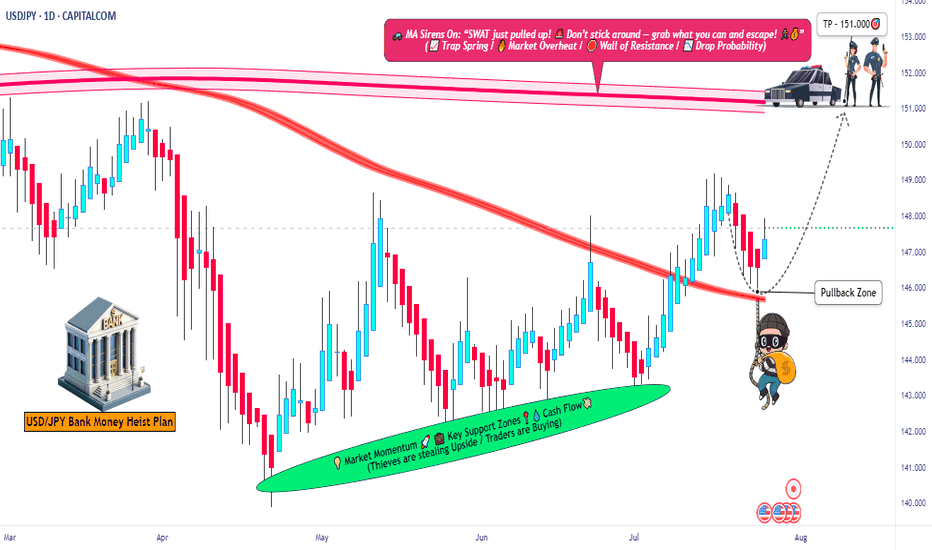

USD/JPY Robbery Route | Enter at Dip, Exit Before Police💥USD/JPY Forex Money Heist Plan 🎯 — Ninja Robbery at 146.000💥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Market Bandits, Money Makers & Risky Robbers 🤑💰💸✈️

Welcome to another Thief Trader-style operation. We've cracked open the USD/JPY vault (aka "The Gopher" 💹), and here's the blueprint to pull off this forex heist like true professionals. 💼🎭💵

🚨 Strategy Overview

This isn't just a trade – it’s a well-researched, precision-timed robbery mission based on technicals, macro analysis, sentiment, and the bigger global picture.

Expect action near critical zones – especially the moving average barricade, where police (aka risk) is waiting. Stay sharp.

🔓 Entry Point – Unlock the Vault

📈 Watch for bullish pullbacks near 146.000.

Whether it's a dip, zone test, or wick bounce — you’re looking to layer buy limit orders like a seasoned thief using DCA tactics.

Enter on swings or any bullish confirmation.

Heist Window is Open.

🛑 Stop Loss – Escape Route

📍 SL near 143.000 (1D swing low) — adjust based on your capital and position size.

💡 Don’t go blind — SL is your backup plan, not an optional accessory.

Custom-fit it based on how many entries you’re stacking.

🎯 Target – Vault Exit Point

🏁 151.000 or exit before resistance heat catches on.

No greedy thieves here — precision exit is key.

Lock profits, vanish in style. 🕶️💼💸

🧲 Scalpers Take Note

Only long side raids are valid. Scalping against the trend? That's walking into a trap.

Use trailing SLs and protect your loot.

Small bag or big vault — play your game smart. 🎯💰

📢 Fundamental Boosters

USD/JPY’s bullish run isn’t random — it’s backed by:

📊 Macro shifts,

📈 COT reports,

🧠 Sentiment drivers,

📉 Intermarket trends,

And a whole mix of thief-level intel 🔍

🧭 Dive deeper before acting. The map’s been provided. 🔗🌍

🗞 News Traps Ahead – Move Cautiously

🚫 Avoid new trades during major releases

🔁 Use trailing SLs on open positions

💡 Position management is a thief’s best defense. Risk management keeps you in the game. 🎯🧠

🔥💖 Support the Heist Crew

Smash that ❤️🔥 Boost Button to keep our robbery engine running.

Each boost = strength for our crew.

