USDJPY S&R IN 1-H AT MUST WATCH OUTHello Guys Here Is Chart Of USDJPY in 1-H AT

Entry Level: BUY Around 148,300 - 148,000

Target Will Be : 149,300

Support: 148,000 The yellow circles highlight previous points where the price respected this trendline as support

However, if the price breaks below the trendline, the bullish scenario may be invalidated.

Usdjpylong

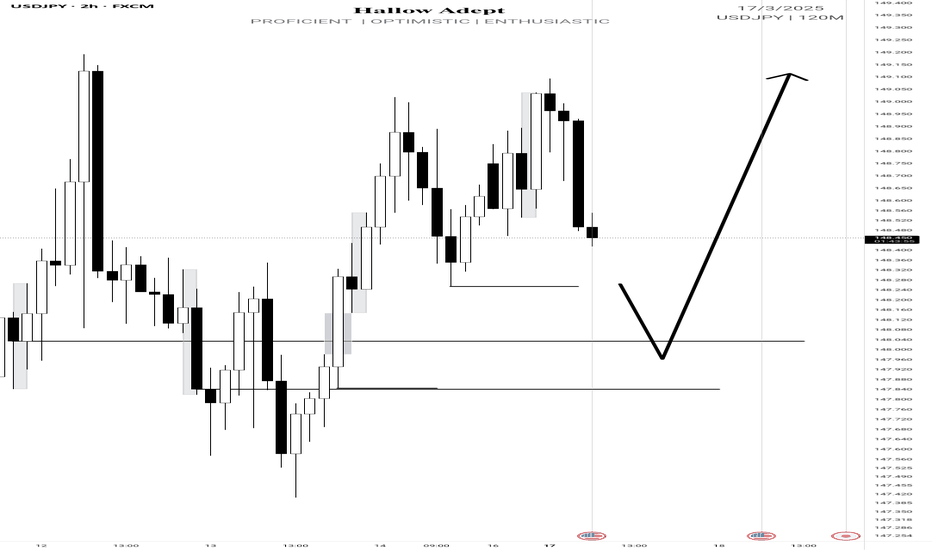

UsdJpy bullish continuation I was patiently waiting for price at 147.842 last week but it didn't come to my point of interest.

Nothing spoil, I'll watch how price reacts at 148.033, that's my assumed poi for the bullish continuation. If price didn't respect that zone then I'll be expecting price at 147.842

My draw on Liquidity 🧲 is the current higher high 149.193.

Kindly boost if you find this insightful 🫴

Long I opened two long positions for USDJPY pair:

My overall bias for USDJPY is bearish so I have been mainly shorting the pair but I saw a good set up wroth while to go long.

Trade set up:

Entry - 148.272 (black line in 4H chart)Target 1 - 149 (previous high and previous week mid price) - Green line in 4H chart)Target 2 - 149.82 (Green line in 4H chart)Stop loss- 147.38 (red line in 4H chart)

Reasons for this trade:

1) All momentum indicators have entered bull territory in 4H chart.

2) All daily momentum indicators are showing positive divergence.

3) All daily momentum indicators are still deep in the bear territory but have crossed to the upside, so it indicates the beginning of the potential corrective move to the upside.

4) The price has dropped to Fib 0.618 level and are boucing up to the upside in the daily chart

USD/JPY Price Rejection at Resistance with Potential Bearish.hello traders.

what are your thoughs on USD/JPY.

my idea is

. Trade Setup:

Entry: Around 148.153, aligning with the pullback area.

Stop Loss: Above 148.624, placed strategically to avoid minor fluctuations.

Take Profit Levels:

First Target: 147.596 – a potential support level where price may find temporary stability.

Final Target: 147.167 – deeper support level indicating further bearish continuation.

USD/JPY at a Key Level: Is a New Trend Emerging?USD/JPY is currently in the D1 discount zone and approaching a D1 FVG, where a potential reaction may occur. The price is moving within a downtrend channel for now.

