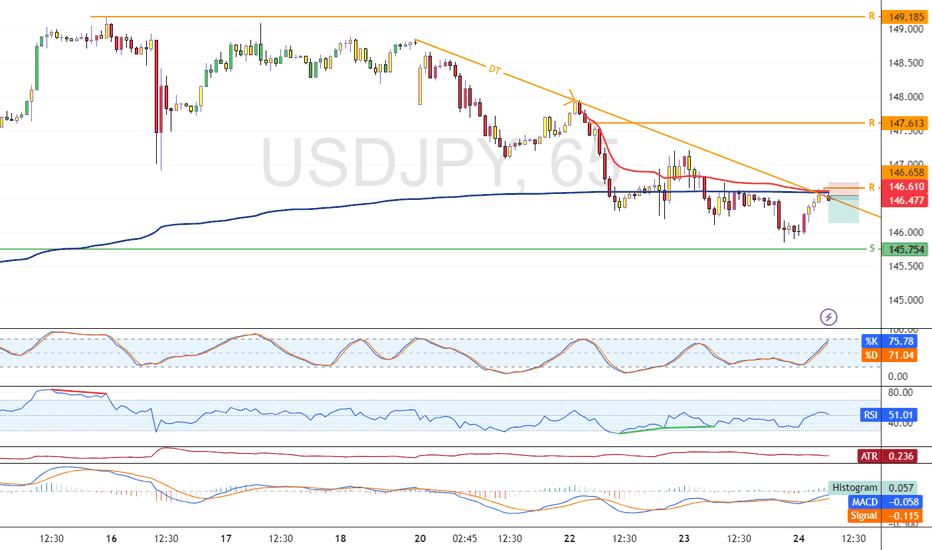

USD/JPY Tests Pivotal Resistance in Bearish ContextFenzoFx—USD/JPY is testing the support at 146.6. This level is backed by anchored VWAP and the descending trendline.

From a technical perspective, the downtrend should resume if this level holds. In this scenario, the next bearish target could be 145.7. Furthermore, if the selling pressure exceeds this level, the price could fall toward the support at 144.1.

Usdjpysignals

USD/JPY: Bearish Setup Looms Below VWAP ZoneUSD/JPY dipped as expected, currently testing the VWAP as support while Stochastic signals the Yen is overpriced in the short term.

Resistance is at 147.6, backed by the bearish VWAP. It is likely the pair will rise and test this level. Furthermore, a new bearish wave can potentially emerge if 147.6 holds. In this scenario, the next target could be the support at 145.8 followed by 144.2.

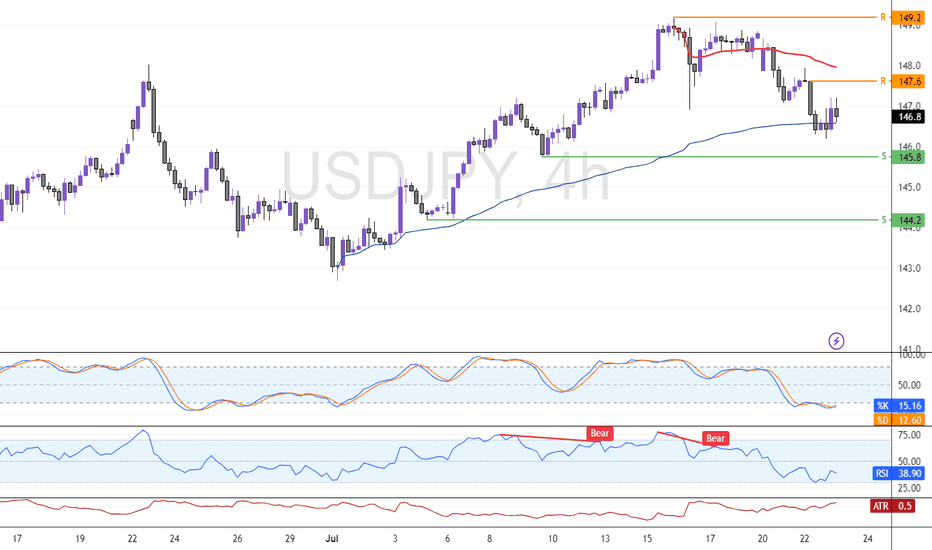

USD/JPY Faces Rejection at 148.6, Bearish Setup EmergesFenzoFx—USD/JPY began a bearish wave after the 148.6 resistance rejected the price. As of this writing, the currency pair flipped below the ascending trendline and formed a bearish FVG at 147.9.

