USDJPY: The Fed & BOJ Likely To Keep Rates In Place. Buy It!Welcome back to the Weekly Forex Forecast for the week of July 28 - Aug 1st.

In this video, we will analyze the following FX market:

USDJPY

The FED and BOJ are expected to keep their perspective interest rates, come Wednesday. The USD is stabilizing, a US-Japanese tariff deal inked, and investors are slowing moving money from the Yen safe haven to riskier assets.

Look for USDJPY to slowly move higher.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Usdjpytechnicalanalysis

USD/JPY Robbery Route | Enter at Dip, Exit Before Police💥USD/JPY Forex Money Heist Plan 🎯 — Ninja Robbery at 146.000💥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Market Bandits, Money Makers & Risky Robbers 🤑💰💸✈️

Welcome to another Thief Trader-style operation. We've cracked open the USD/JPY vault (aka "The Gopher" 💹), and here's the blueprint to pull off this forex heist like true professionals. 💼🎭💵

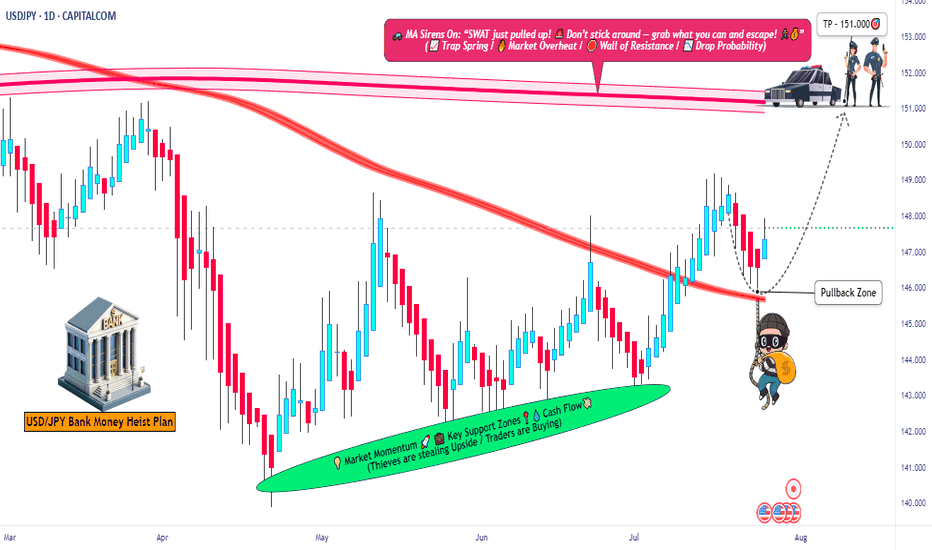

🚨 Strategy Overview

This isn't just a trade – it’s a well-researched, precision-timed robbery mission based on technicals, macro analysis, sentiment, and the bigger global picture.

Expect action near critical zones – especially the moving average barricade, where police (aka risk) is waiting. Stay sharp.

🔓 Entry Point – Unlock the Vault

📈 Watch for bullish pullbacks near 146.000.

Whether it's a dip, zone test, or wick bounce — you’re looking to layer buy limit orders like a seasoned thief using DCA tactics.

Enter on swings or any bullish confirmation.

Heist Window is Open.

🛑 Stop Loss – Escape Route

📍 SL near 143.000 (1D swing low) — adjust based on your capital and position size.

💡 Don’t go blind — SL is your backup plan, not an optional accessory.

Custom-fit it based on how many entries you’re stacking.

🎯 Target – Vault Exit Point

🏁 151.000 or exit before resistance heat catches on.

No greedy thieves here — precision exit is key.

Lock profits, vanish in style. 🕶️💼💸

🧲 Scalpers Take Note

Only long side raids are valid. Scalping against the trend? That's walking into a trap.

Use trailing SLs and protect your loot.

Small bag or big vault — play your game smart. 🎯💰

📢 Fundamental Boosters

USD/JPY’s bullish run isn’t random — it’s backed by:

📊 Macro shifts,

📈 COT reports,

🧠 Sentiment drivers,

📉 Intermarket trends,

And a whole mix of thief-level intel 🔍

🧭 Dive deeper before acting. The map’s been provided. 🔗🌍

🗞 News Traps Ahead – Move Cautiously

🚫 Avoid new trades during major releases

🔁 Use trailing SLs on open positions

💡 Position management is a thief’s best defense. Risk management keeps you in the game. 🎯🧠

🔥💖 Support the Heist Crew

Smash that ❤️🔥 Boost Button to keep our robbery engine running.

