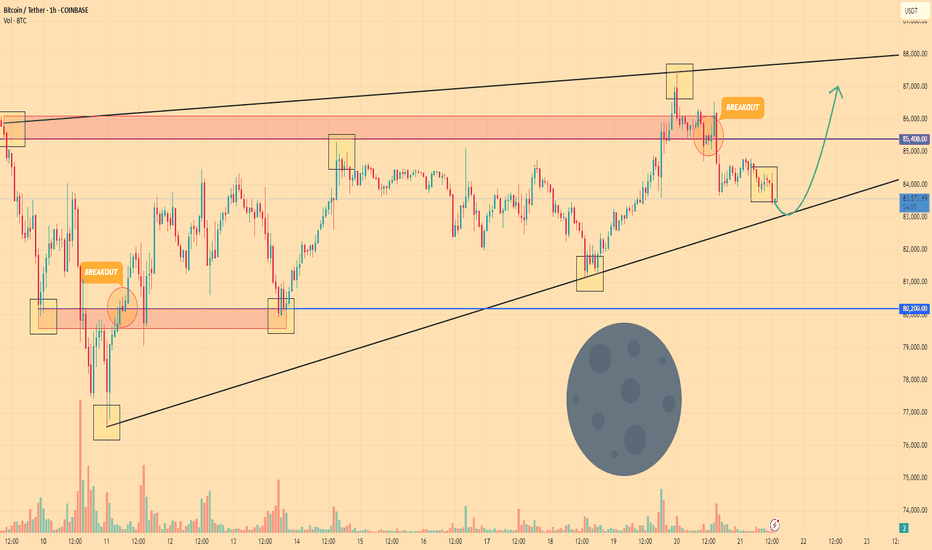

HelenP. I Bitcoin may grow to trend line and then drop to $82200Hi folks today I'm prepared for you Bitcoin analytics. Looking at the chart, we can observe how Bitcoin made a strong upward impulse, reaching the trend line and breaking through the resistance level that aligned with the resistance zone. After that move, the price began to decline within a wedge pattern and soon dropped below the same resistance level, effectively breaking it again. BTC then attempted to recover, climbing back up, but the growth was short-lived — the price failed to hold and fell toward the support level, eventually breaking below it and even dipping under the resistance once more. Following this drop, Bitcoin reversed and gained momentum. Shortly after, it broke through the 82200 level, successfully retested it, and continued moving higher. Later on, the price reached the trend line again — a level that also acted as resistance — but failed to break above and started pulling back from that area. At this point, I anticipate that BTCUSDT may retest the trend line once more before making a move downward toward the support level, potentially breaking out of the wedge pattern. For now, my goal is the 82200 support level. If you like my analytics you may support me with your like/comment ❤️

Usdt

Stablecoin liquidity = Bitcoin bullish thesis --> $109k?Can BTC soon climb to the $109,000 level thanks to stablecoin liquidity? Maybe yes!

An increase in stablecoin market cap often signals more money entering the crypto space, indicating bullish sentiment as investors prepare to deploy capital. This increased liquidity can lead to smoother trading and attract more participants, potentially driving up Bitcoin's price.

The chart clearly illustrates this relationship:

Purple line ( CRYPTOCAP:USDT + CRYPTOCAP:USDC + CRYPTOCAP:DAI + CRYPTOCAP:USDEE market cap) shows steady growth

Bitcoin candle chart ( COINBASE:BTCUSD price) follows with more volatile increases

Blue line at the bottom: BTC and stablecoin correlation coefficient of 0.9 😊

This correlation can serve as a leading indicator for Bitcoin price movements. During downturns, investors might sell Bitcoin for stablecoins, but as sentiment shifts, this "dry powder" can quickly flow back, driving Bitcoin's price up.

Adding to that, the long-term correlation coefficient between stablecoin liquidity market cap (USDT+USDC+DAI+USDE) and Bitcoin is 90%. So, yes, there's a strong long term correlation and usually BTC and stablecoin liquidity converge.

According to my views on the stablecoin liquidity, the Bitcoin price should target the $109k level.

Last time I made this analysis, Bitcoin jumped from $58k to my price target of FWB:73K in the span of 2 months.

Let me know your thoughts.

