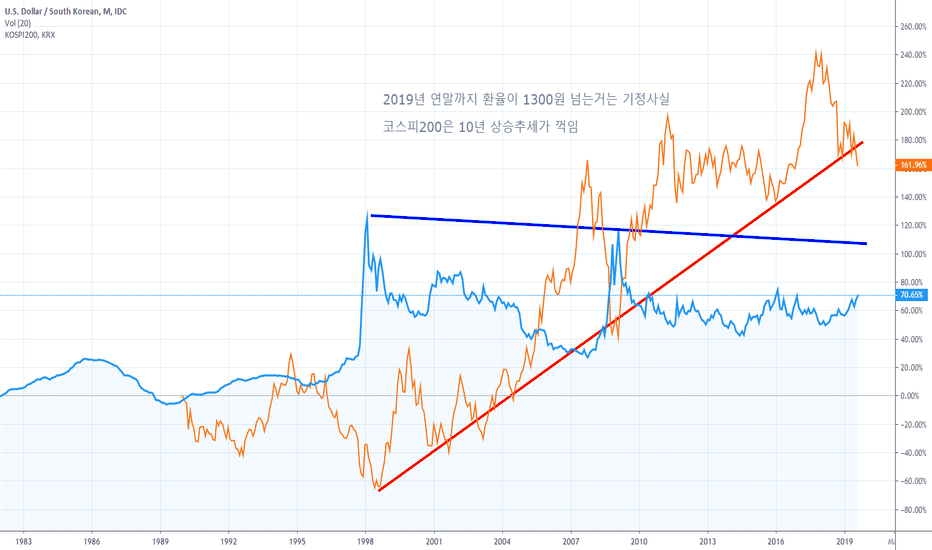

Turning point for the South Korean WonPicture perfect technical setup here for a short play to the downside for USDKRW.

- We hold a guarded optimistic view on economic recovery across the South Korean economy following revisions in growth expectations. We see slowing growth bottoming out with sensitivity now positioned to the upside and a gradual rebound across the semiconductor sector as a hedge against further monetary easing.

- Confirmation via BOK commentary should see decisive technical conviction through the neckline and flows into the buyside floor as optimism rises.

- Put exposure added across our macro and directional portfolios.

USDKRW

ridethepig | KRW 2020 Macro MapKorea's economy looks set to be forming a meaningful floor in Q4 and with a helping hand from a temporary pause in protectionism we should see KRW remain in bid for the first half of 2020.

For the domestic story, Korean exports have fallen which spilt over to the demand side. With this in mind, should the USD devaluation / reflationary theme pick up pace for the first half of 1H20 it will mean repricing in KRW. On the monetary side, cuts are widely priced from BoK for January. Fundamental risks to the thesis com from US-China trade and the significance of USD devaluation.

On the technicals, a textbook Steel Resistance has held at 1219.xx after completing an ABC target sequence. Very high odds a meaningful top is in place and invalidation to this count comes in above 1200.

Thanks for keeping the support coming with likes, comments, questions and etc. Another round of 2020 FX maps coming over the next few sessions. For those wanting to dig deeper with the 2020 strategies:

NZDUSD

USDJPY

EURUSD

EURSEK

USDCNY

USDKRW - Depreciation of the Korean Won Accelerates. After breaking the 2yr highs a couple of days ago, now it seems we will get close to 1210, a level reached on January 2017.

I expect the USDKRW to go higher, especially since the slowdown in local economy and not good news from the US/China trade talks.

I do not recommend buying the KRW at his levels. Any bad news from US/China trade talks will make the KRW go lower, and in case of good news I do not see traders going back to KRW.

USD/KRW retracement near the end of 2019 South Korea's policy to raise the salary will make this currency inflated more and continue becoming weaker and weaker to USD. Bearish trend will continue until the end of 2019, until it meets a strong resistance at 103x~104x+. Hard resistance at 101x.

In short term, salary might undermine KRW due to inflation, however, in the long-term, this policy will attract more foreign labors and eventually have a good effect on the currency. Beside, the inflation also have good impacts on Korea's export.

At this point, a good long position will be available.

Good exit at Fib retracement 0.5

For more details, see the chart analysis.