Each boost = strength for our crew.

💬 Share the love, spread the intel, and trade like a rogue with brains. 🤝💵

👀 Stay tuned for more high-profile FX heists from Thief Trader.

Until next time — loot wisely, vanish clean. 🐱👤💨

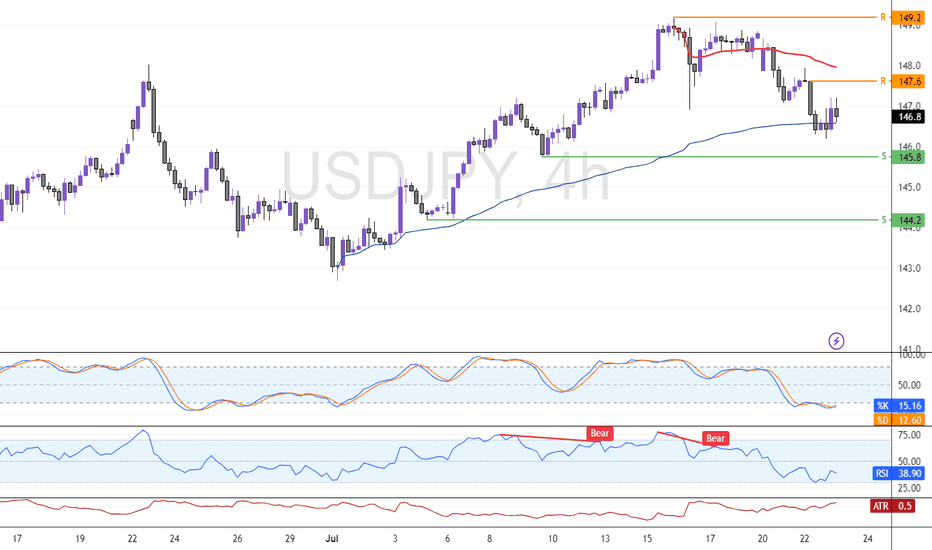

USD/JPY: Bearish Setup Looms Below VWAP ZoneUSD/JPY dipped as expected, currently testing the VWAP as support while Stochastic signals the Yen is overpriced in the short term.

Resistance is at 147.6, backed by the bearish VWAP. It is likely the pair will rise and test this level. Furthermore, a new bearish wave can potentially emerge if 147.6 holds. In this scenario, the next target could be the support at 145.8 followed by 144.2.

USD/JPY "The Ninja Heist" – Bullish Loot Grab!🌟 Hey, Thieves & Market Bandits! 🌟

💰 Ready to raid the USD/JPY "The Gopher" vault? 💰

Based on 🔥Thief Trading Style🔥 (technical + fundamental heist analysis), here’s the master plan to swipe bullish profits before the market turns against us! Escape near the high-risk Yellow MA Zone—overbought, consolidation, and bear traps ahead! 💸 "Take the money and run—you’ve earned it!" 🏆🚀

🕵️♂️ Heist Strategy:

📈 Entry (Bullish Raid):

The vault’s unlocked! Buy any price—this heist is LIVE!

Pullback lovers: Set buy limits at recent/swing lows for extra loot.

🛑 Stop Loss (Escape Route):

Thief SL at recent/swing low (4H/Day trade basis).

Adjust based on your risk, lot size, and multiple orders.

🎯 Target (Profit Escape):

147.500 (or flee earlier if bears ambush!)

⚔️ Scalpers’ Quick Strike:

LONG ONLY! If rich, attack now. If not, join swing traders & rob slowly.

Trailing SL = Your bodyguard! 💰🔒

💥 Why This Heist?

USD/JPY "The Ninja" is bullish due to key factors—check:

📌 Fundamental + Macro + COT Report

📌 Quantitative + Sentiment + Intermarket Analysis

📌 Future Targets & Overall Score (Linkks In the profile!) 🔗🌍

🚨 Trading Alert (News = Danger!):

Avoid new trades during news—volatility kills!

Trailing SL saves profits on running positions.

💖 Support the Heist Team!

💥 Smash the Boost Button! 💥

Help us steal more money daily with Thief Trading Style! 🏆🚀

Stay tuned—another heist is coming soon! 🤑🎯

Market Analysis: USD/JPY Recovers Above 145.00Market Analysis: USD/JPY Recovers Above 145.00

USD/JPY is rising and might gain pace above the 145.50 resistance.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY climbed higher above the 144.00 and 145.00 levels.

