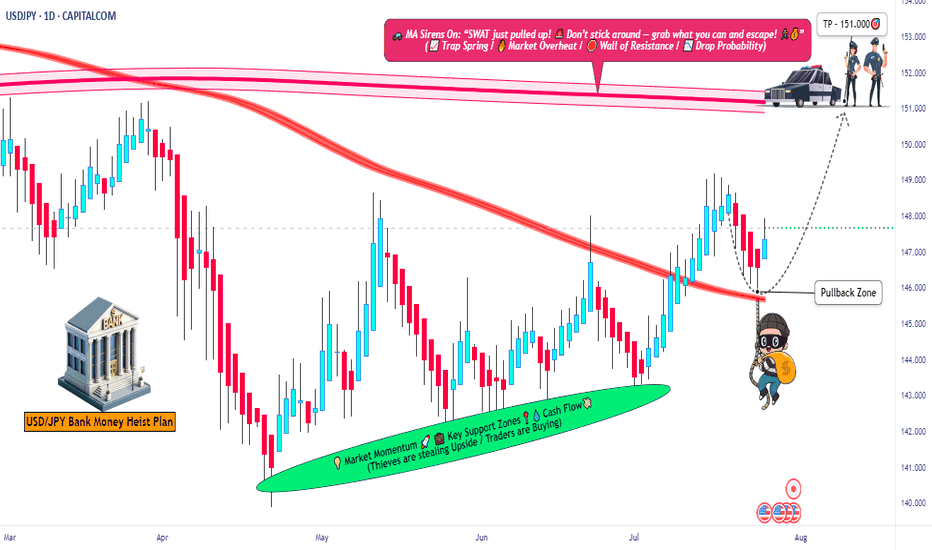

USD/JPY Robbery Route | Enter at Dip, Exit Before Police💥USD/JPY Forex Money Heist Plan 🎯 — Ninja Robbery at 146.000💥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Market Bandits, Money Makers & Risky Robbers 🤑💰💸✈️

Welcome to another Thief Trader-style operation. We've cracked open the USD/JPY vault (aka "The Gopher" 💹), and here's the blueprint to pull off this forex heist like true professionals. 💼🎭💵

🚨 Strategy Overview

This isn't just a trade – it’s a well-researched, precision-timed robbery mission based on technicals, macro analysis, sentiment, and the bigger global picture.

Expect action near critical zones – especially the moving average barricade, where police (aka risk) is waiting. Stay sharp.

🔓 Entry Point – Unlock the Vault

📈 Watch for bullish pullbacks near 146.000.

Whether it's a dip, zone test, or wick bounce — you’re looking to layer buy limit orders like a seasoned thief using DCA tactics.

Enter on swings or any bullish confirmation.

Heist Window is Open.

🛑 Stop Loss – Escape Route

📍 SL near 143.000 (1D swing low) — adjust based on your capital and position size.

💡 Don’t go blind — SL is your backup plan, not an optional accessory.

Custom-fit it based on how many entries you’re stacking.

🎯 Target – Vault Exit Point

🏁 151.000 or exit before resistance heat catches on.

No greedy thieves here — precision exit is key.

Lock profits, vanish in style. 🕶️💼💸

🧲 Scalpers Take Note

Only long side raids are valid. Scalping against the trend? That's walking into a trap.

Use trailing SLs and protect your loot.

Small bag or big vault — play your game smart. 🎯💰

📢 Fundamental Boosters

USD/JPY’s bullish run isn’t random — it’s backed by:

📊 Macro shifts,

📈 COT reports,

🧠 Sentiment drivers,

📉 Intermarket trends,

And a whole mix of thief-level intel 🔍

🧭 Dive deeper before acting. The map’s been provided. 🔗🌍

🗞 News Traps Ahead – Move Cautiously

🚫 Avoid new trades during major releases

🔁 Use trailing SLs on open positions

💡 Position management is a thief’s best defense. Risk management keeps you in the game. 🎯🧠

🔥💖 Support the Heist Crew

Smash that ❤️🔥 Boost Button to keep our robbery engine running.

