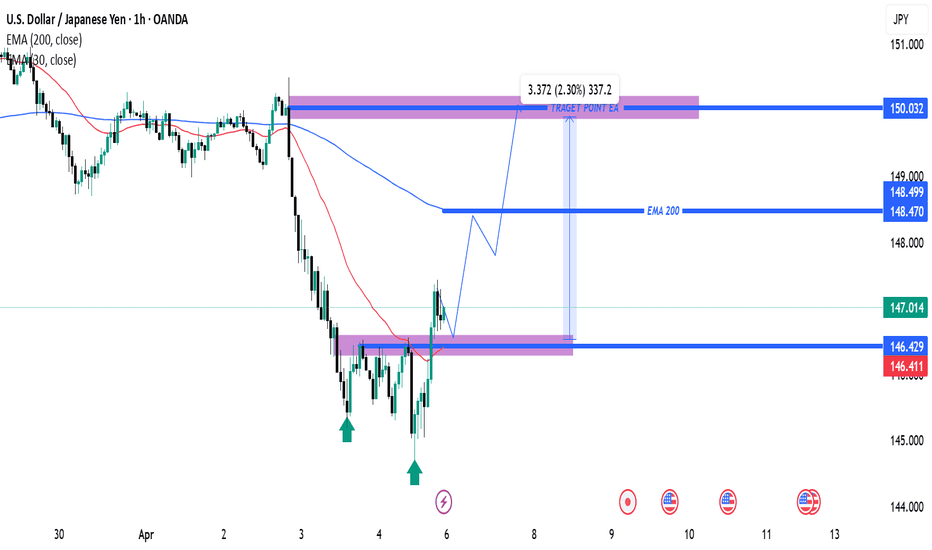

USD/JPY Bullish Reversal Setup with 2.30% Upside PotentialThis is a USD/JPY 1-hour chart analysis, and it looks like a bullish setup is being anticipated. Here's a breakdown:

Key Observations:

1. Support Zone (Purple Box - Around 146.411 - 146.429):

Multiple bullish rejections (green arrows) indicate a strong support level.

Price bounced off this support recently, forming a potential double bottom.

2. EMA Levels:

50 EMA (Red Line) is currently at 146.411.

200 EMA (Blue Line) is at 148.499, acting as dynamic resistance.

Price has crossed above the 50 EMA, a bullish sign, and might aim for the 200 EMA next.

3. Projected Bullish Path:

The path drawn suggests a pullback to the support zone around 146.429, followed by a bullish continuation.

Target zone is marked around 150.032, showing a projected gain of 2.30% (337.2 pips).

4. Resistance Levels:

Minor resistance at the 200 EMA (~148.5).

Usdjpylong

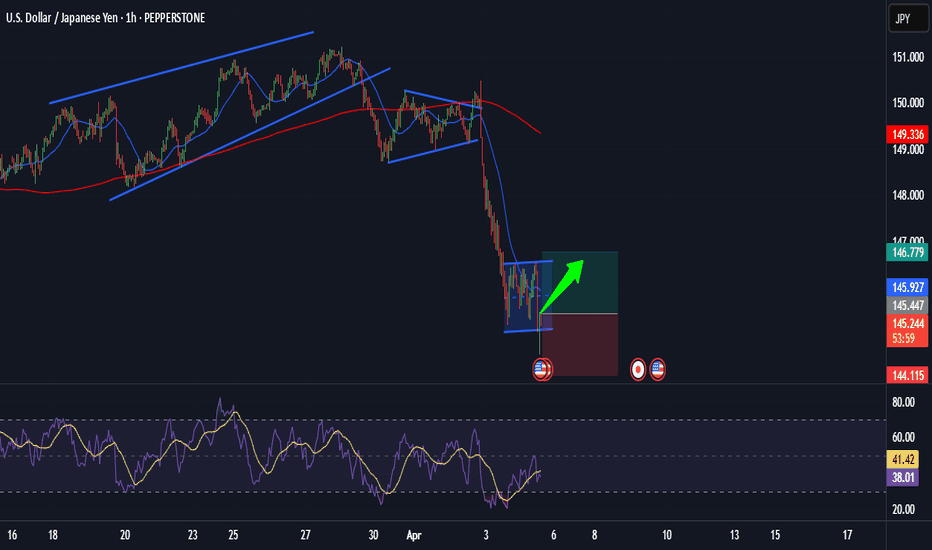

USD/JPY Ready for Liftoff? Catch This Potential Rebound! Hi traders! , Analyzing USD/JPY on the 1H timeframe, spotting a potential long entry:

