USDJPY: Bottom formation successful. Strong buy.USDJPY is neutral on its 1D technical outlook (RSI = 46.191, MACD = -0.020, ADX = 12.744) as it is consolidating around the 1D MA50. This is the bottom formation process straight after rebounding on the S1 Zone. The wider pattern is a Descending Triangle and the bottom formation suggests that the new bullish wave is about to be initiated. Go long and target the 0.618 Fibonacci level (TP = 153.500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Usdjpytrading

USDJPY: Bounce on the 17 month Support starting massive rally.USDJPY is neutral on its 1D technical outlook (RSI = 50.306, MACD = -0.870, ADX = 40.251) but is on a massive bounce on the S1 Zone, which has been holding since December 25th 2023. That Low last week also approached the 1W MA200. The LH trendline is the Resistance level of this pattern (Descending Triangle) and since the last one hit the 0.786 Fibonacci, we expect this one to hit the 0.618 Fib (TP = 153.500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY: Critical moment for the 2 month Channel Down.USDJPY is neutral on its 1D technical outlook (RSI = 46.506, MACD = -0.960, ADX = 25.882) as it is on the tightest range possible between the 4H MA50 and 4H MA200. This consolidation is taking place at the top of the 2 month Channel Down. As long as it holds, the trade is short, aiming for a -3.20% bearish wave (TP = 145.500). If the price crosses above the 4H MA200 though, go long, aiming for the R1 level (TP = 154.835).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY: Bullish signal on the 0.5 Fib.USDJPY is almost oversold on its 1D technical outlook (RSI = 32.042, MACD = -1.350, ADX = 47.008), pulling back on a technical retrace inside the long term Channel Up. This bullish wave correction is identical to the 0.5 Fibonacci pullback of December 29th 2023 that also traded on similar RSI levels. We expect the price to start recovering now and aim at the 1.382 Fibonacci. Go long, TP = 166.300.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY: Channel Up extending its 2nd bullish wave.USDJPY continues to trade on an highly bullish 1D technical outlook (RSI = 66.571, MACD = 1.090, ADX = 47.294) as today made a new high inside the 4 month Channel Up. It is on its 2nd bullish wave and it has started its 2nd stage, as it crossed above the 0.382 Fibonacci level, much like the previous bullish wave on October 21st. Aim for the 0 Fib near the top of the Channel (TP = 164.000)

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY: Technical buy opportunity on RSI fractal.USDJPY turned bearish on its 1D technical outlook (RSI = 41.175, MACD = -0.460, ADX = 31.807) as it crossed under its 1D MA50 and has failed to recover it this week. Yet, this is technically a buy opportunity in disguise as this is the exact same pattern that the price did on the March 24th 2023 Low. After the initial bullish wave start of the long term Channel Up, the price pulled back again and formed that low with the RSI at 37.000. This is the level it is right now as well. We expect the bullish wave to resume the uptrend like it did then. We are again targeting the 1.786 Fibonacci extension, only a bit lower on the R1 level (TP = 161.870).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY: Buy opportunity inside the 1H MA200 and 4H MA100.USDJPY is bullish on its 1D technical outlook (RSI = 58.138, MACD = 1.880, ADX = 50.518) which perfectly explains the Channel Up it's been trading in since October 8th. At the moment the price is on an aggressive bearish wave, which got accelerated today as it was rejected on the 1H MA50. The result is so far a direct hit on the 1H MA200 for the first time since Nov 10th. The last two HL were on the 4H MA100 however, so there is still some more room to fall but even on the current level the reward largely outweighs the risk. We are just over the 0.5 Fibonacci level afterall, which is where the November 5th low was formed. We're long, aiming for a +3.20% rise (TP = 158.500).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY: 1H Rising Wedge approaching its top.USDJPY is almost overbought on its 1H technical outlook (RSI = 69.322, MACD = 0.160, ADX = 19.927) as the price is approaching the top (HH) of the 10 day Rising Wedge. A 74.00 RSI has been the most optimal sell signal during the three past highs to start shorting. Wait for the opportunity and target the 0.5 Fib at least (TP = 149.645) as it has been the minimum target during the last two bearish waves.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY Analysis for 03/10/2024: Anticipating a Slightly Bullish.As of October 3, 2024, the USDJPY currency pair is exhibiting signs of a slightly bullish bias. Several fundamental factors and market conditions are aligning to support this outlook. Traders focusing on USDJPY today should be aware of key drivers influencing this potential movement.

