TradeCityPro | Bitcoin Daily Analysis #47👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. As usual, in this analysis, I will review the futures session triggers for the New York market.

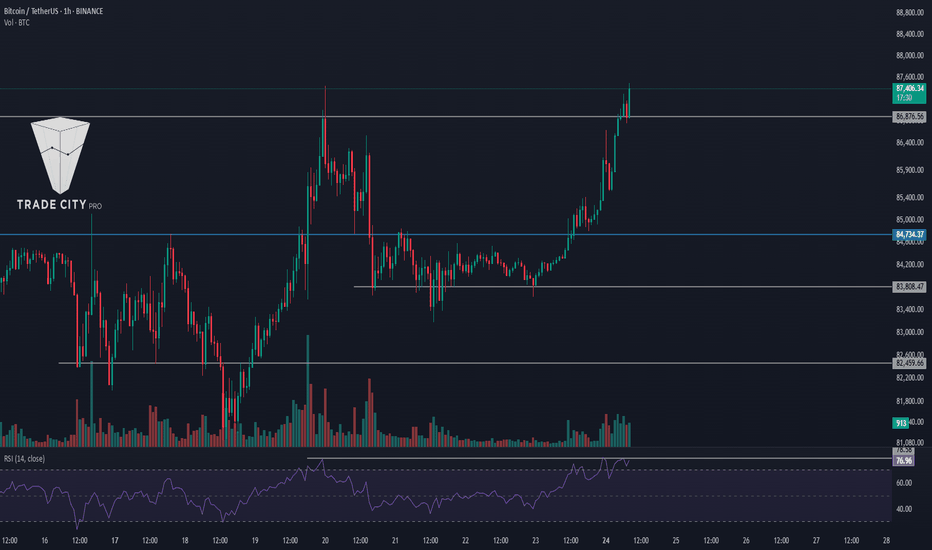

⌛️ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, yesterday the 83,808 trigger was activated, and the price moved down to the next support at 82,302.

⚡️ The 19.70 level in the RSI is a crucial area, as the price has reacted to this level in the last two bearish legs, leading to slight corrections.

✔️ Today, it might be a bit late to open new positions, as the price is slightly oversold, suggesting that the move has already extended sufficiently.

🔽 This situation means we should enter positions with lower risk today. The short trigger for today is 82,302, and if this level breaks, the price could decline even further.

📈 For a long position, we need to wait for confirmation of a trend reversal. First, the SMA 25 must reach the price, and then a Dow Theory confirmation should establish a new bullish trend.

👑 BTC.D Analysis

Now, let’s analyze Bitcoin dominance. As you can see, this index increased yesterday as the market dropped. It briefly faked out above 62.14 before reversing downward again.

🎲 At the moment, 62.14 remains a key trigger for bullish dominance, while the main support level is 61.81.

📅 Total2 Analysis

Moving on to Total2, this index is in bad shape. It has broken its key support at 1.01 and is now moving toward 0.984.

💥 I can't provide any specific trigger for this chart today because it has dropped significantly without any corrections. For now, we need to wait for a new structure to form.