🔹 Entry: 145.44

🔹 TP: 146.78

🔹 SL: 144.115

USD/JPY has formed a consolidation zone after a sharp downtrend, indicating a potential bullish reversal. If buyers step in, we could see a move towards 146.78. RSI is recovering from oversold levels, supporting the upside scenario.

⚠️ DISCLAIMER: This is not financial advice. Every trader makes their own decision.

USD/JPY(20250403)Today's AnalysisMarket news:

US trade policy-① Trump signed an executive order to establish a 10% "minimum base tariff" for all countries, and will impose reciprocal tariffs, including 20% for the EU, 24% for Japan, 46% for Vietnam, and 25% for South Korea. The tariff exemption for goods that meet the USMCA will continue, and the tariff for those that do not meet the requirements will remain at 25%; ② The US Treasury Secretary called on countries not to retaliate; ③ The base tariff will take effect on April 5, and the reciprocal tariff will take effect on the 9th. In addition, the 25% automobile tariff will take effect on the 3rd, and the automobile parts tariff will take effect on May 3rd; ④ Gold bars, copper, pharmaceuticals, semiconductors and wood products are also not subject to "reciprocal tariffs".

Today's buying and selling boundaries:

149.61

Support and resistance levels

150.97

150.46

150.13

149.08

148.75

148.24

Trading strategy:

If the price breaks through 148.75, consider buying, the first target price is 149.08

If the price breaks through 148.24, consider selling, the first target price is 148.00

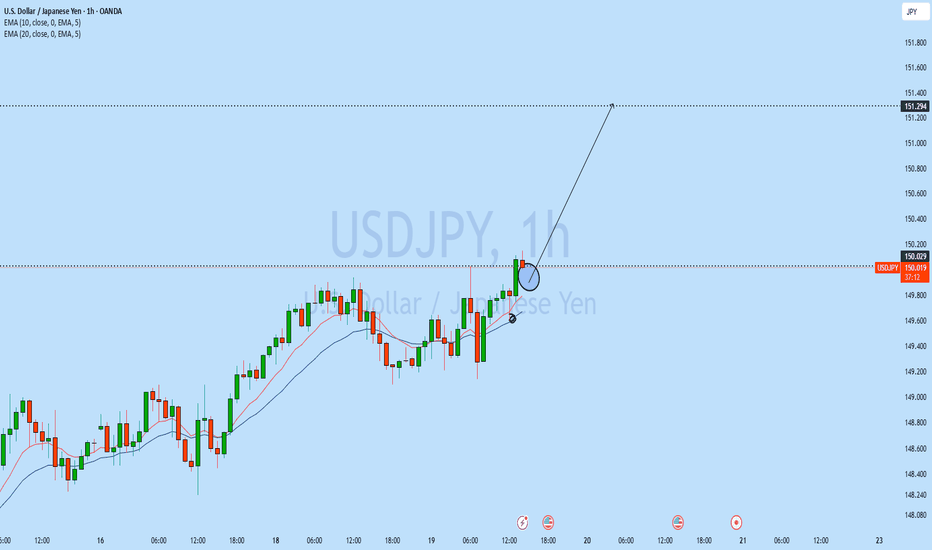

USD/JPY Ready to Take Off: Golden Opportunity on 1H!Hi traders! Analyzing USD/JPY on the 1H timeframe, spotting a potential entry:

🔹 Entry: 150.08

🔹 TP: 150.589

🔹 SL: 149.547

USD/JPY is breaking out of a bullish pennant pattern, suggesting a potential upward move. The RSI is holding above 50, indicating bullish momentum building up. If the price sustains above 150.08, we could see a push toward 150.589. Keep your eyes on price action and manage your risk!

⚠️ DISCLAIMER: This is not financial advice. Trade responsibly.

