USD/SEK The fall of the Utopia of SwedenIts time to strike out the greedy 25 Leverage Whales on the super fundamental chart.

The USDSEK will slightly pass the sell zone in order to make it hurt for the bulls until the Swedish central bank increases rents in June.

Promises by Swedish Central bank 2% Rate increase until 2021 but i doubt that will ever happen due to the housing market being over loaned.

A rent increase would significantly increase the chance of the bubble popping as the Swedish salaries has been at a standstill for the last years due to democrats increasing taxes even though the numbers showing positive in increase.

I see us forced to move up and the OMX30 alongside the Descent of the Krona in minus correlation.

USDSEK

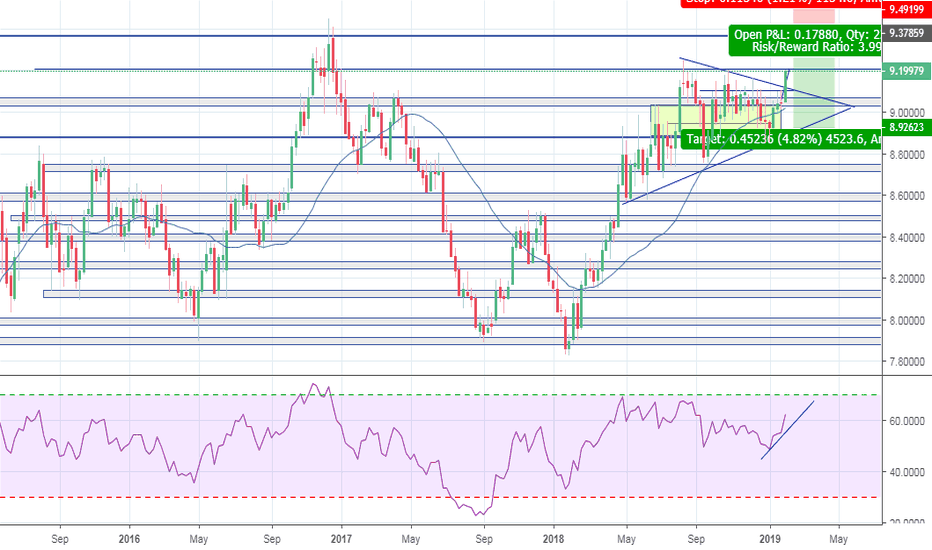

USD/SEK Potential Buy Setup on D1After a strong down-move following the dovish FOMC meeting yesterday, USD/SEK seems recovering at an important demand zone.

The pair is trading inside a rising channel and has reached near the lower channel support, which aligns with a horizontal support and the 61.8% Fib level.

Today's candle could provide the needed confirmation to enter with a long.

Like our analysis? Please hit the "Like" button and join us on Telegram -> t.me

USDSEK.. What now? #USDSEK maintains a bullish “triangle” continuation pattern, as well as an existing base from April last year, keeping the risks higher. We see resistance back at the 2016 high at 9.4482,

with potential long-term trend resistance seen at 9.4818, which we expect to cap at first. Big picture though, the “measured triangle objective” is set much higher at 9.6176.

Usd/Sek Short awaiting. Right guys , I have been on the roll with this move , and it nearly toke 2months ahaha . but as you can see price has broke out from the range with a bullish momentum. So my next trade is to short this when it get the previous high , I know many might be skeptical of waiting till it get to the previous high / if it get there and make a new high . well i don't see the USD getting any stronger to make a 5month move , so i can possibly get 200pips from this .

Keep an eye out guys . one of the trade for 2019. £££

a micro analysis on eursekfollowing our last analysis on eursek where we expect a big drop, we expect eursek to behave the very same way it did the last two peaks before drop last months. to target the exact point of reversal during those endless ascending move (generally heralding an important reversal) we want to see two things :

1) the upper bollinger band on 4h time frame must draw an upper parabolic maximum

2)the price curve must in a last attempt (typical stop loss hunting) impulsively touch this point and reverse immediately

regarding how eursek is near of such a situation this should take place this monday or at the latest thursday with a flat monday to bring confusion first.

we shall do nothing before seeing that, if it crosses badly this upper bollinger band we won't be caught, if it falls even without doing so we won't believe in the reality of the fall, experience on eursek tells us to be cautious and act if and only if those two conditions are met before

eursek, all or nothingeursek has been perfectly bouncing on a support 3 times with a bounce losing intensity each time it hit the support, then it broke and started confidently a down move inside a new channel below. of course now we have through a perfect alignment a retest by below of this previous support, exactly at this point the DMI reaches an extreme value, we do not see how eursek can do anything else than dropping sharply now, this move is also supported by what we see on noksek, usdsek, eurnok and eurusd. this is very simple, if eursek surprisingly cross confidently the 1.53 1.54 area, we will see it coming very soon and then we freeze everything, the loss will be minimal, otherwise we can short eursek massively from where it stands

Historical resistance! We hope rebound!FX:USDSEK

En el último año es la tercera vez que toca esta zona de precio, en las dos veces anteriores este nivel fue rechazado y el precio bajó, la resistencia fue fuerte. Esperamos que ocurra lo mismo.

El precio está en los niveles máximos históricos, en pocas ocasiones llegó a este nivel y siempre rebotó en la resistencia.

Agosto 2018: el precio rebotó en la resistencia.

Noviembre 2018: el precio rebotó en la resistencia.

Estaríamos en condiciones de vender en este momento.

In the last year it is the third time that this price zone touches, in the two previous times this level was rejected and the price fell, the resistance was strong. We hope that the same thing happens.

The price is at historic maximum levels, rarely reached this level and always bounced on the resistance.

August 2018: the price bounced on the resistance.

November 2018: the price bounced on the resistance.

We would be able to sell at this time.

LONG USDSEKWe did follow this pair for a few weeks now. On the daily chart, it can be seen that it reached an area where it will consolidate (based on the previous patterns) until a breakout occurs. Based on our analysis, we went long and set our TP to the previous highs (9.09523) and SL to (9.02374), where support can be seen above this area.

Trade safely!

The Forex Farmers.

USDSEK (EURUSD BABY BROTHER)USDSEK often gets overlooked by retail traders as they see this market as having a mind of its own however, this market

can be traded instead of the EURUSD due to its strong correlations. If you use the compare tool in tradingview add this chart

to the EURUSD chart and you will see when EURUSD goes long, this chart goes short and vice versa.

Often the EURUSD can become cluttered and the USDSEK could show clearer trading opportunities.

Technically we have been waiting for price to break the key supporting trendline, price completed this on the Daily chart

and now we are looking for the continued short trades after it re-tested the key resistance at 9.0200.

[DXY] Correlation with other pairsHi guys !

This is an other simple chart to explain the correlation between DXY and other pairs. As you know, the best exemple is with EURUSD. When EURUSD goes up, DXY goes down, and when DXY goes up, EURUSD goes down. This is because in the DXY (Dollar Index), there is more than 50 % EURUSD.

The U.S. Dollar Index is calculated with this formula:

USDX = 50.14348112 × EURUSD ^(-0.576) × USDJPY ^(0.136) × GBPUSD ^(-0.119) × USDCAD ^(0.091) × USDSEK ^(0.042) × USDCHF ^(0.036)

Thanks for your time guys !