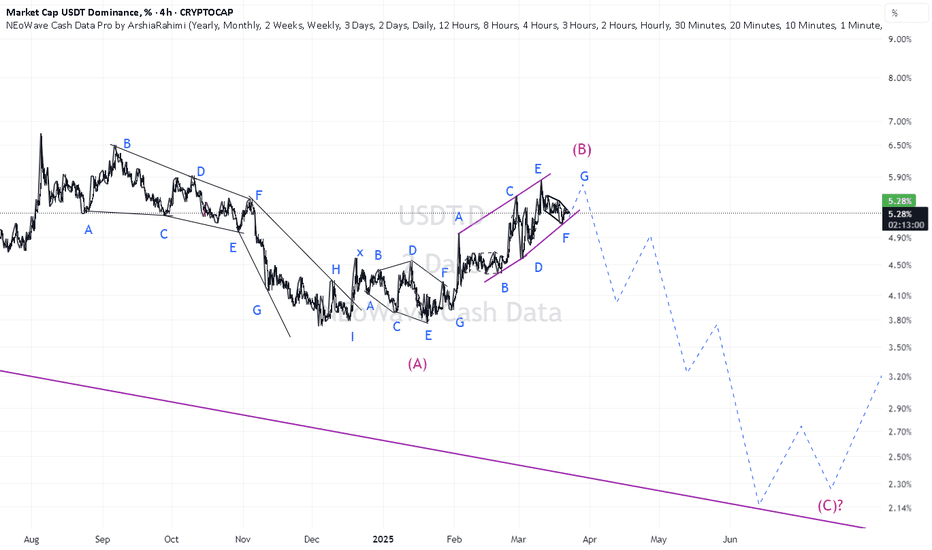

📅 USDT.D Analysis

Now, let’s look at USDT dominance. Yesterday, dominance finally stabilized above 5.34, which triggered a market drop.

🔍 Currently, USDT dominance has reached the next resistance at 5.48 and has shown a reaction to this level. To confirm further upside, we need a break above 5.48. If a correction starts and we see more red candles, the price could retrace back down to 5.34.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Usdtdominance

TradeCityPro | Bitcoin Daily Analysis #46👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. As usual, in this analysis, I will review the futures session triggers for the New York market.

⌛️ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, yesterday the 86,401 trigger was activated, and the price moved downward. Since the price was making lower highs, I anticipated this move yesterday, and now the price is near 83,808, approaching this support level.

✔️ At this point, I believe the price has declined sufficiently, and it may start forming a base around 83,808. However, for a short position, this same 83,808 level is key, and we can enter a position if it breaks below this area.

🔼 For a long position, we need to wait until at least the SMA 25 reaches the price and the price stabilizes above this zone. Once the trend turns bullish, we can consider opening a long position.

👑 BTC.D Analysis

Moving on to Bitcoin dominance, as the market declined and Bitcoin broke support, dominance increased. This helped Bitcoin hold up better than other coins, which experienced heavier losses.

📊 Currently, dominance has reached 62.14 and faced a strong rejection from this level. If a corrective phase begins, the key support area for price is 61.81, and the price could retrace to this level.

✨ For a bullish move in dominance, a break above 62.14 is required, with the next resistance at 62.30.

📅 Total2 Analysis

Now let’s analyze Total2. As I mentioned, altcoins have experienced a much sharper decline than Bitcoin, and after breaking 1.06, Total2 started a strong downtrend, even breaking through 1.04.

🎲 Currently, the price is fluctuating between 1.01 and 1.04, and it seems that the trend is showing signs of weakness, indicating that this bearish leg may be ending. If a correction begins, the price could move up to 1.04. However, for the next short position, the trigger level to watch is 1.01.

📅 USDT.D Analysis

Now let’s analyze USDT dominance. This index broke through the key 5.19 level and has risen to 5.34.

🌩 If a candle closes above this level, the next major resistance is at 5.45. In case of a pullback, the key support to watch is 5.25.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

USDT.D update (1H)USDT.D has vioalated the previous analysis. It's breaking out the parallel channel which may engage a bullish flag pattern to activate.

As an extra, there will be PCE reports coming soon. If you see green candles on assest, don't dive in to long positions blindly.

Many of the parameters and signals are showing that prices about to go cheapher.

Market might be about getting close to another crash!

USDT.DOMINANCE 4HOUR CHART UPDATE !!A downward trend in USDT dominance typically signals growing confidence in riskier assets (such as Bitcoin and altcoins), as traders move funds out of stablecoins and into crypto investments.

Breakout Attempt

The latest price action shows a breakout from the descending channel.

This signals a potential reversal, during which traders may return funds to USDT due to market uncertainty or a correction in crypto prices.

The black line forecasts a strong upward move in USDT dominance.

If this happens, it could indicate that investors are selling crypto holdings and moving funds into stablecoins in anticipation of a market decline.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

TradeCityPro | Bitcoin Daily Analysis #45👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. In this analysis, as usual, I want to review the futures session triggers for the New York market.

