USDMYR - 25Oct2021USDMYR - 25Oct2021

On daily timeframe, price close below trendline. Will need to wait for today close to determine whether there are further downside.

On the H8 timeframe, price is still holding support at 4.1500.

Will need to wait out for today price action to determine further bias.

This is for personal record purposes only, not financial advise or solicitation of trade.

USDMYR

USDMYR - 22Oct2021USDMYR - 22Oct2021

On the H8 timeframe, price is consolidating sideways. With the pullback in oil price last night, USDMYR might rebound to 1st Resistance at 4.1705.

It also looks like it might go down test the daily 200MA some time next week.

This is for personal record purposes only, not financial advise or solicitation of trade.

USDMYR - 14Oct2021USDMYR - 14Oct2021

On H4 timeframe, price gap down below major support level indicating future bearish momentum. For now, it's oversold and due for short-term bounce to 1st Resistance before facing bearish to 1st Support.

This is for personal record purposes only, not financial advise or solicitation of trade.

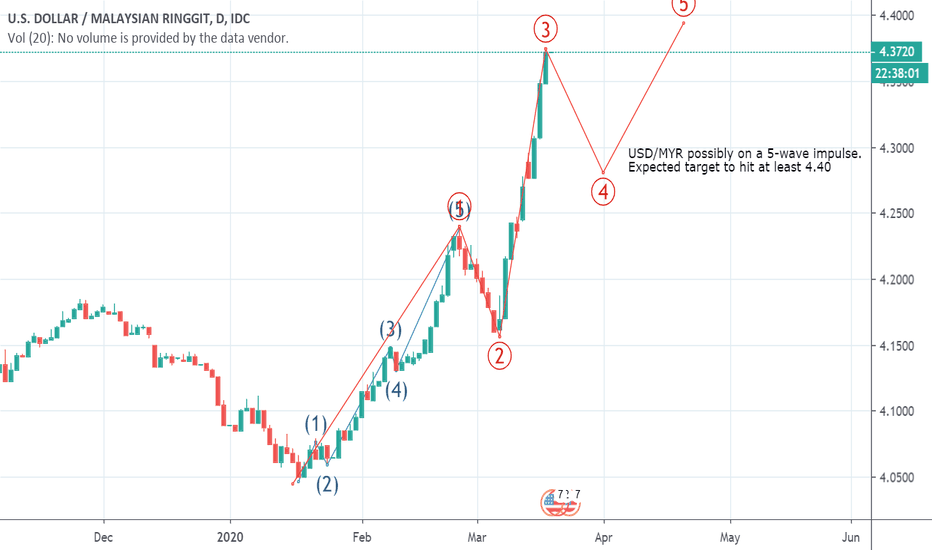

USDMYR on Wave 5 Final Leg ?

USDMYR has been respecting the daily trendline from the start of March.

USDMYR has been respecting the 50% and 61.8% fib retracement levels (from 2020 low to 2020 high)

Possible upward breakout of the triangle to complete Wave 5 final leg. Target just above Wave 3 high (4.4480)

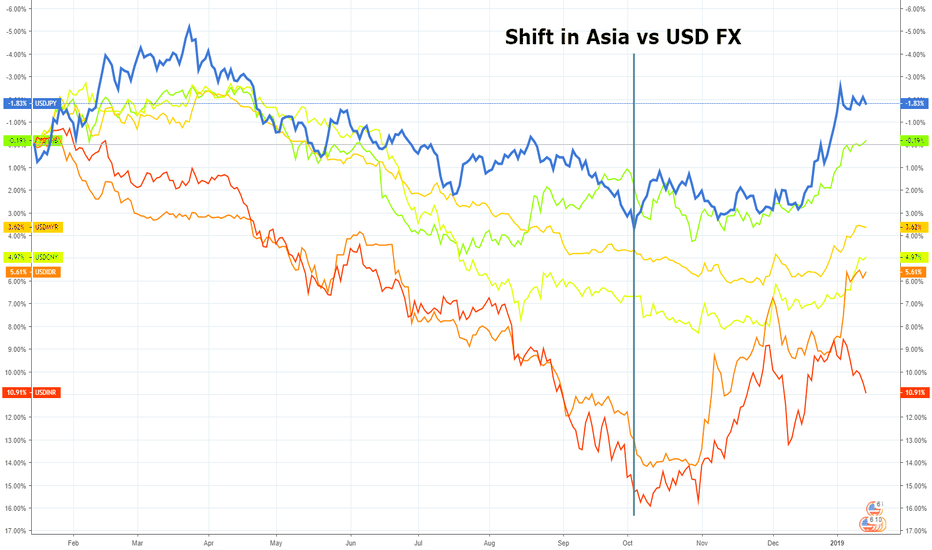

Asia Forex: Comparison chart vs USDFor the purposes of taking a broader view of movements in forex markets...

Chart: 1-year performance of JPY, THB, MYR, CNY, IDR, INR vs the USD (inverted)

Since October, there has been a marked improvement in the performance of Asian currencies. The change means Asian currencies have paired losses over the last 12 months, with the yen and Tai bot entering the black.

A relief rally or turning point for Asia FX?

USDMYR heading to 4.165This is a historical study on how fibonacci spirals work in price cycling, back to 2016 November, ringgit start strengthening with the rebound of oil price. and the down cycling projection projected as 4.26, 4.11 and 3.87. Ringgit reach the previous high at 3.85 then start weakening.

On the right side we have up cycling projection which indicating ringgit to reach 4.165 in the near term. As you can see fro the projection levels price found short term retracement 3.97 & 4.04 and the trend remain until we see lower low set up.

Sticking the knife in for real pain=> Dark clouds continue to rest over EM, we are eyeballing a 4% move here against Malaysia.

=> Almost 90% of short term debt in Malaysia is covered by FX reserves whilst two thirds come in the form of short term borrowing.

=> If the banking system continues to feel pressure via uncertainty from Chinese officials then we are going to see some real pain here.

=> The risk to our thesis is that uncertainty around EM begins to fade, a scenario we unfortunately think has passed the point of no return in the global economy.

=> Good Luck