💬 Share the love, spread the intel, and trade like a rogue with brains. 🤝💵

👀 Stay tuned for more high-profile FX heists from Thief Trader.

Until next time — loot wisely, vanish clean. 🐱👤💨

Usdjpyprediction

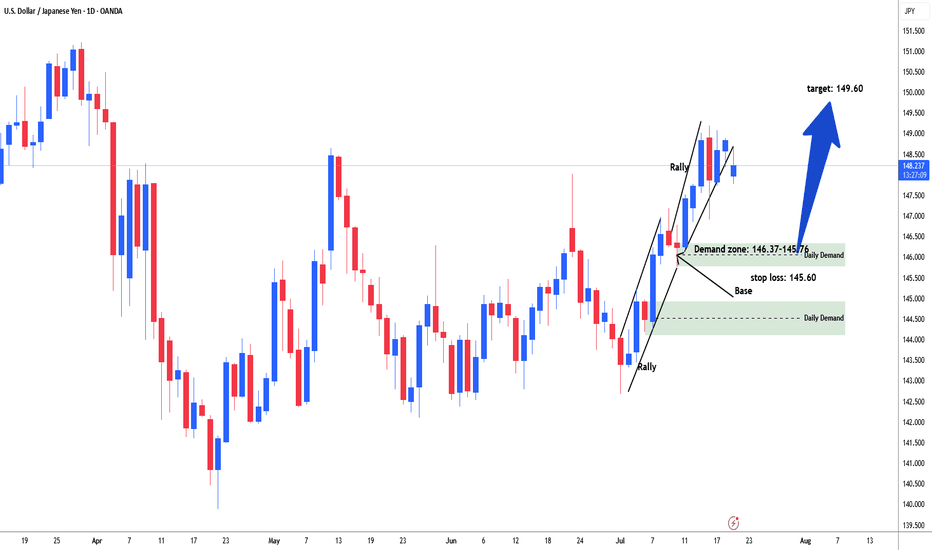

USDJPY Possible long for 149.60#usdjpy started rally from the start of the month of July. Price consolidate in range between 142.85-10. Then started rally. price again consolidate in range between 147.15-145.76 area. Market build energy and institutional add further longs and broke above the daily resistance line 148.60. Need to sell off / retracement to test demand zone range 146.37-145.78 area to test and filled remaining institutional orders for long. Buying area 146.37-145.76. stop loss: 145.60. Target: 149.60

USD/JPY "The Ninja Heist" – Bullish Loot Grab!🌟 Hey, Thieves & Market Bandits! 🌟

💰 Ready to raid the USD/JPY "The Gopher" vault? 💰

Based on 🔥Thief Trading Style🔥 (technical + fundamental heist analysis), here’s the master plan to swipe bullish profits before the market turns against us! Escape near the high-risk Yellow MA Zone—overbought, consolidation, and bear traps ahead! 💸 "Take the money and run—you’ve earned it!" 🏆🚀

🕵️♂️ Heist Strategy:

📈 Entry (Bullish Raid):

The vault’s unlocked! Buy any price—this heist is LIVE!

Pullback lovers: Set buy limits at recent/swing lows for extra loot.

🛑 Stop Loss (Escape Route):

Thief SL at recent/swing low (4H/Day trade basis).

Adjust based on your risk, lot size, and multiple orders.

🎯 Target (Profit Escape):

147.500 (or flee earlier if bears ambush!)

⚔️ Scalpers’ Quick Strike:

LONG ONLY! If rich, attack now. If not, join swing traders & rob slowly.

Trailing SL = Your bodyguard! 💰🔒

💥 Why This Heist?

USD/JPY "The Ninja" is bullish due to key factors—check:

📌 Fundamental + Macro + COT Report

📌 Quantitative + Sentiment + Intermarket Analysis

📌 Future Targets & Overall Score (Linkks In the profile!) 🔗🌍

🚨 Trading Alert (News = Danger!):

Avoid new trades during news—volatility kills!

Trailing SL saves profits on running positions.

💖 Support the Heist Team!

