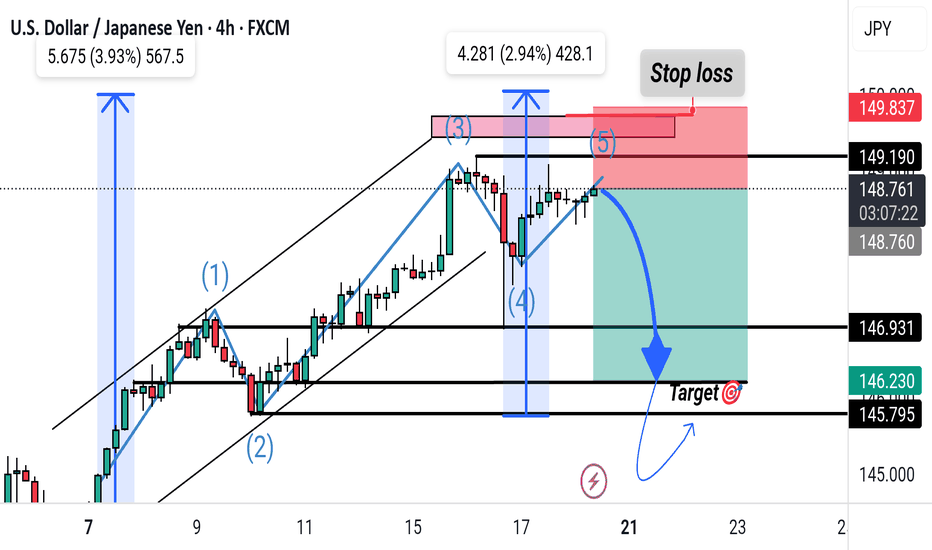

"USD/JPY Elliott Wave Short Setup – Targeting Key Support Zone"This chart shows a potential USD/JPY short trade setup based on Elliott Wave analysis. The price appears to have completed a 5-wave upward structure, reaching resistance near 148.75–149.19. A short position is suggested with:

Entry: Around 148.75

Stop Loss: Above 149.19

Target: 146.23–145.80 support zone

The trade aims to capture a corrective move following wave (5).

Usdjpyupdate

USD/JPY Made H&S Reversal Pattern , Short Setup Valid !Here is my 15 Mins Chart on USD/JPY , We have a very clear reversal pattern , head & shoulders pattern and we have a confirmation by closure below our neckline so we can enter direct now or waiting the price to go back and retest the neckline and this is my fav scenario .

USD/JPY 1H chart PATTERNUSD/JPY 1H chart, the pair has broken below an ascending channel, which is typically a bearish signal. The price is currently inside the Ichimoku cloud, indicating uncertainty, but a breakdown seems likely.

📉 Bearish Target Points:

1. First Target:

✅ 146.078 — Near the bottom edge of the Ichimoku cloud and a horizontal support level.

2. Second Target:

✅ 145.300 — Clear support zone below the cloud, also aligns with previous consolidation area.

---

🔎 Additional Notes:

A breakdown below the Ichimoku cloud will confirm stronger bearish momentum.

Watch for a retest of the lower trendline or cloud support before a deeper drop.

Use stop-loss above 146.80 to manage risk if you're trading this setup.

Let me know if you want a buy/sell entry recommendation or SL/TP planning.

(BTC/USD) Short Trade Setup – Bearish Reversal from Resistance 1. Entry Point: 111,516.84

2. Stop Loss: 112,858.08

3. EA Target Point (Take Profit): 106,068.04

4. Resistance Point: ~110,563 (currently being tested)

Trade Setup Summary:

Type: Short position

Risk (Stop LOss - Entry): 112,858.08 - 111,516.84 = 1,341.24

Reward (Entry - Target): 111,516.84 - 106,068.04 = 5,448.80

Risk/Reward Ratio: Roughly 1:4, which is favorable.

Technical Indicators:

The chart shows:

Moving Averages: A red (shorter) and blue (longer) MA, suggesting recent bullish momentum.

