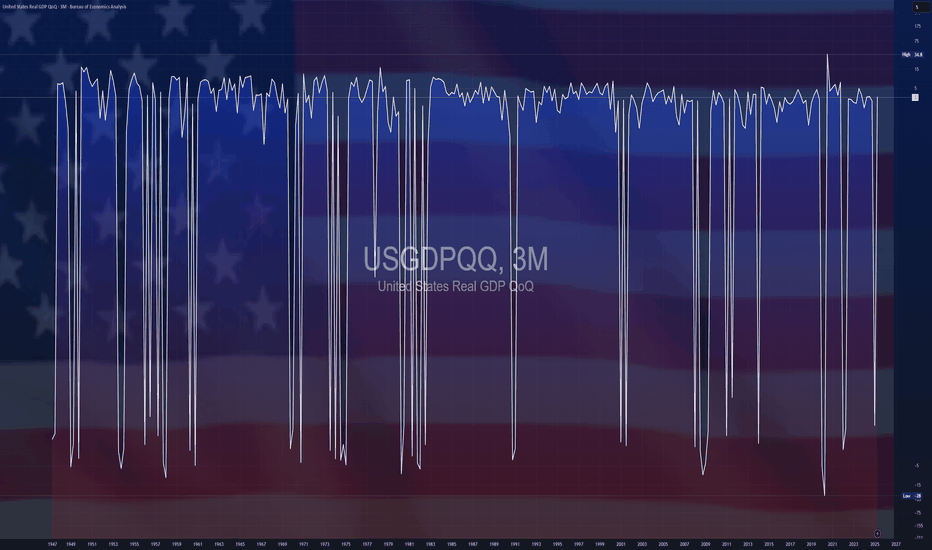

$USGDPQQ -U.S Economic Growth Outpaces Forecasts (Q2/2025)ECONOMICS:USGDPQQ 3%

Q2/2025

source: U.S. Bureau of Economic Analysis

- The US economy grew at an annualized rate of 3% in Q2 2025,

sharply rebounding from a 0.5% contraction in Q1 and exceeding market expectations of 2.4% growth, largely driven by a decline in imports and a solid increase in consumer spending.

However, the gains were partly offset by weaker investment and lower exports.

Useconomy

S&P 500: Defying Tariff Headwinds, Breaking RecordsThe S&P 500 has staged a remarkable rally in 2025, shattering all-time highs and capturing global attention. This surge has unfolded despite the negative economic overhang of renewed tariff threats and ongoing trade tensions, raising critical questions for investors: How did the market overcome such headwinds, and what lies ahead for both the short and long term?

The Rally Against the Odds

Tariff Turbulence: Earlier this year, President Trump announced sweeping new tariffs, sparking fears of supply chain disruptions and higher costs for American companies. Historically, such moves have triggered volatility and corrections.

Market Resilience: Despite these concerns, the S&P 500 not only recovered losses from the spring but surged to new record highs, with the index climbing over 23% since April’s lows. Major tech companies, especially those leading in AI and innovation, have been at the forefront of this advance.

Investor Sentiment: The rally has been fueled by optimism around potential Federal Reserve rate cuts, robust corporate earnings, and expectations of long-term economic growth—even as the immediate impact of tariffs remains uncertain.

Short-Term Correction: A Healthy Pause?

While the long-term outlook remains bullish, several indicators suggest the market may be due for a short-term correction:

Narrow Market Breadth: The current rally has been driven by a handful of mega-cap stocks, leaving the median S&P 500 stock well below its own 52-week high. Historically, such narrow leadership often precedes periods of consolidation or pullbacks.

Valuation Concerns: Stock valuations are at elevated levels, and some analysts warn that earnings growth could slow as companies adapt to higher input costs and shifting trade policies.

Correction Forecasts: Some strategists predict the S&P 500 could correct to around 5,250 by the third quarter of 2025, citing factors like slowing consumer spending and persistent policy uncertainty.

Long-Term Outlook: Higher Highs Ahead

Despite the potential for near-term volatility, the long-term trajectory for the S&P 500 remains positive:

Fed Policy Tailwinds: Anticipated rate cuts and lower bond yields are expected to provide further support for equities, encouraging risk-taking and higher valuations.

Corporate Adaptation: Companies are actively offsetting tariff impacts through cost savings, supply chain adjustments, and strategic pricing.

Growth Sectors: Innovation in technology, productivity gains, and deregulation are setting the stage for sustained profit growth, especially in sectors like AI, robotics, and defense.

