USD/JPY) support boost Bullish Trend Read The captionSMC Trading point update

Technical analysis of USD/JPY on the 4-hour timeframe, based on a rejection from a key support zone and signs of trend continuation toward a higher target.

---

Technical Breakdown:

1. Support Level:

Price has bounced from a clearly defined support zone around 146.00 – 146.50, which has held multiple times in the past.

This zone is acting as a strong demand area where buyers are stepping in.

2. Bullish Rejection + Structure:

A bullish candle has formed from the support area, signaling potential reversal.

The drawn projection suggests higher highs and higher lows forming — indicating bullish continuation.

3. EMA (200):

Price has respected the 200 EMA (blue line), bouncing off it — a strong confluence for bullish trend continuation.

EMA is slightly upward sloping, indicating a longer-term bullish bias remains intact.

4. RSI (14):

RSI is rising from oversold territory (42.09), indicating a bullish momentum shift.

A potential bullish divergence might be forming (price made lower low, RSI made higher low).

5. Target Point:

Price is projected to reach 150.904, giving a potential move of ~2.91% (426 pips) from current levels.

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: 146.90 – 147.30 (current levels or slight pullback)

Stop Loss: Below the support zone (~145.90)

Take Profit (TP): 150.900 (key resistance / previous high)

Risk-to-Reward Ratio: Attractive, based on the size of the support zone vs. projected move

Mr SMC Trading point

---

Key Insights:

Strong confluence between price structure, support zone, and 200 EMA bounce.

Favorable risk-reward ratio for swing or intraday traders.

Best confirmation would come from a bullish engulfing candle or break above minor resistance near 147.80.

Please support boost 🚀 this analysis)

Usdjpybuy

USDJPY BUYThe year will be politically marked by Trump’s return to the White House. A Republican government is seen as positive for financial markets, but Trump’s pledge to cut taxes and impose tariffs on foreign goods and services may introduce uncertainty to both the political and economic landscape.

In Japan, political uncertainty looms, as the ruling Liberal Democratic Party (LDP) lacks a parliamentary majority and may call fresh elections. An LDP victory could strengthen the Yen by ensuring stability, while opposition gains might lead to fiscal expansion and weaken the currency. If no elections occur, a modest budget would likely keep the Yen supported.

In terms of monetary policy, the Fed and BoJ are set to diverge in monetary policy. The Fed expects to deliver only two additional rate cuts in 2025, the BoJ is expected to maintain its dovish stance, avoiding rate hikes amid weak inflation and a shrinking economy, leaving the Yen vulnerable to market disappointment over policy inaction

SUPPORT 149.232

SUPPORT 148.598

SUPPORT 147.963

RESISTANCE 147.285

RESISTANCE 146.913

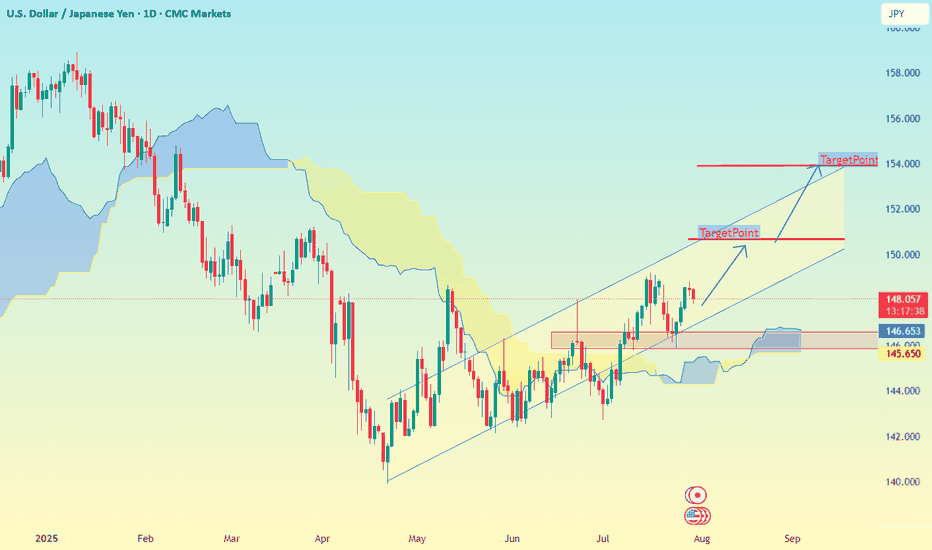

USD/JPY on the 1D timeframeBased on the chart I provided for USD/JPY on the 1D timeframe, here is the target analysis:

📉 Downtrend Analysis:

The chart is showing a descending channel, indicating a bearish trend.