- There is a key bullish trend line forming with support at 144.80 on the hourly chart at FXOpen.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a fresh upward move from the 142.80 zone. The US Dollar gained bullish momentum above 143.40 against the Japanese Yen.

It even cleared the 50-hour simple moving average and 144.00. The pair climbed above 145.00 and traded as high as 145.43 before there was a downside correction. It is now moving lower toward the 23.6% Fib retracement level of the upward move from the 142.79 swing low to the 145.40 high.

The current price action above the 144.50 level is positive. There is also a key bullish trend line forming with support at 144.80. Immediate resistance on the USD/JPY chart is near 145.40.

The first major resistance is near 146.20. If there is a close above the 146.20 level and the RSI moves above 60, the pair could rise toward 147.50. The next major resistance is near 148.00, above which the pair could test 148.80 in the coming days.

On the downside, the first major support is 144.80 and the trend line. The next major support is visible near the 144.40 level. If there is a close below 144.40, the pair could decline steadily.

In the stated case, the pair might drop toward the 143.40 support zone and the 76.4% Fib retracement level of the upward move from the 142.79 swing low to the 145.40 high. The next stop for the bears may perhaps be near the 142.80 region.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Bank of Japan Leaves Interest Rate UnchangedBank of Japan Leaves Interest Rate Unchanged

This morning, the Bank of Japan (BOJ) released its interest rate decision, keeping the rate unchanged as widely expected. According to Forex Factory, the BOJ Policy Rate remains at 0.5%.

BOJ Governor Kazuo Ueda noted the following:

→ Japan’s economy is recovering moderately.

→ The Bank will continue raising rates if economic and inflationary conditions improve.

→ The situation surrounding trade tariffs remains highly uncertain.

The fact that the decision was anticipated by markets is reflected in price action on the charts.

Technical Analysis of the USD/JPY Chart

A brief spike in volatility occurred on the USD/JPY chart this morning, but it did not significantly alter the broader structure of price movements, which in June have formed a contracting triangle pattern.

In recent days, the pair has been climbing from the lower boundary of the triangle toward the upper edge, forming a short-term ascending channel (highlighted in blue). However, in the near term, this bullish momentum may weaken as the USD/JPY rate approaches the upper boundary of the triangle, which coincides with the psychologically significant level of 145 yen to the dollar (indicated by arrows).

From a medium-term perspective, traders should watch for a potential breakout from the triangle pattern, which could trigger a meaningful trend. One possible catalyst could be news of a trade agreement between the United States and Japan.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/JPY Analysis: Bears Put Pressure on Key SupportUSD/JPY Analysis: Bears Put Pressure on Key Support

As shown on the USD/JPY chart, the pair is hovering near key support at ¥142.50 per US dollar.

While demand was strong enough at the end of May to lift the exchange rate from this level to a peak around ¥146.00, USD/JPY has once again retreated to the ¥142.50 area.

Why has USD/JPY declined?

On one hand, the US dollar has weakened following disappointing economic data released yesterday. The figures revealed a sharp slowdown in private sector hiring and an unexpected contraction in the US services sector, fuelling concerns over a possible recession.

On the other hand, yen strength is being driven by the Bank of Japan's apparent willingness to raise interest rates — reaffirmed on Tuesday by Governor Kazuo Ueda — which has reinforced expectations of a tightening cycle.

USD/JPY Technical Analysis

In early June, the ¥142.50 level had already shown its role as support (as indicated by the arrow), but it is once again under pressure — a sign of bearish dominance.

Yesterday, sellers broke through local support at ¥143.57, which may now act as resistance.

More US economic data is due on Friday, with key labour market figures set to be released at 15:30 GMT+3. These could potentially trigger a bearish attempt to break below the ¥142.50 level on the USD/JPY chart.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Analysing the Volatility Spike on the USD/JPY ChartAnalysing the Volatility Spike on the USD/JPY Chart

The USD/JPY chart offers plenty of noteworthy insights for analysis:

→ A one-month low was recorded today (marked by the arrow);

→ This was followed by a sharp upward reversal, with a series of large bullish candlesticks forming on the intraday chart.

Why Is USD/JPY Moving Sharply Today?

The primary driver appears to be recent statements from Bank of Japan Governor Kazuo Ueda.

According to Trading Economics, this morning Ueda:

→ warned of rising core inflation risks linked to increasing food prices;

→ indicated that the Bank of Japan is prepared to adjust its monetary policy in order to achieve a stable inflation target.

