USDTRY

💡Ascending Triangle in USDTRY - "Learn More Earn More" With USAscending Triangle Definition:

An ascending triangle is a type of triangle chart pattern that occurs

when there is a resistance level and a slope of higher lows .

It is defined by two lines:

. A horizontal resistance line running through peaks.

. An u ptrend line drawn through the bottoms.

The higher lows indicate more buyers are gradually entering the market

and buying pressure increases as price consolidates moving further towards the apex.

An ascending triangle is classified as a continuation chart pattern.

If price can break through the resistance level , that level will now act as a support level .

Breakouts can also happen in both directions. Statistically,

upward breakouts are more likely to occur, but downward ones seem to be more reliable.

In most cases, the buyers will win this battle and the price will break out past the resistance.But Sometimes the resistance level is too strong, and there is simply not enough buying power to push it through. Therefore you should be ready for movement in EITHER direction.

ENTRY:

We would set an entry order above the resistance line and below the slope of the higher lows.

TARGET:

Target is approximately the same distance as the height of the triangle formation.

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated! ❤️

💎 Want us to help you become a better Forex trader ?

Now, It's your turn !

Be sure to leave a comment let us know how you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

💡Ascending Triangle in USDTRY - "Learn More Earn More" With USAscending Triangle Definition:

An ascending triangle is a type of triangle chart pattern that occurs

when there is a resistance level and a slope of higher lows .

It is defined by two lines:

. A horizontal resistance line running through peaks.

. An u ptrend line drawn through the bottoms.

The higher lows indicate more buyers are gradually entering the market

and buying pressure increases as price consolidates moving further towards the apex.

An ascending triangle is classified as a continuation chart pattern.

If price can break through the resistance level , that level will now act as a support level .

Breakouts can also happen in both directions. Statistically,

upward breakouts are more likely to occur, but downward ones seem to be more reliable.

In most cases, the buyers will win this battle and the price will break out past the resistance.But Sometimes the resistance level is too strong, and there is simply not enough buying power to push it through. Therefore you should be ready for movement in EITHER direction.

ENTRY:

We would set an entry order above the resistance line and below the slope of the higher lows.

TARGET:

Target is approximately the same distance as the height of the triangle formation.

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated! ❤️

💎 Want us to help you become a better Forex trader ?

Now, It's your turn !

Be sure to leave a comment let us know how you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

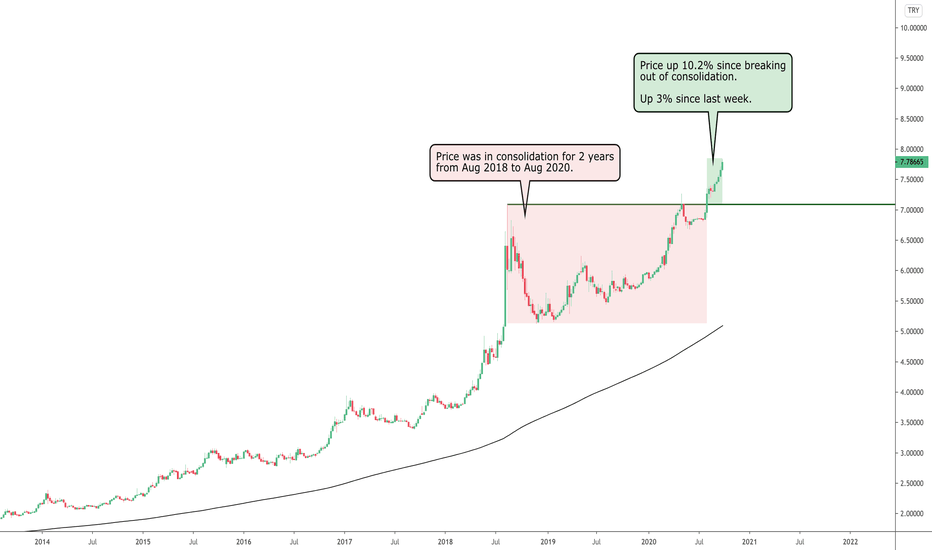

USDTRY Gains Another 1,390 Pips!The Turkish Lira continues to weaken which we can see in this chart where the US Dollar is displaying

dominance over the Lira.

Since the last post, price has risen by 1,390 pips which is 1.8%. Based on the weekly timeframe,

price has not yet formed a clean pullback so we may be due one. But if the trend is strong,

then we may not see a pullback for some time.

