluence

Price remains well above the 200 EMA (145.143), reinforcing the bullish bias.

A clear higher low was formed at the inner trendline (support), followed by strong upside moves.

3. RSI Strength

RSI is around 63.16, indicating strong bullish momentum without being overbought yet.

Suggests more upside potential while maintaining healthy trend conditions.

4. Price Target Projection

The chart shows two upward extensions:

First move projected ~+2.20%, indicating a measured move target around 149.7.

Final target point is 151.016, based on previous price action extension and resistance level.

Mr SMC Trading point

---

Summary

Bias: Bullish

Current Price: 147.366

Key Support: Rising trendline + 145.143 EMA

Targets:

Short-term: ~149.7

Final: 151.016

RSI: Strong but not overbought (63.16)

Invalidation: Break below the inner trendline support and EMA (below 145.00)

Please support boost 🚀 this analysis)

USD/JPY) LOGN TIME Analysis Read The captionSMC trading point update

Technical analysis of USD/JPY on the daily timeframe, highlighting a long-term downtrend reversal with potential for significant upside.

---

Analysis Summary

Pair: USD/JPY

Timeframe: Daily

Current Price: 147.442

Bias: Bullish breakout from a descending wedge structure.

---

Key Technical Insights

1. Descending Trendline Break:

Price has broken above the long-term downtrend line, signaling a reversal.

Breakout area is circled in yellow, confirming bullish intent.

2. Trendline & Structure Support:

Multiple rejections from the ascending support trendline (marked by green arrows) confirm accumulation and higher lows.

3. 200 EMA as Dynamic Resistance/Support:

Price is now above the 200 EMA (147.920) — a bullish signal, turning resistance into support.

4. RSI (14):

RSI at 62.99, approaching overbought territory, but still has room to push further.

---

Target Point

Target: 158.951

Based on measured move from wedge breakout and historical resistance level.

---

Trade Setup Idea

Direction Entry Stop-Loss Target

Buy 147.40–147.60 Below 145.80 158.95

Mr SMC Trading point

---

Summary

This chart signals a major bullish breakout on USD/JPY, with the break of a year-long downtrend structure, reclaiming the 200 EMA. If this breakout sustains, price could aim for 158.95 in the coming weeks.

Please support boost 🚀 this analysis)

USD/JPY "The Ninja Heist" – Bullish Loot Grab!🌟 Hey, Thieves & Market Bandits! 🌟

💰 Ready to raid the USD/JPY "The Gopher" vault? 💰

Based on 🔥Thief Trading Style🔥 (technical + fundamental heist analysis), here’s the master plan to swipe bullish profits before the market turns against us! Escape near the high-risk Yellow MA Zone—overbought, consolidation, and bear traps ahead! 💸 "Take the money and run—you’ve earned it!" 🏆🚀

🕵️♂️ Heist Strategy:

📈 Entry (Bullish Raid):

The vault’s unlocked! Buy any price—this heist is LIVE!

Pullback lovers: Set buy limits at recent/swing lows for extra loot.

🛑 Stop Loss (Escape Route):

Thief SL at recent/swing low (4H/Day trade basis).

Adjust based on your risk, lot size, and multiple orders.

🎯 Target (Profit Escape):

147.500 (or flee earlier if bears ambush!)

⚔️ Scalpers’ Quick Strike:

LONG ONLY! If rich, attack now. If not, join swing traders & rob slowly.

Trailing SL = Your bodyguard! 💰🔒

💥 Why This Heist?

USD/JPY "The Ninja" is bullish due to key factors—check:

📌 Fundamental + Macro + COT Report

📌 Quantitative + Sentiment + Intermarket Analysis

📌 Future Targets & Overall Score (Linkks In the profile!) 🔗🌍

🚨 Trading Alert (News = Danger!):

Avoid new trades during news—volatility kills!

Trailing SL saves profits on running positions.

💖 Support the Heist Team!

💥 Smash the Boost Button! 💥

Help us steal more money daily with Thief Trading Style! 🏆🚀

Stay tuned—another heist is coming soon! 🤑🎯

USD/JPY Profit Heist – Are You In or Missing Out?"🔥💰 "USD/JPY NINJA HEIST: Bullish Loot Before the Trap! (Thief Trading Style)" 💰🔥

🌟 Attention Market Robbers & Profit Takers! 🌟

🚨 Thief Trading Alert: USD/JPY "The Ninja" is primed for a BULLISH HEIST!