Latest data show that Japan’s core inflation unexpectedly rose to 3.5% — the highest level in two years — reinforcing the case for further rate hikes. However, what's particularly striking is that despite Ueda’s hawkish tone, the yen is weakening.

Technical Analysis of the USD/JPY Chart

Yen fluctuations formed a downward trajectory (marked in orange) in the second half of May, partly driven by US dollar weakness. Following a period of relative calm, the market has shifted into high gear — the ATR indicator is climbing sharply from multi-month lows, breaking through resistance at the 143.0 level.

This aggressive price action on the USD/JPY chart today suggests we may be witnessing an attempted bullish breakout from the channel. In light of this, it is possible that the surge in volatility reflects a fundamental shift in market sentiment — one that could potentially lead to the development of an upward trend.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/JPY "The Ninja" Forex Bank Money Heist (Bullish)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Market Heist. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk YELLOW MA Zone. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 1H timeframe (143.000) Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 147.000

💰💵💸USD/JPY "The Ninja" Forex Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.... go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/JPY Dips FurtherUSD/JPY Dips Further

USD/JPY declined below 144.50 and is currently consolidating losses.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY is trading in a bearish zone below the 146.10 and 144.90 levels.

- There is a short-term bearish trend line forming with resistance at 144.25 on the hourly chart at FXOpen.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a steady decline from well above the 146.00 zone. The US Dollar gained bearish momentum below the 145.00 support against the Japanese Yen.

The pair even settled below the 144.50 level and the 50-hour simple moving average. There was a spike below 144.00 and the pair traded as low as 143.72. It is now consolidating losses with a bearish angle. Immediate resistance on the USD/JPY chart is near the 23.6% Fib retracement level of the recent decline from the 146.10 swing high to the 143.42 low at 144.25.

There is also a short-term bearish trend line forming with resistance at 144.25. The first major resistance is near the 144.90 zone and the 50% Fib retracement level of the recent decline from the 146.10 swing high to the 143.42 low.

If there is a close above the 144.90 level and the hourly RSI moves above 50, the pair could rise toward 145.50. The next major resistance is near 146.10, above which the pair could test 147.50 in the coming days.

On the downside, the first major support is near 143.70. The next major support is near the 143.20 level. If there is a close below 143.20, the pair could decline steadily. In the stated case, the pair might drop toward the 142.00 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USDJPY Long PositionUSDJPY pair is currently positioned at a key support zone, where price action has historically reversed direction. Following a recent rebound from this level, the pair retested the support area. Given the broader uptrend structure (characterized by higher highs and higher lows), this retest presents a potential opportunity to enter long positions, contingent on bullish confirmation at this critical juncture.

Key Observations:

Established Uptrend: The pair’s consistent upward trajectory on higher time frames supports a bullish bias.

Support Retest: The current pullback to the support zone aligns with typical price behavior in trending markets, where retests of prior levels often precede trend resumptions, but a decisive close below the support would invalidate the bullish setup, potentially signaling a trend reversal or deeper correction.

Risk Management Strategy: A prudent approach would involve placing a stop-loss below the support zone to protect against a breakdown, while targeting the next resistance level for profit-taking.

Final Assessment:

The setup aligns with bullish momentum, provided the support holds.

Market Analysis: USD/JPY Eyes Fresh IncreaseMarket Analysis: USD/JPY Eyes Fresh Increase

USD/JPY is rising and might gain pace above the 142.45 resistance.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY climbed higher above the 141.00 and 141.65 levels.

- There was a break above a connecting bearish trend line with resistance at 141.20 on the hourly chart at FXOpen.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a fresh upward move from the 140.00 zone. The US Dollar gained bullish momentum above 141.65 against the Japanese Yen.

There was a break above a connecting bearish trend line with resistance at 141.20. It even cleared the 50-hour simple moving average and 142.45. The pair climbed above 143.00 and traded as high as 143.21 before there was a downside correction.

The pair dipped below the 23.6% Fib retracement level of the upward move from the 139.88 swing low to the 143.21 high. The current price action above the 141.65 level is positive.

Immediate resistance on the USD/JPY chart is near 142.45. The first major resistance is near 143.20. If there is a close above the 143.20 level and the RSI moves above 75, the pair could rise toward 144.50.

The next major resistance is near 145.00, above which the pair could test 148.00 in the coming days. On the downside, the first major support is 141.65 and the 50% Fib retracement level of the upward move from the 139.88 swing low to the 143.21 high.