The consolidation resistance was formed around the 7.000 round number, so the next round number

at 8.000 may create some difficulty for price to make it past.

When the USDTRY is in a trend, it does tend to pick up speed so we shouldn’t be surprised if we

experience a surge in price. This happened back in 2018 when price was in an uptrend then we saw

a move of 26% in the month of August 2018 alone.

We can’t guarantee what will happen next so we just have to continue on as normal and look to

maximise profits as much as we can, so long as this trend continues to run.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

USDCAD | SWING - 4 Oct. 2020Hello my friend | Welcome Back.

Please support this idea with LIKE if you find it useful.

***

After breaking the downtrend and retesting the broken area, we will notice a new rise to Fibonacci level 0.61.

***

Here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

Remember this analysis is not 100% accurate No single analysis is To make a decision follow your own thoughts.

***

The information given is not a Financial Advice.

BTCUSD Apple GBPUSD EURUSD XAUUSD AUDUSD

EURGBP NZDUSD USDCHF USDJPY

USDCAD | SWING - 2 Oct. 2020Hello my friend | Welcome Back.

Please support this idea with LIKE if you find it useful.

***

It may swing at the trend line if the trend line is broken, and it is the support that will go according to the scenario that you set.

***

Here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

Remember this analysis is not 100% accurate No single analysis is To make a decision follow your own thoughts.

***

The information given is not a Financial Advice.

BTCUSD Apple GBPUSD EURUSD XAUUSD AUDUSD

EURGBP NZDUSD USDCHF USDJPY

USDTRY Up 10% After Consolidating!Since posting about the USDTRY last week, price has continued to rise, handing out easy profits

so far to those investors that have added this to their portfolio.

This forex pair has been mentioned in our community leading up to our entry and as you can see,

a linear trend is starting to form.

In last week’s post, price had moved up over 7% since breaking out of consolidation. Price has since

moved up another 3% taking it to a rise of 10%.

There is still potential for further bullish moves here and the next level of resistance price may

move towards is the 8.0000 round number.

The USDTRY usually trends well and is then followed by periods of consolidation so we want to

position ourselves with compounds before the trend is over, in order to maximise our profits.

At the moment we will continue to manage our positions and lock in profits.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

#USDTRY - 200 BPS EtkisiTam burada 200bps faiz artırdık

Etkisi ne olacak? Esas sorumuz bu.

Düzeltme tetiklenirse aşağıda destek olarak 7.26

Tepe aşılırsa yukarıda 8.25 bizi bekliyor.

Right here we raised 200bps interest rate

Our main question is what will be the effect?

7.26 as support below if correction triggered

If USDTRY hit and pass the higher-high 8.25 above awaits us.

ridethepig | Turkish Lira Strategy🔸 Ceilings and profit taking

I am starting to unwind partials in the USDTRY longs with all of these moves so full of energy in the current chapter it wont be long until the retailers and bloomberg crowd are on board. There is lots of thunder and lightening across the global economy, Turkey will catch more than the sniffles but it is prudent we stick to the plan - the same plan since 2018 (yes 2018).

In this position, wave 5 was an obvious impulse, because after buyers held support they could then start to promote their positions and adding to winners. The 30% upside once looked miles away and is now shining us right in the face, will sellers dare to come out? Will other sharp speculators riding this for months/quarters want to also take profits?

If buyers hold 7.82xx it will trigger the collapsing of local banks, so we make this play with a heavy heart. It would be interesting to investigate further whether we will get the intermediate highs in USDTRY, so lets leave some partials running incase we get capitulation...

USDTRY Trending Strong!Forex pairs have been off the radar for some time as most of the action has been in stocks.

But here and there, certain forex pairs will pop up with opportunities and this is the reason

that we never take our eye off the ball.

You can clearly see from the chart that the US Dollar is gaining strength over the Turkish Lira

and has consistently been on the rise for a number of years now.

In 2018 alone, we saw a sudden surge in price with a rise of 89% in just 8 months of that year.

Like with most big trends, price will take a break in the form of a pullback or period of consolidation.

In this case we saw price consolidate for 2 years.

With consolidation zones, we always want to patiently wait for breakouts because we can expect

to see a strong move in the direction of the breakout.

So far, this breakout has started to trend nicely to the upside with price already up 7.3%

since breaking above resistance at 7.0831.

With a trend currently in play, we have to look at the next area price may move to and we

can see that then 8.0000 round number is above and may act as resistance.

We currently have a position in this pair and we will look to compound as long as price

continues to break previous levels of resistance.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.