⌛️ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, the price is still within a ranging box between 86,401 and 88,480.

🔍 The price is making lower highs, and it seems that the bullish momentum has faded. However, valid triggers for both short and long positions can still be found.

✨ For a short position, you can enter if the price breaks below 86,401. In this case, the price could extend its corrective leg down to 84,734.

🔽 For a long position, you can enter if the price breaks above 88,480. This is a very important trigger and could start the next bullish leg up to 91,588.

👑 BTC.D Analysis

Let's move on to Bitcoin dominance. This dominance has formed a bit more structure, and its triggers are also close.

⚡️ If 61.63 breaks, we confirm a bearish trend, and if 61.81 breaks, we confirm a bullish trend.

📅 Total2 Analysis

Let's analyze Total2. This index also has a ranging box between 1.06 and 1.08, which can provide good trading opportunities.

💫 If 1.08 breaks, we confirm a long position for altcoins. For a short position, a break of 1.06 is suitable.

📅 USDT.D Analysis

Now, let’s analyze USDT dominance. As you can see, we are witnessing a downtrend, and now a box has formed between 5.19 and 5.05.

🧩 To confirm a bullish move in dominance, we need a break above 5.19. The bearish triggers for USDT dominance are 5.11 and 5.05.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #44👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and other important crypto indices. As usual, I want to review the futures triggers for the New York session for you.

⏳ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, yesterday Bitcoin managed to stabilize above 86876 and moved up to 88480.

⚡️ Currently, the area that the price has reacted to is 86401, so I moved the 86401 line from 86876.

💥 As I mentioned yesterday, if the RSI had stayed above 70, the movement could have continued, which it did, but the RSI did not stabilize above 78.58 and we did not witness a pump.

💫 With the break of the 70 area in the RSI, the upward momentum disappeared and the corrective phase of the price began. The market volume is currently in favor of the buyers and has decreased during the correction.

🔽 Today, for a short position, you can enter a risky position with a break of 86401 because the market trend is currently upward and all short positions are considered risky for now.

📈 For a long position, we currently don't have any specific triggers sooner than 88480, and if you want to open a position sooner, you need to wait for more structure to be created and catch triggers in lower timeframes.

👑 BTC.D Analysis

Let's move on to the analysis of Bitcoin dominance, yesterday the dominance made a lower peak than 61.80 and was rejected from 61.76.

✨ Currently, a box has formed between 61.35 to 61.76, and breaking any of these areas could confirm and start the next leg.

📅 Total2 Analysis

As for Total2, as you can see, this index is doing much better than Bitcoin and has made less correction because dominance was rejected from 61.76 yesterday.

🔑 Today, I don't have a short trigger for Total2 because it's very bullish, but for a long, the trigger of 1.09 is very suitable and with a break of this area, we can witness the next bullish leg up to 1.12.

📅 USDT.D Analysis

Let's look at the USDT.D, it seems a range box is forming between 5.15 and 5.05, and breaking either of these areas could be important.

🎲 A break of 5.05 for a short, especially if it coincides with a break of 1.09 in Total2, would be very appropriate.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #43👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and other key crypto indices. As usual, I want to discuss the futures triggers for the New York session.

⏳ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, Bitcoin finally moved, activating our trigger, and it reached its target. Now, let's analyze today's triggers.

🔄 Yesterday, the breakout of the 84734 range box was activated, and the price made an upward move.

✔️ Currently, the price has reached 86876 and has been rejected from this area but is still above it. If it can stabilize above this area, the next price leg could start.

💥 The RSI oscillator has significant resistance at 78.58, and breaking this area could introduce a lot of momentum into the market, potentially starting a robust upward leg.

⚡️ Additionally, this oscillator has important support at 70, and if it can maintain above this area, the likelihood of breaking 86876 increases.

🔽 For short positions, we need to wait for the price momentum to turn bearish before entering in line with the trend direction.