A pullback toward the FVG can provide a premium price to go short on USD/JPY, targeting 146.9, followed by 145.7.

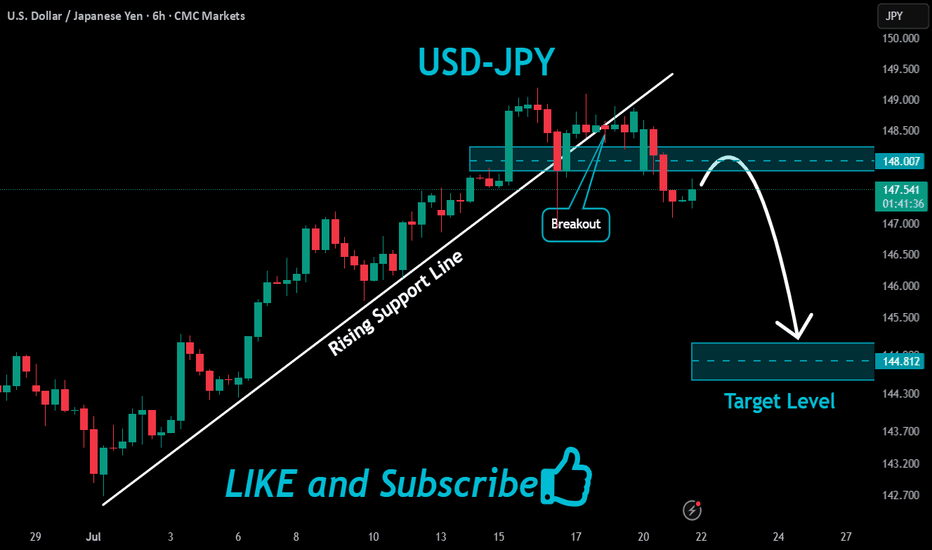

Market Analysis: USD/JPY RisesMarket Analysis: USD/JPY Rises

USD/JPY is rising and might gain pace above the 149.20 resistance.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY climbed higher above the 147.50 and 148.40 levels.

- There is a key bullish trend line forming with support at 148.40 on the hourly chart at FXOpen.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a fresh upward move from the 145.75 zone. The US Dollar gained bullish momentum above 146.55 against the Japanese Yen.

It even cleared the 50-hour simple moving average and 148.00. The pair climbed above 149.00 and traded as high as 149.18. The pair is now consolidating gains above the 23.6% Fib retracement level of the upward move from the 145.74 swing low to the 149.18 high.

The current price action above the 148.50 level is positive. There is also a key bullish trend line forming with support at 148.40. Immediate resistance on the USD/JPY chart is near 149.20.

The first major resistance is near 149.50. If there is a close above the 149.50 level and the RSI moves above 70, the pair could rise toward 150.50. The next major resistance is near 152.00, above which the pair could test 155.00 in the coming days.

On the downside, the first major support is 148.40 and the trend line. The next major support is visible near the 147.90 level. If there is a close below 147.90, the pair could decline steadily.

In the stated case, the pair might drop toward the 147.50 support zone and the 50% Fib retracement level of the upward move from the 145.74 swing low to the 149.18 high. The next stop for the bears may perhaps be near the 146.55 region.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USDJPY: Strong Bullish Price Action 🇺🇸🇯🇵

I see 2 strong bullish confirmation on USDJPY after a test of a key daily

support cluster.

The price violated a trend line of a falling channel and a neckline of

an inverted head & shoulders pattern with one single strong bullish candle.

The pair may rise more and reach 144.45 level soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY Strong support formed. Excellent buy opportunity.The USDJPY pair is trading within a Channel Down since the start of the year but following the April 22 Low, it has been rising on Higher Lows. Today that trend-line was tested and again produced a rebound (so far).

Since the April 22 Low was very close to the 139.600 Support (from the September 16 2024 Low), there are higher probabilities that we will have a trend change to bullish, at least for the medium-term.

The natural Resistance now is the 1D MA200 (orange trend-line), so we will target just below it at 148.675 (Resistance 1).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDJPY: Strong Intraday Bullish Price Action 🇺🇸🇯🇵

On the today's live stream, we discussed a very bullish setup

on USDJPY.

The price retested a recently broken horizontal resistance.

A resistance line of a falling wedge pattern was violated with

a strong bullish movement then.

We see its retest at the moment.

