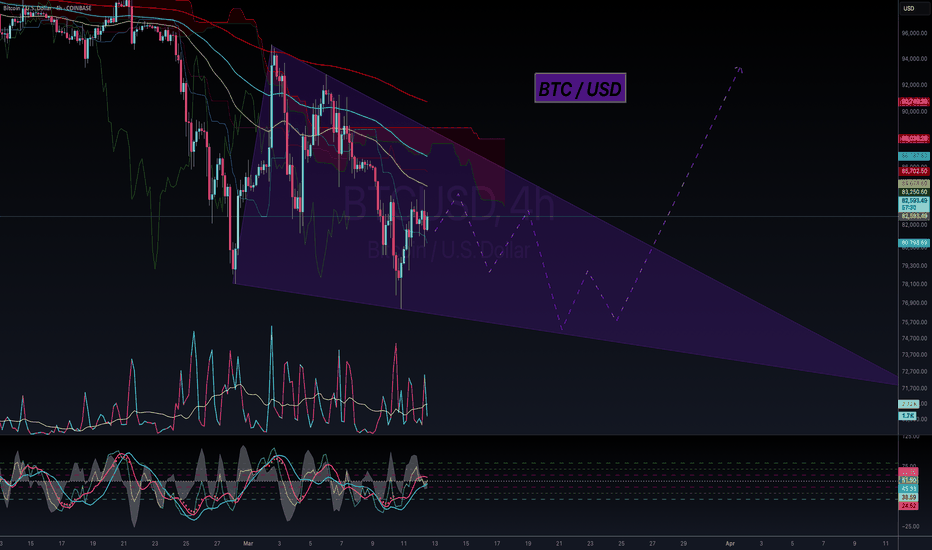

I'm Bullish, but... BTC / USDHello my friends,

At a minimum we're looking at 30 days inside this wedge before breaking out and testing the $96k range once again. Trust me, Bitcoin must form a bullish structure before doing anything interesting.

It could wick to FWB:73K but I'm thinking the heavy orders around $75k might hold and we range instead of dumping more.

Keep an eye on this wedge.

Trade thirsty, my friends!

Usdt

Patience Friends...Howdy again,

As much as the 2.5% is coming we must have patience. It looks like it wants to tough the resistance trend lines once again before actually losing this support here. It also is a double bottom on the weekly which is pretty hard to break, but once it does, not only btc, but the whole market will explode.

Trade thirsty!

P.S: I'll put this as SHORT even though you should LONG usdt and SHORT the market.

HelenP. I Bitcoin can rebound up from support zone to trend lineHi folks today I'm prepared for you Bitcoin analytics. Some time ago, BTC showed a strong downward move that brought the price into the support zone between 82200 and 80900 points. This area acted as a major demand zone, and after several retests, the price formed a solid base. From this support, BTC made a sharp bullish impulse, breaking through local resistance and heading toward the descending trend line. Eventually, the price reached the key resistance zone and tested the trend line, but failed to break through it. After that, BTC started to decline again and returned to the support zone around the 82200 level, where it is currently consolidating. At the moment, the price is trading near the lower boundary of the support zone. The strong reaction from this zone in the past and the overall price structure suggest that bulls are still active. Given the previous impulse move, the bounce from the support, and the clear target structure, I expect BTCUSDT to rise from the current level toward my goal at 87500 points. If you like my analytics you may support me with your like/comment ❤️

ATOMUSDT Forming Inverse Head & Shoulders ATOMUSDT is currently forming a classic inverse head and shoulders pattern on the chart—a strong technical indicator often associated with trend reversals. This bullish pattern, combined with rising volume, suggests that a breakout may be on the horizon. The neckline is being tested, and a confirmed breakout could trigger a wave of buying interest as traders anticipate a significant upside move.

Volume is looking promising as buyers step in around key support zones, showing confidence in the potential of ATOM. With the broader market stabilizing and altcoins gaining momentum, ATOMUSDT could ride this wave for a projected gain of 50% to 60%+. The current technical setup aligns well with historical bullish reversals seen with this pattern.

Investors are increasingly paying attention to ATOM, not just for its price action but also for its utility in the Cosmos ecosystem. With strong fundamentals backing the project and a promising technical structure, this may be the beginning of a new uptrend. A successful breakout above resistance could bring renewed momentum and fresh highs in the short to medium term.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

TURBO long-term outlookAfter completing its first cycle TURBO seems to stabilize around the 0.0010-0.0020$ region which marks the last ATH from 2023. What's interesting here is that TURBO follows the DOGE coin pattern levels almost to a T, in speedrun mode. It is absolutely not the same structure but it respects the same trading ranges and shows a lot of similarities, which is quite remarkable.