🧩 If the price does not stabilize above 86876 and moves downward, with confirmation from Dow Theory or the activation of a fake breakout trigger, you can enter a short position.

👑 BTC.D Analysis

Let's move on to the analysis of Bitcoin dominance. Yesterday, dominance was supported at 61.35 and moved up to 61.80, which helped Bitcoin rise more than altcoins.

🧲 Currently, dominance has been rejected from 61.80 and is moving downwards. I believe a range has formed between 61.35 and 61.80, and breaking this box in either direction could determine the next leg of dominance.

📅 Total2 Analysis

Moving on to Total2, yesterday the price broke the 1.05 area and moved upwards, even surpassing 1.07. Currently, I have moved the 1.05 area to 1.06 because it is more accurate, and the price has moved away from it.

⭐ The next resistance for the price is at 1.09, and it seems that Total2 could move up to this area.

📅 USDT.D Analysis

Finally, let's look at the Tether dominance analysis. Yesterday, the 5.25 trigger in dominance was activated, and we observed a clean pullback in dominance that brought it down to 5.13.

✨ The next support for dominance is at 5.08, and we need to see if it can stabilize below this area or not.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Market Shift Incoming! USDT Dominance Nears Critical Turning PoiThe USDT Dominance (USDT.D) chart is currently testing a strong resistance zone, where price action is showing signs of exhaustion. A bearish RSI divergence has formed, indicating potential weakness and a possible correction. The rising support line has provided multiple bounces, but a breakdown from this structure could trigger a larger downside move.

If USDT dominance falls, liquidity will likely shift into altcoins, potentially fueling a bullish rally in the altcoin market. Conversely, if USDT dominance continues to rise, it could signal increased market fear, leading to further weakness in altcoins.

TradeCityPro | Bitcoin Daily Analysis #42👋 Welcome to TradeCity Pro!

Let's delve into the analysis of Bitcoin and other key crypto indices. As usual, I will review the futures triggers for the New York session for you.

⏳ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, the price still maintains a range box between 83808 and 84734, and the market volume has decreased even more from yesterday.

📊 The less the volume, the closer we are to a price movement, so again, keep an eye on the market to ensure you don't miss any active triggers.

⚡️ For a short position, you can enter with a break of 83808, and for a long position, with a break of 84734.

👑 BTC.D Analysis

Let's move to the analysis of Bitcoin dominance. Yesterday, the support at 61.43 was broken, and it's moving towards 61.08.

✔️ Currently, I don’t have any specific triggers for confirmation in dominance, but as long as the dominance stays below 61.43, I see it continuing its downward trend.

📅 Total2 Analysis

On to the analysis of Total2, the trigger at 1.05 is about to be activated, and the price could move towards 1.07 with a break of this area.

🔽 The short trigger remains at 1.04 for now.

📅 USDT.D Analysis

Finally, looking at the Tether dominance, this index is still ranging between 5.25 and 5.34.

💫 A break of either of these areas could determine the next leg of the price movement.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #41👋 Welcome to TradeCity Pro!

Let's delve into the analysis of Bitcoin and important crypto indices. Today, as usual, I aim to review the New York session futures triggers for you.

⏳ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, Bitcoin is still in a range box between 83808 and 84734, and the market volume is continuously decreasing.

📊 The market volume has reached its lowest possible level, indicating that a move is imminent, so be alert today as the likelihood of our triggers activating is very high.

🔼 For a long position, entering at a break of 84734 could be beneficial, as breaking this area could start a bullish leg up to 86876.

📉 For short positions, a break of 83808 remains suitable. Yesterday, the price briefly breached this area but seemed to rebound, making it still appropriate for positioning.

👑 BTC.D Analysis

Moving on to Bitcoin dominance analysis, as you can see, dominance was rejected from the high of 61.63 yesterday, then set a lower high compared to this area, and now the floor of 61.43 has been broken.

💫 Currently, with the break of 61.43, dominance could move down to 61.08. However, if the break of 61.43 proves to be a fake-out, the likelihood of breaking 61.63 increases.