Each boost = strength for our crew.

💬 Share the love, spread the intel, and trade like a rogue with brains. 🤝💵

👀 Stay tuned for more high-profile FX heists from Thief Trader.

Until next time — loot wisely, vanish clean. 🐱👤💨

Usdjpytrade

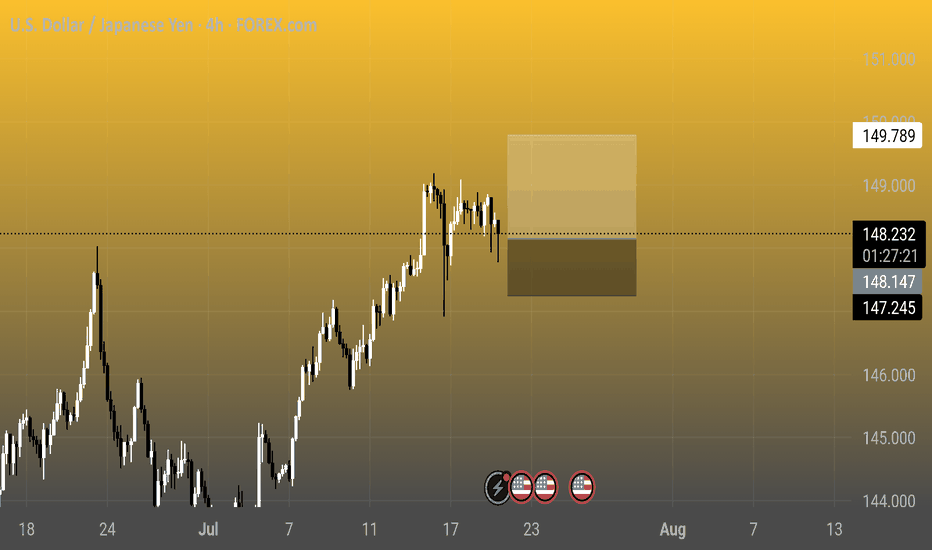

U.S. Dollar / Japanese Yen - 4h Chart (FOREX.com)4-hour chart from FOREX.com shows the exchange rate between the U.S. Dollar (USD) and the Japanese Yen (JPY). The current rate is 148.184, reflecting a decrease of 0.623 (-0.42%) as of 01:29:16. The chart highlights recent price movements over the past few hours, with a shaded area indicating a consolidation phase around the current level.