I think that the price will resume growth soon and reach 145.25 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

#USDJPY: +2000 PIPS Big Swing Move! Do not miss outThe cryptocurrency’s price is currently experiencing bearish pressure, and the current trading price is pivotal for determining its future trajectory. A smooth downtrend is anticipated, potentially propelling the price to 124 in the long term. The US dollar is likely to remain bearish, potentially reaching 95 in the US currency index. Three potential target sets are envisaged, and further updates will be provided based on price developments.

Best of luck and ensure safe trading practices.

Team Setupsfx_

Technical Analysis on JPY Price Action (as of June 9, 2025)📈 Technical Analysis on JPY Price Action (as of June 9, 2025)

---

🗂️ Overview:

This chart illustrates the price movement of the Japanese Yen (JPY) with clearly defined support and resistance zones. The setup suggests a bullish bias in the short term, with potential for a breakout toward previous highs.

---

🔍 Key Levels Identified:

🟥 Main Support Zone (141.80 – 142.80):

This is a strong demand zone.

Price bounced aggressively from this level in late May.

If broken, could trigger a major downside move 📉.

🟧 Support Zone (143.80 – 144.70):

Price is currently testing this zone.

Holding this area will be crucial for bullish continuation.

🟨 Resistance Zone (145.80 – 146.60):

This is the next target for bulls 🐂.

Historically acted as a supply zone, causing pullbacks.

🟫 ATH Resistance Zone (~147.80 – 148.50):

The All-Time High (ATH) resistance zone.

Strong rejection from here in the past; likely to act as a hard ceiling again 🚫.

---

🔄 Price Action Forecast:

🕊️ If the current support holds, expect a bullish move toward the 146.00–146.50 resistance.

📈 A breakout above this resistance could initiate a move to the ATH zone (147.80+).

🚨 A breakdown below 143.80 could lead to retesting the main support near 142.00.

---

📊 Technical Sentiment:

Bias: Bullish ✅

Trend: Recovering uptrend after forming a higher low.

Confirmation Needed: Break and retest of the 145.80–146.60 resistance for continuation.

---

✅ Trading Tip:

Wait for either:

🔁 A retest and bounce from 144.00 for long entries 🎯.

❌ A rejection at resistance for potential short opportunities if price fails to break 146.60.

---

📌 Conclusion:

The market shows bullish intent from support, but traders should watch the reaction near the resistance zone to confirm trend continuation. 📍Patience and confirmation are key.

USDJPY: 300+ Pips From Previous Idea, What Hold Next? Hey Everyone

USDJPY is on a roll! It’s rebounded a whopping 300+ pips and is now on the positive side. We reckon it’s going to keep climbing in the coming days as DXY is starting to regain its strength.

And here’s the cherry on top: there’s some exciting news coming up, including the NFP tomorrow. This could really boost the USDJPY to a new record high.

But remember, when trading, it’s crucial to manage your risk carefully.

Now, let’s talk about the potential for a significant market movement. We’ve spotted a chance for a substantial bullish swing that could reach around 2050 pips. We’ve also identified three potential targets, so you can choose the one that best fits your analysis.

The main driver behind this move is the reversal of the Japanese Yen (JPY) from a bullish trend to a bearish one. So, let’s be cautious and use precise risk management techniques during this period.

Good luck and happy trading! 😊

Oh, and if you’d like to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Thanks a bunch for your support! 😊

Cheers,

The Setupsfx_ Team

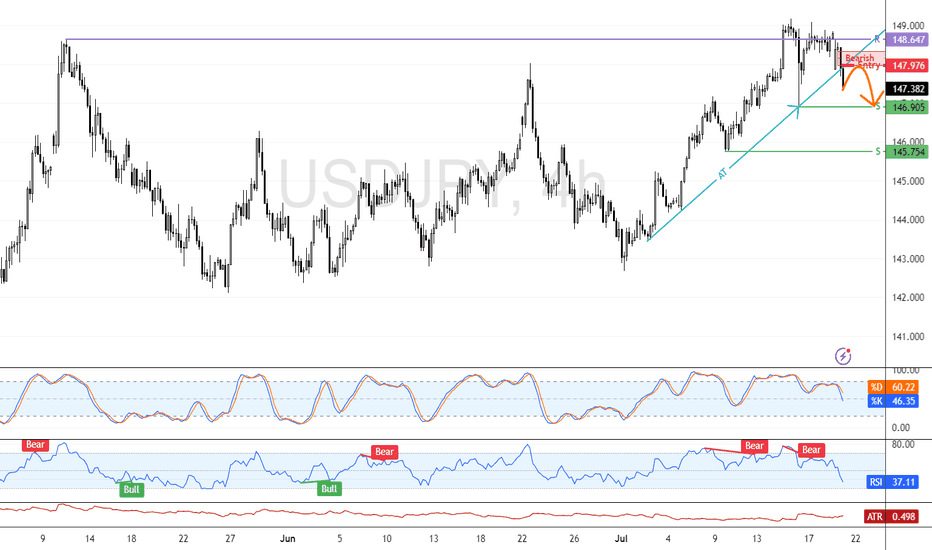

USDJPY Bearish Continuation Setup Trend Analysis

The market is in a clear downtrend, evidenced by the sequence of lower highs and lower lows.