📅 Total2 Analysis

Let’s talk about Total2; this index doesn't have a very reliable trigger right now, and you can still enter a position with a break of 1.07, but if the price reacts to 1.05, on a second contact, entering on a break of this area might be viable.

🔽 For short positions, a break of 1.04 is suitable, and you can enter a position with the break of this area.

📅 USDT.D Analysis

Lastly, analyzing Tether dominance, it is still ranging and has formed a box between 5.25 and 5.34.

✔️ For a downward trend in dominance, you can confirm with a break of 5.25, and for an upward trend, a break of 5.34 will serve as your confirmation.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #40👋 Welcome to TradeCity Pro!

Let's delve into the analysis of Bitcoin and important crypto indices. Today, as usual, I aim to review the New York session futures triggers for you.

⏳ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, the price has pulled back to below the 84734 area again today.

🔽 The short trigger we have for today is the break of 83808. With the break of this area, the price could move downwards.

✅ The important supports are at 82459 and 80105, which we can use as targets.

📈 For a long position, entering at a break of 84734 could be beneficial, with a target at 86876.

👑 BTC.D Analysis

Moving on to the Bitcoin dominance analysis, a support was established yesterday at 61.43, creating a price box between 61.43 and 61.63.

💫 To confirm an upward trend in dominance, watch for a break of 61.63, and for a downward trend, a break of 61.43 will serve as a confirmation.

📅 Total2 Analysis

Let’s talk about Total2; this index has broken its support at 1.04, and if Bitcoin also loses its support, it could move down to 1.01 again.

🎲 If you don't have positions open, you might consider looking for altcoins that have not yet lost their support, or wait for Bitcoin.

🔼 For long positions, the trigger for Total2 remains at 1.07.

📅 USDT.D Analysis

Lastly, analyzing Tether dominance, it has come back above 5.26, pulled back to this area, and is poised to potentially initiate an upward leg to 5.46.

✔️ The upward dominance trigger for Tether is a break of 5.31. With the break of this area, we can expect dominance to potentially rise again to 5.46.

📉 For downward dominance, a break of 5.26 is a suitable trigger.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

USDT.DOMINANCE WEEKLY CHART UPDATE. Current Market Structure:

Breakout Confirmation: USDT Dominance has broken out of its descending trendline and is now in a retest phase.

50MA as Support: The 50-week moving average now acts as dynamic support, reinforcing the bullish outlook.

Rejection or Breakout? The price is currently testing resistance. If it gets rejected, a temporary pullback is likely before further gains.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

TradeCityPro | Bitcoin Daily Analysis #39👋 Welcome to TradeCity Pro!

Let's delve into the Bitcoin and key crypto indexes analysis. As usual, I want to review the New York session futures triggers for you.

⏳ 1-hour timeframe

As you can see in the 1-hour timeframe, Bitcoin broke the 84734 resistance yesterday and the price moved upwards. We had some triggers before breaking this area, which I hope you opened positions with and made some profits.

✅ Currently, the price has reached the 86876 area, got rejected, and has returned to 84734. Given the low volume of the red candles, we can consider this movement a correction and a ranging box might form between 84734 and 86876.

⚡️ For today, the best long trigger is breaking 86876, which the price has already hit once. If it can break this area in subsequent contacts, we can enter a position.

🔽 For short positions, the first trigger is the break of 84734, but it’s a risky trigger and I prefer to wait until the price makes a significant trend change before entering a position.

👑 BTC.D Analysis

Moving on to the Bitcoin dominance analysis, yesterday, as Bitcoin's price increased, dominance broke through 61.49 and moved downward, which helped altcoins move higher.

💫 However, as dominance reached 61.08, the market momentum completely changed, and dominance returned above 61.49. Now, after the trend line break, with the break of 61.63, we can confirm a fake breakout.

🧩 For dominance to move downward, the break of 61.49 is still appropriate, and a break of this area can still confirm a downward trend in dominance.

📅 Total2 Analysis

Moving on to the Total2 analysis, yesterday’s trigger at 1.04 was activated, and I moved this area to 1.05 today because the price reacted better to it.