USDJPY DOWNWARDhello fellow traders, we wait for another down/retracements on this pair FX:USDJPY , but this is only my view, you can share yours if you have any idea.

1st target 148.6,

Long zone 145 . this idea base on my own understanding, on my other pairs that posted, still valid folks. GU, GJ, XAU. are we all connected?

this is not a financial advice,

follow for more swing trades. swing it....

USD/JPY "The Ninja" Forex Bank Heist Plan (Day / Scalping Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Bank . Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (148.600) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 152.400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/JPY "The Ninja" Forex Bank Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/JPY(20250328)Today's AnalysisToday's buying and selling boundaries:

150.74

Support and resistance levels

151.83

151.42

151.16

150.32

150.06

149.66

Trading strategy:

If the price breaks through 151.16, consider buying, the first target price is 151.42

If the price breaks through 150.74, consider selling, the first target price is 150.32

USDJPY LongAussie Inflation and BOJ Decision in focuse

Dollar getting strong because of FED Decision:,,No-rates cuts!,,

2 ways to trade this:

aggressive entry

and conservative entry:Risk to enter the 2nd approach(That price comes back to the 2nd entry is 37,25% but higher reward-risk ratio

Risk management based on your risk appetite

151.00 Cracks: Is USD/JPY’s Rally Over? Key Levels AheadFrom a fundamental perspective, the USD/JPY exchange rate retreated from around the 151.00 level. Despite the poor Japanese PMI data on Monday, investors bought the Japanese yen influenced by the hawkish outlook of the Bank of Japan (BoJ). The minutes of the January meeting showed that policymakers tend to tighten policies when appropriate. The BoJ governor also stated that the degree of monetary easing will be adjusted once the 2% inflation target is achieved.

Technically, the overnight breakout above the 150.00 psychological mark and the 200 - period Simple Moving Average (SMA) on the 4 - hour chart is a bullish signal. Indicators on the daily chart also support appreciation, and pullbacks may present buying opportunities. If the rate breaks below 150.00, it may accelerate its decline to support levels such as 149.30 - 149.25. Failure to hold these levels indicates that the rebound momentum has been exhausted and the trend may turn bearish. Conversely, if it stabilizes above 151.00, the upward resistance levels are successively 151.30, 151.75 (the 200 - day SMA), and it may even rise to 153.00.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