Key Drivers for USDJPY Bullish Bias

1. US Dollar Strength

- The U.S. dollar is maintaining its strength amid ongoing Federal Reserve hawkishness. Recent speeches from Fed officials have reinforced the possibility of additional interest rate hikes, which supports the USD. Higher U.S. interest rates typically attract foreign investment, leading to increased demand for the dollar.

- Today, expectations of economic resilience in the U.S. are high, with upcoming non-farm payrolls and inflation data later in the week likely to cement this bullish outlook.

2. Divergence in Central Bank Policies

- The Federal Reserve’s stance is increasingly at odds with the Bank of Japan (BoJ), which remains committed to ultra-loose monetary policies. The BoJ continues to support its yield curve control program, making the yen less attractive for investors. As the U.S. tightens, the BoJ’s dovish position could lead to further depreciation of the yen, supporting a bullish USDJPY trend.

- Today’s market sentiment reflects this divergence, as traders expect the BoJ to stay accommodative while the U.S. dollar benefits from higher yields.

3. Treasury Yields on the Rise

- U.S. Treasury yields, especially the 10-year note, have been climbing. Higher yields are a crucial indicator of rising demand for the dollar. As bond yields rise, so does the attractiveness of U.S. assets, drawing capital away from yen-denominated assets.

- With Treasury yields set to increase, USDJPY is likely to follow a bullish trajectory today, as investors seek better returns from U.S. bonds.

4. Risk-On Sentiment

- Today’s global risk sentiment is relatively optimistic, which traditionally favors higher-yielding currencies like the USD over the safe-haven yen. Equity markets have seen gains, and positive sentiment around U.S. economic data could continue to support risk-on trades, driving USDJPY higher.

Technical Factors Supporting Bullish Bias

- Support and Resistance Levels: Currently, USDJPY is trading near key support levels around 149.00. A successful hold above this zone could encourage a bullish push towards the 150.00 psychological level. Breaking through this level could lead to further upward momentum, strengthening the pair's bullish bias.

- Moving Averages: On the daily chart, USDJPY remains above both the 50-day and 200-day moving averages, indicating a well-established uptrend.

Conclusion: USDJPY Slightly Bullish Bias for 03/10/2024

In conclusion, the USDJPY pair is expected to maintain a slightly bullish bias today, supported by strong U.S. dollar fundamentals, central bank divergence, rising U.S. Treasury yields, and favorable market sentiment. Traders should watch for key levels of resistance and monitor U.S. data releases later this week, which could provide additional bullish momentum for the pair.

This analysis reflects the latest fundamental factors and market conditions for USDJPY on October 3, 2024, offering insights for traders seeking to capitalize on today's potential bullish movement.

Keywords for SEO: USDJPY analysis, USDJPY forecast, USDJPY trading, USDJPY bullish bias, U.S. dollar strength, Bank of Japan monetary policy, Federal Reserve interest rates, U.S. Treasury yields, Forex market analysis, USDJPY 03/10/2024, TradingView analysis.