Price has been respecting the upper and lower bounds of the channel.

Two target zones are marked with labels “TakeProfit”, suggesting projected bearish targets.

🎯 Identified Targets:

1. First Target Zone (TakeProfit):

📍 Around 152.00

This is the first expected support area where price may bounce or consolidate.

2. Second Target Zone (TakeProfit):

📍 Around 146.50 – 146.00

This level aligns with historical support and volume profile concentration.

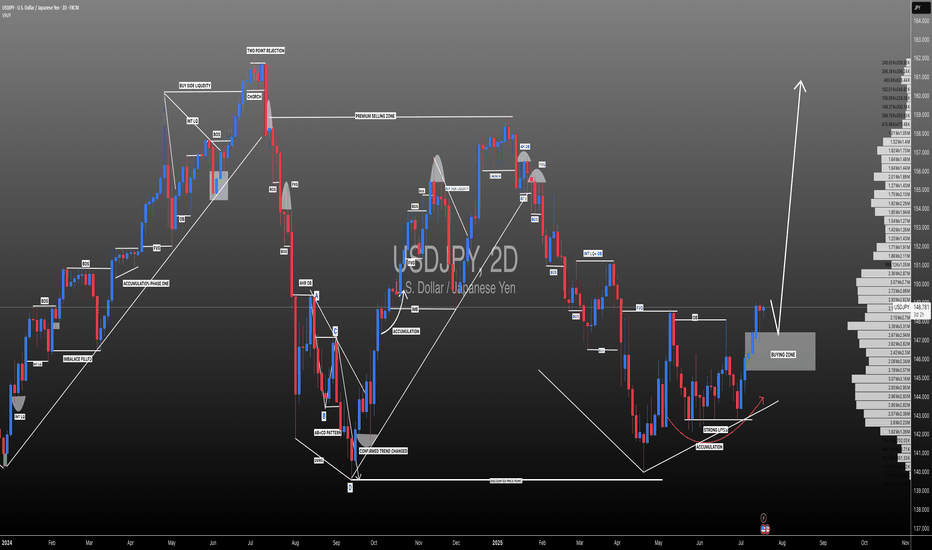

#USDJPY: Swing Buy Almost +2000 Pips! Dear Traders,

The USDJPY currency pair appears to be in an accumulation phase at the moment, as evidenced by the lack of significant price movement throughout the current week. Several factors contribute to this trend.

Firstly, several significant economic events are scheduled for this week, particularly tomorrow and Friday. These developments will have substantial implications for the future trajectory of the USDJPY pair. Consequently, there’s a possibility that the price may experience a decline before initiating a bullish trend. We’ve recently seen a strong bullish candle, which suggests a strong bullish move in the coming weeks. Additionally, the strong USD could continue rising, while the JPY is dropping.

Secondly, there are two primary areas where the price could reverse its course. The extent to which the USD reacts to the economic data will indicate potential reversal zones.

It’s crucial to conduct your own analysis before making any financial decisions. This chart should be used solely for educational purposes and does not guarantee any specific outcome.

Regarding the stop loss, as this is a swing trade, it’s advisable to employ a larger stop loss if the price reaches entry zones. The take profit level can be determined based on your entry type and analysis.

We wish you the best of luck in your trading endeavours and emphasise the importance of trading safely.

Please share this analysis with others through likes, comments, and social media platforms. If you have any questions or require further assistance, don’t hesitate to comment below. We’re here to provide support.

