Usdjpylongsetup

USD/JPY Bullish Outlook – Targeting Key Resistance at 150.155USD/JPY Technical Analysis – Bullish Outlook Toward Resistance

Chart Insights:

The price is currently in a recovery phase after a significant drop.

A Fair Value Gap (FVG) zone has been identified, suggesting a potential pullback before further movement.

The target point aligns with the resistance level around 150.155, which acts as a key supply zone.

Potential Scenario:

Price may retrace into the FVG zone around 148.704 – 148.956.

A bullish rebound from this level could drive price toward the resistance at 150.155.

If price reaches the resistance level, further rejection or continuation will depend on market conditions.

Key Levels:

Support Zone: 148.167 – 148.315

FVG Area: 148.704 – 148.956

Resistance Zone: 150.007 – 150.155 (Target area)

Conclusion:

The current structure suggests a bullish bias if price respects the FVG zone for a push higher. However, a break below the FVG could signal further downside movement.

USD/JPY Technical Analysis & Trade Outlook – March 16, 2025Current Price: 148.618

EMA (30): 148.545 (short-term trend)

EMA (200): 148.286 (long-term trend)

Resistance Zone: 149.233

Support Zone: 148.286

Analysis & Price Action:

The price is trending upwards, forming higher lows, indicating bullish momentum.

The price is above both the 30 EMA and 200 EMA, which suggests an ongoing uptrend.

A support level around 148.286 is holding, reinforcing a bullish bias.

Forecast & Trade Plan:

A potential breakout above the minor resistance could push USD/JPY towards the 149.233 target.

If price retraces, a bounce off 148.286 would present a buy opportunity.

If price breaks below 148.286, the bullish outlook weakens, and further downside may follow.

📌 Bias: Bullish towards 149.233

📌 Confirmation: Watch price action at support and resistance levels

📌 Risk Management: Consider stop-loss below 148.200 to protect downside.

Would you like further details on trade entry points?

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

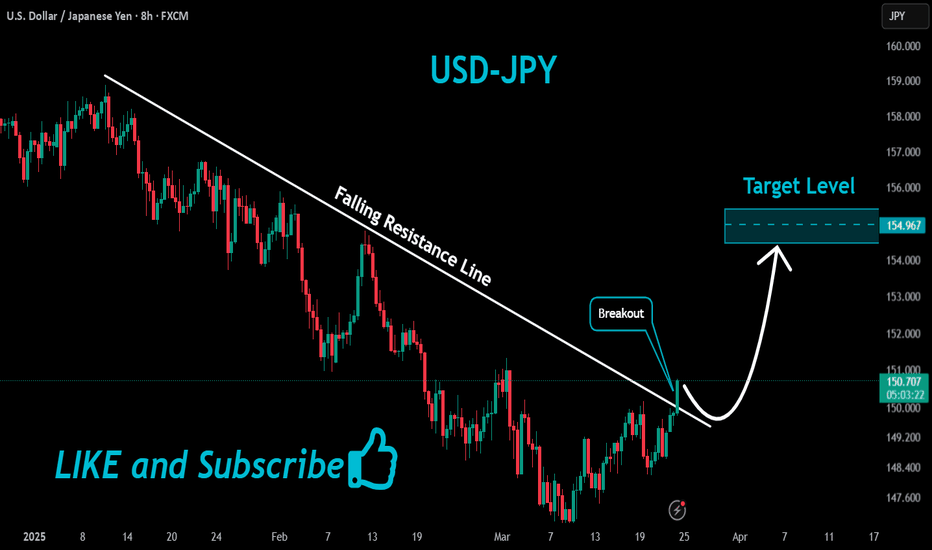

USDJPY Counter Trend Opportunities - Fxdollars - {11/03/2025}Educational Analysis says USDJPY may give countertrend opportunities from this range, according to my technical.

Broker - FXCM

So my analysis is based on a top-down approach from weekly to trend range to internal trend range.

The weekly trend range is long up to 170.000

Trading Range Approach is a long counter trend opportunity or pushback up to 155.000

The internal Trend Range Approach is a Long counter trend opportunity or pushback up to 150.000

or continue going down with an internal trading range or trading range up to 135.000

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS ONLY EDUCATIONAL PURPOSE ANALYSIS.

I have no concerns with your profit and loss from this analysis.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars .

USD/JPY "The Gopher" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Gopher" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 1H timeframe (148.600) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 152.300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

USD/JPY "The Gopher" Forex Market is currently experiencing a bullish trend,., driven by several key factors.

🔰 Fundamental Analysis

- The Bank of Japan's (BOJ) monetary policy decisions significantly impact the yen's value. The BOJ's negative interest rate policy and quantitative easing program have contributed to the yen's depreciation.

- The US Federal Reserve's interest rate decisions also influence the USD/JPY exchange rate. Higher interest rates in the US can attract investors, causing the dollar to appreciate.

- Japan's trade balance and current account deficit can impact the yen's value. A large trade deficit can lead to a depreciation of the yen.

🔰 Macroeconomic Factors

- Inflation: Japan's inflation rate has been relatively low, which can impact the BOJ's monetary policy decisions.

- GDP Growth: Japan's GDP growth rate has been slow, which can impact the yen's value.

- Unemployment Rate: Japan's unemployment rate has been relatively low, which can impact the labor market and inflation.

🔰 COT Data

- Non-Commercial Traders: These traders, including hedge funds and individual investors, hold a significant portion of the USD/JPY futures market.

- Commercial Traders: These traders, including banks and other financial institutions, hold a smaller portion of the USD/JPY futures market.