⭐ If you had opened a position with the break of 1.04, you could have made a good profit as the price reached 1.07.

🔑 Currently, the price is ranging between 1.05 and 1.07, and you can open positions if any of these areas break.

📅 USDT.D Analysis

Finally, looking at the Tether dominance, the chart is very similar to Total2 but in reverse.

✨ A break of 5.26 confirms an upward trend, and a break of 5.13 confirms a downward trend in dominance.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

USDT DOMINANCE NEW UPDATE (8H)This analysis is an update of the analysis you see in the "Related publications" section

From the upper green zone, Wave F of this bullish diametric is expected to complete, leading to Wave G. Wave G is a bullish wave that will likely cause the market to turn red.

Let's see what happens

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

TradeCityPro | Bitcoin Daily Analysis #38👋 Welcome to TradeCity Pro!

Let's dive into the Bitcoin analysis and key crypto indexes. As usual, I will review the futures triggers for the New York session for you.

✨ Yesterday, our short trigger was activated, and the price moved downward but then moved back up after a few candles.

⏳ 1-hour timeframe

In the 1-hour timeframe, as I mentioned, the trigger at 82066 that I specified for you yesterday was activated, but I personally opened my position at the break of 82459 because there was good downward momentum in the market, and the candle that broke this area was very strong.

🔄 The position I opened went to a risk-to-reward of 2 and became risk-free, and then the market moved upwards, now reaching 83806.

💫 Today, for opening positions, our long trigger is exactly 83906, and if the price breaks this area, we could see the next upward leg. I prefer that the price reacts to this area once and then breaks through it.

✔️ However, be aware that there is another important area at 84573 and a significant range has formed between 83906 and 84573. If you want to open a position confidently, wait until 84573 is also broken so the price can fully exit this range.

⚡️ A break of 62.94 in the RSI can be a good confirmation of momentum. As you can see, the volume is gradually increasing, which is suitable for a long position.

🔽 For short positions, you can still enter with a break of 82459. It's better to wait for the price to react to this area once and look for a break on the second contact.

👑 BTC.D Analysis

Let's move on to the analysis of Bitcoin dominance. As you can see, a descending triangle has formed, and the price has a downward trend line that has caused it to set a lower high every time it reaches 61.49, and now there is a very high chance of breaking this area, which could start a new downward leg in dominance.

👀 On the other hand, if the trend line breaks, dominance could move back up to 62.03. If this happens, money will move out of altcoins and into Bitcoin.

📅 Total2 Analysis

Let's move on to the analysis of Total2. This index still hasn't exited its ranging box and is moving between 1.01 and 1.04.

🔼 You can open a long position with a break of 1.04 and a short position with a break of 1.01.

📅 USDT.D Analysis

Let's look at the USDT.D analysis. Yesterday, the 5.43 area was broken, but like Bitcoin, after a few candles, this area was faked, and the price returned to the box between 5.28 and 5.43.

🔑 For confirming a downward trend in Tether dominance, you can confirm with a break of 5.28. For an upward trend in dominance, you should wait until the price creates a new structure.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

USDT Dominance Dropping! Is This the Start of a Crypto Bull Run?CRYPTOCAP:USDT Dominance chart is approaching a critical phase, currently trading within a strong resistance zone while showing RSI bearish divergence.

This suggests potential weakness ahead, which could lead to a drop in USDT dominance. If that happens, it typically correlates with a bullish phase for altcoins, as traders rotate capital from stablecoins into riskier assets.

A breakdown below the rising support line could confirm a reversal, leading to further downside in USDT dominance. This scenario would likely trigger increased buying pressure in the altcoin market.

TradeCityPro | Bitcoin Daily Analysis #37👋 Welcome to TradeCity Pro!

Today, we're going to analyze Bitcoin and other important crypto indices. In this analysis, as usual, I want to examine the futures triggers for the New York session.

⏳ 1-hour timeframe

In the 1-hour timeframe, as you can see, after breaking 83806, a downward movement occurred, but afterward, it moved upwards again and now has formed a box between 82066 and 83806.