USDJPY: Going for the 1D MA200. Bottom priced in.USDJPY is neutral on its 1D technical outlook (RSI = 52.086, MACD = -0.760, ADX = 27.579) as it is recovering from the previous oversold state and is already approaching the 1D MA50. September 16th was technically the new HL on the one year Channel Up bottom, with the 1D RSI already on a bullish divergence. These are all formation we saw on its previous bottom on January 16th 2023, whose rebound that followed initially hit the 1D MA200 before going for a full yearly extension. That's our medium term target again (TP = 150.500).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY: Bullish short term. Attention at the top of the Channel.USDJPY is neutral on its 1D technical outlook (RSI = 53.858, MACD = 0.730, ADX = 52.633) and is rebounding after almost the second 1D MA50 test in 2 weeks. The pair is capitalizing on the bullish momentum of the 1 year Channel Up but this rebound could be the last before a correction, as the price is very close to the HH top trendline. Our goal is still that top (TP = 160.000).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY: Excellent buy opportunity.USDJPY is bearish on its 1D technical outlook (RSI = 41.212, MACD = -0.110, ADX = 47.052) but not only is the price making a rebound on the 1D MA200 but the 1D RSI is also staging a rebound from nearly oversold levels, much like it did on July 13th 2023. All this price action is taking place inside a long term Channel Up pattern, so this is a buy opportunity with significant upside potential. Our target is the top of the Channel (TP = 160.00).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

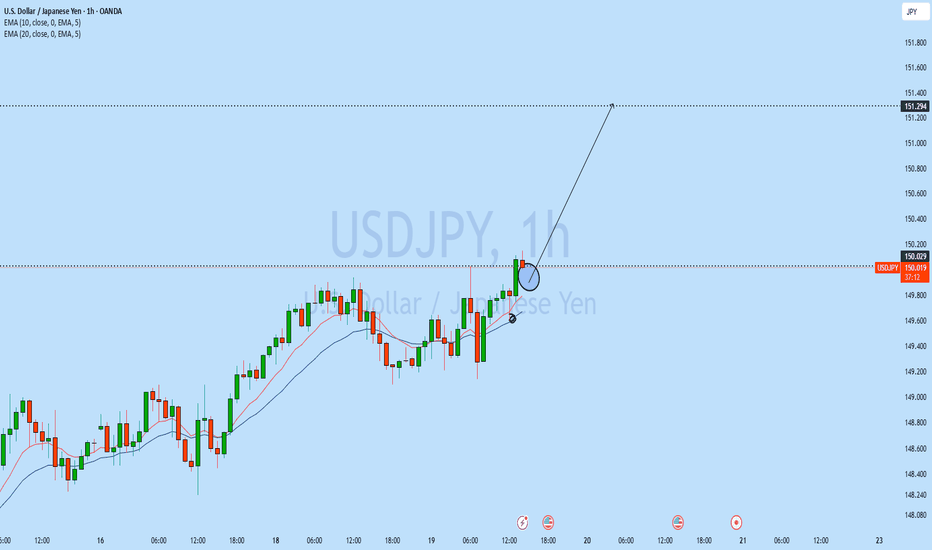

USDJPY: Will the Growth Continue?! 🇺🇸🇯🇵

As I predicted earlier, USDJPY nicely respected a broken key horizontal structure on a daily

and bounce from that.

Analysing a 4H time frame, I spotted one more bullish confirmation:

this time, the price violated a resistance line of a symmetrical triangle formation.

We may expect a retest of a current high now,

with a consequent continuation to 151.3 level.

❤️Please, support my work with like, thank you!❤️

USDJPY: Sustainable rise on 1D. Buy.USDJPY is on a bullish 1D technical outlook (RSI = 66.246, MACD = 0.750, ADX = 53.805) as the price has established trading over the 1D MA50, negating a potential 1D Death Cross and is extending the bullish wave inside the Channel Up. The 1D RSI looks like March-April 2023 so far which was the start of the second bullish wave of 2023. We are expecting a minimum of +10.75% rise and remain bullish on the medium term (TP = 155.000).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY: Bottom of Channel Up. Time to decide.USDJPY is trading inside a Channel Up since the start of the year, with the 1D technical outlook just turning red (RSI = 40.803, MACD = -0.760, ADX = 32.756) as the price reached its bottom under the 1D MA100. The 1D RSI shows a rounded bottom, as it did on March 24th, so it is an optimal level to buy and target the R1 level (TP = 152.000).

