USDPLN moves up on 4.10 & further breakout past 4.12

I took this trade Long a few moments ago. I thought whether I was getting into the trade a bit late, but I opened the Daily and Weekly charts to see that this is moving fast on the RSI momentum and its chasing 4.12 a previous key record high, which beyond breaking should launch this combo even further.

This is a pair that tends to rally hard and fast, there is a bit of a buy spread usually but it moves fast to break even on the spread.

Usdplnlong

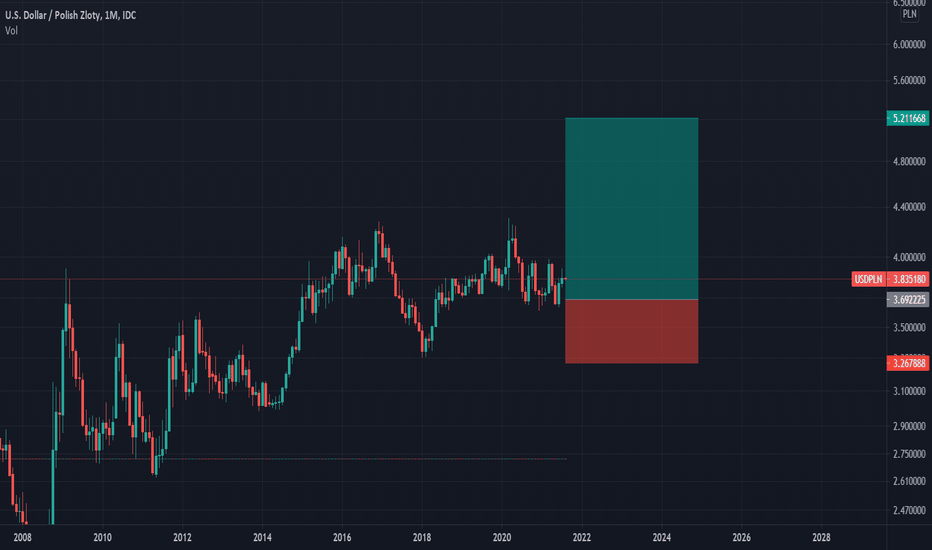

USDPLN is time to UP?!USDPLN reached the long-term growth base plotted since 2011 - there was the first important minimum in the white growth tunnel. Interestingly, each subsequent minimum every few years is practically exactly 30 polish "groszy" (polish cents) higher. Would this indicate that what we see here is the place to start? :) For a long-term purchase of the dollar on this instrument? We reached the bottom edge of the tunnel. However, this is a bit tenous, because if EURUSD still has growth potential, it is rather impossible for the USDPLN instrument to stand still (consolidation) and the zloty not to strengthen further. Movements on USDPLN are always inversely proportional to movements on EURUSD in 95%. If you buy EURUSD, sell USDPLN. CPI in Poland is still falling every month - 6,5% in November this year. I wonder how much level 3.75 is possible to achieve currently on sale? Several zones of demand (tf 1 Month) are also important here on the way down, they can brake this move ...and other TL's. Also check Fibo levels. On oscillators in long terms the instrument is practically sold out. The idea is interesting and the place is worth paying attention to now all the time. Because if the zloty starts to depreciate, it will automatically start to lose against the Euro, the Swiss Franc and probably also against the British Pound, as is usually the case. However, currently the GBP and EUR have little room to fall against the zloty.

Overvalued (+10%) Central European Currencies vs. USDInflation induced rate differentials over nominal exchange rates drove a steady (almost uniform) overvaluation of the Central European Currencies vs. the USD.

With present premiums around +10% a swift, near term correction is ever more likely.

LONG USDHUF, USDPLN, USDRON, USDCZK

USDNOK,USDPLN & AUDJPY correlation trade on D1 ChartGREETINGS

This articles will be a follow up piece to the educational article I did on correlation trades in the forex market. Check out my article on CORRELATION-DIVERSIFYING-HEDGING-An-elementary-view

Now in a previous article that I wrote I had strongly suggested that the AUDJPY had reached a key level of resistance on the daily and weekly chart and was suggesting a possible short sell. Interestingly this was about 2 weeks ago and the price action hasn't really come down at the magnitude expected, except for today (21/12/2020). As I concluded the previous article I promised to explore the idea of how correlated pairs can be used to confirm break outs and avoid fake outs, and this is what we are going to do with the above currency pairs.

To start of we shall consider that pair that I had last made an analysis on, which was the AUD/JPY. This pair I had concluded had reached a crucial resistance level and therefore was ready for a sell. I realised at the time that currency pairs do not move in isolation so to avoid the risk associated with putting all my eggs in one "trade", I sought negatively correlated pairs to place a trade and potentially double up my profits while giving me the comfort of a diversified portfolio. I came across 2 pairs which had a -98% negative correlation and these pairs were the USD/NOK and USD/PLN.

So how we use such correlated pairs to confirm a break out and not a fake out is to closely monitor both pairs when there is a sudden move in the opposite direction by one pair, you observe the other to see if there is a corresponding move. This I learnt the hard way last week as the prevailing trend on the AUD/JPY was somewhat bullish, whenever it would reverse I would quickly look to put an opposing entry on the USD/NOK. I would not wait for the confirmation on that pair and guess what the USD/NOK would rally further down. this showed that the reversal on the bullish AUD/JPY was a fake out. Sure enough the AUD/JPY would go back up. Now that both pairs seems to be correlating perfectly I think it might be an opportunity here.

I have attached the chart which shows how these pairs look like a mirror image.

Now I will be looking for long positions "only when price action confirms". This confirmation will be in the form of a pin bar or bullish engulfing candle on the daily (D!) chart. So possible a buy stop or just put an alert at the open of the last bearish candle.

My outlook

My outlook for the USD/NOK and USD?PLN is to go long This view is long term and could possibly look beyond Jan 2021

My possible entries could be:

USD/NOK

Buy Stop 8.7416

Take Profit around 9.1400 and maybe let it run to 9.51

USD/PLN

Buy Stop 3.72

Take Profit around 3.88

As I said this could go beyond Jan 2021

Takunda Mudenge is a market analyst based in Zimbabwe, Africa. He writes in his personal capacity for educational and entertainment purposes. This should not be construed, assumed or viewed as investment advise. Please consul a professional for such.

USDPLN formed a bullish shark | A good long opportunityPriceline of US Dollar / Polish Zloty has formed a bullish shark and entered in potential reversal zone to hit the sell targets soon insha Allah.

I have defined the targets using Fibonacci sequence:

Buy between: 3.92700 to 3.90748

Sell between: 3.94348 to 3.98155

Regards,

Atif Akbar (moon333)