USDPLN

Spotlight on the currencies of Ukraine’s neighboursThe USD has lived up to its classification as a safe-haven currency since the beginning of Russia’s invasion of Ukraine. Other safe-haven currencies, such as the Swiss franc and the Japanese yen, have failed in this respect. Both have lost strength over the past month and a half. The Swiss franc index has fallen 1.2% over this time, while the Japanese yen has plummeted 8.6%.

The physical approximation of Switzerland to the Ukrainian border might explain why the Swiss franc has failed to live up to its safe-haven status. The same reasoning cannot be applied to the yen as Japan has a 5000-mile wide buffer between it and the locale of the conflict. Nevertheless, Switzerland is not the only European country that has been affected by the Ukraine invasion, many of them being direct or close neighbours of Ukraine.

Spotlight on the currencies of Ukraine’s neighbours

The currencies of several close and bordering countries of Ukraine have followed a similar pattern since Russia entered Ukraine for its ‘special military operation’ on 24 February 2022.

The Czech koruna, Polish zloty, and the Hungarian forint each spent the period of 24 February until the 7 March considerably weakening against the US dollar. The US dollar strengthened in a range of 9% to 14% against these pairs. The two weeks before 24 February saw gradual but moderate de-risking in these European currencies, with the US dollar gaining in the range of 2% to 3.5%.

Strangely, significant movement was seen on the bookends of this period, on the 24 February, 6 March, and 7 March. All the stranger for the very sharp reversals that took place on 8 and 9 March. This may have been when it became evident that Russia had botched its invasion. The reversals that occurred were not entirely successful in erasing the losses the currencies made since 24 February. The Czech koruna (USDCZK) has fared the best during this affair so far, weakening by only -3% and followed by the Polish zloty (USDPLN) at -4.9% and the Hungarian forint (USDHUF) at -7.8%.

USDPLN EMA 200 USDPLN, encountering the EMA200 line, what could that mean?

It will probably have a certain stay at this level for a couple of days, if the ipk is one day with a big green Japanese candle, there will probably be a change in the trend and a transition to growth.

My personal opinion to begin with will stay here. and will have several tests.

yano14 | USDPLN long after pullback. Target 4.30 Why long?

-Poland has the biggest inflation in EU

-Poland has conflict at the boarder with Belarus

-Polish government hands out money a lot

-USDPLN crossed psychologic 4.00 area

Wait for pullback to 4.00

Remember about risk and do not overleverage your positions.

-------------------

Share your opinion in the comments and support the idea with like.

Thanks for your support!

USDPLN looks like PLN will get stronger despite inflation scareLong term chart of USDPLN

Charts like to tell the future. That is why i treat them like a magic device.

Despite huge PLN inflation at more than 4% it looks like it will grow stonger against two giants like USD and EUR. Both charts look very similar.

Saving this chart for future reference.

Good luck.

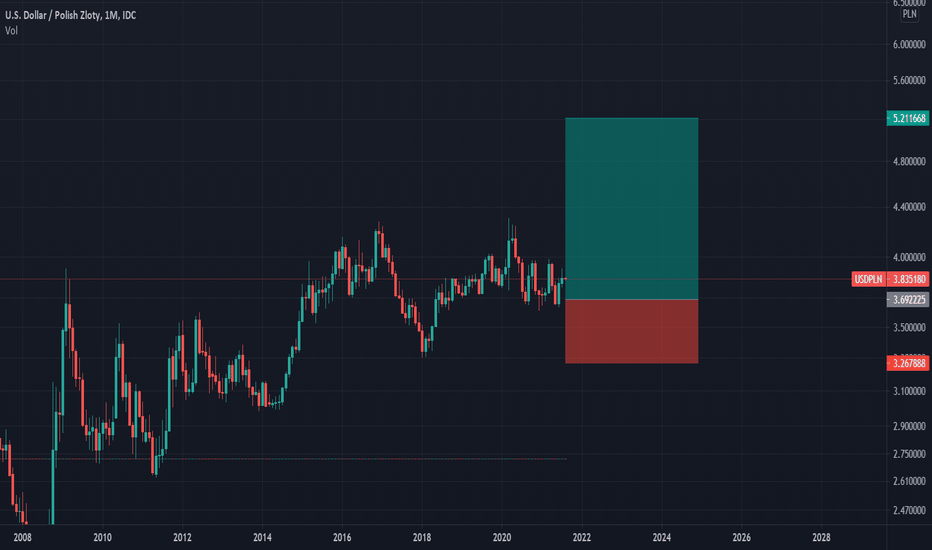

USDPLAN top-down analysisHello traders, this is the full breakdown of this pair. We will take this trade if all the conditions are satisfied as discussed in the analysis video. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover my next analysis.

Also, let me know your thought in the comment section about what you think about this pair.

USDPLN - Sell Setup Forming!Hello everyone, if you like the idea, do not forget to support with a like and follow.

USDPLN is approaching strong daily resistance in green and round number 4.00 so we will be looking for sell setups on lower timeframes.

on H4: USDPLN is forming a trendline in red, but it is not valid yet, so we will be waiting for a third swing low to form around it to consider it our trigger swing. (projection in purple).

Trigger => Waiting for that swing to form and then sell after a momentum candle close below it (gray zone)

Until the sell is activated, USDPLN would be overall bullish and can still test the 4.00 level or even break it upward.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

USD/PLN : 🔥 PRICE ACTION ON DAILY TMF + GARTLEY PATTERN 🔔Welcome back Traders, Investors and Community!

Analysis of #USDPLN

If you have found this useful then help us support my page by hitting the LIKE button.

If you are not subscribed yet then please feel free to follow my page for daily updates and ideas. Thank you

It means a lot to us!

***

Strategy: Price Action on Daily Timeframe+Bearish BAT - We will be waiting for all the confirmations to enter in this trade.

A clear chart is Always the best business card for a trader.

***

Your support and feedback will always welcome

Thank you for your time.

The information contained herein is not intended to be a source of advice or credit analysis

Rega