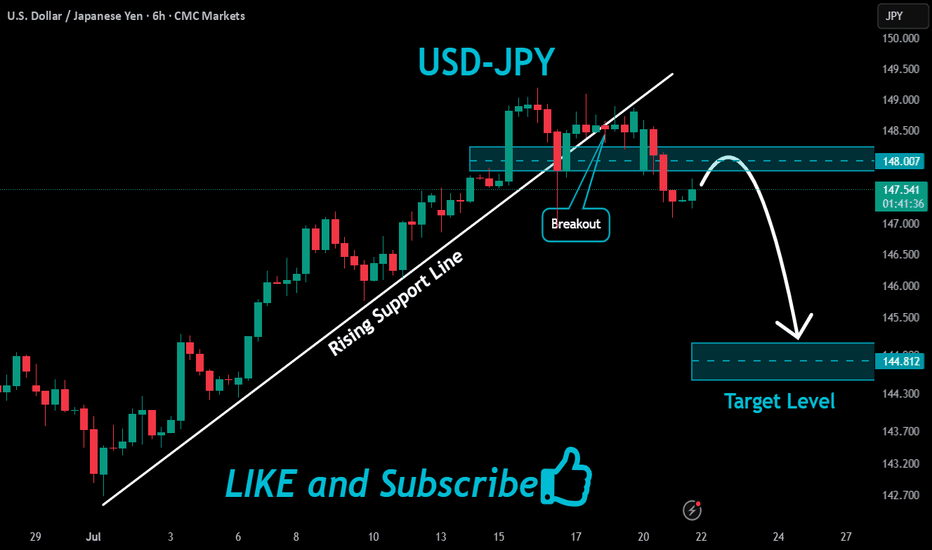

#USDJPY: Price is currently accumulating ! Wait For DistributionAt present, the USDJPY currency pair appears to be in an accumulation phase, as evidenced by the absence of significant price movement throughout the current week. Several factors contribute to this trend.

Firstly, several significant economic events are scheduled for this week, particularly tomorrow and Friday. These developments hold substantial implications for the future trajectory of the USDJPY pair. Consequently, there exists a possibility that the price may experience a decline prior to initiating a bullish trend.

Secondly, there are two primary areas where the price could reverse its course. The extent to which the USD reacts to the economic data will serve as an indicator of the potential reversal zones.

It is imperative that you conduct your own analysis before making any financial decisions. This chart should be utilised solely for educational purposes and does not guarantee any specific outcome.

Regarding the stop loss, as this is a swing trade, it is advisable to employ a larger stop loss if the price reaches entry zones. The take profit level can be determined based on your entry type and analysis.

We wish you the best of luck in your trading endeavours and emphasise the importance of trading safely.

Kindly share this analysis with others through likes, comments, and social media platforms. If you have any questions or require further assistance, please do not hesitate to comment below. We are here to provide support.

Team Setupsfx_

❤️🚀

Market Analysis: USD/JPY RisesMarket Analysis: USD/JPY Rises

USD/JPY is rising and might gain pace above the 149.20 resistance.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY climbed higher above the 147.50 and 148.40 levels.

- There is a key bullish trend line forming with support at 148.40 on the hourly chart at FXOpen.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a fresh upward move from the 145.75 zone. The US Dollar gained bullish momentum above 146.55 against the Japanese Yen.

It even cleared the 50-hour simple moving average and 148.00. The pair climbed above 149.00 and traded as high as 149.18. The pair is now consolidating gains above the 23.6% Fib retracement level of the upward move from the 145.74 swing low to the 149.18 high.

The current price action above the 148.50 level is positive. There is also a key bullish trend line forming with support at 148.40. Immediate resistance on the USD/JPY chart is near 149.20.

The first major resistance is near 149.50. If there is a close above the 149.50 level and the RSI moves above 70, the pair could rise toward 150.50. The next major resistance is near 152.00, above which the pair could test 155.00 in the coming days.

On the downside, the first major support is 148.40 and the trend line. The next major support is visible near the 147.90 level. If there is a close below 147.90, the pair could decline steadily.

In the stated case, the pair might drop toward the 147.50 support zone and the 50% Fib retracement level of the upward move from the 145.74 swing low to the 149.18 high. The next stop for the bears may perhaps be near the 146.55 region.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/JPY "The Ninja Heist" – Bullish Loot Grab!🌟 Hey, Thieves & Market Bandits! 🌟

💰 Ready to raid the USD/JPY "The Gopher" vault? 💰

Based on 🔥Thief Trading Style🔥 (technical + fundamental heist analysis), here’s the master plan to swipe bullish profits before the market turns against us! Escape near the high-risk Yellow MA Zone—overbought, consolidation, and bear traps ahead! 💸 "Take the money and run—you’ve earned it!" 🏆🚀

🕵️♂️ Heist Strategy:

📈 Entry (Bullish Raid):

The vault’s unlocked! Buy any price—this heist is LIVE!

Pullback lovers: Set buy limits at recent/swing lows for extra loot.

🛑 Stop Loss (Escape Route):

Thief SL at recent/swing low (4H/Day trade basis).

Adjust based on your risk, lot size, and multiple orders.