Price Action: Consolidation near the resistance after an uptrend; current candle appears bearish and breaking the support.

Interpretation:

This is a bearish reversal setup.

If the price breaks the support around 110,563 convincingly, it may confirm a move downward.

The stop loss is placed safely above recent highs to avoid getting caught in short-term volatility.

The target is significantly lower, around previous support levels, implying a strong move down is anticipated.

Risk:

This strategy banks on a clear breakdown. If the support holds, price may reverse upward, hitting the stop loss.

USDJPY with Price ActionPrice has broken above the key pivot zone around 145.00, which previously acted as resistance and may now flip into support. We’re currently seeing a minor pullback near the 145.60–146.00 zone after a strong bullish impulse. This red-circled area highlights hesitation, but as long as the price holds above the pivot, I’m maintaining a bullish bias.

The market structure remains clean with higher highs and higher lows. The volume spiked during the move up and has decreased on the pullback—exactly what I want to see in a healthy retracement. I'm watching for a bullish reaction at or slightly above 145.00 to confirm continuation.

If we get a strong bounce from the pivot zone, I’m targeting 147.00 as the first level and 148.50 as the extended target. However, if price breaks and closes below 145.00 with momentum, I’ll reassess—downside support could be around 143.50–144.00.

Next steps: Waiting for a confirmation entry signal (bullish engulfing or strong rejection wick) near the pivot. Key risk to this setup is upcoming USD news and any BoJ commentary that could trigger volatility.

Staying patient—will update if the pivot holds or fails.

WHY USDJPY BULLISH ??DETAILED ANALYSISUSDJPY is currently reacting strongly from a well-established demand zone near the 142.50–143.00 level. After a sharp correction, price has shown signs of exhaustion at support, suggesting a potential bullish reversal is underway. If this bounce sustains, we could see a significant upside move toward the 157.00 region, aligning with the previous high and maintaining the longer-term bullish structure.

From a technical standpoint, this level has historically acted as a key pivot zone. The bullish engulfing candlestick pattern forming here hints at renewed buyer interest, and with risk-reward highly favorable, this could be an ideal entry point for swing traders. The risk remains limited below 139.00, while the upside potential offers over 1:3 reward.

Fundamentally, the divergence in monetary policy between the Federal Reserve and the Bank of Japan continues to support a bullish outlook for USDJPY. Recent U.S. inflation data came in hotter than expected, reigniting speculation that the Fed may delay rate cuts. Meanwhile, the BoJ has shown minimal inclination to shift away from ultra-loose policy, keeping the yen pressured.

This pair remains one of the top-watched on TradingView, drawing high search volume due to its volatility and potential breakout structure. With market sentiment leaning risk-on and yield differentials favoring the dollar, this rebound from support could be the beginning of a new leg up. Keep an eye on DXY movements and U.S. treasury yields for confirmation.

USD/JPY Ready For Sell To Give Us 250 Pips In The Next Days !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

USD/JPY Broke D Res Area , Be Reay To Buy It And Get 200 Pips !We have a very good Daily closure above our daily res , so we have a very good chance to buy this pair with retest to this broken res area and targeting 200 pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

USD/JPY Finally Breakout , Best Place To Buy It To Get 200 Pips This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

USD/JPY Ready For Sell After Daily Closure , Are You Ready ?This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

USD/JPY Giving Amazing Bearish P.A , Short Setup Valid Soon !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

✨FULL USDJPY. Multitimeframe Analysis✨☝️Do not act based on my analysis, do your own research!!

The main purpose of my resources is free, actionable education for anyone who wants to learn trading and improve mental and technical trading skills. Learn from hundreds of videos and the real story of a particular trader, with all the mistakes and pain on the way to consistency. I'm always glad to discuss and answer questions. 🙌

☝️ALL ideas and videos here are for sharing my experience purposes only, not financial advice, NOT A SIGNAL. YOUR TRADES ARE YOUR COMPLETE RESPONSIBILITY. Everything here should be treated as a simulated, educational environment. Important disclaimer - this idea is just a possibility and my extremely subjective opinion. Do not act based on my analysis, do your own research!!