Key Takeaways for Investors

Stay Disciplined: While a short-term correction is possible, history shows that markets often rebound strongly after periods of volatility.

Diversify Exposure: With market gains concentrated in a few names, diversification and active stock selection are more important than ever.

Focus on Fundamentals: Long-term investors should look beyond headlines and focus on companies with resilient earnings and adaptive business models.

The S&P 500’s ability to break records in the face of tariff headwinds is a testament to the underlying strength and adaptability of the U.S. economy. While short-term bumps are likely, the path ahead still points toward new highs for those with patience and perspective.

This article is for informational purposes only and does not constitute investment advice. Always consult with a financial advisor before making investment decisions.

#spx500 #stockmarket #analysis #economy #us #nasdaq #fed #bonds #rates #trading

DXY CRACK! BAD JUJU!After Trump unilaterally imposed Tariffs (Taxes) on its citizens to buy imported goods from the rest of the world, promising 90 deals in 90 days, "in two weeks", the demand for the dollar payment system has collapsed by -12% reducing purchasing power for all $ holders'.

Imports of goods mean exporting $s to the rest of the world. As a world reserve currency (WRC), the US gets the benefit of seeing those $s invested back into the US. That creates demand for the $ payment system, and raises $ holders' purchasing power, reducing inflation.

What else happens? A bit complicated but I will try to explain. High demand for $ means the US indirectly exports inflation. Meaning, more $ for the same amount of goods and services. However, as a WRC, the US is not really exporting inflation. That is a bit inaccurate bc the US payment system as a WRC is actually includes a lot more goods and services from the entire planet. This makes sense if you think about it. However only going one way, meaning as long as the demand from the world for our payment system, more $ required by the world reflect more goods and services. As such not inflationary.

Now let's reverse it so you can see why it is not entirely accurate. Should the Global Economy (which is worth today about $100 trillion,) demand ever drop off. The $ value will collapse as people sell their $ holdings in exchange for other currencies. What you are seeing right now in this chart with a CRACK in it.

The US GDP is currently about $30 trillion. There is no way! A $ payment system designed for a $100T economy can suddenly absorb all those $ in a $30T economy. Inflation would skyrocket as more and more $ chase the same amount of goods and services ($30T). This is not rocket science. This is basic 3rd-grade arithmetic!

This CRACK! could be very bad JUJU!

CAUTION is in order. Don't let normality bias fool you. No matter how you feel about Trump. It is irrelevant to basic arithmetic.

$USIRYY -U.S CPI Below Expectations (May/2025)ECONOMICS:USIRYY 2.4%

(May/2025)

source: U.S. Bureau of Labor Statistics

- The annual inflation rate in the US increased for the first time in four months to 2.4% in May from 2.3% in April, though it came in below the expected 2.5%.

Prices rose slightly more for food, used cars and new vehicles but shelter cost slowed and gasoline prices continued to decline.

Meanwhile, the annual core inflation rate held steady at 2.8%.

On a monthly basis, both headline and core CPI increased by 0.1%, falling short of market expectations.

U.S. Dollar Index (DXY) Weekly 2025Summary:

The U.S. Dollar Index (DXY) has corrected down to the key 38.60% Fibonacci retracement zone and is currently showing signs of a potential bullish reversal, bolstered by a clear hidden bullish divergence on the MACD. This may signal a renewed rally toward key upside targets, especially if the 93.3–99.9 support Zone holds.

Chart Context:

Current Price: 98.864

Key Fib Support: 38.60% @ 99.906, 48.60% @ 93.310, 61.80% @ 87.476

Support Zone: 93.3–99.9 USD

Hidden Bullish Divergence: Observed both in 2021 and now again in 2025 on the MACD

Trendline Support: Long-term ascending trendline holding since 2011

Fib Extension Targets (Trend-Based):

TP1: 115.000

TP2: 120.000

TP3: 126.666

Key Technical Observations:

Fibonacci Confluence: DXY is bouncing from a strong Fib cluster between 93.310 and 99.906, historically acting as a reversal zone.

Hidden Bullish Divergence: Suggests potential upside despite price weakness.

Downtrend Retest: Price may revisit 93.3–87.4 before confirming full reversal.

Breakout Pathway: Green dashed arrows outline the likely recovery trajectory toward 114–126 range.

Indicators:

MACD: Showing hidden bullish divergence and potential signal crossover.

