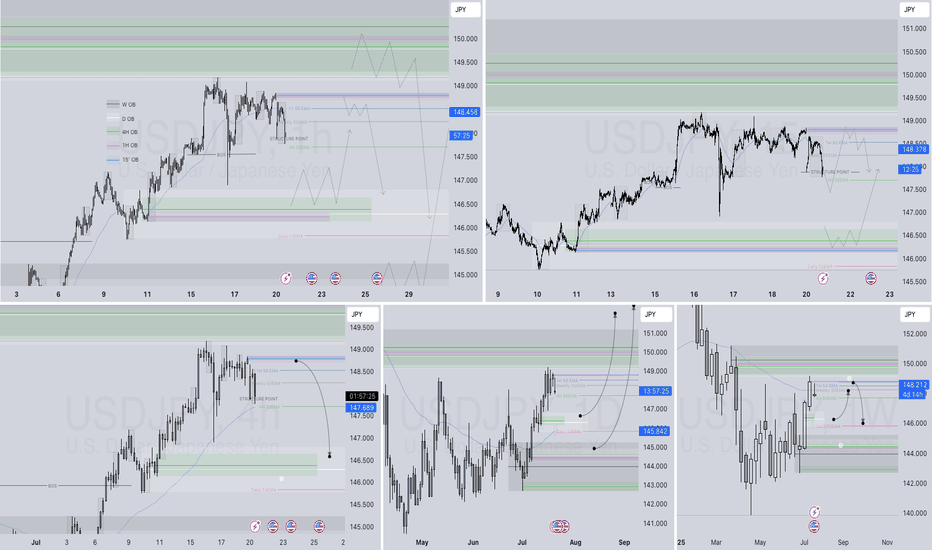

USDJPY Q3 | D21 | W30 | Y25 15' OB UPDATE 📊USDJPY Q3 | D21 | W30 | Y25 15' OB UPDATE

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

Usdjpyshortsetup

USDJPY LONG & SHORT – DAILY FORECAST Q3 | D15 | W29 | Y25💼 USDJPY LONG & SHORT – DAILY FORECAST

Q3 | D15 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

USDJPY is currently reaching for a key higher time frame supply zone, looking for price action to show weakness at premium levels. Structure and momentum are now aligning for a short opportunity backed by multi-timeframe confluence.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Looking for Strong reaction and early signs of distribution.

✅ 4H Order Block

Break of internal structure (iBoS) confirms a short-term bearish transition.

✅ 1H Order Block

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

The confluences are stacked.

Let execution follow discipline, not emotion.

USD/JPY Short1. Intervention-fade (always live)

Sell Limit 146.00

Stop Loss 146.80

Take-Profit 1 144.50 – if hit, move stop to breakeven

Take-Profit 2 143.00

Good-till-cancelled: auto-cancel if not filled after 5 trading days

2. Break-and-retest (place this only after a daily candle closes below 145.00)

Sell Limit 145.20

Stop Loss 146.00

Take-Profit 1 144.00

Take-Profit 2 143.00

Good-till-cancelled: auto-cancel if not filled within 5 trading days of being placed

Rule: the moment one of these orders fills, cancel the other so you never have two USD/JPY shorts open at the same time.

#USDJPY: +2000 PIPS Big Swing Move! Do not miss outThe cryptocurrency’s price is currently experiencing bearish pressure, and the current trading price is pivotal for determining its future trajectory. A smooth downtrend is anticipated, potentially propelling the price to 124 in the long term. The US dollar is likely to remain bearish, potentially reaching 95 in the US currency index. Three potential target sets are envisaged, and further updates will be provided based on price developments.

Best of luck and ensure safe trading practices.

Team Setupsfx_

USD/JPY Breakdown: Sell the Rallies, Ride the TrendUSD/JPY has decisively shifted bearish across all key timeframes. On the daily chart, the pair broke below the 50-, 100-, and 200-day EMAs with consistent lower highs and lows. The hourly chart confirms this trend, with bearish EMA stacking and failed attempts to reclaim the 200-hour EMA. RSI remains under 50 across timeframes, signaling persistent bearish momentum without exhaustion.