If a reaction happens at this level, we should wait for a channel breakout. A trade opportunity arises either on the breakout retest or immediately after the breakout, confirming bullish momentum and increasing the probability of an upward move.

Risk Management Strategy:

To secure profits and manage risk effectively, consider scaling out at key levels:

• Target 1: Close 25% of the position to secure initial profits.

• Target 2: Close 50% of the position to lock in more gains.

• Target 3: Close 100% of the remaining position for full take profit.

Risk Reward 1.3

Monitoring price action closely at this level is crucial.

USDJPY Counter Trend Opportunities - Fxdollars - {11/03/2025}Educational Analysis says USDJPY may give countertrend opportunities from this range, according to my technical.

Broker - FXCM

So my analysis is based on a top-down approach from weekly to trend range to internal trend range.

The weekly trend range is long up to 170.000

Trading Range Approach is a long counter trend opportunity or pushback up to 155.000

The internal Trend Range Approach is a Long counter trend opportunity or pushback up to 150.000

or continue going down with an internal trading range or trading range up to 135.000

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS ONLY EDUCATIONAL PURPOSE ANALYSIS.

I have no concerns with your profit and loss from this analysis.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars .

JPY Market Analysis Update – Key Level at 148.000Market Overview:

📈 Strong JPY Performance:

Expectations of another BoJ rate hike have pushed the Japanese Yen to perform strongly in the Asia-Pacific region.

📊 Record Net Long Positions:

Non-commercial traders' net long yen futures surged to 96K contracts (up from 61K), setting a 30-year record according to CFTC data.

Technical Insights:

📉 Descending Channel & Reversal Setup:

While bearish pressure has been evident, momentum is showing signs of easing, hinting at a potential stabilization or near-term bounce. A reversal setup is identified in the 147.000/148.000 zone.

🎯 Key Level:

Next week, the crucial level is 148.000. Be prepared for a buy signal if prices break above, or a sell signal if they remain below this level.

Upcoming Catalysts:

⏰ Fed Policy Uncertainty:

With Fed Chair Jerome Powell indicating that rate cuts are not imminent, this policy uncertainty could favor the US Dollar in the coming week, influencing the JPY further.

Keep an eye on the Consumer Price Index, Producer Price Index, and Michigan Consumer Sentiment Index.

Stay Tuned:

I'll provide a detailed update at the beginning of next week. Follow along for more insights and actionable trading strategies!

Happy Trading!

Disclaimer:

Forex and other market trading involve high risk and may not be for everyone. This content is educational only—not financial advice. Always assess your situation and consult a professional before investing. Past performance doesn’t guarantee future results.

U.S. Dollar / Japanese YenHello and Respect to Dear Traders

Last week, we received the necessary confirmations for the bullish trend of the Japanese yen chart, and we were waiting for the price to return to an optimal buying range. At this hour, I have obtained the essential confirmations, and we can utilize the 15-minute timeframe for optimal entry.

Specifically, based on recent fundamental news, the Japanese government has announced that interest rates in the country will not change in the near future, which could help strengthen the yen and boost its price. Therefore, this presents a suitable opportunity to enter a long-term buy position on the daily timeframe.

Keep in mind that this currency can be held until the main target.

Important Points:

Liquidity Daily: 156.755

IFC 4 H Candle: 157.617 & 158.136

And finally, our main target is 158.874.

Thank you for your support. A very simple and clear chart has been drawn for your use.

Wishing you all success!

Fereydoon Bahrami

A retail trader in the Wall Street Trading Center (Forex)

Risk Disclosure:

Trading in the Forex market is risky due to high price volatility. This analysis is solely my personal opinion and should not be considered financial advice. Please do your own research. You are responsible for any profits or losses resulting from this analysis.

USDJPY BuyUSDJPY Trade Signal

📉 Pullback & Potential Reversal

Price Level: 150.41

Support Zone: 148.37 - 149.98

Resistance Targets: 152.06 / 154.00

📌 Trade Plan:

Wait for a pullback confirmation before entering long.