Trendline Support: Holding intact from 2021 low.

Fib Levels: Used for retracement and trend-based extension.

Fundamental Context:

Interest Rate Outlook: If U.S. inflation remains controlled and Fed signals future hikes or sustained high rates, DXY strength may persist.

Global Liquidity & Recession Risk: If risk aversion returns, the dollar may rise as a safe haven.

Geopolitical Risks: Conflicts, trade tensions, or BRICS dedollarization efforts may create volatility.

Our Recent research suggests the Fed may maintain higher-for-longer rates due to resilient labor markets and sticky core inflation. This supports bullish USD bias unless macro shifts rapidly.

Why DXY Could Continue Strengthening:

Robust U.S. economic performance & monetary policy divergence

U.S. GDP growth (~2.7% in 2024) outpaces developed peers (~1.7%), supporting stronger USD

The Fed maintains restrictive rates (4.25–4.50%), while the ECB pivots to easing, widening the policy and yield gap .

Inflation resilience and Fed hawkishness

Labor markets remain tight, keeping inflation “sticky” and delaying expected rate cuts; market-implied cuts for 2025 have been pushed into 2026

Fed officials (e.g. Kugler) emphasize ongoing tariff-driven inflation, suggesting rates will stay elevated.

Safe-haven and yield-seeking capital flows

With global risks, capital favors USD-denominated assets for yield and stability

Why the Dollar Might Face Headwinds

Fiscal expansion & trade uncertainty

Ballooning U.S. deficits (~$3.3 trn new debt) and erratic tariff policy undermine confidence in USD

Wall Street’s consensus bearish position.

Major banks largely expect a weaker dollar through 2025–26. However, this crowded bearish sentiment poses a risk of a sharp rebound if data surprises occur

barons

Tariff policy risks

Trump's new tariffs could dampen dollar demand—yet if perceived as fiscal stimulus, they could unexpectedly buoy the USD .

Synthesis for Our Biases

A bullish DXY thesis is well-supported by:

Economic and policy divergence (U.S. growth + Fed vs. peers).

Hawkish Fed commentary and sticky inflation.

Safe-haven capital inflows.

Conversely, risks include:

Deteriorating fiscal/trade dynamics.

Potential Fed pivot once inflation shows clear decline.

A consensus that could trigger a short squeeze or reversal if overstretched.

Philosophical / Narrative View:

The dollar remains the world’s dominant reserve currency. Periodic dips often act as strategic re-accumulation phases for institutional capital—especially during global macro uncertainty. A return toward 120+ reflects this persistent demand for USD liquidity and safety.

Bias & Strategy Implication:

1. Primary Bias: Bullish, contingent on support at 93.3–99.9 holding.

2. Risk Scenario: Breakdown below 93.3 invalidates bullish thesis and targets 87.4–80 zones.

Impact on Crypto & Gold and its Correlation and Scenarios:

Historically, DXY has had an inverse correlation to both gold and crypto markets. When DXY strengthens, liquidity tends to rotate into dollar-denominated assets and away from risk-on trades like crypto and gold. When DXY weakens, it typically acts as a tailwind for both Bitcoin and gold.

Correlation Coefficients:

DXY vs. Gold: ≈ -0.85 (strong inverse correlation)

DXY vs. TOTAL (crypto market cap): ≈ -0.72 (moderate to strong inverse correlation)

Scenario 1: DXY Rallies toward 115–126 then, Expect gold to correct or stagnate, especially if yields rise. Crypto likely to pull back or remain suppressed unless specific bullish catalysts emerge (e.g., ETF flows or tech adoption).

Scenario 2: DXY ranges between 93–105 then Gold may consolidate or form bullish continuation patterns. Then Crypto may see selective strength, particularly altcoins, if BTC.D declines.

Scenario 3: DXY falls below 93 and toward 87 Then Gold likely to rally, possibly challenging all-time highs. Crypto could enter a major bull run, led by Bitcoin and followed by altcoins, fueled by increased liquidity and lower opportunity cost of holding non-USD assets.

Understanding DXY’s direction provides valuable insight for portfolio positioning in macro-sensitive assets.

Notes & Disclaimers:

This analysis reflects a technical interpretation of the DXY index and is not financial advice. Market conditions may change based on unexpected macroeconomic events, Fed policy, or geopolitical developments.