The next major support is visible near the 141.00 level. If there is a close below 141.00, the pair could decline steadily. In the stated case, the pair might drop toward the 139.90 support zone. The next stop for the bears may perhaps be near the 137.50 region.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/JPY Analysis: Exchange Rate Falls Below 140 Yen per DollarUSD/JPY Analysis: Exchange Rate Falls Below 140 Yen per Dollar Today

As shown on the USD/JPY chart today, the exchange rate between the US dollar and Japanese yen has fallen below 140 yen per dollar – marking the first time this has occurred in 2025. Since the beginning of the year, the rate has dropped by approximately 11%.

Among the main driving factors is the White House's tariff policy, which has triggered a sell-off in US government bonds and a weakening of the dollar. One of the more recent developments includes the release of the Consumer Price Index report by the Bank of Japan, which revealed that the CPI remained steady at 2.2%, despite analysts (according to ForexFactory) forecasting a rise to 2.4%.

It’s possible that, due to the lack of inflationary pressure in Japan, the yen is in a relatively stronger position compared to the US currency, where concerns persist that trade wars and Trump’s push for lower interest rates may lead to a spike in inflation and a devaluation of the dollar.

Technical Analysis of the USD/JPY Chart

It’s worth noting that the psychological level of 140 yen per dollar has acted as key support since late 2023. On the rare occasions when the rate has dipped below this mark, the bulls have soon regained confidence, prompting a reversal.

It’s quite possible we may witness a similar attempt on the USD/JPY chart in the coming weeks or even days. However, the current outlook remains bearish, as the price has broken below the Descending Wedge pattern (marked with black lines), indicating that supply is outweighing demand.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Bearish Momentum Eases at 141.70 Support in USD/JPYFenzoFx—The USD/JPY currency pair resumed its bearish trend after breaking below 144.56 but steadied at the 141.70 support level. Indicators show sideways movement, reflecting a lack of momentum.

With the price below the 50-period moving average, the bearish outlook persists. If the pair stabilizes below 141.70, the downtrend may deepen, while surpassing 144.56 could pave the way for a rise toward 148.20.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at F enzo F x Decentralized Forex Broker

USDJPY Technical AnalysisFenzoFx—USDJPY tested 150.25, a trading range below this level and the 50-period simple moving average. A close above 150.25 can trigger the uptrend, targeting 151.2.

Conversely, a dip below 148.2 invalidates the bullish outlook, with 148.2 as the first target and 147.43 as the secondary target.

USD/JPY "The Gopher" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the USD/JPY "The Gopher" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Goal 🎯: 163.000

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

USDJPY Daily Analysis: Slight Bearish Bias as Economic DataUSDJPY Daily Analysis: Slight Bearish Bias as Economic Data and Market Sentiment Weigh on the Pair 03/12/2024

Introduction

USDJPY is expected to show a slight bearish bias today as a combination of weaker U.S. economic data, dovish Federal Reserve expectations, and strengthening risk sentiment exert downward pressure on the pair. This article breaks down the key factors influencing USDJPY’s potential move today, highlighting the fundamental drivers behind the bearish outlook.

---

Key Drivers Influencing USDJPY

1. Dovish Fed Outlook and U.S. Economic Data

The U.S. Federal Reserve's recent stance has remained cautious, signaling that further interest rate hikes are less likely in the near term. This dovish bias, coupled with disappointing economic data from the U.S., including weaker-than-expected manufacturing PMI and labor market figures, is reducing the appeal of the U.S. dollar (USD) relative to other currencies. As market expectations for a pause in U.S. monetary tightening grow, the USD faces pressure, contributing to the bearish outlook for USDJPY.

2. Improved Global Risk Sentiment

There has been a shift towards a risk-on sentiment in global markets, with stock markets showing positive momentum. As investors turn to riskier assets, the Japanese yen (JPY) tends to benefit due to its status as a safe-haven currency. A strong yen in a risk-on environment can weigh on USDJPY, especially as the Japanese economy shows resilience in key sectors like exports and manufacturing.

3. Declining U.S. Bond Yields

U.S. Treasury yields have softened recently, which has reduced the appeal of holding U.S. assets. Lower yields on U.S. government bonds make the dollar less attractive, particularly against currencies like the JPY, which has relatively higher yield expectations. This decline in U.S. bond yields contributes to the negative sentiment around USDJPY.