Team Setupsfx_

❤️🚀

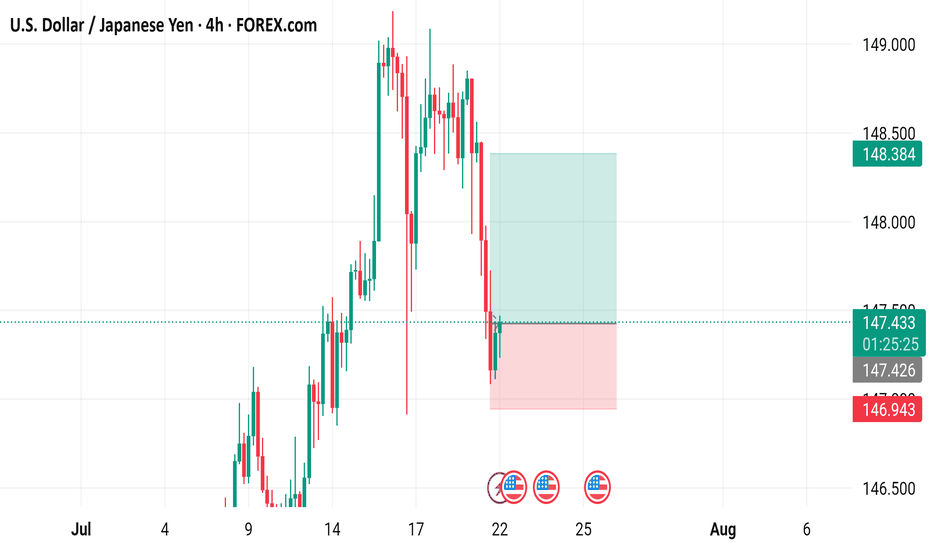

USD/JPY 4-Hour Forex Chart4-hour chart from FOREX.com displays the exchange rate between the U.S. Dollar (USD) and the Japanese Yen (JPY). The current rate is 147.446, with a slight increase of 0.072 (+0.05%). The chart shows recent price movements, including a notable drop within a highlighted support and resistance zone (light green and pink areas). Buy and sell prices are marked at 147.446 and 147.444, respectively, with additional price levels indicated on the right side ranging from 146.943 to 149.000. The chart includes candlestick patterns and is timestamped up to July 22, 2025.

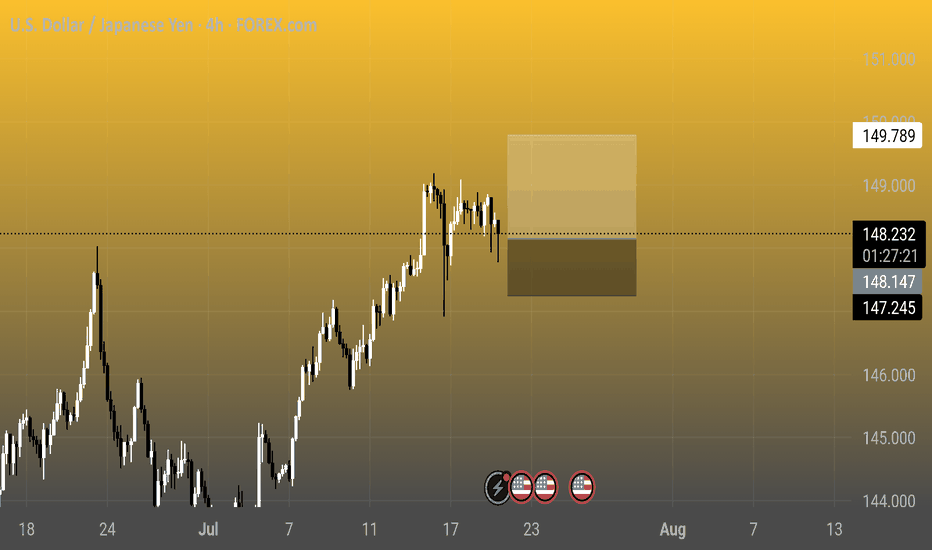

U.S. Dollar / Japanese Yen - 4h Chart (FOREX.com)4-hour chart from FOREX.com shows the exchange rate between the U.S. Dollar (USD) and the Japanese Yen (JPY). The current rate is 148.184, reflecting a decrease of 0.623 (-0.42%) as of 01:29:16. The chart highlights recent price movements over the past few hours, with a shaded area indicating a consolidation phase around the current level.

#USDJPY: Price is currently accumulating ! Wait For DistributionAt present, the USDJPY currency pair appears to be in an accumulation phase, as evidenced by the absence of significant price movement throughout the current week. Several factors contribute to this trend.

Firstly, several significant economic events are scheduled for this week, particularly tomorrow and Friday. These developments hold substantial implications for the future trajectory of the USDJPY pair. Consequently, there exists a possibility that the price may experience a decline prior to initiating a bullish trend.

Secondly, there are two primary areas where the price could reverse its course. The extent to which the USD reacts to the economic data will serve as an indicator of the potential reversal zones.