🎯 Target (Profit Escape):

147.500 (or flee earlier if bears ambush!)

⚔️ Scalpers’ Quick Strike:

LONG ONLY! If rich, attack now. If not, join swing traders & rob slowly.

Trailing SL = Your bodyguard! 💰🔒

💥 Why This Heist?

USD/JPY "The Ninja" is bullish due to key factors—check:

📌 Fundamental + Macro + COT Report

📌 Quantitative + Sentiment + Intermarket Analysis

📌 Future Targets & Overall Score (Linkks In the profile!) 🔗🌍

🚨 Trading Alert (News = Danger!):

Avoid new trades during news—volatility kills!

Trailing SL saves profits on running positions.

💖 Support the Heist Team!

💥 Smash the Boost Button! 💥

Help us steal more money daily with Thief Trading Style! 🏆🚀

Stay tuned—another heist is coming soon! 🤑🎯

USD/JPY Profit Heist – Are You In or Missing Out?"🔥💰 "USD/JPY NINJA HEIST: Bullish Loot Before the Trap! (Thief Trading Style)" 💰🔥

🌟 Attention Market Robbers & Profit Takers! 🌟

🚨 Thief Trading Alert: USD/JPY "The Ninja" is primed for a BULLISH HEIST!

Based on our stealthy technical & fundamental analysis, we’re locking in a long entry strategy. The plan? Loot profits before the RED ZONE danger hits! Overbought? Maybe. Risky? Sure. But the real robbery happens before the bears wake up! 🏴☠️💸

🎯 ENTRY: The Vault is OPEN!

Buy Limit Orders: Swipe the dip on pullbacks or jump in at key swing lows.

Aggressive? Enter now & ride the wave!

🛑 STOP LOSS (Thief-Style Escape Plan):

Swing Low (5H TF): 143.600 (Adjust based on your risk & lot size!)

Multiple orders? Scale SL wisely—don’t get caught!

🎯 TARGETS:

Main Take-Profit: 151.000 (Or escape earlier if the trap triggers!)

Scalpers: Only play LONG—trail your SL & lock in quick loot!

📢 SCALPERS & SWING TRADERS:

Got deep pockets? Ride the wave now!

Small account? Join the swing heist & rob the trend slowly!

📈 WHY USD/JPY?

Bullish momentum + Macro/Fundamental tailwinds!

COT Report, Sentiment, & Intermarket Analysis all hint at more upside! go ahead to check 👉🔗🌏

⚠️ WARNING: NEWS = VOLATILITY!

Avoid new trades during high-impact news!

Trailing SL = Your best friend! Protect profits & avoid jail (stop-out)!

💥 BOOST THIS IDEA TO SUPPORT THE HEIST!

More boosts = More robberies = More profits for YOU!

Stay tuned—next heist coming soon! 🚀💰

🔥 Like, Share, & Follow for Daily Steals! 🔥

USD/JPY Long Trade SetupBuy dips - 146.50-146.60

Stop Loss -145.80 - Below retest zone; invalidates breakout.

TP-1 148.80 - Scale 50 % Pattern target / June high cluster.

TP-2 150.00 - Round-number magnet, option strikes.

Rationale

The dollar-yen cross has snapped out of its early-summer drift and vaulted back above the 100-day simple moving average for the first time since February, reaching ¥147.19 on 9 July – a two-and-a-half-week high – as the greenback rides an upswing in U.S. yields and tariff-driven inflation fears. The technical breakout puts the familiar 148.00/150.00 band – the June swing high and the psychological round number – back in play for trend-followers over the next several sessions.

Policy divergence as wide as ever

Federal Reserve – higher-for-longer: Minutes from the June FOMC showed staff pushing inflation projections higher and flagging “upside risks” should tariff pass-through accelerate, reinforcing the market’s view that rate cuts will be pushed into Q4 at the earliest. Five straight sessions of rising Treasury yields have followed, lifting the 10-year to 4.45 % and widening the U.S.–Japan real-rate gap.