Best Place To Sell USD/JPY After We Have A Good Confirmation 👌This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

USDJPY Wave Analysis Update: Potential for Upside ContinuationHello Traders,

The initial perspective I held regarding this pair has been disproven by subsequent market developments. Hence the need for this update. As it stands, given that we don't have a combination, it appears the ABC correction in wave 4 might have been fully formed and we have now seen the smaller degree wave 1 of larger degree wave 5. If this scenario holds true, we might see a corrective downward move to 145.433 - 145.235 to complete smaller degree wave 2 before the continuation to the upside. I will looking to buy at the 145.433 & 145.235 price region while targeting 147.956 in the medium term.

Cheers and happy Trading!

USDJPY | Perspective for the new week | Follow-upIn light of recent data, Thursday's release indicated that U.S. consumer price index (CPI) inflation for July met expectations, mirroring the previous month's trajectory. This outcome has fueled speculation that the Federal Reserve will maintain its current interest rates in September. However, this development has concurrently prompted a reduction in expectations for a rate cut within the current year, leading to the anticipation of sustained rates at their 22-year highs.

Consequently, this adjustment has exerted downward pressure on risk-oriented assets, inducing a sense of caution among investors reluctant to engage with Asian currencies, given the prevailing robust outlook on U.S. interest rates.

As a result, the Japanese yen bore the brunt of this shift, registering a decline to a one-month low during overnight trading, only to stabilize in proximity to the pivotal 145 threshold on Friday. However, it is noteworthy that trading volumes remained subdued due to a market holiday observed in the country.

USDJPY Technical Analysis:

In this video, we conduct an in-depth technical analysis of the USDJPY chart, carefully examining the current market structure. Our primary focus is within the key zone of 145.000, which will serve as our center of focus ahead of the upcoming week. As price action remains within this zone, it becomes an area of interest that could lead to choppy consolidation before a clear direction emerges. The market's reaction around this area at the beginning of the new week will heavily influence the trajectory of price action in the days to come.

Join me on this journey as we explore potential trading opportunities using trendlines, key levels, and chart patterns. Be sure to stay connected to my channel, follow my updates, and actively engage in the comment section as we navigate the dynamic USDJPY market together.

Wishing you the best of luck as you chart your course in the USDJPY market this week.

Disclaimer Notice:

Please be aware that margin trading in the foreign exchange market, including commodity trading, CFDs, stocks, and other instruments, carries a high level of risk and may not be suitable for all investors. The content of this speculative material, including all data, is provided by me for educational purposes only and to assist in making independent investment decisions. All information presented here is for reference purposes only, and I do not assume any responsibility for its accuracy.

It is important that you carefully evaluate your investment experience, financial situation, investment objectives, and risk tolerance level. Before making any investment, it is advisable to consult with your independent financial advisor to assess the suitability of your circumstances.

Please note that I cannot guarantee the accuracy of the information provided, and I am not liable for any loss or damage that may directly or indirectly result from the content or the receipt of any instructions or notifications associated with it.

Remember that past performance is not necessarily indicative of future results. Keep this in mind while considering any investment opportunities.

USDJPY | Perspective for the new week | Follow-upThe USDJPY market sentiment is undergoing a captivating transformation, edging from neutral to bearish, with intriguing signs of bullish exhaustion surfacing.

The Japanese currency is on the rise, gaining traction as Bank of Japan (BoJ) comments reveal plans to widen the benchmark 10-year Japanese Government Bonds (JGB) from 0.5% to 1.0%. This move has propelled Japanese yields to their highest levels since 2014, sparking anticipation of a potential pivot by the BoJ. However, the Yen remains vulnerable unless the bank takes decisive action. Currently, there's a prevailing perception that the BoJ's hawkish signals and surging Japanese yields might curtail the pair's gains in the foreseeable future.