4. Positive Data from Japan

Japan's economic fundamentals are showing strength, particularly in the export sector. Data indicating stable economic growth and a positive outlook for Japan’s trade balance further supports the Japanese yen. As Japan benefits from stronger export performance, the JPY is gaining in value, adding pressure to USDJPY's upward momentum.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading just below its 50-day moving average, suggesting a potential for bearish continuation. The Relative Strength Index (RSI) is approaching the overbought territory, indicating that the pair may be nearing a correction. If the RSI continues to fall, it could signal a deeper pullback in the pair.

MACD and Key Levels

The Moving Average Convergence Divergence (MACD) shows a slight bearish crossover, reinforcing the downtrend in USDJPY. Immediate resistance is at 148.00, while support is seen around 147.00. A break below 147.00 could lead to further downside, with the next key support level at 146.50.

---

Conclusion

USDJPY is likely to experience a slight bearish bias today due to a combination of dovish Federal Reserve expectations, soft U.S. economic data, and a risk-on market sentiment that favors the Japanese yen. Traders should monitor key support levels and watch for any changes in U.S. economic conditions or global risk sentiment, as these factors will play a crucial role in determining the pair’s movement in the short term.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #USDBearishOutlook

- #JPYstrength

- #USDJPYtoday

- #ForexMarketAnalysis

- #USDJPYprediction

USDJPY Daily Analysis: Slight Bearish Bias Amid Dollar Weakness USDJPY Daily Analysis: Slight Bearish Bias Amid Dollar Weakness and Yen Resilience 02/12/2024

Introduction

The USDJPY pair is projected to lean slightly bearish today, driven by continued U.S. dollar (USD) weakness and the Japanese yen’s (JPY) resilience as a safe-haven asset. With risk sentiment in flux and U.S. Treasury yields declining, the pair faces downward pressure. This article provides an in-depth analysis of the fundamental and technical factors shaping USDJPY’s outlook for the day.

---

Key Drivers Influencing USDJPY

1. Weak U.S. Dollar Sentiment

The USD remains under pressure following last week’s dovish remarks from Federal Reserve officials, which signaled a pause in interest rate hikes. With market expectations of monetary easing in 2025 growing, the dollar’s attractiveness continues to decline, weighing on USDJPY.

2. Japanese Yen's Safe-Haven Demand

The JPY is benefiting from its status as a safe-haven currency amid lingering global uncertainties. Concerns about geopolitical tensions and slower global growth are keeping investors cautious, favoring the yen over the dollar.

3. Declining U.S. Treasury Yields

Lower U.S. Treasury yields are eroding the yield advantage of the USD against the JPY. The 10-year Treasury yield has fallen below key levels, diminishing the carry trade appeal that often supports USDJPY.

4. Economic Divergence

While Japan’s economic recovery remains modest, the stability in inflation and a cautious Bank of Japan (BoJ) monetary policy provide support for the yen. In contrast, slowing U.S. economic data, including weaker consumer spending and manufacturing activity, adds to bearish sentiment for USDJPY.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, reinforcing bearish momentum. The Relative Strength Index (RSI) is hovering near oversold territory, suggesting limited downside but no immediate reversal signals.

MACD and Key Levels

The MACD indicator shows a continuation of bearish momentum. Immediate support lies at 147.80, and a break below could target 147.00. Resistance is capped at 148.50, which may limit any corrective movements.

---

Conclusion

USDJPY is likely to exhibit a slight bearish bias today as fundamental factors such as dollar weakness, safe-haven demand for the yen, and declining U.S. Treasury yields align against the pair. Traders should remain cautious of intraday volatility driven by economic data releases or sudden risk sentiment shifts.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenOutlook

- #USDWeakness

- #USDJPYtoday

- #ForexMarketAnalysis

- #USDJPYprediction

USDJPY Daily Analysis: Slight Bearish Bias Amid Dollar Weakness USDJPY Daily Analysis: Slight Bearish Bias Amid Dollar Weakness and Yen Resilience 29/11/2024

Introduction

The USDJPY pair is expected to exhibit a slight bearish bias today, driven by persistent U.S. dollar weakness and the Japanese yen's resilience as a safe-haven asset. Market participants remain cautious ahead of key economic events, while falling U.S. Treasury yields and geopolitical uncertainties provide additional support for the yen. In this article, we will delve into the fundamental and technical drivers shaping the USDJPY outlook for the day.

---

Key Drivers Influencing USDJPY

1. Weak U.S. Dollar

The U.S. dollar remains under pressure as investors continue to price in dovish Federal Reserve policies. Recent economic data pointing to slowing consumer activity and declining durable goods orders further weakens the greenback’s appeal, supporting a bearish outlook for USDJPY.