Bank of Japan – stuck on hold: Former BOJ board member Makoto Sakurai told Reuters the central bank will “wait at least until March 2026” before considering another hike, as Trump’s 25 % tariff on Japanese goods (effective 1 August) clouds the export outlook and will likely force the BOJ to cut its growth forecast at the 31 July Outlook Report. With headline CPI still only just above target and real wages contracting.

USDJPY Price Accumulated|Time For Bullish Distribution|Setupsfx|The price has accumulated nicely and is now distributing. We have three targets in mind, but set your own based on your analysis. Our approach is purely technical, but also includes a basic fundamental approach. This analysis concludes over 1500 pips and is a swing move. Please use this analysis as educational purposes only, as it does not guarantee that price will move exactly as predicted.

If you like our idea, please consider liking and commenting on it.

Good luck and trade safely!

Team Setupsfx_

Unlocking the Bull Vault: USD/CAD Heist Setup🕵️♂️💼 The Loonie Vault Raid: USD/CAD Buy Blueprint 💰🔐

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

To All Currency Conquerors, Market Raiders & Profit Seekers 💸🚁🕶️

Welcome to another Thief Trading Style playbook, crafted for bold traders ready to infiltrate the Forex vaults with precision.

📜 Mission Brief – The Loonie USD/CAD Buy Op:

Using a blend of 🔥strategic market intel🔥 (technical + fundamental), we’re gearing up for a targeted buy operation. The goal? Extract max profits and vanish before the guards show up. 🏃♂️💨

🎯 ENTRY POINT – Authorized Access Only!

🎯 Buy Zone #1: Around 1.37000+

🎯 Buy Zone #2: Around 1.36400 (Caution: This is Market Maker Trap turf – approach wisely)

⏳ Wait for pullback signs & reversal confirmation before execution – The real pros enter when the crowd hesitates.

🛑 STOP LOSS – Backup Plan if Things Go South

🧠 Wise raiders always have an exit route!

🔹 SL Strategy 1: Nearest Swing Low on 2H timeframe (e.g., 1.36000)

🔹 SL Strategy 2: Institutional Buy Zone SL (1.34000 or deeper)

💡 Position sizing and risk tolerance are your call, but don’t skip this shield.

🏴☠️ TARGET – Where the Loot Lies

🎯 Aim for 1.39500 or exit early if the heat rises (volatility spike/consolidation stalls)

💼 Remember, the best thieves know when to grab the bag and bounce.

💹 Scalpers Advisory – Shortcuts to Riches

👀 Only ride the bullish tide.

💰 If you’ve got capital muscle, dive in. If not, roll with the swing crew.

📌 Trail that SL like a pro – don’t get caught slippin’.

📊 Why We Strike Now – The Big Picture

USD/CAD is showing bullish signs backed by:

✔️ Macro shifts

✔️ COT reports

✔️ Sentiment shift

✔️ Intermarket synergy

✔️ Smart money positioning

🔗 Full intel available – KlicK & explore!

⚠️ High Alert: News & Chaos Protocol

🚨 News drops = alarm bells.

To survive:

📌 Avoid fresh trades during major releases

📌 Use trailing SL to protect your gains

📌 Don’t overexpose – one vault at a time

💖 Support the Crew – Hit BOOST

Your boost helps fund the next mission. Show love, share strength, and become part of the Forex Heist Syndicate 🕵️♂️💵💼

One chart at a time, we rewrite the game.

🎯 Stay locked in – next mission drops soon... 🤑💻🚀

USD/JPY "The Ninja Heist" – Bullish Loot Grab!🌟 Hey, Thieves & Market Bandits! 🌟

💰 Ready to raid the USD/JPY "The Gopher" vault? 💰

Based on 🔥Thief Trading Style🔥 (technical + fundamental heist analysis), here’s the master plan to swipe bullish profits before the market turns against us! Escape near the high-risk Yellow MA Zone—overbought, consolidation, and bear traps ahead! 💸 "Take the money and run—you’ve earned it!" 🏆🚀

🕵️♂️ Heist Strategy:

📈 Entry (Bullish Raid):

The vault’s unlocked! Buy any price—this heist is LIVE!