The descending trendline has been respected multiple times, acting as dynamic resistance.

🧠 Key Technical Factors

Rejection Zone (Supply Area):

The marked “Rejection Point” aligns with the confluence of the trendline resistance, 50 EMA (red), and historical supply.

Price attempted to break above but faced a strong rejection—signaling institutional sell interest.

EMA Confluence:

50 EMA (142.993) and 200 EMA (144.063) are both sloping downward.

Price is trading below both EMAs, confirming bearish momentum and trend continuation bias.

BOS (Break of Structure):

Multiple BOS levels marked, showing a consistent pattern of structure breaks to the downside.

Each rally is met with selling pressure, failing to create new highs.

🧩 Projected Price Action

Current retracement could retest the trendline/50 EMA before a potential continuation move downward.

Expectation is a lower high formation near the descending trendline followed by a bearish impulse.

🏹 Bias: Bearish

Traders might consider short opportunities around the 142.90–143.00 zone, targeting 142.00 and below, with stops just above the trendline/supply zone.

⚠️ Risk Note

A clean break and close above the trendline and 50 EMA would invalidate this setup and could lead to a shift in structure.

USD/JPY "The Gopher" Forex Bank Bullish Heist Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Gopher" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Yellow MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

Place buy limit orders most recent or swing, low level for Pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (138.500) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 147.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸USD/JPY "The Ninja" Forex Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets & Overall Score... go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USDJPY Channel Down rejection aiming for the 2024 Support.The USDJPY pair has been trading within a Channel Down pattern since the January 10 2025 High and right now is on its latest Bearish Leg, an outcome of the rejection near the 1D MA200 (orange trend-line).

This has also been confirmed by the 1D MACD Bearish Cross and the next technical Support is on 139.600. By the time it gets tested, the price may also make contact with the 1W MA200 (red trend-line). Our short-term Target is 139.600.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USD/JPY Analysis: Bearish Bias with Multi-Market Confluence!📉 USDJPY Technical Breakdown – Yen Strength in Focus 📉

In this video, we take a close look at the USD/JPY, which is currently under pressure and trending to the downside 🔽. The bearish momentum is clear, but there are several key factors to consider before positioning ourselves for a potential short 📊.

🔍 First, it’s important to monitor the equity markets. If we start to see a pullback or sell-off in the stock indices 🏦📉, that could translate into further yen strength, adding weight to a USD/JPY short bias 💴💪.

Another key piece of confluence is comparing the DXY (Dollar Index) 📈 with the JXY (Japanese Yen Index) 📉. This gives us deeper insight into the relative strength of each currency and helps confirm our directional bias before entering a trade ⚖️.

🔁 Coming back to the USD/JPY chart, we’re watching for a retracement into a Fibonacci point of interest, which could provide a high-probability area to enter a sell setup. If price reacts from that level and confirms with structure, we could have a clean opportunity for continuation 🔂🎯.

⚠️ This is not financial advice — always conduct your own analysis and manage risk accordingly.

USD/JPY Breakdown: Sell the Rallies, Ride the TrendUSD/JPY has decisively shifted bearish across all key timeframes. On the daily chart, the pair broke below the 50-, 100-, and 200-day EMAs with consistent lower highs and lows. The hourly chart confirms this trend, with bearish EMA stacking and failed attempts to reclaim the 200-hour EMA. RSI remains under 50 across timeframes, signaling persistent bearish momentum without exhaustion.

The 15-minute chart highlights ideal short-entry setups on pullbacks to the 20- or 50-EMA, especially when RSI fails to breach 50. The 200-EMA on this timeframe acts as dynamic resistance near 145.30. Short entries are favorable on rallies to the 145.10–145.35 zone, with downside targets at 144.80, 144.50, and potentially 144.20.