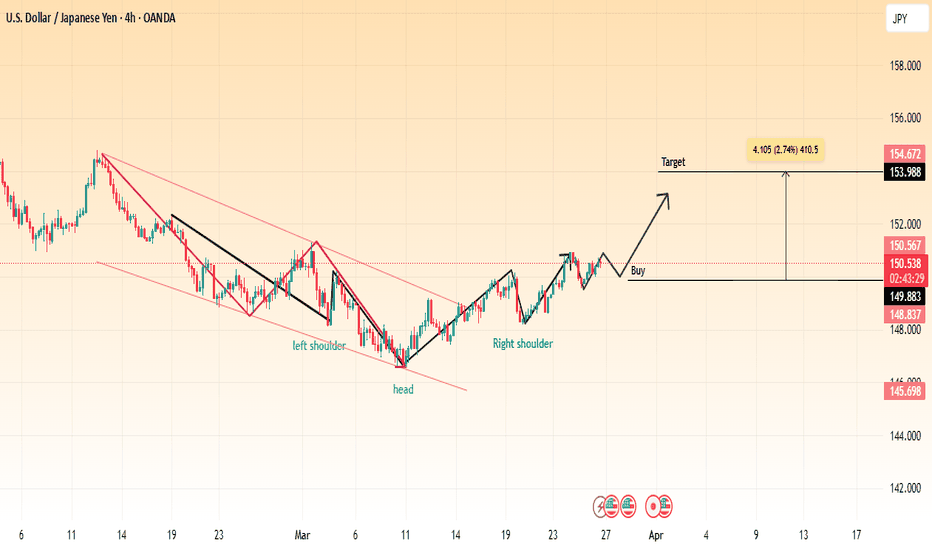

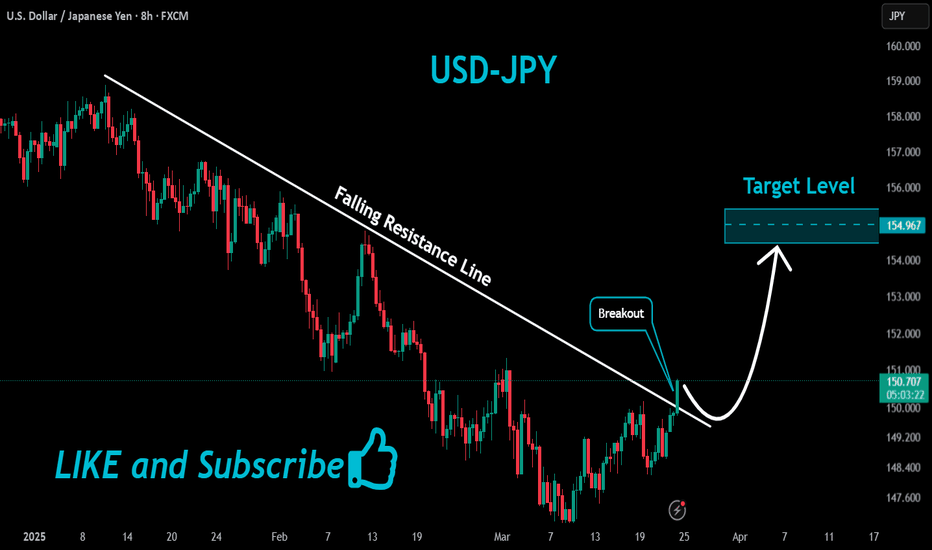

USD/JPY Bullish Reversal (Inverse Head & Shoulders)📌 Pattern: Inverse Head & Shoulders

📌 Analysis: The chart showcases an inverse head and shoulders pattern, a classic bullish reversal formation. The price has successfully broken out of the downward trendline, indicating potential upside movement.

🔹 Left Shoulder: Formed during the previous retracement.

🔹 Head: The lowest point of the pattern, marking strong support.

🔹 Right Shoulder: Completed with a breakout above resistance.

📈 Trading Plan:

✅ Entry (Buy): After a confirmed breakout and possible retest.

🎯 Target: 153.988 - 154.672 (2.74% potential gain).

🔻 Support: 149.883 - 148.837 (Stops should be placed accordingly).

📊 Conclusion:

If the price maintains above the breakout level, we may see a strong rally toward the resistance target. Watch for volume confirmation and pullback retests before entering a trade.

USDJPY 18K PROFIT LIVE TRADE AND BREAK DOWNUSD/JPY rebounds toward 150.50 on risk recovery

USD/JPY is bouncing back toward 150.50 in Wednesday's Asian session. The pair reverses US President Trump's fresh tariff threats and hawkish BoJ commentary-led drop, tracking the rebound in risk sentiment and the US Dollar. All eyes stay on US tariffs, data and Fedspeak.

USDJPY 1.2850 Long in Profit: Next Week's Take - Profit GuideThis week, the long position signal on USDJPY at the 1.28500 level has already started yielding profits. As we look ahead to next week, it is advisable to commence position closing once the price reaches the pre - determined target levels. Rest assured, I will persist in furnishing precise trading signals.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