Pullback lovers: Set buy limits at recent/swing lows for extra loot.

🛑 Stop Loss (Escape Route):

Thief SL at recent/swing low (4H/Day trade basis).

Adjust based on your risk, lot size, and multiple orders.

🎯 Target (Profit Escape):

148.700 (or flee earlier if bears ambush!)

⚔️ Scalpers’ Quick Strike:

LONG ONLY! If rich, attack now. If not, join swing traders & rob slowly.

Trailing SL = Your bodyguard! 💰🔒

💥 Why This Heist?

USD/JPY "The Ninja" is bullish due to key factors—check:

📌 Fundamental + Macro + COT Report

📌 Quantitative + Sentiment + Intermarket Analysis

📌 Future Targets & Overall Score (Linkks In the profile!) 🔗🌍

🚨 Trading Alert (News = Danger!):

Avoid new trades during news—volatility kills!

Trailing SL saves profits on running positions.

💖 Support the Heist Team!

💥 Smash the Boost Button! 💥

Help us steal more money daily with Thief Trading Style! 🏆🚀

Stay tuned—another heist is coming soon! 🤑🎯

USD/JPY Bullish Reversal AnalysisUSD/JPY Bullish Reversal Analysis 📈💹

🔍 Technical Overview:

The chart illustrates a strong bullish reversal pattern forming on USD/JPY after price reacted from a key support zone at 144.600. This level has held firm multiple times, marked by green arrows, signaling strong buying interest.

📐 Chart Patterns & Structure:

✅ A bullish harmonic pattern (possibly a bullish Bat or Gartley) is completing near the 144.600 zone.

🔄 Multiple rejection wicks and bullish engulfing patterns indicate a potential upside reversal.

🔵 Descending trendlines have been broken, confirming momentum shift.

🔁 Previous resistance turned support (near 145.000) is acting as a possible launchpad for the next move.

🎯 Upside Target:

The projected move targets the resistance zone at 147.698, aligning with previous highs and a significant supply area.

If price breaks above 145.900 convincingly, continuation toward this resistance is expected.

🔻 Downside Risk:

A break below 144.600 would invalidate the bullish setup and expose price to the lower support range near 142.000–143.000.

📊 Conclusion:

USD/JPY is showing signs of bullish reversal from a strong demand zone. If price sustains above 145.000 and breaks the minor consolidation, the pair could rally toward 147.698 🎯.

Bias: Bullish ✅

Support: 144.600

Resistance: 147.698

USD/JPY Breaks Higher – Bullish Momentum Targets 148.40FX:USDJPY CMCMARKETS:USDJPY USD/JPY continues to climb, extending gains above the key 146.00 breakout level, supported by Fed–BoJ policy divergence and rising geopolitical tensions. Despite Japan’s strong CPI and PMI prints, the BoJ maintains a dovish tone, while tariff concerns continue to cap yen sentiment. The Middle East conflict further fuels demand for the USD as a safe haven.

Technically, the pair confirmed a bullish breakout, with price hugging the upper Bollinger Band – a sign of sustained upside pressure. As long as 146.00 holds, bulls may aim for the 148.40 monthly resistance.

Key Levels :

Resistance : 146.75 / 148.40

Support : 146.00 / 145.25

⚠️ Momentum favours the upside while above 146.00. Break below may trigger short-term pullback toward 145.25.

Market Analysis: USD/JPY Recovers Above 145.00Market Analysis: USD/JPY Recovers Above 145.00

USD/JPY is rising and might gain pace above the 145.50 resistance.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY climbed higher above the 144.00 and 145.00 levels.

