Title: Ringgit Rally Fuels Foreign Bond Inflows: A Deep DiveThe Malaysian ringgit has experienced a substantial appreciation, driven by robust foreign investment in the domestic bond market. A surge in capital inflows, totaling RM5.5 billion in July alone, has propelled the ringgit's performance. This analysis delves into the underlying economic factors driving this trend, examining key indicators and assessing the outlook for sustained growth. While the current trajectory is promising, investors must remain cognizant of potential global economic headwinds.

Key Points:

Strong foreign inflows into Malaysian bonds

Ringgit's appreciation driven by multiple factors

Deep dive into economic indicators shaping USD/MYR

Assessment of Malaysia's economic fundamentals

Cautious outlook amid potential global challenges

Key Drivers of the Ringgit Rally:

Currency Appreciation: Investors are buying bonds unhedged, betting on further ringgit gains.

Strong Domestic Economy: Malaysia's economic robustness and expected interest rate stability bolster investor confidence.

Global Factors: Anticipated Federal Reserve rate cuts weakening the USD benefit the ringgit.

Economic Indicators Influencing USD/MYR:

Interest Rate Differentials: Higher local rates attract foreign capital, strengthening the ringgit.

Inflation Rates: Low inflation supports currency value.

T rade Balance: Surpluses strengthen the ringgit, reflecting Malaysia's export strength.

Economic Growth: Domestic consumption and government spending drive economic growth, enhancing the ringgit's appeal.

Political Stability: A stable political climate attracts investment, supporting the currency.

Global Economic Conditions: Global trends and geopolitical events affect investor risk appetite and currency flows.

Outlook:

Malaysia's diversified economy, fiscal prudence, and growing middle class underpin the ringgit's strength. Efforts to boost foreign direct investment and exports further support currency appreciation. However, global uncertainties, US monetary policy shifts, and geopolitical tensions could introduce volatility.

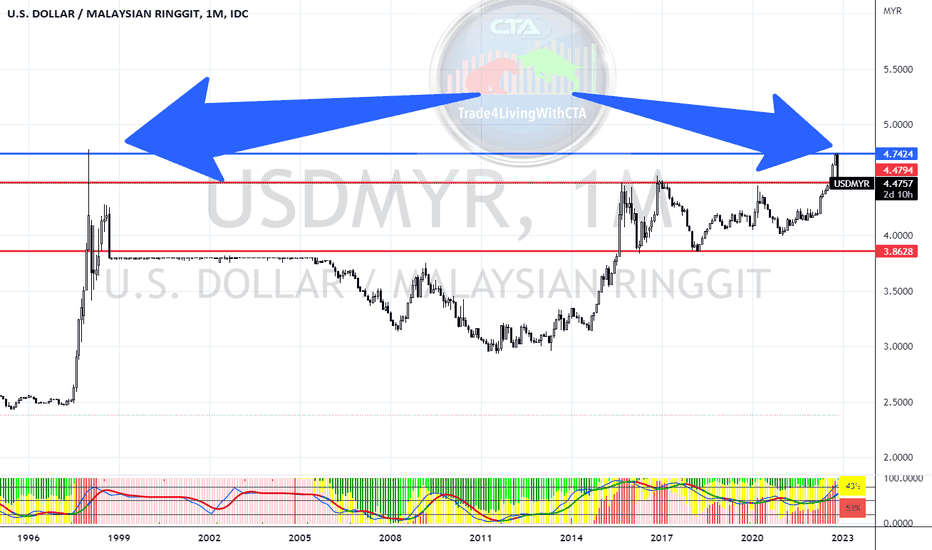

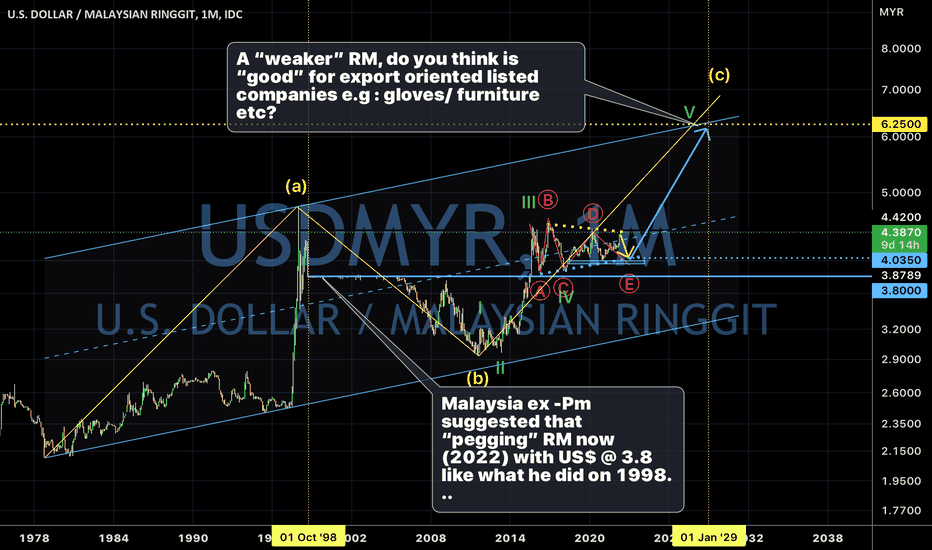

USDMYR

USDMYR Simple Chart AnalysisUSDMYR - This chart can use to monitor our country economy too, hopefully the double top here can indicate that our MYR can continue to be strengthen under the unity government.