💥 Smash the Boost Button! 💥

Help us steal more money daily with Thief Trading Style! 🏆🚀

Stay tuned—another heist is coming soon! 🤑🎯

Unlocking the Bull Vault: USD/CAD Heist Setup🕵️♂️💼 The Loonie Vault Raid: USD/CAD Buy Blueprint 💰🔐

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

To All Currency Conquerors, Market Raiders & Profit Seekers 💸🚁🕶️

Welcome to another Thief Trading Style playbook, crafted for bold traders ready to infiltrate the Forex vaults with precision.

📜 Mission Brief – The Loonie USD/CAD Buy Op:

Using a blend of 🔥strategic market intel🔥 (technical + fundamental), we’re gearing up for a targeted buy operation. The goal? Extract max profits and vanish before the guards show up. 🏃♂️💨

🎯 ENTRY POINT – Authorized Access Only!

🎯 Buy Zone #1: Around 1.37000+

🎯 Buy Zone #2: Around 1.36400 (Caution: This is Market Maker Trap turf – approach wisely)

⏳ Wait for pullback signs & reversal confirmation before execution – The real pros enter when the crowd hesitates.

🛑 STOP LOSS – Backup Plan if Things Go South

🧠 Wise raiders always have an exit route!

🔹 SL Strategy 1: Nearest Swing Low on 2H timeframe (e.g., 1.36000)

🔹 SL Strategy 2: Institutional Buy Zone SL (1.34000 or deeper)

💡 Position sizing and risk tolerance are your call, but don’t skip this shield.

🏴☠️ TARGET – Where the Loot Lies

🎯 Aim for 1.39500 or exit early if the heat rises (volatility spike/consolidation stalls)

💼 Remember, the best thieves know when to grab the bag and bounce.

💹 Scalpers Advisory – Shortcuts to Riches

👀 Only ride the bullish tide.

💰 If you’ve got capital muscle, dive in. If not, roll with the swing crew.

📌 Trail that SL like a pro – don’t get caught slippin’.

📊 Why We Strike Now – The Big Picture

USD/CAD is showing bullish signs backed by:

✔️ Macro shifts

✔️ COT reports

✔️ Sentiment shift

✔️ Intermarket synergy

✔️ Smart money positioning

🔗 Full intel available – KlicK & explore!

⚠️ High Alert: News & Chaos Protocol

🚨 News drops = alarm bells.

To survive:

📌 Avoid fresh trades during major releases

📌 Use trailing SL to protect your gains

📌 Don’t overexpose – one vault at a time

💖 Support the Crew – Hit BOOST

Your boost helps fund the next mission. Show love, share strength, and become part of the Forex Heist Syndicate 🕵️♂️💵💼

One chart at a time, we rewrite the game.

🎯 Stay locked in – next mission drops soon... 🤑💻🚀

USD/JPY "The Ninja Heist" – Bullish Loot Grab!🌟 Hey, Thieves & Market Bandits! 🌟

💰 Ready to raid the USD/JPY "The Gopher" vault? 💰

Based on 🔥Thief Trading Style🔥 (technical + fundamental heist analysis), here’s the master plan to swipe bullish profits before the market turns against us! Escape near the high-risk Yellow MA Zone—overbought, consolidation, and bear traps ahead! 💸 "Take the money and run—you’ve earned it!" 🏆🚀

🕵️♂️ Heist Strategy:

📈 Entry (Bullish Raid):

The vault’s unlocked! Buy any price—this heist is LIVE!

Pullback lovers: Set buy limits at recent/swing lows for extra loot.

🛑 Stop Loss (Escape Route):

Thief SL at recent/swing low (4H/Day trade basis).

Adjust based on your risk, lot size, and multiple orders.

🎯 Target (Profit Escape):

148.700 (or flee earlier if bears ambush!)

⚔️ Scalpers’ Quick Strike:

LONG ONLY! If rich, attack now. If not, join swing traders & rob slowly.

Trailing SL = Your bodyguard! 💰🔒

💥 Why This Heist?

USD/JPY "The Ninja" is bullish due to key factors—check:

📌 Fundamental + Macro + COT Report

📌 Quantitative + Sentiment + Intermarket Analysis

📌 Future Targets & Overall Score (Linkks In the profile!) 🔗🌍

🚨 Trading Alert (News = Danger!):

Avoid new trades during news—volatility kills!