- There is a key bullish trend line forming with support at 144.80 on the hourly chart at FXOpen.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a fresh upward move from the 142.80 zone. The US Dollar gained bullish momentum above 143.40 against the Japanese Yen.

It even cleared the 50-hour simple moving average and 144.00. The pair climbed above 145.00 and traded as high as 145.43 before there was a downside correction. It is now moving lower toward the 23.6% Fib retracement level of the upward move from the 142.79 swing low to the 145.40 high.

The current price action above the 144.50 level is positive. There is also a key bullish trend line forming with support at 144.80. Immediate resistance on the USD/JPY chart is near 145.40.

The first major resistance is near 146.20. If there is a close above the 146.20 level and the RSI moves above 60, the pair could rise toward 147.50. The next major resistance is near 148.00, above which the pair could test 148.80 in the coming days.

On the downside, the first major support is 144.80 and the trend line. The next major support is visible near the 144.40 level. If there is a close below 144.40, the pair could decline steadily.

In the stated case, the pair might drop toward the 143.40 support zone and the 76.4% Fib retracement level of the upward move from the 142.79 swing low to the 145.40 high. The next stop for the bears may perhaps be near the 142.80 region.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Bank of Japan Leaves Interest Rate UnchangedBank of Japan Leaves Interest Rate Unchanged

This morning, the Bank of Japan (BOJ) released its interest rate decision, keeping the rate unchanged as widely expected. According to Forex Factory, the BOJ Policy Rate remains at 0.5%.

BOJ Governor Kazuo Ueda noted the following:

→ Japan’s economy is recovering moderately.

→ The Bank will continue raising rates if economic and inflationary conditions improve.

→ The situation surrounding trade tariffs remains highly uncertain.

The fact that the decision was anticipated by markets is reflected in price action on the charts.

Technical Analysis of the USD/JPY Chart

A brief spike in volatility occurred on the USD/JPY chart this morning, but it did not significantly alter the broader structure of price movements, which in June have formed a contracting triangle pattern.

In recent days, the pair has been climbing from the lower boundary of the triangle toward the upper edge, forming a short-term ascending channel (highlighted in blue). However, in the near term, this bullish momentum may weaken as the USD/JPY rate approaches the upper boundary of the triangle, which coincides with the psychologically significant level of 145 yen to the dollar (indicated by arrows).

From a medium-term perspective, traders should watch for a potential breakout from the triangle pattern, which could trigger a meaningful trend. One possible catalyst could be news of a trade agreement between the United States and Japan.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Current USD/JPY Trend Analysis and Trading RecommendationsOn Wednesday, the USD/JPY attracted buyers for the second consecutive day, trading near 145.20 in the early European session, close to a two-week high. Japan's May CGPI rose 3.2% YoY, the slowest pace since September last year, potentially easing BOJ rate hike pressure and weakening the JPY. Additionally, optimism over a framework agreement in U.S.-China trade talks dented the JPY's safe-haven appeal. Technically, the price holds above the 200-period SMA on the 4-hour chart and breaches the 145.00 psychological level, with oscillators tilting bullish. A valid break above 145.30 (Tuesday's high) would confirm the bullish setup, targeting the 146.00 integer mark and 146.25-146.30 resistance zone.

USDJPY

buy@145.000-145.200

tp:145.600-146.000

Technical Analysis on JPY Price Action (as of June 9, 2025)📈 Technical Analysis on JPY Price Action (as of June 9, 2025)

---

🗂️ Overview:

This chart illustrates the price movement of the Japanese Yen (JPY) with clearly defined support and resistance zones. The setup suggests a bullish bias in the short term, with potential for a breakout toward previous highs.

---

🔍 Key Levels Identified:

🟥 Main Support Zone (141.80 – 142.80):

This is a strong demand zone.

Price bounced aggressively from this level in late May.