It is imperative that you conduct your own analysis before making any financial decisions. This chart should be utilised solely for educational purposes and does not guarantee any specific outcome.

Regarding the stop loss, as this is a swing trade, it is advisable to employ a larger stop loss if the price reaches entry zones. The take profit level can be determined based on your entry type and analysis.

We wish you the best of luck in your trading endeavours and emphasise the importance of trading safely.

Kindly share this analysis with others through likes, comments, and social media platforms. If you have any questions or require further assistance, please do not hesitate to comment below. We are here to provide support.

Team Setupsfx_

❤️🚀

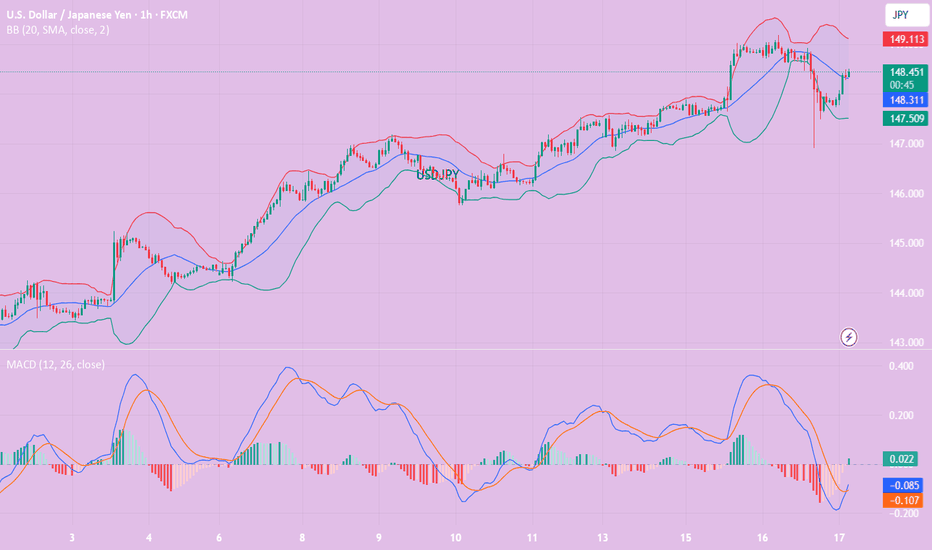

USD/JPY(20250717)Today's AnalysisMarket news:

The annual rate of PPI in the United States in June was 2.3%, lower than the expected 2.5%, the lowest since September 2024, and the previous value was revised up from 2.6% to 2.7%. Federal Reserve Beige Book: The economic outlook is neutral to slightly pessimistic. Manufacturing activity declined slightly, and corporate recruitment remained cautious.

Technical analysis:

Today's buying and selling boundaries:

147.97

Support and resistance levels:

150.23

149.38

148.84

147.11

146.56

145.72

Trading strategy:

If it breaks through 147.97, consider buying in, and the first target price is 148.84

If it breaks through 147.11, consider selling in, and the first target price is 146.56