Trailing SL saves profits on running positions.

💖 Support the Heist Team!

💥 Smash the Boost Button! 💥

Help us steal more money daily with Thief Trading Style! 🏆🚀

Stay tuned—another heist is coming soon! 🤑🎯

Technical Analysis on JPY Price Action (as of June 9, 2025)📈 Technical Analysis on JPY Price Action (as of June 9, 2025)

---

🗂️ Overview:

This chart illustrates the price movement of the Japanese Yen (JPY) with clearly defined support and resistance zones. The setup suggests a bullish bias in the short term, with potential for a breakout toward previous highs.

---

🔍 Key Levels Identified:

🟥 Main Support Zone (141.80 – 142.80):

This is a strong demand zone.

Price bounced aggressively from this level in late May.

If broken, could trigger a major downside move 📉.

🟧 Support Zone (143.80 – 144.70):

Price is currently testing this zone.

Holding this area will be crucial for bullish continuation.

🟨 Resistance Zone (145.80 – 146.60):

This is the next target for bulls 🐂.

Historically acted as a supply zone, causing pullbacks.

🟫 ATH Resistance Zone (~147.80 – 148.50):

The All-Time High (ATH) resistance zone.

Strong rejection from here in the past; likely to act as a hard ceiling again 🚫.

---

🔄 Price Action Forecast:

🕊️ If the current support holds, expect a bullish move toward the 146.00–146.50 resistance.

📈 A breakout above this resistance could initiate a move to the ATH zone (147.80+).

🚨 A breakdown below 143.80 could lead to retesting the main support near 142.00.

---

📊 Technical Sentiment:

Bias: Bullish ✅

Trend: Recovering uptrend after forming a higher low.

Confirmation Needed: Break and retest of the 145.80–146.60 resistance for continuation.

---

✅ Trading Tip:

Wait for either:

🔁 A retest and bounce from 144.00 for long entries 🎯.

❌ A rejection at resistance for potential short opportunities if price fails to break 146.60.

---

📌 Conclusion:

The market shows bullish intent from support, but traders should watch the reaction near the resistance zone to confirm trend continuation. 📍Patience and confirmation are key.

USD/JPY "The Gopher" Forex Bank Bullish Heist Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Gopher" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Yellow MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

Place buy limit orders most recent or swing, low level for Pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (138.500) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 147.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸USD/JPY "The Ninja" Forex Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets & Overall Score... go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USDJPY Technicals Price reacting near a key horizontal support level just below 145.00, where a visible bounce is attempting to form. This level has been tested multiple times, establishing it as a reliable demand zone, and price is now trying to stabilize after a sharp drop from the 146.20s. The recent move downward followed a failed bullish breakout attempt near a local resistance (highlighted with a red circle), which then turned into a supply zone around 145.70–145.80. That area has since capped further upside, resulting in a sell-off.

At current levels, there's a combination of technical signals suggesting a potential reversal or at least a short-term bounce. First, price has reached a structurally important area where previous buying interest was observed. Additionally, the Relative Strength Index (RSI) on the 30-minute chart shows values around 38–40, indicating the market is entering oversold territory without being extremely extended, which often aligns with corrective moves or base formations.

Volume analysis also supports the reversal idea. The recent bearish candles approaching the 145.00 support zone show decreasing bearish volume, followed by a slight uptick in buying pressure (as shown by the magenta lightning bolt icon), hinting at potential absorption of selling pressure and the beginning of buyer interest. This could mark the end of the down leg and the start of a higher low structure.

The projected path drawn on the chart suggests a bullish recovery scenario where price reclaims the mid-145s, retests prior minor resistance levels, and attempts to push toward the 146.00 handle again. However, this move is only valid if price holds above the current support. A breakdown below 144.90 would invalidate this idea and may lead to deeper downside.

In summary, the setup favors a bullish reversal off support, aided by RSI recovering from oversold conditions, a slowdown in bearish momentum, and historical support alignment. That said, price action confirmation (like bullish engulfing or a strong reclaim candle) is necessary to initiate a long position with tighter risk below the support base.