2. Japanese Yen Safe-Haven Appeal

The Japanese yen (JPY) continues to attract demand as a safe-haven currency amid global economic uncertainties. Persistent geopolitical risks and concerns about slowing global growth have led investors to favor the yen, exerting downward pressure on USDJPY.

3. Falling U.S. Treasury Yields

Declining U.S. Treasury yields, particularly on the 10-year note, reduce the dollar’s attractiveness in yield-sensitive pairs like USDJPY. Lower yields diminish the carry trade advantage, making the yen more appealing.

4. Bank of Japan's Stability

While the Bank of Japan (BoJ) maintains its accommodative monetary policy, steady inflation and economic stability support the yen. BoJ policymakers’ cautious approach to monetary tightening continues to provide implicit strength to the currency.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, indicating a bearish trend. The Relative Strength Index (RSI) remains neutral but leans toward oversold conditions, hinting at potential further downside.

MACD and Key Levels

The MACD indicator signals continued bearish momentum. Key support lies at 147.00, with a break below this level potentially targeting 146.50. Immediate resistance is seen at 148.20, which may cap any intraday recoveries.

---

Conclusion

USDJPY is likely to maintain a slight bearish bias today as weak U.S. dollar dynamics and strong demand for the yen weigh on the pair. Traders should keep an eye on any unexpected shifts in risk sentiment or economic data releases that could influence intraday volatility.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenOutlook

- #USDWeakness

- #USDJPYtoday

- #ForexMarketAnalysis

- #USDJPYprediction

USDJPY Daily Analysis: Slight Bearish Bias Expected Amid Dollar USDJPY Daily Analysis: Slight Bearish Bias Expected Amid Dollar Weakness and Yen Strength 28/11/2024

Introduction

The USDJPY pair is poised for a slight bearish bias today, driven by continued weakness in the U.S. dollar and growing demand for the Japanese yen (JPY). Factors such as falling U.S. Treasury yields, dovish Federal Reserve expectations, and geopolitical uncertainties favor the yen’s appreciation against the greenback. This analysis outlines the fundamental and technical factors shaping the USDJPY outlook for the day.

---

Key Drivers Influencing USDJPY

1. Weak U.S. Dollar

The U.S. dollar is under pressure as market participants price in a prolonged pause in Federal Reserve rate hikes. Recent U.S. economic data, including a decline in durable goods orders and consumer sentiment, reinforces the dovish tone, limiting the dollar’s strength against the yen.

2. Japanese Yen Safe-Haven Appeal

The Japanese yen benefits from its status as a safe-haven currency amid lingering global economic uncertainties. Investors seeking stability are increasing their exposure to the yen, further driving USDJPY lower.

3. Declining U.S. Treasury Yields

U.S. Treasury yields continue to trend lower, reflecting reduced market expectations for future rate hikes. The 10-year yield, in particular, has fallen to multi-week lows, diminishing the attractiveness of the dollar in yield-sensitive currency pairs like USDJPY.

4. Japan’s Stable Monetary Policy Outlook

While the Bank of Japan (BoJ) maintains its ultra-loose monetary policy, steady domestic inflation data and a resilient labor market lend implicit support to the yen, providing a counterbalance to the dollar’s weakness.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, indicating a bearish trend. The Relative Strength Index (RSI) is near neutral levels but trending downward, suggesting potential for further downside.

MACD and Key Levels

The MACD indicator remains in bearish territory, pointing to sustained selling pressure. Immediate support is seen at 147.20, with a break below potentially opening the door to the 146.50 level. Resistance is located at 148.50, which could cap any short-term rebounds.

---

Conclusion

The USDJPY pair is expected to exhibit a slight bearish bias today, influenced by a weaker U.S. dollar, stronger demand for the Japanese yen, and falling Treasury yields. Traders should monitor key economic releases and shifts in risk sentiment, which could impact intraday movements.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenOutlook

- #USDWeakness

- #USDJPYtoday

- #ForexMarketAnalysis

- #USDJPYprediction

USDJPY Daily Analysis: Slight Bearish Bias Expected Amid WeakUSDJPY Daily Analysis: Slight Bearish Bias Expected Amid Weak U.S. Dollar and Safe-Haven Yen Demand 27/11/2024

Introduction

The USDJPY pair is anticipated to hold a slight bearish bias today as macroeconomic and geopolitical factors weigh on the U.S. dollar while favoring the Japanese yen. With falling U.S. Treasury yields, dovish Federal Reserve expectations, and steady demand for safe-haven assets, the yen gains a tactical advantage over the greenback. Let’s delve into the fundamental and technical factors shaping the USDJPY outlook for today.