Bitcoin may rebound up from pennant to 90K pointsHello traders, I want share with you my opinion about Bitcoin. Not long ago, BTC was trading inside a wide range, where the price moved sideways and eventually touched the resistance line, from which it turned around and began to fall. After the decline, BTC exited the range, breaking through the lower boundary and sharply dropping to the support level, which aligned with the buyer zone. From there, we saw a quick impulse up, but this movement faced strong resistance inside the seller zone, where a fake breakout occurred — price briefly moved above but then sharply reversed and began another decline. As BTC continued to decline, it formed a downward pennant pattern. Within this structure, we can clearly see how the price respected both the resistance line and the support line of the pennant, bouncing up from the lower boundary several times. The most recent bounce came again from the buyer zone, indicating that bulls are still defending this area. At the moment, BTC is consolidating near the tip of the pennant, and I believe there’s a high probability of an upcoming breakout. My base scenario assumes that we could see one more minor pullback toward the support line, followed by an upward breakout from the pennant. If that happens, the price may reach the 90000 points, which I consider as TP1. Please share this idea with your friends and click Boost 🚀

ALGO / USDT - Big Move AheadEvening fellas,

I got an order ready near the gap I believe its at $0.1844, it would require coming back down to the purple between both trendiness, one placed at the wick low, and the other at the body.

Maybe it moves up to resistance once again before a final shakeout.

It'll be a nice long.

Trade thirsty.

HelenP. I Bitcoin may break support level and fall to trend lineHi folks today I'm prepared for you Bitcoin analytics. A few days ago, the price made a small upward move before dropping to Support 2, which aligned with the support zone, breaking through Support 1 in the process. After that, BTC attempted to rise but failed and continued to decline, breaking Support 2 and reaching the trend line. Following this move, Bitcoin reversed direction and started to climb, soon reaching the 80100 level and breaking it again. It then pushed up nearly to Support 1 before correcting back to Support 2, after which it made a strong impulse move back to Support 1. The price consolidated around this level for some time before correcting back to the trend line, from where it resumed its upward movement. In a short time, BTC broke through Support 1, climbed to 87500, and then corrected back to the support zone. At this stage, I expect BTCUSDT to pull back to the support level, make a small upward move, and then continue declining, breaking the support level. If this scenario plays out, I anticipate the price falling to 83000, which aligns with the trend line. If you like my analytics you may support me with your like/comment ❤️

Bitcoin can exit from triangle and rise to resistance levelHello traders, I want share with you my opinion about Bitcoin. On the chart, we can see that the price entered a downward triangle, where it rebounded from the resistance line and dropped to the resistance level. After that, BTC bounced from the 86500 level, climbed back to the resistance line of the triangle, and then started to decline. Soon, it broke through 86,500 and reached the support level, which coincided with the buyer zone. BTC then broke this support and dropped further to the support line of the triangle before reversing and beginning to rise. In a short time, the price reached 81100, broke through it, and made a retest before continuing its upward movement. However, it later corrected back to the buyer zone, then climbed to 85000, and started declining again. Shortly after, the price dropped to the support level and then rebounded to the resistance line of the triangle. Given this price action, I expect BTC to correct toward the support line of the triangle before bouncing back up and breaking out of the pattern. From there, I anticipate further growth toward the 86500 resistance level, which is why I have set my TP at this level. Please share this idea with your friends and click Boost 🚀

BITCOIN - Price can bounce up to $87K, breaking resistance levelHi guys, this is my overview for BTCUSDT, feel free to check it and write your feedback in comments👊

Price entered to wedge and at once dropped to support line, breaking two levels, after which it bounced up.

Soon, it broke $80200 level and then tried to grow, but failed and made a correction to $80200 support level.

Later BTC rose to $85400 level and then some time traded near, after which it turned around and corrected to support line.

Then price in a short time rose to resistance line of wedge, breaking the resistance level, but a not long time ago fell back.

Bitcoin broke $85400 level and continued to decline, and in my mind, it can soon reach support line of wedge.

