USDT Dominance $USDT.D – Channel Breakout in Action!!USDT.D has officially broken out of the descending channel, indicating a potential shift in momentum.

Key Points:

- LTF bullish divergence supported the recent push.

- Price is now testing the breakout level with potential to move higher.

- Next key resistance levels are marked at 4.85%, 5.23%

Both levels align with Fibonacci retracement zones, adding to their importance.

If this move sustains, we might see temporary pressure on alts due to increased USDT strength.

However, if price fails to hold above the channel and confirms a deviation, alts may resume dominance.

Weekly close remains key — it will either validate this breakout or trap the breakout traders.

Usdtd

100% Win Rate on BTC & Alts! Where’s the Next Breakout?USDT Dominance Update:

While the herd chases the latest hype, we called this before it even unfolded. BTC’s recent surge was lightning-fast.

These were the trades shared in the last 30 days. I'm just saying we could've had more wins!

Our setups didn’t just hit targets…

They exploded through them 🚀

These are spot gains, imagine trading wth leverage with these.

There's more to come in the next week.

✅ MIL:ENA +53%

✅ HOSE:VIC +50%

✅ $CHILLGUY +40%

✅ NASDAQ:HUMA +35%

✅ CRYPTOCAP:XRP +34%

✅ $VOXEL +32%

✅ OMXTSE:MAGIC +30%

✅ CRYPTOCAP:RENDER +25%

✅ CRYPTOCAP:AVAX +24%

✅ SEED_DONKEYDAN_MARKET_CAP:FLOKI +25%

✅ CRYPTOCAP:LINK +17.65%

✅ CRYPTOCAP:SUSHI +17.3%

✅ AMEX:MBOX +15%

✅ $MAVIA +14.7%

✅ TVC:MOVE +11.66%

✅ $EPT +11%

✅ BME:ETC +10.3%

✅ PSX:POL +20%

✅ CRYPTOCAP:SUI +20%

✅ LSE:ONDO +7.5%

✅ SET:PORT +6.17%

✅ CRYPTOCAP:TON +3%

📈 These aren’t just simple trades; they’re alpha-backed calls.

If you’re still watching from the sidelines…

You’re watching others print.

Be patient and precise with your entries and exits. Never FOMO.

The market will bait you into bad timing if you let it.

A 4.4% drop in USDT dominance marks the start of a new altcoin season, but remember, BTC will steer this cycle.

More setups on the way.

Stay tuned.

Do hit the like button and share your views in the comments.

Thank you

#PEACE

USDT Dominance Consolidating — Major Move Loading?USDT dominance is currently stuck in a sideways range between key resistance and strong support zones.

We’ve seen a rejection from the upper resistance, and now price is drifting toward the nearest support. If this zone holds, expect another bounce. If it breaks, altcoins could finally catch a strong bid — possibly the early signal for altseason.

No rush here. Just keep your eyes on that mid S/R level. It’s a key battleground.

$USDT.D: Bearish ChartCRYPTOCAP:USDT.D | 3D

Price action on USDT dominance has been significantly cleaner than CRYPTOCAP:BTC in recent weeks, providing much clearer pivot signals.

On the 3-day chart, we can see that the 5% level has turned into a strong supply zone and is currently being rejected. If the price fails to reclaim the 5% level, it will likely move back down toward the 4.30% level.

Outlook: Expecting CRYPTOCAP:BTC to sweep local highs while CRYPTOCAP:USDT.D remains bearish.

Potential downside levels: 4.5% and possibly even 3.90%

USDT.D/OTHERS.D - Altcoin Season IndicatorPrice rejected from the 3M HTF supply and major BSL on the prior highs. Price has now gave a confirmed 1W bearish market shift, indicating a market wide altcoin reversal is playing out and the next bullish impulse higher isnt far off....

Watching for rejections in this weekly supply on this pair as marked and looking for a bearish daily market shift to give confirmations of a potential reversal bearish in line with the recent weekly bearish market shift that occurred from the BSL sweep into 3M supply and refined supply within it.

As shown, this chart is an altcoin indicator and im expecting that last altcoin season and cycle to occur after this chart tops out into supply and then continues lower into the SSL low at 0.29% and into the 3 month demand below it.

Seeing similar indications from the other charts shared like BTC.D and BTC.D+ETH.D+USDT.D+USDC.D, where they show continued weakness in alts for now with a HYTF bullish reversal in altcoins not far off.