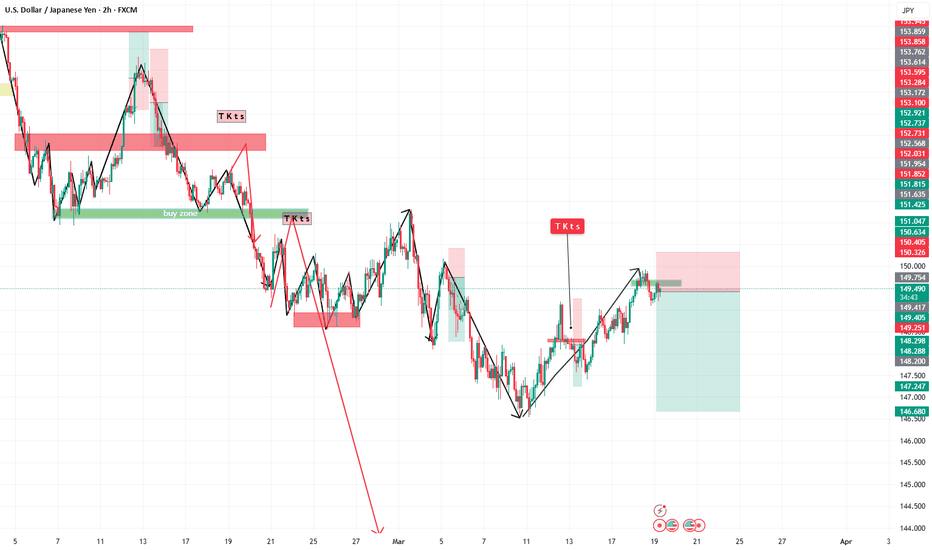

USD/JPY Multi-Timeframe Trading Plan – Week AheadUSD/JPY is trending higher short-term but remains below key resistance on the daily chart. The daily timeframe shows an inverted head-and-shoulders forming, with a neckline at 152. Until that breaks, rallies into 148–150 are likely to fade. The 1-hour chart shows a rising wedge from 142 to 148.5 with support around 145.0. Momentum is slowing, warning of potential exhaustion near 148.

On the 15-minute chart, recent price action shows a bull flag and a double bottom, offering buy zones at 146.10–146.30. The plan for early week is to long dips to this zone, targeting 146.80–147.20 with stops below 145.90. Watch for fades around 147.50–148.00 mid-week. A break above 148.00 opens room to 150.00; below 145.00, momentum shifts bearish.

Strategy: Buy pullbacks early in the week; fade rallies near 148 mid-week. Flip long above 148.00 or short below 145.00. Use tight stops and manage risk per trade.

USD/JPY "The Gopher" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Gopher" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 1D timeframe (148.800) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 140.000 (or) Escape Before the Target

💰💵💸USD/JPY "The Gopher" Forex Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

Detailed Explanation Recap ✨

Fundamentals: Policy divergence + trade risks ⚖️ favor JPY 💪.

Macro: US slowdown 📉 + Japan resilience 🌱 lift JPY.

Global Markets: Risk-off flows 🛡️ + yield dynamics 📜 boost JPY.

COT: Speculative unwinding 📉 aligns with bearish pressure.

Seasonality: Mild JPY edge in April 🌸.

Intermarket: USD weakness 💸 across assets aids JPY.

Quantitative: Technicals confirm bearish 📉.

Sentiment: Broad bearish tilt 😟, retail as contrarian 🚨.

Trend Prediction: Downward bias 📉 across timeframes.

Outlook: Strong bearish case 🐻 with clear targets.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USDJPY Long PositionUSDJPY pair is currently positioned at a key support zone, where price action has historically reversed direction. Following a recent rebound from this level, the pair retested the support area. Given the broader uptrend structure (characterized by higher highs and higher lows), this retest presents a potential opportunity to enter long positions, contingent on bullish confirmation at this critical juncture.

Key Observations:

Established Uptrend: The pair’s consistent upward trajectory on higher time frames supports a bullish bias.

Support Retest: The current pullback to the support zone aligns with typical price behavior in trending markets, where retests of prior levels often precede trend resumptions, but a decisive close below the support would invalidate the bullish setup, potentially signaling a trend reversal or deeper correction.