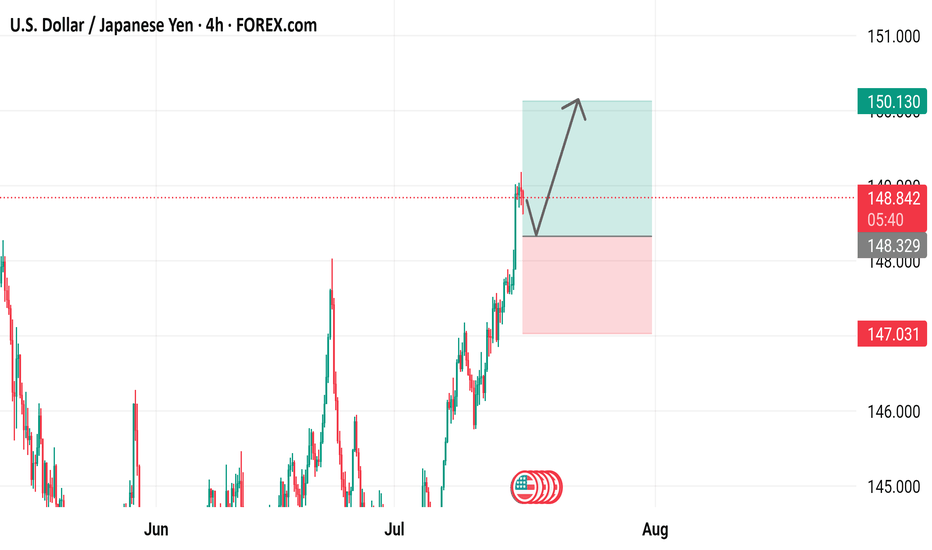

USD/JPY 4-Hour Chart Analysis4-hour chart displays the price movement of the U.S. Dollar against the Japanese Yen (USD/JPY) from June to August 2025. The chart shows a significant upward trend in July, followed by a correction. Key levels are highlighted, including support at 147.031 and resistance at 150.130, with the current price at 148.809. The chart suggests a potential bullish continuation, as indicated by the upward arrow and green box, targeting higher levels above 150.000.

USD/JPY) Bullish trend analysis Read The captionSMC trading point update

Technical analysis of USD/JPY on the 4-hour timeframe, signaling a breakout and possible rally toward the 151.016 target zone. Here's the detailed breakdown:

---

Technical Analysis – USD/JPY (4H)

1. Bullish Structure Breakout

Price has broken above a long-term resistance trendline, indicating a bullish breakout from a rising wedge or ascending channel.

The breakout is confirmed by bullish momentum and sustained price action above the previous highs.

2. Trendline + EMA Confluence

Price remains well above the 200 EMA (145.143), reinforcing the bullish bias.

A clear higher low was formed at the inner trendline (support), followed by strong upside moves.

3. RSI Strength

RSI is around 63.16, indicating strong bullish momentum without being overbought yet.

Suggests more upside potential while maintaining healthy trend conditions.

4. Price Target Projection

The chart shows two upward extensions:

First move projected ~+2.20%, indicating a measured move target around 149.7.

Final target point is 151.016, based on previous price action extension and resistance level.

Mr SMC Trading point

---

Summary

Bias: Bullish

Current Price: 147.366

Key Support: Rising trendline + 145.143 EMA

Targets:

Short-term: ~149.7

Final: 151.016

RSI: Strong but not overbought (63.16)

Invalidation: Break below the inner trendline support and EMA (below 145.00)

Please support boost 🚀 this analysis)

USD/JPY Profit Heist – Are You In or Missing Out?"🔥💰 "USD/JPY NINJA HEIST: Bullish Loot Before the Trap! (Thief Trading Style)" 💰🔥

🌟 Attention Market Robbers & Profit Takers! 🌟

🚨 Thief Trading Alert: USD/JPY "The Ninja" is primed for a BULLISH HEIST!

Based on our stealthy technical & fundamental analysis, we’re locking in a long entry strategy. The plan? Loot profits before the RED ZONE danger hits! Overbought? Maybe. Risky? Sure. But the real robbery happens before the bears wake up! 🏴☠️💸

🎯 ENTRY: The Vault is OPEN!

Buy Limit Orders: Swipe the dip on pullbacks or jump in at key swing lows.

Aggressive? Enter now & ride the wave!

🛑 STOP LOSS (Thief-Style Escape Plan):

Swing Low (5H TF): 143.600 (Adjust based on your risk & lot size!)

Multiple orders? Scale SL wisely—don’t get caught!

🎯 TARGETS:

Main Take-Profit: 151.000 (Or escape earlier if the trap triggers!)

Scalpers: Only play LONG—trail your SL & lock in quick loot!

📢 SCALPERS & SWING TRADERS:

Got deep pockets? Ride the wave now!

Small account? Join the swing heist & rob the trend slowly!

📈 WHY USD/JPY?

Bullish momentum + Macro/Fundamental tailwinds!

COT Report, Sentiment, & Intermarket Analysis all hint at more upside! go ahead to check 👉🔗🌏

⚠️ WARNING: NEWS = VOLATILITY!

Avoid new trades during high-impact news!

Trailing SL = Your best friend! Protect profits & avoid jail (stop-out)!

💥 BOOST THIS IDEA TO SUPPORT THE HEIST!

More boosts = More robberies = More profits for YOU!

Stay tuned—next heist coming soon! 🚀💰

🔥 Like, Share, & Follow for Daily Steals! 🔥

USDJPY – Key Support Bounce with Macro TailwindsUSDJPY is bouncing off a key trendline and 61.8% Fib zone (143.25–143.60) with confluence across multiple JPY crosses (EURJPY, AUDJPY, CADJPY). This area has historically triggered strong upside momentum, and the current setup aligns with both technical structure and macro drivers.