3D:

1W:

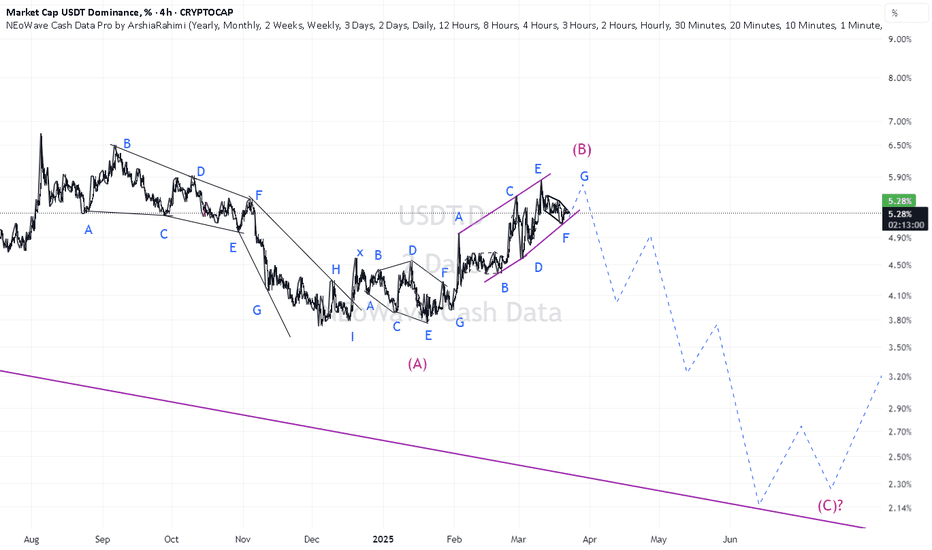

USDT Dominance Tells Us That Shakeout AheadHello, Skyrexians!

Despite most of traders now already do not believe in correction for Bitcoin, CRYPTOCAP:USDT.D is showing the potential warning sign. For sure my global forecast for this chart that Tether dominance will go below 2% is still actual. You can find it here . By the way it's playing out great. But in the short term shakeout is likely.

12 hours time frame Awesome Oscillator shows that wave 1 of global C has been finished. Now it's time for reactive wave 2. The most likely target is 5.3% at 0.5 Fibonacci. Only from there I expect crypto bull run continuation (for BTC) and start (for altcoins).

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Tether Dominance, TA» There is a lower high on the chart. This is a long-term timeframe. The signals are very strong here.

» There is a strong rejection at SMA200, this level being confirmed as resistance.

» There is a very strong decline in volume.

» There are three consecutive weeks closing red.

These are all very powerful bearish signals.

» This week wicked lower compared to 24-March.

Tether Dominance just produced the lowest reading on a drop since November 2024. When USDT.D was moving down in November 2024, everything Crypto was moving up. The conditions are similar today.

Tether Dominance can be seen moving down as a continuation of a bearish trend. This is happening after a lower high is fully in and confirmed.

Short-term, there can be a small pullback followed by lower prices.

For example, several days can close green but by the time next week ends, the action turns full red. Just as it happened on the 7-April week. The action started strongly bullish but USDT.D ended with a bearish week and the start of a decline that will lead to a lower low.

We are likely going to see the lowest reading on this index since March 2022 or December 2021. It is a long process but the chart is pointing down. That is what the chart says.

Thank you for reading.

Namaste.

Tariff Pause = Crypto Pump?USDT Dominance is testing strong resistance (5.60%–5.80%) while holding a rising support line. A break below 5.40% could signal a shift to risk-on sentiment, triggering a move into Bitcoin and altcoins.

Trump’s 90-day tariff pause may further boost market confidence, reduce demand for stablecoins, and support crypto inflows. If dominance breaks down, it could spark an altcoin rally. If it holds above 5.80%, caution remains. This is a key turning point.

Market Shift Incoming! USDT Dominance Nears Critical Turning PoiThe USDT Dominance (USDT.D) chart is currently testing a strong resistance zone, where price action is showing signs of exhaustion. A bearish RSI divergence has formed, indicating potential weakness and a possible correction. The rising support line has provided multiple bounces, but a breakdown from this structure could trigger a larger downside move.

If USDT dominance falls, liquidity will likely shift into altcoins, potentially fueling a bullish rally in the altcoin market. Conversely, if USDT dominance continues to rise, it could signal increased market fear, leading to further weakness in altcoins.

USDT Dominance Dropping! Is This the Start of a Crypto Bull Run?CRYPTOCAP:USDT Dominance chart is approaching a critical phase, currently trading within a strong resistance zone while showing RSI bearish divergence.

This suggests potential weakness ahead, which could lead to a drop in USDT dominance. If that happens, it typically correlates with a bullish phase for altcoins, as traders rotate capital from stablecoins into riskier assets.

A breakdown below the rising support line could confirm a reversal, leading to further downside in USDT dominance. This scenario would likely trigger increased buying pressure in the altcoin market.