Risk Management Strategy: A prudent approach would involve placing a stop-loss below the support zone to protect against a breakdown, while targeting the next resistance level for profit-taking.

Final Assessment:

The setup aligns with bullish momentum, provided the support holds.

USDJPY Short Term Buy Trading Plan Update!!!Hi Traders, on April 23rd I shared this idea "USDJPY Short Term Buy Trading Plan"

I expected bullish continuation higher from the marked Fibonacci support zones. You can read the full post using the link above.

Price reached the first Fibonacci support zone, respected it and bounced higher as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY Short Term Buy Trading PlanM15 - Strong bullish momentum followed by a pullback

No opposite signs

Expecting bullish continuation until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD/JPY "The Ninja" Forex Bank Heist Plan (Swing/Scalping Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. It's Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average 151.500 (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the nearest / swing low level Using the 5H timeframe (149.500) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 155.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💵💰USD/JPY "The Ninja" Forex Bank Heist Plan (Swing/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/JPY "The Ninja" Forex Bank Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 1H timeframe (148.250) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 152.300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/JPY "The Ninja" Forex Bank Heist Plan (Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/JPY "The Ninja" Forex Bank Heist Plan (Day / Scalping Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Bank . Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (148.600) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 152.400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/JPY "The Ninja" Forex Bank Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/JPY "The Gopher" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ˗ˏˋ ★ ˎˊ˗USD/JPY "The Gopher"˗ˏˋ ★ ˎˊ˗ Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (148.000) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

📌I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at (150.000) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 145.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

USD/JPY "The Gopher" Forex Market is currently experiencing a Bearish trend in short term, driven by several key factors.

💡Fundamental Analysis

Fundamental analysis evaluates the economic indicators of the United States and Japan, which directly influence the USD/JPY pair.

💡United States Economic Indicators:

GDP growth is forecasted at around 2.0% to 2.5% for 2025, reflecting steady expansion Economic Forecast for the US Economy.

Inflation rate is expected to be around 2.5% to 3.0%, with recent data showing stability United States Inflation Rate.

Interest rates are at 4.50%, with expectations of cuts to around 4.0% to 4.25% by the end of 2025, reflecting a dovish shift United States Fed Funds Interest Rate.

Trade balance shows a deficit of $50 billion in January 2025, a persistent challenge but manageable with strong growth United States Balance of Trade.

💡Japan Economic Indicators:

GDP growth is projected at 1.1% for 2025, with recent Q4 2024 data showing 2.8% annualised growth, indicating recovery Japan's GDP beats forecasts.

Inflation is expected at around 2%, with core inflation robust, driven by wage gains Japan Economic Outlook.

Interest rates are at 0.5%, with expectations to reach 1.0% by the end of 2025, reflecting policy normalization Japan Outlook.

Trade balance shows a deficit, with recent figures at -2759 JPY Billion in January 2025, impacted by import costs Japan Balance of Trade.

The narrowing interest rate differential, with US rates expected to cut and Japan's rates rising, could support JPY strength, though US economic resilience remains a counterforce.

💡Macroeconomics

Macroeconomics encompasses broader economic factors influencing the pair:

Global GDP growth is projected at 3.0% to 3.3% for 2025, according to recent forecasts, with mixed regional performances World Economic Outlook Update.

Commodity prices are expected to decline by 5% in 2025, with energy prices leading the drop, impacting JPY due to Japan's import reliance Commodity Markets Outlook.

Stock markets show mixed performance, with US indices up 5% YTD and Japanese indices showing recovery, supporting risk-sensitive currencies Global Stock Market Performance.

Bond yields are expected to be range-bound, with the US 10-year Treasury yield possibly around 3.5% to 4.5%, suggesting lower USD appeal 2025 Bond Market Outlook.

💡Global Market Analysis

Global economic conditions play a significant role in currency movements:

Geopolitical events, such as potential tensions, could boost JPY as a safe-haven currency, though no major events are currently noted.

Central bank policies are diverging, with the Fed expected to cut rates and the Bank of Japan (BoJ) raising rates, narrowing the interest rate differential Central Bank Policies.