⚡️ Today, we have triggers for both long and short positions because the price has created a good structure for opening positions, and since it's the beginning of the week, volume could enter the market.

✔️ Additionally, we have an ascending trend line that started from the base at 77598 and the price has touched it several times. If this trend line breaks, the price could start a new downward leg.

🔼 For long positions, the first trigger we have is 83806, which could coincide with an RSI of 54.70. However, this trigger is risky and the main trigger for breaking is 84817.

📉 For short positions, a good trigger was created yesterday at 82066. Breaking this area could start the next downward leg to 80105. This trigger is also a trigger for breaking the trend line, and breaking this area could start the next downward leg to 80105. The main trigger is the break of 80105 itself.

👑 BTC.D Analysis

Let's move on to the analysis of Bitcoin dominance, as you see, dominance has rejected from the ceiling of 62.03 again and is moving downward. Currently, dominance has again reached 61.53.

🎲 If 61.53 breaks, we can expect dominance to move downward, and on the other hand, if 62.03 breaks, the price can move upward.

✨ In general, a new range box has been formed again, and breaking the floor or ceiling of this box can determine the next price leg.

📅 Total2 Analysis

Let's move on to the analysis of Total2, this index rose from 1.01 yesterday and is moving towards 1.04 again.

💫 The long trigger for today is the break of 1.04, although we should wait until the price reacts to this area once so that the exact number of resistance is revealed, and we can open a position with its break.

🔽 For short positions, you can enter a very good and suitable short position with the break of 1.01.

📅 USDT.D Analysis

Let's move on to the analysis of Tether dominance, like Total2, its triggers have not been activated yet and nothing new can be said about it.

🔑 A breakout above 5.43 indicates an upward move and a break below 5.28 indicates a downward move

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | Bitcoin Daily Analysis #36👋 Welcome to TradeCity Pro!

Let's dive into the Bitcoin analysis and key crypto indices. In this analysis, as usual, I want to review the futures triggers for the New York session.

⏳ 1-hour timeframe

In the 1-hour timeframe, as you can see, after breaking 83806, a downward movement occurred but then it moved upwards again, now forming a box between 82066 and 83806.

✔️ Today we have triggers for both long and short positions because the price has formed a good structure for opening positions, and since it's the beginning of the week, volume can enter the market.

🎲 We also have an ascending trendline that originated from the bottom at 77598, which the price has hit several times. If this trendline breaks, the price can start a new downward leg.

🔼 For long positions, our first trigger is 83806, which may coincide with an RSI of 54.70. However, this trigger is risky and the primary trigger for a breakout is 84817.

📉 For short positions, a good trigger was formed yesterday at 82066. Breaking this area could initiate the next downward leg to 80105. This trigger is also a trendline break trigger, and breaking this area could start the next downward leg to 80105. The primary trigger for this is also the break of 80105.

👑 BTC.D Analysis

Let's move on to the Bitcoin dominance analysis. As you can see, dominance was rejected from the ceiling of 62.03 and moved downward. Currently, dominance has again reached 61.53.

💥 If 61.53 breaks, dominance can move downwards and conversely, if 62.03 breaks, the price can move upwards.

📊 Overall, a range box has been formed again, and breaking the floor or ceiling of this box can determine the next price leg.

📅 Total2 Analysis

Moving on to the Total2 analysis, this index rose from 1.01 yesterday and is now moving towards 1.04.

💫 Today's long trigger is the break of 1.04, but we need to wait until the price reacts to this area once to get the exact resistance number and open a position with its breakout.

🔽 For short positions, you can enter a very good and suitable short position with a break of 1.01.

📅 USDT.D Analysis

The dominance of Tether has formed a large range box between 5.28 and 5.56, and currently, the price is near the bottom of the box. There is also a resistance line at 5.43 within the box.

⚡️ Today, for confirming a downward trend in dominance, you can use the break of 5.28, and for an upward trend, you can confirm with the break of 5.43.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.