---

Key Drivers Influencing USDJPY

1. Weaker U.S. Dollar

The U.S. dollar remains under pressure as markets digest weak economic data, including slowing consumer confidence and subdued retail sales. These reports reinforce expectations that the Federal Reserve will maintain a dovish stance on monetary policy, limiting the dollar’s upside potential.

2. Strengthening Japanese Yen

The Japanese yen (JPY), often seen as a safe-haven currency, is benefiting from subdued risk sentiment in global markets. Investors seeking refuge amid lingering uncertainties in economic recovery and geopolitical tensions are turning to the yen, bolstering its value against the dollar.

3. Falling U.S. Treasury Yields

Declining yields on U.S. Treasuries continue to exert downward pressure on USDJPY. The 10-year yield has dipped as markets price in lower growth prospects and anticipate potential Federal Reserve rate cuts in 2025. This reduces the appeal of the dollar in yield-sensitive pairs like USDJPY.

4. Japan’s Steady Economic Data

Japan’s economy shows resilience, supported by consistent industrial output and improving labor market conditions. These factors strengthen the yen’s position against the dollar.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, signaling a bearish trend. The Relative Strength Index (RSI) is neutral but trending toward the oversold region, suggesting potential for further downside.

MACD and Key Levels

The MACD indicator remains in bearish territory, highlighting sustained downward momentum. Key support is observed at 147.00, while resistance lies at 148.30. A breach below 147.00 could accelerate bearish momentum toward the next major level at 145.80.

---

Conclusion

USDJPY is poised for a slight bearish bias today, driven by the weakening U.S. dollar, safe-haven yen demand, and falling U.S. Treasury yields. Traders should keep an eye on upcoming economic releases from the U.S. and Japan, as well as any shifts in global risk sentiment, which could influence intraday movements.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenStrength

- #USDWeakness

- #USDJPYtoday

- #ForexMarketOutlook

- #USDJPYprediction

USDJPY Daily Analysis: Slight Bearish Bias Anticipated Amid Yen USDJPY Daily Analysis: Slight Bearish Bias Anticipated Amid Yen Strength and U.S. Dollar Weakness 26/11/2024

Introduction

USDJPY is expected to exhibit a slight bearish bias today as market dynamics favor the Japanese yen over the U.S. dollar. The yen's safe-haven status, coupled with declining U.S. Treasury yields and dovish Federal Reserve expectations, continues to apply downward pressure on the pair. This article explores the key fundamental and technical factors shaping the USDJPY outlook.

---

Key Drivers Influencing USDJPY

1. Japanese Yen’s Safe-Haven Appeal

The Japanese yen (JPY) remains supported by its safe-haven status, attracting investors amid persistent global economic uncertainties. Despite a modest improvement in risk sentiment, the yen continues to draw strength from its traditional role as a hedge against volatility, particularly as market participants look for stability.

2. Weaker U.S. Dollar

The U.S. dollar (USD) is under significant pressure due to dovish Federal Reserve policy expectations. Recent economic data, including subdued inflation and slowing retail sales, have reinforced market beliefs that the Fed will refrain from tightening monetary policy further, reducing the dollar’s appeal against the yen.

3. Falling U.S. Treasury Yields

U.S. Treasury yields are declining as markets price in stable interest rates and potential economic slowing in the U.S. Lower yields make the dollar less attractive to investors, further contributing to the bearish bias in USDJPY.

4. Improved Japanese Economic Data

Recent economic reports from Japan have painted a picture of gradual recovery, with improvements in industrial production and consumer sentiment. This strengthens the yen and adds additional downward pressure on USDJPY.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, signaling sustained bearish momentum. The Relative Strength Index (RSI) remains neutral but is trending lower, leaving room for further downside.

MACD and Key Levels

The MACD indicator continues to show a bearish crossover, indicating strong downward momentum. Immediate support lies at 146.50, while resistance is seen at 148.50. A break below the support level could lead to further declines toward the 145.00 level.

---

Conclusion

With the Japanese yen’s safe-haven appeal, weakening U.S. dollar, and falling Treasury yields, USDJPY is expected to maintain a slight bearish bias today. Traders should monitor global economic developments and any potential surprises in U.S. or Japanese economic data that could impact market sentiment.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenStrength

- #USDWeakness

- #USDJPYtoday

- #ForexMarketOutlook

- #USDJPYprediction