Is the Golden Arches Losing Its Shine?McDonald's, a global fast-food icon, recently reported its most significant decline in U.S. same-store sales since the peak of the COVID-19 pandemic. The company experienced a 3.6 percent drop in the quarter ending in March, a downturn largely attributed to the economic uncertainty and diminished consumer confidence stemming from President Donald Trump's tariff policies. This performance indicates that the unpredictable nature of the trade war is prompting consumers to curb discretionary spending, directly impacting even seemingly resilient sectors like fast food through reduced customer visits.

The link between sinking consumer sentiment and tangible sales figures is evident, as economic analysts note the conversion of "soft data" (sentiment) into "hard data" (sales). While some commentators suggest that McDonald's price increases have contributed to the sales slump, the timing of the decline aligns closely with a period of heightened tariff-related anxiety and a contraction in the U.S. economy during the first quarter. This suggests that while pricing is a factor, the broader macroeconomic environment shaped by trade tensions plays a critical role.

In response, McDonald's emphasizes value offerings to attract and retain customers navigating a challenging economic landscape. The company's struggles mirror those of other businesses in the hospitality sector, which also report reduced consumer spending on dining out. The situation at McDonald's serves as a clear illustration of how complex trade policies and the resulting economic uncertainty can have far-reaching consequences, affecting diverse industries and altering consumer behavior on a fundamental level.

$USGDPQQ -US Economy Slows More than ExpectedECONOMICS:USGDPQQ 2.3%

(Q4/2024)

source: U.S. Bureau of Economic Analysis

- The US economy expanded an annualized 2.3% in Q4 2024, the slowest growth in three quarters, down from 3.1% in Q3 and forecasts of 2.6%.

Personal consumption remained the main driver of growth, but fixed investment and exports contracted.

Considering full 2024, the economy advanced 2.8%.

$USINTR -Feds Cuts RatesECONOMICS:USINTR

(November/2024)

source: Federal Reserve

-The Fed lowered the federal funds target range by 25 basis points to 4.5%-4.75% at its November 2024 meeting, following a jumbo 50 basis point cut in September, in line with expectations.

Policymakers reiterated their previous message that they will carefully assess incoming data, the evolving outlook, and the balance of risks when considering additional adjustments to borrowing costs.

On the economic front, the Fed noted that recent indicators suggest that economic activity has continued to expand at a solid pace.

Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low.

Inflation has made progress toward the 2% objective but remains somewhat elevated.

However, officials removed a reference they had “gained greater confidence” that inflation is moving toward the target.

-United States PCE (October/2024)$USCPCEPEPIMM 0.3%

(October/2024)

source: U.S. Bureau of Economic Analysis

-The US core PCE price index, the Federal Reserve’s preferred gauge to measure underlying inflation, rose by 0.3% from the previous month in September of 2024, the highest gain in five months, following an upwardly revised 0.2% increase in August, matching market forecasts. Service prices rose by 0.3%, while goods prices decreased 0.1%.

Year-on-Year, core PCE prices rose 2.7%, the same as in August, but above forecasts of 2.6%. source: U.S. Bureau of Economic Analysis

XAUUSD | Market outlookGold Reserve Diversification: At the LBMA conference, central bank representatives shared that gold purchases are driven by financial and strategic goals.

US Election Impact:

Uncertainty over the upcoming presidential elections, with Trump and Harris closely tied in polls, is prompting banks to hedge risks.

Geopolitical Risks: Tensions in the Middle East are also boosting gold, with Israel expressing readiness to target Iran's military infrastructure.

Price Trends:

Long-term trend: Upward, aiming to break the historical high of 2685.00 . Potential targets: 2750.00 and 2810.00 if consolidation succeeds.

Support and Correction: If the price drops to 2602.00 , long positions toward 2685.00 are favourable. A breakout below 2602.00 could trigger a correction targeting 2546.00 and 2471.00 .

Medium-term trend:

Correction: Last week’s correction did not reach key support at 2575.61–2564.61 . If a reversal occurs, the price could rise to 2685.61 and potentially 2712.70–2701.70 .

Correction Scenario: If another correction develops, the price may revisit 2575.61–2564.61 , followed by growth toward 2625.00 and 2685.00 .

$USIRYY -U.S Inflation Rate Falls to 2.5%- The annual inflation rate in the US slowed for a 5th consecutive month to 2.5% in August, the lowest since February 2021 and below market expectations of 2.6%.

Compared to the previous month, the CPI rose 0.2%, the same as in July, and matching forecasts.