Based on our stealthy technical & fundamental analysis, we’re locking in a long entry strategy. The plan? Loot profits before the RED ZONE danger hits! Overbought? Maybe. Risky? Sure. But the real robbery happens before the bears wake up! 🏴☠️💸

🎯 ENTRY: The Vault is OPEN!

Buy Limit Orders: Swipe the dip on pullbacks or jump in at key swing lows.

Aggressive? Enter now & ride the wave!

🛑 STOP LOSS (Thief-Style Escape Plan):

Swing Low (5H TF): 143.600 (Adjust based on your risk & lot size!)

Multiple orders? Scale SL wisely—don’t get caught!

🎯 TARGETS:

Main Take-Profit: 151.000 (Or escape earlier if the trap triggers!)

Scalpers: Only play LONG—trail your SL & lock in quick loot!

📢 SCALPERS & SWING TRADERS:

Got deep pockets? Ride the wave now!

Small account? Join the swing heist & rob the trend slowly!

📈 WHY USD/JPY?

Bullish momentum + Macro/Fundamental tailwinds!

COT Report, Sentiment, & Intermarket Analysis all hint at more upside! go ahead to check 👉🔗🌏

⚠️ WARNING: NEWS = VOLATILITY!

Avoid new trades during high-impact news!

Trailing SL = Your best friend! Protect profits & avoid jail (stop-out)!

💥 BOOST THIS IDEA TO SUPPORT THE HEIST!

More boosts = More robberies = More profits for YOU!

Stay tuned—next heist coming soon! 🚀💰

🔥 Like, Share, & Follow for Daily Steals! 🔥

USDJPY M15 Support & Resistance Levels🚀 Here are some key zones I've identified on the 15m timeframe.

These zones are based on real-time data analysis performed by a custom software I personally developed.

The tool is designed to scan the market continuously and highlight potential areas of interest based on price action behavior and volume dynamics.

Your feedback is welcome!

USDJPY Analysis : Major Move Loading Towards Target Zone🕵️♂️ Overview

The USDJPY pair is approaching a critical turning point within a well-established descending channel structure. After several months of corrective movement and internal structure shifts, the market is now displaying multiple layers of confluence pointing toward an impending major reaction or reversal. Let’s break down this chart step by step.

🧱 Market Structure Analysis

🔹 Descending Channel:

The entire chart is governed by a broad descending channel, with price making lower highs and lower lows since early March.

Each touch of the channel support has led to a bounce, and the price is now once again near channel resistance, creating a possible reaction zone.

🔹 Volume Contraction Phase:

In the mid-section of the chart, we observe volume contraction, indicating liquidity drying up and buyers/sellers entering a phase of uncertainty.

This contraction is typical in accumulation or re-accumulation phases, which often precede strong impulsive moves — exactly what followed here.

🧩 Structural Breaks and Trendline Clarity

🔸 Minor Break of Structure:

A recent high was taken out in early July, marking a minor break of structure (BOS), showing the first signs of bulls taking short-term control.

🔸 Major Break of Structure:

A more significant high (marked on the chart) has also been broken, confirming a major BOS — this implies institutional positioning or a shift in market sentiment.

🔸 Trendline Break – Extra Confirmation:

The bullish push came after breaking a clean internal trendline, which acted as diagonal resistance.

Once this trendline broke, price aggressively accelerated upward — this is a classic market maker cycle (MMC) Phase 2 (expansion) move.

📍 Confluence at Next Reversal Zone (149.00 – 150.00)

The green highlighted zone is the next potential area for bearish pressure to return, based on:

Key Supply Zone: Historical area where sellers previously dominated.

Channel Resistance Confluence: Top of the descending channel aligns with this zone.

Psychological Level: 150.00 is a major psychological round number — often attracts profit-taking and institutional activity.

Fibonacci (if plotted): Likely 78.6% – 88.6% retracement from last swing high.

Overextended Rally: Price has rallied strongly since early July with very little correction — it’s approaching exhaustion.