How to view the guidance via chart ( Refer back to pin message guidance if to trade )

Red Line = Support

Blue Line = Resistance

Light Blue = bullish/bearish pattern

Arrow = Double/Trip top/bottom

Red Chip = $$

Green Chip = XX

USDMYR - 26Apr2022USDMYR - 26Apr2022

On the daily, USDMYR has reached its upside triangle breakout target. Noting daily RSI is also at resistance.

On the H8, price is overbought and Stochastic is at resistance. We could expect USDMYR to pull back to 1st Support at 4.3230.

Disclaimer: This is for personal work record purposes only, not financial advise or solicitation of trade.

USDMYR - 25Apr2022USDMYR - 25Apr2022

On the weekly, USDMYR had a huge surge higher last week on the back of USD strengthening + oil price pulling back. It is now approaching its triangle breakout target at around 4.3500. Also noting daily RSI is at resistance.

On the H8, same outlook as the daily. H4 Stochastic is also at resistance. In view of resistance on different timeframe, USDMYR is expected to face bearish pressure once it achieve its triangle upside target at around 4.3500

Disclaimer: This is for personal work record purposes only, not financial advise or solicitation of trade.

USDMYR - 22Apr2022USDMYR - 22Apr2022

On the daily, USDMYR macro triangle breakout was revised and the revised upside target is to around 4.3500 in the medium term. However Daily RSI is at resistance and it may pull back / consolidate sideways before further upside.

On the H8, same outlook as the daily. Price is overbought and need to pull back / consolidate before continuing upside target to 4.35000.

Disclaimer: This is for personal work record purposes only, not financial advise or solicitation of trade.

USDMYR - 20Apr2022USDMYR - 20Apr2022

On the daily, USDMYR surged on the back of oil prices pulling back to the triangle target at around 4.2800. Daily RSI has also just hit resistance.

On the H8, USDMYR surged even though it was a Malaysia public holiday yesterday. H4 Stochastic is also at resistance. For today, we could expect USDMYR to pull back to at least 1st Support at 4.2520 today.

Disclaimer: This is for personal work record purposes only, not financial advise or solicitation of trade.

USDMYR - 18Apr2022USDMYR - 18Apr2022

On the weekly, price has bounced above 78.6% Fib at 4.2290. We could expect it to retest its highs at 4.2470.

On the H8, USDMYR is retesting resistance at 4.2370. Once price can close above, we could expect it to continue its upside target to 4.2580. On the way to its upside, price is expected to face bearish pressure at 4.2463 and 4.2510.

Disclaimer: This is for personal work record purposes only, not financial advise or solicitation of trade.

USDMYR - 11Apr2022USDMYR - 11Apr2022

On the weekly, USDMYR closed higher last week.

On the H8, USDMYR resumes its bullish momentum after breaking the minor triangle. However, H8 target is only around 4.260. If USD can continue to strengthen across the board + oil price pulling back, this target can be achieved within these few days.

This is for personal work record purposes only, not financial advise or solicitation of trade.

USDMYR - 06Apr2022USDMYR - 06Apr2022

On the weekly, USDMYR faced bearish pressure and formed a doji candle last week. Nevertheless, it is now bouncing higher to continue its triangle breakout target to around 4.270.

On the H8, USDMYR also broke another small triangle. However, H8 target is only around 4.260. If USD can continue to strengthen across the board + oil price pulling back, this target can be achieved within these few days.

This is for personal record purposes only, not financial advise or solicitation of trade.

USDMYR - 01Apr2022USDMYR - 01Apr2022

On the H4, price is making lower highs and lower lows. It has now bounce back near the descending trendline resistance. We could expect price to face bearish pressure and drop lower to 200MA support around 4.1950.

This is for personal record purposes only, not financial advise or solicitation of trade.

USDMYR - 28Mar2022USDMYR - 28Mar2022

USDMYR faced bearish pressure from the resistance at 4.2360. On the daily with the long bearish candle, price could possible drop back to 20EMA + 1st Support at 4.1985 before a bounce.

On the H8, price closed below the 20EMA and is now at support. With the bearish momentum, we could expect price to drop further to 1st Support at 4.2000 before rebounding back.

This is for personal record purposes only, not financial advise or solicitation of trade.

USDMYR - 25Mar2022USDMYR - 25Mar2022

On the H8, price has pulled back to 1st Support at 4.2180. Stochastic also have pulled back from resistance. For today, we could expect USDMYR to bounce back and retest 1st Resistance at 4.2360.

This is for personal record purposes only, not financial advise or solicitation of trade.

USDMYR Exchange RateLong shadow candles appear on the daily chart. Well, before you say anything, yes the candle isn't close yet, but it's a pretty good exchange rate.

If you had earned from trading and the denomination is in USD, it is a good time to withdraw some profits. 4.2240 indeed is a great zone for profit-taking.

You will be surprised, at how much more $$ it will bring you when you time your withdrawal.

However, it is not a good time to pay using MYR for your USD commitment, SGD will be a better option(if you had stored SGD in advance).

Never underestimate the importance of business planning from shifting your cashflow from 1 currency to another.

USDMYR - 24Mar2022USDMYR - 24Mar2022

On the H4, price bounced as expected to previous resistance at 4.2360. With Stochastic at resistance, USDMYR is looking to pullback/consolidate first before bouncing higher to daily target around 4.28000.

This is for personal record purposes only, not financial advise or solicitation of trade.

USDMYR - 23Mar2022USDMYR - 23Mar2022

On the daily, USDMYR managed to bounce back above the trendline to continue its triangle breakout upside target to around 4.2700

On the H4, price has managed to close and confirm above Fib confluence at 4.2120 before pulling back. After a quick pullback, we could expect USDMYR to continue its uptrend to target at 4.27000

This is for personal record purposes only, not financial advise or solicitation of trade.