After this movement, I expect that BTC can bounce up to $87000, breaking resistance level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

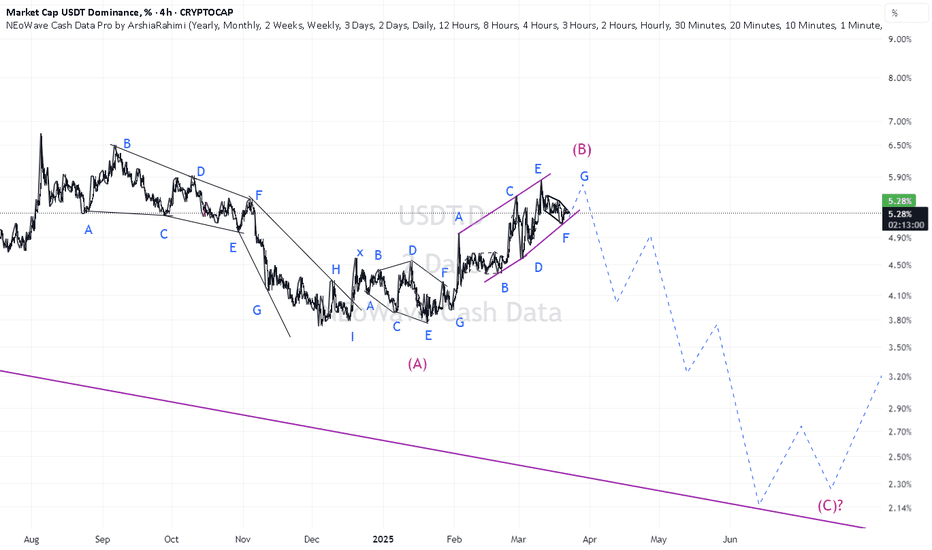

bear market confirmationIf the chart will consolidates above 5.81%, i.e. above the sloping downtrend line, this would be an early indicator of the start of a bear market, because this line is global for the current bull market.

The second confirmation will be if dominance will bumped at 3.94 - 4.30% range as wave B and will update the end of wave A.

USDT.DOMINANCE WEEKLY CHART UPDATE. Current Market Structure:

Breakout Confirmation: USDT Dominance has broken out of its descending trendline and is now in a retest phase.

50MA as Support: The 50-week moving average now acts as dynamic support, reinforcing the bullish outlook.

Rejection or Breakout? The price is currently testing resistance. If it gets rejected, a temporary pullback is likely before further gains.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

Bitcoin can rebound from triangle pattern to 90K pointsHello traders, I want share with you my opinion about Bitcoin. Not long ago, the price was trading within a range, where it quickly entered the seller zone and remained near this area for quite some time. BTC attempted to rise but failed, and after nearly reaching the upper boundary of the range, it dropped sharply. The price broke through the 94000 level, exiting the range as well, and then fell to the support level, which aligned with the buyer zone. Shortly after, the price made a strong upward impulse toward the resistance level before starting a decline within a downward triangle. Inside this pattern, BTC initially made a correction, climbed back to the resistance line of the triangle, and then resumed its decline. Eventually, the price dropped to the 78900 support level, where it touched the triangle’s support line and then began to rise. At the moment, BTC continues to climb near this level, and I expect it to rebound from the support line of the triangle and break above the resistance, signaling an exit from the pattern. If this happens, I anticipate further growth, so my target is set at 90000 points. Please share this idea with your friends and click Boost 🚀

GBPUSD 1HOUR CHART TECHNICAL ANALYSIS NEXT MOVE POSSIBLE This chart shows a technical analysis of GBP/USD on the 1-hour timeframe.

1. Resistance Rejection – Price reached 1.30056 and faced rejection, indicating a possible reversal.

2. Bearish Scenario – The chart suggests a potential drop toward 1.29514 as the first support.

3. Breakdown Possibility – If 1.29514 fails, price could continue falling toward 1.29136, the next key support.

4. Price Action Structure – The drawn arrows indicate a possible retest of 1.29514 before a further decline.

Overall, this chart signals a potential bearish move if price fails to hold above key levels.

Why GBPJPY is Bullish?? Detailed technical and fundamentalsThe GBP/JPY pair has recently confirmed a bullish reversal by breaking out of a falling wedge pattern, aligning with our earlier analysis. Currently trading at 194.000, the pair is on track toward our target of 199.000.

Technically, the breakout from the falling wedge—a pattern typically indicative of bullish reversals—suggests increased buying momentum. This is further supported by the pair's ability to maintain levels above key resistance points, now acting as support. The next significant resistance is anticipated around the 195.000 level, a psychological barrier that, if surpassed, could pave the way toward our 199.000 target.