The 15-minute chart highlights ideal short-entry setups on pullbacks to the 20- or 50-EMA, especially when RSI fails to breach 50. The 200-EMA on this timeframe acts as dynamic resistance near 145.30. Short entries are favorable on rallies to the 145.10–145.35 zone, with downside targets at 144.80, 144.50, and potentially 144.20.

For the week ahead, the strategy is clear: fade rallies into EMA resistance and use RSI confirmation for timing. Avoid chasing lows—wait for price to come to you. Tight stops just above the EMAs minimize risk, and partial profit-taking at swing lows allows for trend-riding flexibility.

As long as USD/JPY remains below the 200-hour EMA, bearish momentum dominates. Trade with the trend, manage risk with precision, and stay alert for breakdowns below key support levels.

USD/JPY "The Gopher" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Gopher" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 1D timeframe (148.800) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 140.000 (or) Escape Before the Target

💰💵💸USD/JPY "The Gopher" Forex Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

Detailed Explanation Recap ✨

Fundamentals: Policy divergence + trade risks ⚖️ favor JPY 💪.

Macro: US slowdown 📉 + Japan resilience 🌱 lift JPY.

Global Markets: Risk-off flows 🛡️ + yield dynamics 📜 boost JPY.

COT: Speculative unwinding 📉 aligns with bearish pressure.

Seasonality: Mild JPY edge in April 🌸.

Intermarket: USD weakness 💸 across assets aids JPY.

Quantitative: Technicals confirm bearish 📉.

Sentiment: Broad bearish tilt 😟, retail as contrarian 🚨.

Trend Prediction: Downward bias 📉 across timeframes.

Outlook: Strong bearish case 🐻 with clear targets.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Japanese Yen seems poised to appreciate further against weaker UFrom a technical perspective, the daily Relative Strength Index (RSI) is already flashing slightly oversold conditions and warrants some caution for bearish traders. Hence, it will be prudent to wait for some near-term consolidation or a modest bounce before positioning for an extension of the USD/JPY pair's well-established downtrend witnessed over the past three months or so.

In the meantime, attempted recovery might now confront some resistance near the 141.60-141.65 region. This is followed by the 142.00 round figure and the 142.40-142.45 hurdle, above which a fresh bout of a short-covering move could lift the USD/JPY pair to the 143.00 mark en route to the 143.25-143.30 zone. Any further move up, however, might still be seen as a selling opportunity.

On the flip side, a sustained break and acceptance below the 141.00 mark could be seen as a fresh trigger for bearish traders and makes the USD/JPY pair vulnerable. The subsequent downfall below the 140.45-140.40 intermediate support might expose the 140.00 psychological mark. The downward trajectory could extend to the 2024 yearly swing low, around the 139.60-139.55 region.

USDJPY short on daily chartStop Loss = 152.065

Entry Order = 149.815

TP1 = 147.565

Two positions with the same stop loss and x1 target for the first position

The stop loss of the second position to breakeven when the first position hits the target1.

The second position has no target, only exit

Risk = 2% of account capital (1% each position)

USDJPY Scenario 1.1.2025At this moment we are shown two scenarios, both shorts, we have an sfp above the low because it could give us a better view of the overall direction the market could be heading at the moment, support above us, which if it breaks, nothing prevents us from moving to a higher level, if we hold the level, then we can expect a move somewhere towards the price of 150, but I am still waiting for confirmation.