📊 Fundamentals Supporting the Move:

✅ US Yields Stable: US10Y is holding above 4.20%, keeping USDJPY supported. If yields push back toward 4.30%, expect USDJPY to retest 145.30 and potentially 147.80.

✅ BoJ Dovish: Japan shows no shift in policy. Despite weak Tankan data, BoJ remains patient, and no meaningful rate hike or YCC change is expected soon.

✅ USD Macro Resilience: Core PCE held firm at 2.6%. Focus now shifts to ISM Services PMI (Wed) and NFP (Fri). Markets are still pricing a soft landing – supporting risk-on and a stronger USD.

✅ JPY as a Fading Safe Haven: Even with geopolitical headlines (Trump tariff tensions, Taiwan, Middle East), JPY demand remains weak. Traders are favoring USD and Gold over JPY as risk hedges.

⚠️ Risks to Watch:

Dovish US Data Surprise: Weak NFP or ISM could drag yields down and trigger USDJPY reversal.

Verbal or Actual BoJ Intervention: If we approach 148.50–150, Japan may step in again.

Geopolitical Escalation: Any sharp risk-off could trigger safe haven demand for JPY, though this has underperformed recently.

🔎 Correlation Dynamics:

📈 USDJPY is leading JPY crosses like EURJPY and AUDJPY. The recent bounce started simultaneously across the JPY complex, with USDJPY slightly ahead.

📉 If US yields drop or risk sentiment shifts, USDJPY may lag gold or bonds but eventually catch up.

🧠 Trading Plan:

📍 Entry Zone: 143.30–143.60 (trendline + Fib confluence)

🎯 Target 1: 145.30 (38.2% Fib)

🎯 Target 2: 147.80 (channel resistance)

🛑 Invalidation: Daily close below 141.50 with US yields breaking down

📅 Upcoming Events to Watch:

Wed July 3: ISM Services PMI (key for USD reaction)

Fri July 5: US Non-Farm Payrolls + Average Hourly Earnings

JPY Risk: Verbal intervention possible near 148+

🧭 Summary:

USDJPY is positioned for a bullish continuation, backed by:

Rising yields

Resilient US macro

Weak JPY fundamentals

Technical structure respecting trendline support

Short-term traders can target the 145–147.80 range ahead of NFP, with a tight eye on yield and risk sentiment.

📌 If this analysis helps, drop a like and follow for more real-time macro-technical breakdowns. Stay nimble ahead of NFP! 🧠📈

USDJPY Price Accumulated|Time For Bullish Distribution|Setupsfx|The price has accumulated nicely and is now distributing. We have three targets in mind, but set your own based on your analysis. Our approach is purely technical, but also includes a basic fundamental approach. This analysis concludes over 1500 pips and is a swing move. Please use this analysis as educational purposes only, as it does not guarantee that price will move exactly as predicted.

If you like our idea, please consider liking and commenting on it.

Good luck and trade safely!

Team Setupsfx_

LONG ON USD/JPYUSD/JPY has given us a CHOC (change of character) from down to up.

It has engineered sell side liquidity right above a demand zone.

I expect price to sweep sell side liquidity, tap into the demand zone then take off to the upside.

looking to catch 150-250 pips on UJ. (Economic News could set this trade on Fire!)

USD/JPY "The Ninja Heist" – Bullish Loot Grab!🌟 Hey, Thieves & Market Bandits! 🌟

💰 Ready to raid the USD/JPY "The Gopher" vault? 💰

Based on 🔥Thief Trading Style🔥 (technical + fundamental heist analysis), here’s the master plan to swipe bullish profits before the market turns against us! Escape near the high-risk Yellow MA Zone—overbought, consolidation, and bear traps ahead! 💸 "Take the money and run—you’ve earned it!" 🏆🚀

🕵️♂️ Heist Strategy:

📈 Entry (Bullish Raid):

The vault’s unlocked! Buy any price—this heist is LIVE!

Pullback lovers: Set buy limits at recent/swing lows for extra loot.

🛑 Stop Loss (Escape Route):

Thief SL at recent/swing low (4H/Day trade basis).

Adjust based on your risk, lot size, and multiple orders.

🎯 Target (Profit Escape):

148.700 (or flee earlier if bears ambush!)