As we journey through the US economy's realm, recent developments have dealt a blow to the bulls. The lower-than-expected increase in Nonfarm Payrolls, with a mere 187,000 new jobs reported in the July jobs report, has significantly impacted investor sentiment. The implications of Fitch's downgrade of the United States government's long-term debt rating further add complexity to the picture.

Amidst this intricate landscape, all eyes now turn to the upcoming week, where no high-impact events are expected from Japan's economy. Traders are keenly observing US economic indicators for pivotal signals that could shed light on the likely direction of prices. The BoJ's hawkish stance continues to play a major role in shaping the currency's trajectory.

USDJPY Technical Analysis:

In this video, we conduct an in-depth technical analysis of the USDJPY chart, carefully examining the current market structure. Our primary focus is within the key zone of 142.000, which will serve as our center of focus ahead of the upcoming week. As price action remains within this zone, it becomes an area of interest that could lead to choppy consolidation before a clear direction emerges. The market's reaction around this area at the beginning of the new week will heavily influence the trajectory of price action in the days to come.

Join me on this journey as we explore potential trading opportunities using trendlines, key levels, and chart patterns. Be sure to stay connected to my channel, follow my updates, and actively engage in the comment section as we navigate the dynamic USDJPY market together.

Wishing you the best of luck as you chart your course in the USDJPY market this week.

Disclaimer Notice:

Please be aware that margin trading in the foreign exchange market, including commodity trading, CFDs, stocks, and other instruments, carries a high level of risk and may not be suitable for all investors. The content of this speculative material, including all data, is provided by me for educational purposes only and to assist in making independent investment decisions. All information presented here is for reference purposes only, and I do not assume any responsibility for its accuracy.

It is important that you carefully evaluate your investment experience, financial situation, investment objectives, and risk tolerance level. Before making any investment, it is advisable to consult with your independent financial advisor to assess the suitability of your circumstances.

Please note that I cannot guarantee the accuracy of the information provided, and I am not liable for any loss or damage that may directly or indirectly result from the content or the receipt of any instructions or notifications associated with it.

Remember that past performance is not necessarily indicative of future results. Keep this in mind while considering any investment opportunities.

USD/JPY Gave Yesterday +100 Pips 0 Drawdown , New Entry Valid !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

USD/JPY Made Inverted Head &Shoulders pattern , Can We Buy Now ?This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

USD/JPY Short Scalping Setup And Long Swing Setup For Free !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

BluetonaFX - USDJPY 06/06/2023 Progress Report UPDATEHi Traders!

Just after two weeks, we have reached our forcasted Vector level of 142.255 on the USDJPY (PLEASE SEE LINK TO ORIGINAL IDEA BELOW). The 137.915 support area held and we got the anticipated push to 142.255.

We have not been around this level for seven months, so this is a key level and we will see over the next few days how strong the resistance is here.

If there is a pullback from 142.255 then we expect a possible retracement to the 140 area. However, if 142.255 breaks and continues, the bullish push the next key long term level is at 145.108 (WE HAVE THIS LEVEL IN OUR OTHER PREVIOUS IDEA LINKED BELOW).

Please do not forget to like, comment and follow.

Thank you for your support.

BluetonaFX

BluetonaFX - USDJPY Critical Week for the US Dollar UpdateHi Traders!

PLEASE SEE LINK TO ORIGINAL IDEA BELOW.

USDJPY has now broken the 140 level with momentum to reach the 141 area and has fulfilled our idea. We have also broken our bullish price channel on the chart. We have further long-term vector levels to the upside that we mentioned in our previous ideas (links also below).

We do have further fundamental announcements today with the ECB's interest rate decision later today and US Retail Sales and Initial Jobless Claims so please make sure that you trade safely and responsibly.

Please remember to support us by liking, following, and commenting on our posts; this helps us greatly.

Thank you for your support.

BluetonaFX