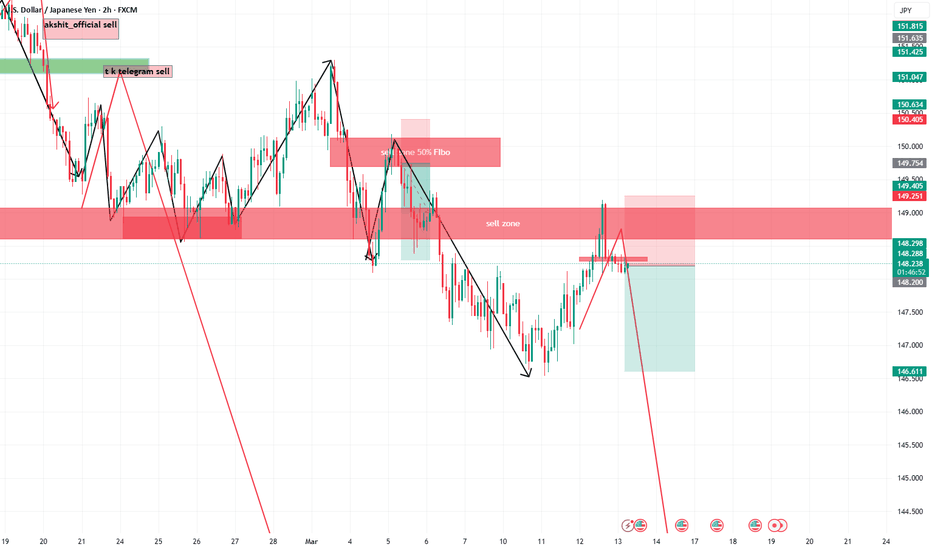

#USDJPY 2HUSDJPY (2H Timeframe) Analysis

Market Structure:

The price is trading within a channel pattern, respecting both support and resistance levels. Currently, it is near the upper boundary of the channel, indicating possible resistance.

Forecast:

Wait for a retest of the channel resistance before considering a sell position, as confirmation is required to validate a potential move downward.

Key Levels to Watch:

Entry Zone: After a retest and rejection from the upper boundary of the channel.

Risk Management:

Stop Loss: Placed above the channel resistance or recent swing high.

Take Profit: Target the midline or lower boundary of the channel for potential downside movement.

Market Sentiment:

The setup suggests a cautious bearish bias, but confirmation signals are needed before executing a trade.

Scenario on USDJPY In this market, I'm going exactly according to plan. The market turned beautifully at the fibo level of 0.786 and continued according to the previous prediction according to the bearish scenario. This chart today is just about adjusting the level. Now I'm waiting for a return to the price level of something around 152. If the price rejects, there is a potential entry into the short.

#UASJPY: Swing Selling is in progress, Are we heading Bears Era?Dear Traders,

Hopefully, you having a great weekend so far, we have a great opportunity on USDJPY, possible a total bearish meltdown on all the jpy pairs especially with UJ, we are on the verge of collapse. At the moment we expect price to do a small correction before it drops further. At this correction we may expect price to reverse nicely. We expect this idea to be activated by Friday when we will be having a last nfp data of the 2024. Decembers are known for bears control over jpy pairs.

thank you ;)

USDJPY: First Entry dropped 400 pips, Focusing on ReentryDear Traders,

OANDA:USDJPY first entry dropped successfully 400 pips, now there is possibility of price filling up the liquidity and dropping from that region. Bullish price will likely to push the price up to our area of entry where price will fall strongly. Use accurate stop loss and take profit as described in our chart, if you have any doubt or finding it hard to understand something, please leave a comment.

good luck and trade safe as always

USDJPY SELL | Setup Trading AnalysisHello Traders, here is the full analysis.

Short after the BULL RUN. GOOD LUCK! Great SELL opportunity USDJPY

I still did my best and this is the most likely count for me at the moment.

Support the idea with like and follow my profile TO SEE MORE.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

Patience is the If You Have Any Question, Feel Free To Ask 🤗

Just follow chart with idea and analysis and when you are ready come in THE GROVE | VIP GROUP, earn more and safe, wait for the signal at the right moment and make money with us💰

USDJPY Shorts from 145.500 back down towards 142.000This week's strategy involves following the ongoing bearish trend in USDJPY. I plan to initiate sell positions around the newly formed 4-hour supply zone. To execute this, I'll wait for a redistribution pattern to unfold and a clear CHOCH signal before considering a sell. It's important to note that there's a possibility of price pushing higher to test the 14-hour or daily supply above.