⚔️ Scalpers’ Quick Strike:

LONG ONLY! If rich, attack now. If not, join swing traders & rob slowly.

Trailing SL = Your bodyguard! 💰🔒

💥 Why This Heist?

USD/JPY "The Ninja" is bullish due to key factors—check:

📌 Fundamental + Macro + COT Report

📌 Quantitative + Sentiment + Intermarket Analysis

📌 Future Targets & Overall Score (Linkks In the profile!) 🔗🌍

🚨 Trading Alert (News = Danger!):

Avoid new trades during news—volatility kills!

Trailing SL saves profits on running positions.

💖 Support the Heist Team!

💥 Smash the Boost Button! 💥

Help us steal more money daily with Thief Trading Style! 🏆🚀

Stay tuned—another heist is coming soon! 🤑🎯

USD/JPY Bullish Reversal AnalysisUSD/JPY Bullish Reversal Analysis 📈💹

🔍 Technical Overview:

The chart illustrates a strong bullish reversal pattern forming on USD/JPY after price reacted from a key support zone at 144.600. This level has held firm multiple times, marked by green arrows, signaling strong buying interest.

📐 Chart Patterns & Structure:

✅ A bullish harmonic pattern (possibly a bullish Bat or Gartley) is completing near the 144.600 zone.

🔄 Multiple rejection wicks and bullish engulfing patterns indicate a potential upside reversal.

🔵 Descending trendlines have been broken, confirming momentum shift.

🔁 Previous resistance turned support (near 145.000) is acting as a possible launchpad for the next move.

🎯 Upside Target:

The projected move targets the resistance zone at 147.698, aligning with previous highs and a significant supply area.

If price breaks above 145.900 convincingly, continuation toward this resistance is expected.

🔻 Downside Risk:

A break below 144.600 would invalidate the bullish setup and expose price to the lower support range near 142.000–143.000.

📊 Conclusion:

USD/JPY is showing signs of bullish reversal from a strong demand zone. If price sustains above 145.000 and breaks the minor consolidation, the pair could rally toward 147.698 🎯.

Bias: Bullish ✅

Support: 144.600

Resistance: 147.698

USD/JPY 4-Hour Forex Chart4-hour chart from FOREX.com displays the exchange rate between the U.S. Dollar (USD) and the Japanese Yen (JPY) as of June 25, 2025. The current rate is 145.156, reflecting a 0.16% increase (+0.226). The chart highlights a recent sharp upward movement followed by a decline, with key support and resistance levels marked around 144.484 and 145.731, respectively. The shaded areas indicate potential trading ranges, with the current price hovering near the upper boundary.

USD/JPY Bullish Reversal Trade Setup – Key Support Test at 145.2Entry Point: 145.273 (highlighted in blue)

Stop Loss: ~144.817–145.260 (purple zone)

Target Point (TP): 148.133 (upper resistance zone)

📉 Recent Price Action:

Price peaked near 148.05 before reversing sharply and breaking the trendline.

The market is currently testing the support zone (near the 145.273 entry level).

Moving averages (red = short-term, blue = long-term) show a crossover to the downside, suggesting short-term bearish momentum.

📈 Trade Setup:

Strategy Type: Long (Buy) Setup

Risk/Reward: Favorable, approximately 1:2+

Entry Zone: The current price is close to the entry level at 145.273, making this a timely area to watch for a bounce or confirmation.

⚠️ Risk Factors:

If price breaks below 144.817, the setup becomes invalid.

Short-term momentum is still bearish; confirmation (like a bullish engulfing candle or support hold) is important before entering.

✅ Confirmation Triggers for Entry:

Strong bullish candlestick pattern near entry zone.

RSI or MACD bullish divergence (not shown but useful to check).

Volume spike on bounce from support.

USD/JPY Breaks Higher – Bullish Momentum Targets 148.40FX:USDJPY CMCMARKETS:USDJPY USD/JPY continues to climb, extending gains above the key 146.00 breakout level, supported by Fed–BoJ policy divergence and rising geopolitical tensions. Despite Japan’s strong CPI and PMI prints, the BoJ maintains a dovish tone, while tariff concerns continue to cap yen sentiment. The Middle East conflict further fuels demand for the USD as a safe haven.

Technically, the pair confirmed a bullish breakout, with price hugging the upper Bollinger Band – a sign of sustained upside pressure. As long as 146.00 holds, bulls may aim for the 148.40 monthly resistance.