For the week ahead, the strategy is clear: fade rallies into EMA resistance and use RSI confirmation for timing. Avoid chasing lows—wait for price to come to you. Tight stops just above the EMAs minimize risk, and partial profit-taking at swing lows allows for trend-riding flexibility.

As long as USD/JPY remains below the 200-hour EMA, bearish momentum dominates. Trade with the trend, manage risk with precision, and stay alert for breakdowns below key support levels.

USD/JPY Multi-Timeframe Trading Plan – Week AheadUSD/JPY is trending higher short-term but remains below key resistance on the daily chart. The daily timeframe shows an inverted head-and-shoulders forming, with a neckline at 152. Until that breaks, rallies into 148–150 are likely to fade. The 1-hour chart shows a rising wedge from 142 to 148.5 with support around 145.0. Momentum is slowing, warning of potential exhaustion near 148.

On the 15-minute chart, recent price action shows a bull flag and a double bottom, offering buy zones at 146.10–146.30. The plan for early week is to long dips to this zone, targeting 146.80–147.20 with stops below 145.90. Watch for fades around 147.50–148.00 mid-week. A break above 148.00 opens room to 150.00; below 145.00, momentum shifts bearish.

Strategy: Buy pullbacks early in the week; fade rallies near 148 mid-week. Flip long above 148.00 or short below 145.00. Use tight stops and manage risk per trade.

USDJPY Trade Plan: Long from Imbalance Zone on Bullish BOSUSDJPY Trade Idea & Analysis

Chart Context:

The 1H USDJPY chart shows a strong bullish impulse, followed by a consolidation and a potential retracement into a clear imbalance zone (highlighted between the 50% and 61.8% Fibonacci retracement levels, around 146.76–146.32). The market structure remains bullish, with higher highs and higher lows.

Market Fundamentals & Sentiment (as of May 2025):

USD Strength: The US dollar remains supported by persistent inflation and the Fed’s hawkish stance, with markets pricing in the possibility of further rate hikes or a prolonged period of higher rates.

JPY Weakness: The Bank of Japan continues its ultra-loose monetary policy, with no immediate signs of tightening. This divergence keeps upward pressure on USDJPY.

Risk Sentiment: Global risk appetite is stable, favoring carry trades and supporting USDJPY upside.

Trade Plan:

Look for a retrace into the imbalance zone (146.76–146.32). Enter long on a confirmed bullish break of structure (BOS) on lower timeframes. Target the recent swing highs (148.65 and above), with a stop loss below the retracement low.

Not financial advice.

USD/JPY Bullish Setup – Demand Zone Buy Opportunity Toward 151.5🔍 Chart Overview (4H Timeframe):

Currency Pair: USD/JPY

Trend: 📈 Uptrend

EMA 70: 🔴 (144.776) – Price is trading above it = Bullish Bias

---

🟦 Demand Zone

📌 Zone: 144.804 – 146.324

💡 What it means: Strong buying interest expected here

🟢 Support line + EMA = Confluence zone!

---

✅ Entry Point:

📍 Between: 146.324 – 146.423

🎯 Best area for long (buy) position

📊 Wait for a pullback to this area before entering

---

❌ Stop Loss:

📉 Below demand zone

🔻 Range: 144.705 – 144.776

🛡️ Helps protect against unexpected drop

---

🎯 Target Point:

📈 151.500

🟩 Big reward area

🔥 Previous resistance zone = Ideal profit-taking point

---

🧭 Summary:

✅ Entry: 146.324

❌ Stop: 144.776

🎯 Target: 151.500

Risk-to-Reward: Excellent!

USD/JPY 4H Analysis: Demand Zone Re-Test Before Bullish Continua1. Trend Channel

🔼 Uptrend: The pair is moving inside an ascending channel.

▪️ Support: Lower boundary of the channel.

▪️ Resistance: Upper boundary of the channel.

2. Recent Price Action

🔴 Pullback: After reaching the top at 146.199, price is retracing.

📉 Price is now heading toward the Demand Zone.

3. Demand Zone

🟦 Demand Zone (142.405 – 143.180):

This zone could act as a strong support

Buyers might step in here

Watch for bullish patterns or rejections around this area

4. EMA 70

📏 EMA 70 (143.568) is slightly below current price (143.949) — this may offer temporary support/resistance.

5. Target

🎯 Target Point: 146.194

If price bounces from demand zone, this is the next bullish target.

Possible Scenario

1. 🔽 Price dips into the Demand Zone

2. 🟢 Bullish bounce → Confirm with candlestick signals

3. 🚀 Upside move targeting 146.194