Considering that price has already reacted to a supply zone, it wouldn't be surprising if it continues lower towards the 15-hour demand zone. In such a scenario, I'll be on the lookout for a buying opportunity, but I'll wait for the Asian low to be breached within that zone, potentially in the form of a spring, before considering a buy.

Confluences for USDJPY Sells are as follows:

- 4hr or 14hr supply zone that has caused a break of structure to the downside.

- Price is completed a retracement so we can expect a wyckoff distribution to play out.

- Lots of major trend lines still left below on the high time frame that needs to get swept.

- Price has been in a very bearish trend ever since it failed to take the all time highs.

- The dollar is also looking bearish so I can expect more downside for this pair too.

P.S. As I currently hold a strong bearish stance on USDJPY, I won't be surprised if the demand zone fails due to significant liquidity below it. However, at the moment, my primary focus is on potential sell opportunities, considering that price has recently completed a retracement. My strategy aligns with the prevailing bearish trend.

USDJPY Shorts from 142.500 down towards 140.000My bias for USDJPY is pro-trend, aiming for a bearish move within a nearby 10hr supply zone. Currently, I expect a bit more upside and a redistribution within my point of interest (POI). Upon confirmation of these factors and other confluences, I'm inclined to sell down towards the psychological level of 140.000.

I am also anticipating a bullish reaction from the 7hr demand, which has caused a break of structure (BOS) to the upside, I recognise the importance of waiting for price to reach a discounted or premium area due to its current equilibrium state. However, considering the recent BOS to the downside, I anticipate a retracement to a supply zone for a potential sell-off.

Confluences for USDJPY Sells are as follows:

- price has broken structure to the downside and has left clean 10hr supply zone.

- Price is currently in a retracement so we can expect a wyckoff distribution to play out.

- Lots of major trendiness still left below on the high time frame that needs to get swept.

- Price has been in a very bearish trend ever since it failed to take the all time highs.

- The dollar is also looking bearish so I can expect more downside for this pair too.

P.S. As this trade aligns with the prevailing trend, the selling proposition is currently highly favorable. While the Fibonacci range indicates that the 14hr supply is more likely, I foresee the possibility of the 10hr supply failing to react off the 14hr at a more premium level.

HAPPY NEW YEARS TO ALL OF YOU AND HOPE THIS YEAR BRING EVERYONE PROFITABILITY AND CONSISTENCY. LETS CATCH THESE PIPS!

USDJPY Shorts from 143.500 down towards 140.000Currently, with the recent reaction from the 22-hour demand zone, there's an expectation for a retracement towards a nearby supply to trade in line with the trend. At the current price, I'll wait for the small bullish reaction to lose steam in order for price to distribute.

Once the Wyckoff distribution occurs on the lower time frame, accompanied by a CHOCH, I plan to initiate sells targeting the 140.00 mark, a zone associated with strong demand. However, I'm also mindful that the price might ascend further and react off a more premium supply above.

Confluences for USDJPY Sells are as follows:

- This bias aligns with the current bearish trend that has been perpetuated.

- Lots of major trend lines, equal lows and asian lows below on the higher time frame.

- There's a near by 14hr supply zone that looks promising and a better supply on the 10hr just above it.

- For price to maintain its bearish trend it must react off a supply to trigger another sell off.

- Bullish pressure is looking exhausted and we could see a wyckoff distribution play out soon.

P.S. Regarding the overall market sentiment, it remains evidently bullish. However, with a strong emphasis on respecting the all-time high (ATH), I am steadfast in my belief that a long-term bearish trend is likely to emerge, given the significant liquidity present below. This is why selling positions are highly preferable and exhibit more favorable reactions.

If you found this post insightful, drop a like & comment!