🔰 Market Sentiment Analysis

- Bullish Sentiment: Some investors are bullish on the USD/JPY due to the interest rate differential between the US and Japan.

- Bearish Sentiment: Others are bearish due to concerns about Japan's economy and the potential for the BOJ to intervene in the currency market.

🔰 Positioning

- Long Positions: Some investors have taken long positions in the USD/JPY, betting on a continuation of the uptrend.

- Short Positions: Others have taken short positions, betting on a reversal of the uptrend.

🔰 Next Trend Move

- The USD/JPY may continue its uptrend if the interest rate differential between the US and Japan remains significant.

- However, if the BOJ intervenes in the currency market or if Japan's economy shows signs of improvement, the uptrend may reverse.

🔰 Overall Summary Outlook

The USD/JPY currency pair is influenced by a combination of fundamental, macroeconomic, and market sentiment factors. While some investors are bullish on the pair due to the interest rate differential, others are bearish due to concerns about Japan's economy. The next trend move will depend on various factors, including the BOJ's monetary policy decisions and Japan's economic performance.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USDJPY BuyUSDJPY Trade Signal

📉 Pullback & Potential Reversal

Price Level: 150.41

Support Zone: 148.37 - 149.98

Resistance Targets: 152.06 / 154.00

📌 Trade Plan:

Wait for a pullback confirmation before entering long.

Stop Loss: Below 148.37

Targets: 152.06 → 154.00

⚠️ Risk Management: Control risk and wait for a clear breakout.

USD/JPY Market Analysis – Potential Reversal or Continuation?This 15-minute chart of USD/JPY displays a clear bullish impulse following a Change of Character (ChoCh) and a Break of Structure (BoS) . Price action has reached a key resistance zone, and traders are now anticipating the next move based on market reactions.

Key Observations :

1. Change of Character (ChoCh) :

- This indicates a shift from bearish to bullish sentiment.

- The market rejected lower prices and started forming higher highs and higher lows.

2. b]Break of Structure (BoS) :

- This confirms bullish momentum as previous resistance levels are broken.

- A strong bullish move suggests demand is dominating.

3. Current Price Action :

- The price has approached a liquidity zone (previous high).

- Potential rejection at this level suggests profit-taking or a shift in order flow.

Possible Scenarios:

✅ Bullish Continuation :

- If price retraces into the M15 demand zone (marked on the chart) and finds support, a continuation to the upside is likely.

- A break above the current high could push price towards 149.950 or even 150.000.

❌ Bearish Reversal :

- If price aggressively rejects the current high and breaks the M15 demand zone , we could see a bearish move towards **149.100 - 148.900**.

- This would indicate a deeper correction or potential trend reversal.

Trading Plan:

- **Wait for confirmation at the M15 demand zone.**

- **Look for bullish price action signals for continuation trades.**

- **If demand fails, shift bias to bearish setups.**

📌 Conclusion :

USD/JPY is at a critical decision point. The next move will depend on whether buyers defend the demand zone or if sellers step in to drive price lower. Stay patient and react to market structure shifts accordingly. 🚀📉

USDJPY: remains below 150.00Furthermore, any significant retracement could find immediate support near the 149.50 level, which is followed closely by the 149.00 round number. A break below the latter might expose the USD/JPY pair to a retest of the 148.50 region, a level seen as the next strong support. Sustained weakness below this area could pave the way for a deeper corrective decline, with the next target around the 148.00 level. Traders will likely keep a close eye on these levels, as they could provide fresh directional impetus for the pair.

USDJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Long: NFP ON TAP!!! NFP is expected to come in at about 169k. We will watch the actual news results before deciding whether to continue the trade. If the news comes in better than expected, we expect the US dollar to become stronger against the Yen. If NFP comes in lower than expected, we will be looking to other major pairs for trading setups.

We can see price is moving in a bullish direction, which is supported by the short-term trendline breakout and a change in market structure from bearish to bullish.

Could the price bounce from here?US Dollar Index (DXY) is falling towards the pivot which is an overlap support and could bounce to the pullback resistance.

Pivot: 107.14

1st Support: 106.57

1st Resistance: 108.11

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce?US Dollar Index (DXY) is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance.

Pivot: 107.57

1st Support: 106.51

1st Resistance: 108.79

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Potential bullish rise?US Dollar Index (DXY) has reacted off the pivot which has been identified as a pullback support and could rise to the 1st resistance.

Pivot: 107.90

1st Support: 107.12

1st Resistance: 108.93

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop?US Dollar Index (DXY) is rising towards the pivot and could reverse to the 1st support.

Pivot: 109.59

1st Support: 107.46

1st Resistance: 111.96

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USDJPY TRADE IDEA: LONG | BUY - W/B: 19/01/25UJ is going to be bearish for the next day or so, therefore taking opportunities as it goes up makes most sense. This is the entry I have found as the reversal has been made official.

RR: 3.64

N.B.: This is not financial advice. Trade safely and with caution.

USDJPY LoongBased on the previous setup (shorting the cuurency), I had anticipated that this currency will make a correction before going loong.

The fact that the price has already touched and rebounded on Novembers Monthly high means that the price has formed its lower low.

The price can now be drawn to the order block at 160.3 or buyside liquidity at 161.9

USD/JPY on the Verge of a Breakout: Key Levels to Watch!USD/JPY is encountering resistance at the trendline, previously a support level. The price attempted to break through earlier but faced rejection. Now, it is approaching the resistance level again, showing breakout potential.

We anticipate a possible breakout above the resistance trendline. A key support zone, marked in grey, provides a critical level to watch for pullbacks or reversals. Monitor price action for confirmation.

DYOR, NFA