Commodity trends, with declining prices, have a muted direct impact, though energy costs affect Japan's inflation.

Stock market performance, with global indices up, suggests risk-on sentiment, potentially supporting USD over JPY Market Performance Analysis.

💡COT Data and Positioning

COT data provides insights into large trader positions, with recent reports showing:

For USD/JPY futures, large speculators are likely net long, driven by the interest rate differential and stronger US economic outlook JPY Commitments of Traders.

Positioning shows that institutional traders are cautiously optimistic, with some covering shorts as the price approaches support levels.

Key Insight: Long positions in USD/JPY align with economic fundamentals, suggesting bullish sentiment among speculators.

💡Intermarket Analysis

Intermarket relationships influence currency valuation:

USD/JPY is positively correlated with US stock markets; with strong US indices, the USD could benefit from risk-on sentiment Intermarket Analysis.

Gold, trading at $1900 per ounce, slightly up, suggests a weaker USD, supporting JPY strength as a safe-haven Gold Price Trends.

Bond yields, with declining US yields, indicate lower USD appeal, potentially boosting JPY/USD Bond Market Insights.

Key Insight: Positive correlations with US stocks suggest USD strength, while gold and bond yields support JPY, creating a mixed dynamic.

💡Quantitative Analysis

Technical analysis provides insights into price trends:

At 149.000, USD/JPY is near key support at 148.43 (Classic S3), with resistance at 149.02 (Classic R2), based on recent charts USD/JPY Technical Analysis.

Moving averages show a mixed picture, with shorter-term (MA5, MA10) suggesting buy and longer-term (MA50, MA100, MA200) suggesting sell TradingView Analysis.

RSI (Relative Strength Index) is at 45.418, neutral, suggesting potential for a bounce if support holds Technical Indicators Guide.

Key Insight: Technicals suggest a possible downward trend, with sell signals dominating, though support levels could trigger a reversal.

💡Market Sentimental Analysis

Market sentiment reflects trader positioning and expectations:

Recent data shows 62% of forex traders long on USD/JPY, with an average price of 154.6568, contrasting with a downward price movement, creating a bearish indicator Forex Sentiment USDJPY.

Bank forecasts predict USD/JPY dropping to 145.00 by year-end, citing Japan's recovery and expected Fed rate cuts Currency Forecasts.

Key Insight: Mixed sentiment, with retail traders long but institutional forecasts bearish, supporting a downward outlook.

💡Next Trend Move

Combining all factors, the next trend move for USD/JPY is likely downward:

The pair is at a key support level (148.43), and if it breaks, could drop to test lower levels around 145.00.

Potential catalysts include Fed rate cuts and BoJ rate hikes, narrowing the interest rate differential, supporting JPY strength.

Key Insight: The next move favors a downward continuation, with risks of an upward bounce if support holds.

💡Overall Summary Outlook

The USD/JPY pair, at 149.000 on March 4, 2025, exhibits a bearish outlook. Key drivers include the narrowing US-Japan interest rate differential, with US rates expected to cut to 4.0%-4.25% and Japan's rates rising to 1.0% by year-end, alongside Japan's economic recovery (1.1% GDP growth in 2025). Technical indicators suggest sell signals, supported by mixed market sentiment and declining commodity prices. Risks include strong US economic data maintaining USD dominance or global risk-off sentiment boosting USD. However, the prevailing trend points to potential JPY appreciation in the near term.

💡Future Prediction

Trend: Bearish

Details: The pair is likely to see a downward move, testing support at 148.43 and potentially dropping to 145.00 in the next few months, driven by narrowing interest rate differentials and technical sell signals. Risks include stronger-than-expected US data maintaining USD strength, but current indicators suggest a reversal is imminent.

💡Summary of Key Economic Indicators

Indicator United States (2025 Forecast) Japan (2025 Forecast)

GDP Growth 2.0%-2.5% 1.1%

Inflation Rate 2.5%-3.0% ~2%

Interest Rate 4.0%-4.25% (end of year) 1.0% (end of year)

Trade Balance Deficit ($50 billion, Jan 2025) Deficit (-2759 JPY Billion, Jan 2025)

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