Watch out for this yearly trendline in the TURBO chart and expect some volatility for the next months. Breaking under 0.0010$ could potentially confirm a longer downtrend if we don't see a big impulsive bounce to the upside in the near future.

USDT.D - The dominance of real moneyThe dominance of the dollar over cryptocurrencies is a real indicator of the growth status of ETH!

The last wave of correction and decline is happening now! Pay attention to the accumulation zone before the Bitcoin price drops/inflates.

Money is being transferred to BTC=>ETH=>ALT=>USDT=>BTC and so on in a circle, during the active participation phase of DOU, money is being transferred to ETH and beyond, so be vigilant

In addition, I would like to draw your attention to the BTC.D indicator.

EOSUSDT Breakout with Strong Volume: Bullish Momentum BuildingEOSUSDT has recently completed a breakout, demonstrating strong bullish momentum with significant volume backing the move. The breakout from the previous resistance level indicates a potential trend reversal, and with the volume surge, it confirms that investors are actively participating in this rally. Market sentiment appears positive, and the pair is well-positioned to capitalize on this momentum.

With the current bullish outlook, EOSUSDT shows promising potential for gains ranging from 90% to 100% or more. The increasing interest from investors further supports the likelihood of continued upward movement. If the buying pressure sustains, we may witness a robust rally that could attract more attention from the trading community.

Technical analysis highlights that the successful breakout combined with consistent volume influx may serve as a solid foundation for future growth. Traders should keep an eye on key support and resistance levels to make the most of potential price surges. As the momentum builds, managing risk effectively and staying updated with market conditions will be crucial.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

HelenP. I Bitcoin will break support level and continue to fallHi folks today I'm prepared for you Bitcoin analytics. Previously, Bitcoin was moving inside a triangle pattern, consistently reacting to the resistance zone between 88500 and 89300 points. Each time the price approached this level, sellers stepped in strongly, pushing the price back down. After multiple unsuccessful attempts to break this resistance, BTC ultimately lost bullish momentum, resulting in a decisive breakdown below the trend line. This breakout confirmed that sellers were taking control of the market. Following this bearish impulse, the price rapidly declined, eventually reaching the key support level at 81500, which coincided with the strong support zone between 81500 and 80800 points. At the moment, Bitcoin is trading near this support zone, showing a weak reaction and limited bullish interest, signaling continued bearish pressure. Considering the recent price action, the clear bearish breakout from the triangle, and the weak response at the current support, I expect that BTCUSDT will continue to decline and break the support level. That's why I set my goal at 79000 points. If you like my analytics you may support me with your like/comment ❤️

Update about my previous warning about a crash of the SPX500📉 SPX500 Major Correction: Scenario 1 or 2?

In my previous analysis, I explained a scenario that could mimic the 2022 crash (Scenario 1):

🔗

However, the price action dropped much faster than in 2022, accelerating the correction.

Now, on the daily timeframe, we already have a bullish MACD crossover, signaling a potential bullish trend for several days:

🔗

Could This Invalidate the Bearish Trend?

✅ Yes, absolutely.

In June 2023 (Scenario 2), a similar situation occurred:

A bearish MACD reset was interrupted mid-course by a violent dump

This triggered a strong rebound, breaking through resistance levels

There are now strong signs that Scenario 2 might play out again.

What Does This Mean for Crypto & TradFi?

📈 If this bullish reversal holds, it could sync Crypto & TradFi, with both gaining bullish momentum on the weekly timeframe, peaking around May 2025.

Two Possible Outcomes:

1️⃣ Scenario 1 – The reversal collapses, and the correction continues 📉

2️⃣ Scenario 2 – The reversal holds, leading to a rally 📈

Let’s monitor this closely to see which scenario unfolds.

🔍 DYOR!

#SPX500 #StockMarket #Crypto #Trading #BullishReversal #BearishTrend #MACD #MarketAnalysis #Investing

LONG $900BMorning fellas,

I have been getting some spite, and about 75% of people who follow me stopped liking or commenting on my posts just because I've been sold since $100k and calling non-stop for this drop.

The drop came, and the moonfellas out there finally gave in.