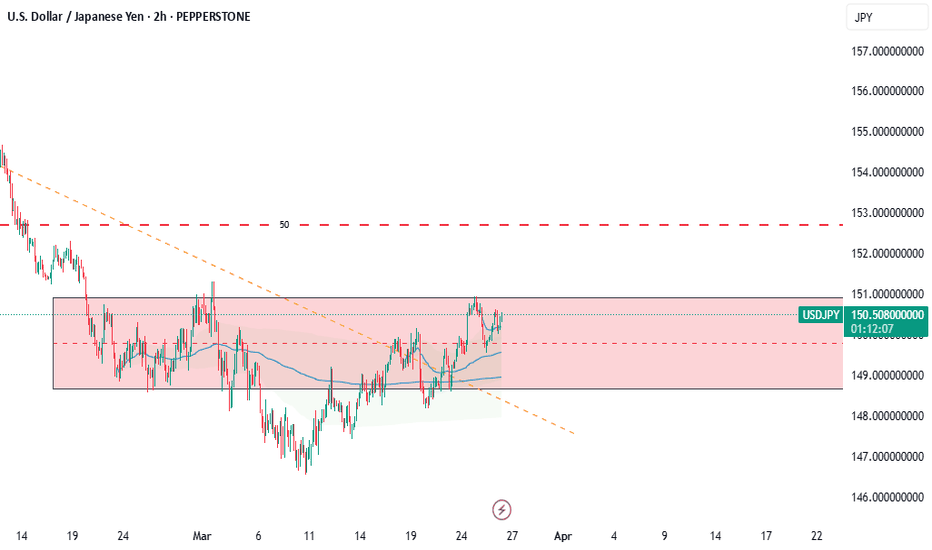

UJ Price Analysis: Key Insights for Next Week Trading DecisionThe USD/JPY pair is currently in a temporary uptrend within a broader consolidation, following a strong bearish move that started at the beginning of the year. The Y149.000 level will be a key zone for our trading decisions.

📌 Key Technical Outlook:

🔹 Price faced selling pressure around Y150.000, leading to a pullback.

🔹 As long as price holds above the ascending trendline & Y149.000, I’ll be looking for buying opportunities in the short term.

🔹 A breakdown and retest of Y149.000 and the trendline would confirm a resumption of the long-term bearish structure.

📌 Major Market Drivers:

🔹 Federal Reserve’s Policy Stance: Powell reiterated that rate cuts are not urgent, keeping the USD supported.

🔹 Trump’s Trade Tariffs: Expected to drive US inflation higher, adding strength to the Dollar.

🔹 Bank of Japan’s Hawkish Expectations: Japan’s largest trade union group (Rengo) secured a 5.4% pay rise, reinforcing expectations that the BoJ will tighten policy further this year.

🔹 Japan’s CPI Cooling Down: Lower inflation in Japan could weaken the Yen and offer USD/JPY support.

📅 Key Economic Events on Our Radar Next Week:

🗓 Tuesday: US S&P Global PMI – A key sentiment indicator for economic conditions.

🗓 Thursday: US GDP (Q4 Final) – A major market mover influencing the Fed’s policy direction.

🗓 Friday: Tokyo CPI & US Core PCE Index – The BoJ and Fed’s preferred inflation measures, critical for future rate decisions.

I’ll be watching how USD/JPY behaves around Y149.000 for confirmation of trend continuation or a bearish continuation. We’ll discuss this in-depth during Forex Morning Mastery tomorrow—stay tuned! 🔥📈 #USDJPY #Forex #MarketAnalysis

USD/JPY Bullish Outlook – Targeting Key Resistance at 150.155USD/JPY Technical Analysis – Bullish Outlook Toward Resistance

Chart Insights:

The price is currently in a recovery phase after a significant drop.

A Fair Value Gap (FVG) zone has been identified, suggesting a potential pullback before further movement.

The target point aligns with the resistance level around 150.155, which acts as a key supply zone.

Potential Scenario:

Price may retrace into the FVG zone around 148.704 – 148.956.

A bullish rebound from this level could drive price toward the resistance at 150.155.

If price reaches the resistance level, further rejection or continuation will depend on market conditions.

Key Levels:

Support Zone: 148.167 – 148.315

FVG Area: 148.704 – 148.956

Resistance Zone: 150.007 – 150.155 (Target area)

Conclusion:

The current structure suggests a bullish bias if price respects the FVG zone for a push higher. However, a break below the FVG could signal further downside movement.

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Trading strategyThe USDJPY is currently at a critical level, with the price fluctuating around 149.00. The resistance level above is at 150.00, and if broken through, it may further test 151.00. The support level below is at 148.50, and if it falls below, it may drop to 148.00. Recently, the market has been focusing on the monetary policy trends of the Federal Reserve and the Bank of Japan. The strengthening of the US dollar and the weakness of the Japanese yen may push USDJPY higher.

USDJPY Trading strategy:

buy@148.50-149.00

tp:150.00-150.50-151.00

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear.

For those who are seeking professional guidance in trading trend analysis, strategy formulation, and risk management, please click below to get the daily strategy updates.

USDJPY analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.