Key Levels :

Resistance : 146.75 / 148.40

Support : 146.00 / 145.25

⚠️ Momentum favours the upside while above 146.00. Break below may trigger short-term pullback toward 145.25.

Current USD/JPY Trend Analysis and Trading RecommendationsOn Wednesday, the USD/JPY attracted buyers for the second consecutive day, trading near 145.20 in the early European session, close to a two-week high. Japan's May CGPI rose 3.2% YoY, the slowest pace since September last year, potentially easing BOJ rate hike pressure and weakening the JPY. Additionally, optimism over a framework agreement in U.S.-China trade talks dented the JPY's safe-haven appeal. Technically, the price holds above the 200-period SMA on the 4-hour chart and breaches the 145.00 psychological level, with oscillators tilting bullish. A valid break above 145.30 (Tuesday's high) would confirm the bullish setup, targeting the 146.00 integer mark and 146.25-146.30 resistance zone.

USDJPY

buy@145.000-145.200

tp:145.600-146.000

USD/JPY) bullish choch Analysis Read The ChaptianSMC trading point update

Technical analysis of USD/JPY presents a bullish outlook with Smart Money Concepts (SMC)-based logic. Here's a breakdown of the idea and key elements:

---

Chart Summary

Current Market Context

Price: ~144.05

EMA 200: Acting as dynamic resistance at 144.19

Trendline: Broken, signaling a potential shift in market structure

Change of Character (ChoCh): Confirmed around 143.3, marking a bullish transition

---

Key Zones Identified

1. Support Level (Strong Demand Zone)

Around 141.8–142.5

Marked by historical rejections

Possible mitigation of unfilled orders here

2. Fair Value Gap (FVG)

Between 143.0–143.8

Price may return to fill this imbalance before rising

---

Projected Move

Price is expected to:

1. Dip into the FVG or Support Zone to mitigate imbalance

2. Reverse and make a bullish rally

3. Reach the target point near 148.68 (approx. +4.55%)

---

RSI Analysis (14-period)

Current RSI: ~49 (neutral)

No overbought/oversold condition

Room for upside momentum

---

Notable Features

Break of structure (ChoCh) → Bullish signal

EMA crossover potential → Bullish confluence

Multiple FVG fills + support reaction → Entry confirmation opportunities

Economic events marked → Be cautious of volatility spikes

Mr SMC Trading point

---

Trading Idea Summary

Buy Entry Zone: 141.8–143.0 (support or FVG)

Stop Loss: Below 141.5

Target: 148.68

Risk/Reward: Favorable (approx. 1:3+)

Pales support boost 🚀 analysis follow)

USD/JPY) Bullish reversal analysis Read The ChaptianMr SMC Trading point update

Technical analysis for the USD/JPY (U.S. Dollar / Japanese Yen) on the 4-hour timeframe. Here's a detailed breakdown of the idea and strategy:

---

Key Components of the Chart:

1. Strong Support Zone:

The yellow zone is labeled as a “big support level of pullback”, around the 142.00 – 141.20 range.

Price has historically bounced from this zone, suggesting demand and buyer interest.

2. Bullish Structure Setup:

Price is forming a double bottom or potential reversal pattern in the support zone.

A downtrend line is clearly marked, and a break above this trendline would signal bullish continuation.

3. EMA 200 (at 145.020):

The EMA is currently acting as dynamic resistance.

A breakout above the EMA would confirm further bullish momentum.

4. RSI Indicator:

RSI is currently below 30, indicating the market is oversold – a common precursor to a bullish reversal.

5. Target Levels:

Target 1: 145.803 – likely the first resistance level or EMA retest.

Target 2: 148.587 – a prior high and strong resistance area.

6. Projection:

Price is expected to bounce from support, break the trendline, retest, and then rally to higher levels.

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: Near 142.00 – 141.20 (support zone)

Confirmation: Break above the descending trendline + bullish RSI divergence

Targets:

TP1: 145.803

TP2: 148.587

Invalidation: Break and close below 141.00 (support zone broken)

Mr SMC Trading point

---

Risk Management Suggestion:

Use a tight stop-loss below the support zone, considering it's the key reversal area. Also, keep an eye on fundamental factors such as U.S. and Japan interest rate decisions or key economic events (indicated by the icons on the chart).

Pales support boost 🚀 analysis follow)