Now it's time to look for longs and nothing better than a few select alt coins. I'm thinking $888B to $900B should hold and then we fly. Check trajectory line.

You people need to stop only posting that it's going up to the moon, and be realistic about things. Buy blood not green, buy LINK at $7 and not $25. Buy dot at $2 and not $15, and so on.

Trade thirsty, my friends.

BITCOIN - Price can reach support level and then start to growHi guys, this is my overview for BTCUSDT, feel free to check it and write your feedback in comments👊

Some time ago, the price long time traded near $83700 level, broke it and started to grow inside an upward wedge.

Firstly, BTC rose to the resistance line of the wedge and then corrected to the support level, after which it reached the $87800 level.

After several attempts to break resistance, price turned around and dropped, thereby exiting from wedge.

Now it is correcting and approaching support level, slowly moving toward $83700 key support level.

In my opinion, when BTC reaches $83700 level, it can turn around and start to grow to the $87800 resistance level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

BTC - What's next BTC Update – March 28, 2025

Quick update on where BTC is at and what I’m watching next.

We finally broke out of that daily downtrend — nice little shift in structure. Price is chilling around $85K right now, sitting just below that FWB:88K –$90K resistance, which is still a pretty strong zone to crack.

Key Levels I’m Watching:

🔴 Major Resistance:

FWB:88K –$90K – First big test. If bulls push through this, could get spicy.

$100K–$105K – Big macro level. Expect sellers to step in heavy here if we make it that far.

🟢 Major Support:

$75K–$78K – Solid higher timeframe support zone. Great bounce area if we dip.

$70K – 2021 ATH retest level. Would still be macro bullish unless that breaks.

🟡 Local Zones:

$84K – Acting as intraday support for now. Holding this could lead to a push higher.

GETTEX:82K – Another local support. If that breaks, next stop is probably mid/high 70s.

What I’m Thinking:

As long as we hold $84K, we’ve got a shot at pushing into FWB:88K –$90K again. Break that and it’s game on toward $100K+. But if we lose $84K and especially GETTEX:82K , I’m watching for a retest of the $75K–$78K zone. That’d still be a healthy pullback, nothing to panic about.

All in all... structure looks solid, levels are clear, let’s just stay patient and let price do its thing. I’ll keep you all posted if anything major changes 🔔

USDT.D update (1H)USDT.D has vioalated the previous analysis. It's breaking out the parallel channel which may engage a bullish flag pattern to activate.

As an extra, there will be PCE reports coming soon. If you see green candles on assest, don't dive in to long positions blindly.

Many of the parameters and signals are showing that prices about to go cheapher.

Market might be about getting close to another crash!

USDT.DOMINANCE 4HOUR CHART UPDATE !!A downward trend in USDT dominance typically signals growing confidence in riskier assets (such as Bitcoin and altcoins), as traders move funds out of stablecoins and into crypto investments.

Breakout Attempt

The latest price action shows a breakout from the descending channel.

This signals a potential reversal, during which traders may return funds to USDT due to market uncertainty or a correction in crypto prices.

The black line forecasts a strong upward move in USDT dominance.

If this happens, it could indicate that investors are selling crypto holdings and moving funds into stablecoins in anticipation of a market decline.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

DXY Monthly Analysis: Key Support Holding, Bullish Move Ahead?📊 DXY Monthly Chart Analysis (March 27, 2025)

Key Observations:

Current Price Action:

The U.S. Dollar Index (DXY) is trading near 104.267, with notable resistance ahead.

Price is consolidating within a key demand zone (~102.5–104) after rejecting higher levels.

Technical Levels:

Support Zone: 100.2–104 (Highlighted in purple)

Resistance Zone: 112.5–114.7 (Highlighted in purple)

Major Resistance: 114.77 (Previous high, acting as a supply zone)

200-MA Support: Located below current price, offering a long-term bullish confluence.

Market Structure:

Price remains in a higher time-frame bullish trend but is experiencing a correction.

The "BOSS" level (Break of Structure) suggests a prior bullish breakout.

If the demand zone holds, a bullish continuation towards 112.5–114.7 is possible.

Projected Move:

A bounce from 102–104 could trigger a rally toward the upper resistance zone (~112.5).

A break below 100.2 could indicate a shift in trend and further downside.

Conclusion:

DXY is at a critical decision point. Holding the current support zone (~102–104) could fuel a bullish continuation toward 112–114, while a breakdown below 100.2 would weaken bullish momentum.