Fundamentally, the British pound has been bolstered by positive economic indicators, including robust GDP growth and a resilient labor market, enhancing investor confidence. Conversely, the Japanese yen has experienced depreciation due to the Bank of Japan's commitment to ultra-loose monetary policies, aiming to stimulate inflation and economic growth. This monetary policy divergence has contributed to the upward trajectory of GBP/JPY.

In conclusion, the confluence of technical and fundamental factors supports a bullish outlook for GBP/JPY. Traders should monitor upcoming economic releases and central bank communications, as these could impact market sentiment and price action. Maintaining a disciplined approach with appropriate risk management strategies is essential as the pair approaches the 199.000 target.

Ripple is Nearing Important SupportHey Traders, in today's trading session we are monitoring XRPUSDT for a buying opportunity around 2.35 zone, XRP is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 2.35 support and resistance area.

Trade safe, Joe.

USDT.D hinting of a massive cryto market reversal ↑. GET SEEDED!USDT.D an inverse confluence of the crypto market has predicted the major correction before it happened. It has gone parabolic for a few weeks tapping its favorite resistance roof line aT 5.50%.

Now, based on the last weekly close, USDT.D is hinting of a major market reversal to the upside. (USDT.D falling = crypto market rising). It means USDT.D in red means, more cash are being converted to crypto holdings.

The first descending shift line at the upper channel has been registered. First time since September 2024. This is already conveying of a major shift in trend and a weighty series of price growth from here is forthcoming in the next coming weeks.

Best season to get seeded again on the market -- moreso scale in on the bluechip ones, BTC ETH ADA XRP.

It's that season again. A very green one.

Spotted at 5.30%

Mid target at 3.50%.

TAYOR. Trade safely.

HelenP. I Bitcoin may grow little and then drop to support areaHi folks today I'm prepared for you Bitcoin analytics. Some time ago, the price rebounded from the resistance level, which aligned with the trend line and resistance zone, attempting to rise. However, it failed and started to decline. Later, BTC dropped to the same resistance level again, broke through it, and then fell to the trend line, which coincided with the support level and support zone. After that, the price made an upward impulse to the resistance zone, followed by a quick correction before reversing and climbing back to the 91300 resistance level. The price consolidated around this level for some time before declining to the 78350 support level. Recently, it turned around and started moving upward again. Given this structure, I expect BTCUSDT to rise slightly before dropping to the support zone and breaking the support level. With this in mind, my target is set in this area - 76500 points. If you like my analytics you may support me with your like/comment ❤️

Bitcoin can reach resistance line of wedge and then dropHello traders, I want share with you my opinion about Bitcoin. This chart illustrates how the price dropped into the buyer zone within an ascending wedge. After that, BTC reversed direction and began to rise, eventually reaching the wedge’s resistance line before making a correction to the support line. The price then made a strong upward impulse, breaking through the resistance level and exiting the ascending wedge. BTC surged to 94800 before reversing and dropping to 82600, breaking through the 87000 level. Following this decline, the price started to recover within a descending wedge and soon reached the resistance line, breaking through another resistance level. However, after this move, BTC reversed again and began to decline, eventually falling back to the 87,000 level, which coincided with the seller zone, where it traded for some time. It then broke through this level and continued declining toward the support level, even entering the buyer zone. BTC also dropped to the support line of the descending wedge before rebounding sharply, breaking above the 80000 support level once again. Currently, the price is continuing its upward movement. Given this setup, I anticipate that Bitcoin will reach the resistance line of the wedge before pulling back to the support level, potentially even lower. For this scenario, my TP is set at 78000. Please share this idea with your friends and click Boost 🚀

BTC/USDT Reversal scenariosThere is bear mood in market, its exactly what is needed for reversal, lets have a look closer. I see 3 options.

1) Manipulation is over, we reached the target of local FIBO 1.618 at 77055$

2) Level 73764$ - its the target of Double TOP , the edge/high of the last block and 0.618 level of grand FIBO

3) POC level of last accumulation block which lasted for 255d at 67436$ - we could reach this level only with fast squeeze and fast buy back, leaving long needle on higher timeframe