🔄 Market Maker Cycle (MMC) Alignment

This move perfectly reflects the Market Maker Cycle:

Accumulation: During volume contraction phase.

Manipulation: Fakeouts near channel support to trap shorts.

Expansion: Break of structure + trendline, aggressive rally.

Distribution (Next): Likely to occur at the 149–150 zone with a sharp rejection.

🧠 Trader’s Plan – What to Look For

📈 If Bullish:

Targets: 148.80 to 149.80 zone

Hold until rejection signs (bearish candles, volume spikes, divergences)

SL: Below recent swing low/trendline (~146.00)

📉 If Bearish (After Rejection):

Watch for:

Strong bearish engulfing candle or shooting star

RSI/MACD divergence (not shown but suggested)

Break of short-term ascending trendline

Targets: Back toward 145.50 or mid-channel (dynamic)

🔖 Summary

USDJPY is showing clear signs of bullish exhaustion near the upper channel resistance and major structure levels. If price respects this zone (149–150), expect a healthy corrective leg or full reversal. Multiple layers of technical evidence, including structure breaks, trendline breach, and MMC phases, are aligning for a high-probability play.

This is a textbook setup for experienced traders watching key zones with proper confirmations.

USD/JPY Made H&S Reversal Pattern , Short Setup Valid !Here is my 15 Mins Chart on USD/JPY , We have a very clear reversal pattern , head & shoulders pattern and we have a confirmation by closure below our neckline so we can enter direct now or waiting the price to go back and retest the neckline and this is my fav scenario .

USDJPY – Key Support Bounce with Macro TailwindsUSDJPY is bouncing off a key trendline and 61.8% Fib zone (143.25–143.60) with confluence across multiple JPY crosses (EURJPY, AUDJPY, CADJPY). This area has historically triggered strong upside momentum, and the current setup aligns with both technical structure and macro drivers.

📊 Fundamentals Supporting the Move:

✅ US Yields Stable: US10Y is holding above 4.20%, keeping USDJPY supported. If yields push back toward 4.30%, expect USDJPY to retest 145.30 and potentially 147.80.

✅ BoJ Dovish: Japan shows no shift in policy. Despite weak Tankan data, BoJ remains patient, and no meaningful rate hike or YCC change is expected soon.

✅ USD Macro Resilience: Core PCE held firm at 2.6%. Focus now shifts to ISM Services PMI (Wed) and NFP (Fri). Markets are still pricing a soft landing – supporting risk-on and a stronger USD.

✅ JPY as a Fading Safe Haven: Even with geopolitical headlines (Trump tariff tensions, Taiwan, Middle East), JPY demand remains weak. Traders are favoring USD and Gold over JPY as risk hedges.

⚠️ Risks to Watch:

Dovish US Data Surprise: Weak NFP or ISM could drag yields down and trigger USDJPY reversal.

Verbal or Actual BoJ Intervention: If we approach 148.50–150, Japan may step in again.

Geopolitical Escalation: Any sharp risk-off could trigger safe haven demand for JPY, though this has underperformed recently.

🔎 Correlation Dynamics:

📈 USDJPY is leading JPY crosses like EURJPY and AUDJPY. The recent bounce started simultaneously across the JPY complex, with USDJPY slightly ahead.

📉 If US yields drop or risk sentiment shifts, USDJPY may lag gold or bonds but eventually catch up.

🧠 Trading Plan:

📍 Entry Zone: 143.30–143.60 (trendline + Fib confluence)

🎯 Target 1: 145.30 (38.2% Fib)

🎯 Target 2: 147.80 (channel resistance)

🛑 Invalidation: Daily close below 141.50 with US yields breaking down

📅 Upcoming Events to Watch:

Wed July 3: ISM Services PMI (key for USD reaction)

Fri July 5: US Non-Farm Payrolls + Average Hourly Earnings

JPY Risk: Verbal intervention possible near 148+

🧭 Summary:

USDJPY is positioned for a bullish continuation, backed by:

Rising yields

Resilient US macro

Weak JPY fundamentals

Technical structure respecting trendline support

Short-term traders can target the 145–147.80 range ahead of NFP, with a tight eye on yield and risk sentiment.