If broken, could trigger a major downside move 📉.

🟧 Support Zone (143.80 – 144.70):

Price is currently testing this zone.

Holding this area will be crucial for bullish continuation.

🟨 Resistance Zone (145.80 – 146.60):

This is the next target for bulls 🐂.

Historically acted as a supply zone, causing pullbacks.

🟫 ATH Resistance Zone (~147.80 – 148.50):

The All-Time High (ATH) resistance zone.

Strong rejection from here in the past; likely to act as a hard ceiling again 🚫.

---

🔄 Price Action Forecast:

🕊️ If the current support holds, expect a bullish move toward the 146.00–146.50 resistance.

📈 A breakout above this resistance could initiate a move to the ATH zone (147.80+).

🚨 A breakdown below 143.80 could lead to retesting the main support near 142.00.

---

📊 Technical Sentiment:

Bias: Bullish ✅

Trend: Recovering uptrend after forming a higher low.

Confirmation Needed: Break and retest of the 145.80–146.60 resistance for continuation.

---

✅ Trading Tip:

Wait for either:

🔁 A retest and bounce from 144.00 for long entries 🎯.

❌ A rejection at resistance for potential short opportunities if price fails to break 146.60.

---

📌 Conclusion:

The market shows bullish intent from support, but traders should watch the reaction near the resistance zone to confirm trend continuation. 📍Patience and confirmation are key.

USDJPY:800+ PIPS Dropping Well Since Our First Idea!Dear Traders,

Since we posted our idea when price was trading at 158 we told you that this will be a massive dropped and since then price has proven us right, now we think there is another big drop is on the way. Please use proper risk management while trading.

USD/JPY Analysis: Bears Put Pressure on Key SupportUSD/JPY Analysis: Bears Put Pressure on Key Support

As shown on the USD/JPY chart, the pair is hovering near key support at ¥142.50 per US dollar.

While demand was strong enough at the end of May to lift the exchange rate from this level to a peak around ¥146.00, USD/JPY has once again retreated to the ¥142.50 area.

Why has USD/JPY declined?

On one hand, the US dollar has weakened following disappointing economic data released yesterday. The figures revealed a sharp slowdown in private sector hiring and an unexpected contraction in the US services sector, fuelling concerns over a possible recession.

On the other hand, yen strength is being driven by the Bank of Japan's apparent willingness to raise interest rates — reaffirmed on Tuesday by Governor Kazuo Ueda — which has reinforced expectations of a tightening cycle.

USD/JPY Technical Analysis

In early June, the ¥142.50 level had already shown its role as support (as indicated by the arrow), but it is once again under pressure — a sign of bearish dominance.

Yesterday, sellers broke through local support at ¥143.57, which may now act as resistance.

More US economic data is due on Friday, with key labour market figures set to be released at 15:30 GMT+3. These could potentially trigger a bearish attempt to break below the ¥142.50 level on the USD/JPY chart.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Risk, Rates, and Reversals: What’s Next for USD/JPY?CMCMARKETS:USDJPY FX:USDJPY USD/JPY rebounded slightly to 143.10 but remains under pressure after slipping from the 144.50 on BoJ-Fed divergence and rising geopolitical tensions. While the BoJ appears cautious about accelerating its balance sheet tapering beyond FY2026, it still signals further rate hikes amid persistent domestic inflation, offering the yen structural support.

Technically, price is reacting off the lower trendline TL2, aligned with the 142.30–142.40 significant support zone. This area has held multiple times in the past and may offer a bullish pullback toward the 143.80 or even 146.15 resistance zones. However, failure to break above these levels could expose USD/JPY to renewed downside toward the 140.89 demand base.

Short-term recovery depends on Friday’s NFP and risk sentiment around trade tensions. A break below 142.30 would invalidate the bullish rebound and open downside to support near 140.89.

Resistance : 143.87 , 146.14

Support : 142.36 , 140.89