Since though the November 13th top and rejection happaned on that R1 level itself, it is not impossible to see the Channel Up finally break and start a long term correction. Consequently if the price crosses under the dotted trendline, we will target the 1D MA200 initially (TP1 = 143.050) and following a relief rebound, eventually aim for the S1 level (TP2 = 138.085).

See how our prior idea has worked:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY: Japan's Economic Minister warned that the global recessiStatement from Japan's Minister of Economy on the third quarter GDP report:

It should be noted that the threat of global recession is depressing the Japanese economy

Domestic demand, including consumption and investment funds, decreased significantly in the third quarter

Personal consumption slumps due to rising prices

Industrial production is under pressure due to rising raw material prices and reduced investment in construction and machinery.

Consumption of services such as eating out continues to recover

Concerns about the future of the Chinese economy need to be carefully monitored

USDJPY: Start selling, Channel Up about to form its High.USDJPY is approaching the R1 level (152.000), which is the October 21 2022 High that caused an immediate bearish reversal. The 1D MA50 is supporting a steady technical uptrend on the 1D timeframe (RSI = 60.333, MACD = 0.530, ADX = 16.176) but the RSI is descending, showing a potential bearish divergence. We consider the current level good enough to start shorting for a correction to the Channel Up bottom (TP = 145.500).

See how well our prior idea has worked:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY: Final rise before the pullback.USDJPY has been extending the fierce rise inside the Channel Up on a healthy bullish 1D technical outlook (RSI = 64.951, MACD = 0.990, ADX = 45.150). The 1D RSI has turned sideways since August 16th, a first indication that the uptrend might be losing steam.

In our view, it is entering the last stage of this rise before a rejection to the 1D MA100 is materialized. See how every Resistance, prior LH of the 2022 decline has been filled and the final one is the R5 level at 152.000. If the pullback starts there, we will short and target the Fibonacci 0.5 level (TP 145.000), a similar structure that priced the July 14th Low.

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY: Rebound on the 1D MA50. Buy signal.USDJPY is on the third straight green 1D candle after a rebound on the 1D MA50 that has turned the 1D time-frame into healthy bullish levels (RSI = 60.603, MACD = 0.480, ADX = 30.898). This is technically a bullish continuation signal, with the 1D MACD after a Bullish Cross, resembling the bullish sequence of April.

We are long, targeting the R3 level (TP = 146.800). If the price crosses under S1, we will short and target the S2 level (TP = 133.515).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY: Double Channel Up pattern. Keep buying until it breaks.USDJPY is trading on a Channel Up inside a long term Channel Up pattern. The 1D time frame is overbought (RSI = 71.702, MACD = 1.430, ADX = 43.738) and as the RSI entered the Resistance Zone of March 1st, we expect a short term pull back inside the first Channel Up to 141.300. If the bottom (dotted lines) holds, we will buy and target towards the R3 (TP = 146.000).

If however the price crosses under the Channel and as such the 1D MA50 too, we will sell and target the S2 (TP = 133.515). The HL trend line can offer an early sell warning if it breaks.

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDJPY has formed reversal on daily, possible drop!!USDJPY( Daily) was in a bullish move for the long term. The price action only daily has created a reversal pattern and on the close of the monthly candle, we could see deeper retracement and a potential drop in USDJPY. We see a double top, followed by a head and shoulder and, today's daily candle has just tested the neckline of this double as resistance and strongly rejected. At the same time, daily head & shoulder has lower highs on the right side. As the monthly & weekly close is nearing, there is highly likely that USDJPY will come for a deeper retracement to the downside!!

If you like this analysis. Do not forget to like and comment to help the idea.

Thank you!!