📌 If this analysis helps, drop a like and follow for more real-time macro-technical breakdowns. Stay nimble ahead of NFP! 🧠📈

USD/JPY) back down Trend Read The captionSMC trading point update

Technical analysis of USD/JPY (U.S. Dollar / Japanese Yen) on the 3-hour timeframe, anticipating a rejection from a descending trendline resistance and a move down toward key support levels.

---

Analysis Overview:

Trend Bias: Bearish correction expected

Structure: Price is reacting at a descending trendline, which has held as resistance on multiple occasions.

Indicators:

EMA 200 (144.756): Price is currently above, but projected to break below it.

RSI (14): Overbought at ~74, signaling potential for a reversal.

---

Key Technical Components:

1. Descending Trendline Resistance:

Price is approaching/has touched a well-respected downtrend line, marked by three strong rejections (red arrows).

This trendline has consistently capped bullish moves, indicating strong seller interest.

2. Bearish Reversal Expectation:

The projected path suggests a potential fake breakout or double-top, followed by a steep decline.

A two-stage drop is anticipated, with price first targeting the EMA 200 zone, then extending lower.

3. Target Points:

First target: Around 145.244, near EMA 200.

Final target: 143.048, aligning with the key support zone (highlighted in yellow), where price previously bounced.

4. RSI (14):

Currently overbought (73.29), signaling a likely retracement.

Prior peaks at this level led to notable corrections.

---

Trade Setup Idea:

Parameter Level

Entry Near current price (~146.85) if bearish pattern confirms

Stop-Loss Above trendline (~147.30–147.50)

Target 1 145.24 (EMA 200 zone)

Target 2 143.05 (Support zone)

This setup offers a high-probability short opportunity if resistance holds.

---

Risk Factors:

Upcoming economic events could trigger volatility (news icon marked).

A clean breakout and close above the trendline (~147.50+) would invalidate this bearish thesis.

Mr SMC Trading point

---

Summary:

The analysis suggests a potential USD/JPY reversal from a descending trendline, supported by overbought RSI and prior rejections. The bearish projection targets a move toward 143.048, following a dip below the EMA 200 level at 145.244.

Please support boost 🚀 this analysis)

DeGRAM | USDJPY formed the triangle📊 Technical Analysis

● Price defended the 142.80 confluence (triangle base + channel median), printing a bullish hammer and reclaiming the short-term trendline; structure now forms an ascending triangle inside the broader consolidation.

● Momentum is rising toward 146.50 – the pattern’s 1:1 swing and prior supply – with the next objective the upper triangle wall at 148.10. Invalid if candles fall back under 142.80.

💡 Fundamental Analysis

● Rebound in US ISM manufacturing and Fed minutes hinting “no near-term cuts” lifted 2-yr yields, while weak Japanese wage growth keeps the BoJ patient. The widening policy gap revives USD/JPY bid.

✨ Summary

Long 143.4-144.1; targets 146.5 then 148.1. Exit on a 4 h close below 142.8.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

USDJPY h4 strongly downBearish Expectation Disruption / Bullish Counterpoint

Resistance (147.5) Rejection and drop Breakout and continuation toward 148.5+

Breakout FVG Fakeout and reversal True breakout — bullish trend continues

Bullish Zone (~144) Clean break below Accumulation zone, strong buying interest may emerge

Target (~143) Next leg down May not be reached if price stabilizes above 145

Support (~142.5) Final drop destination Could become irrelevant if trend flips decisively bullish Original Assumption: Market is behaving in isolation from fundamentals.

Disruption: If U.S. data (e.g., strong NFP, CPI, or Fed commentary) supports rate hikes, USD/JPY may remain bid and breakout to 148+ instead of reversing.

Watch For: Strong dollar narrative or dovish BOJ language.

USDJPY Price Accumulated|Time For Bullish Distribution|Setupsfx|The price has accumulated nicely and is now distributing. We have three targets in mind, but set your own based on your analysis. Our approach is purely technical, but also includes a basic fundamental approach. This analysis concludes over 1500 pips and is a swing move. Please use this analysis as educational purposes only, as it does not guarantee that price will move exactly as predicted.

If you like our idea, please consider liking and commenting on it.

Good luck and trade safely!

Team Setupsfx_