Stop Loss: Below 148.37

Targets: 152.06 → 154.00

⚠️ Risk Management: Control risk and wait for a clear breakout.

USD/JPY Channel Breakout (Weekly Forecast Mar 3-7)The USD/JPY pair on the H2 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Channel Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 153.90

2nd Resistance – 155.60

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

USD/JPY Market Analysis – Potential Reversal or Continuation?This 15-minute chart of USD/JPY displays a clear bullish impulse following a Change of Character (ChoCh) and a Break of Structure (BoS) . Price action has reached a key resistance zone, and traders are now anticipating the next move based on market reactions.

Key Observations :

1. Change of Character (ChoCh) :

- This indicates a shift from bearish to bullish sentiment.

- The market rejected lower prices and started forming higher highs and higher lows.

2. b]Break of Structure (BoS) :

- This confirms bullish momentum as previous resistance levels are broken.

- A strong bullish move suggests demand is dominating.

3. Current Price Action :

- The price has approached a liquidity zone (previous high).

- Potential rejection at this level suggests profit-taking or a shift in order flow.

Possible Scenarios:

✅ Bullish Continuation :

- If price retraces into the M15 demand zone (marked on the chart) and finds support, a continuation to the upside is likely.

- A break above the current high could push price towards 149.950 or even 150.000.

❌ Bearish Reversal :

- If price aggressively rejects the current high and breaks the M15 demand zone , we could see a bearish move towards **149.100 - 148.900**.

- This would indicate a deeper correction or potential trend reversal.

Trading Plan:

- **Wait for confirmation at the M15 demand zone.**

- **Look for bullish price action signals for continuation trades.**

- **If demand fails, shift bias to bearish setups.**

📌 Conclusion :

USD/JPY is at a critical decision point. The next move will depend on whether buyers defend the demand zone or if sellers step in to drive price lower. Stay patient and react to market structure shifts accordingly. 🚀📉

#USDJPY 4HUSDJPY (4H Timeframe) Analysis

Market Structure:

The price is currently respecting a trendline support, indicating that buyers are maintaining control. Additionally, the presence of a buy engulfing area suggests strong bullish momentum, signaling a potential continuation of the uptrend.

Forecast:

A buy opportunity may arise if the price continues to hold above the trendline support, confirming bullish pressure.

Key Levels to Watch:

- Entry Zone: A buy position can be considered near the trendline support after confirmation of bullish price action.

- Risk Management:

- Stop Loss: Placed below the trendline support to manage risk.

- Take Profit: Target key resistance levels based on previous price action.

Market Sentiment:

The combination of trendline support and a buy engulfing area indicates strong buying interest. A confirmed bullish move from this level can provide better validation for a buy setup.

IS USDJPY HAVE BUY SIDE LEQUIDITY?USDJPY is Sweep Buy Side Lequidity now sell side Lequidity Rest In Upside Market Will Go And Hunt These Lequidities That I Mentioned In Chart Be Patience Be Discipline With Your Strategies Without Knowing Market Behaviors Not Put Your Harder Money.

This Is Analysis Not A Financial Advice DYOR.

USDJPY Signal - 5 months support test 24.2.25148.60 to 152.70 range

Currently trading at 149.70

Support of 148.60-149.80 range is holding strong for the past 5 months.

Standard correction 300 pips up towards 152.70 makes sense following the expanding wedge pattern highlighted on the chart.

100 pip downside compared to 300 pip upside swing trade.

Make logical, timed, calculated action sticking to a plan and managing risk as top priorities.

GOOD LUCK!

USDJPY: remains below 150.00Furthermore, any significant retracement could find immediate support near the 149.50 level, which is followed closely by the 149.00 round number. A break below the latter might expose the USD/JPY pair to a retest of the 148.50 region, a level seen as the next strong support. Sustained weakness below this area could pave the way for a deeper corrective decline, with the next target around the 148.00 level. Traders will likely keep a close eye on these levels, as they could provide fresh directional impetus for the pair.