Meanwhile, annual core inflation steadied at an over 3-year low of 3.2% but the monthly gauge edged up to 0.3%, above forecasts of 0.2%.

source: U.S. Bureau of Labor Statistics

$USJO (MoM)ECONOMICS:USJO U.S Job Openings Down to 2021-Lows

source: U.S. Bureau of Labor Statistics

The number of Job Openings fell by 237K to 7.673 million in July 2024,

the lowest level since January 2021, compared to a downwardly revised 7.91 million in June, and well below market forecasts of 8.1 million.

Job openings decreased the most in health care and social assistance; transportation, warehousing, and utilities; and state and local government.

The #FED R FOOLS (or LIAR's) - Chart with 100% chance recession"The Fed sees no recession until at leat 2027 and a very smooth landing"

They are either ignoring blatant economic indicators

Or straight out lying to the public, and the media.

As this chart shows.

When Housing starts go down

and unemployment starts spiking

a recession almost immediately follows .

If I can see that with no economics background, no MBA, or experience in Finance surely they can too!!!

TRUMP vs BIDEN : These 7 Charts Reveal AllThese charts will point out not only the difference between 4 year terms, but also the effect of the worldwide Coronavirus on different sectors.

Just so you know, I am not advising for or against either candidate solely on what they could do or have done for a certain industry. Instead, this post aims to inform and point out the market's response during each Presidential period. It's also important to consider the effect of Covid (marked by the purple line).

1) DXY / TVC:DXY

The U.S. dollar index (USDX) is a measure of the U.S. dollar's value relative to the majority of its most significant trading partners, including the Euro (constituting 57.6% of the weighting), Japanese Yen (13.6%), British Pound (11.9%), Canadian Dollar (9.1%), Swedish Krona (4.2%) and Swiss Franc (3.6%).

Under President Trump, the DXY fell 14% the moment he took office. The DXY then recovered the 14% over the next two years, but dropped again as the Coronavirus crisis was declared a global pandemic in May 2020.

Under President Biden, the DXY rose from post-covid lows by 27%, then retraced 12% unto where it is now trading steadily.

I'll use the following chart below as a reference to how we will be measuring (the difference between inherited point to exit, as seen by the measuring tool).

Change from inherited point to exit:

TRUMP: -13%

BIDEN (inherited point to current) : +19%

2) Consumer Confidence Index / ECONOMICS:USCCI

This Index index measures Americans' assessment of current economic conditions and their outlook for the next six months. The consumer confidence remained fairly stable under Trump, but fell drastically with the announcement of the Covid pandemic. Biden inherited a declining consumer confidence, but the CCI managed to recover with 57.6% after hitting the lowest lows during the midst of the Coronavirus pandemic.

The CCI has not been able to recover to pre-covid highs, showing that consumers are not yet comfortable with the current state of economic affairs.

Change from inherited point to exit:

TRUMP: -19.5%

BIDEN (inherited point to current) : -2.4%

3) Inflation / ECONOMICS:USIRYY

Initially the inflation rate was fairly stable under Trump, and then started to fall drastically, dropping -95%... until Covid. Since Biden took office, the inflation rate increased by 550%, but managed to drop back down by 62% after peaking during covid.

Change from inherited point to exit:

TRUMP: -44.8%

BIDEN (inherited point to current) : +141%

4) S&P 500 / SP:SPX

Trump talked-up the stockmarket as a measure of his presidency when he was in office. (Not that the SPX is something presidents have much control over, but let's take a look at it anyway).

The s&p 500 index of big American firms is higher since Biden took office, but it rose twice as much during Trump’s first 1,000 days in office.

Change from inherited point to exit:

TRUMP: +63%

BIDEN (inherited point to current) : +40.8%

5) United States Employment Rate / ECONOMICS:USEMR

In United States, the employment rate measures the number of people who have a job as a percentage of the working age population. The USEMR was increasing steadily up to 2% when Covid hit.

Under the Biden administration, unlike many European countries, America decided to give money to workers, rather than pay companies to keep people in employment. The share in work fell, but America’s economy bounced back more quickly than Europe’s. Biden administration takes credit for a 4.8% increase since taking office.

Change from inherited point to exit:

TRUMP: -14.5%

BIDEN (inherited point to current) : +4.8%

6) Unemployment Rate / FRED:UNRATE

Trump inherited a steadily decreasing unemployment rate from the Obama administration. The UNRATE continued to drop until -25.8% after which, again, covid. It is true that the Biden administration inherited a tough one here, and there has been a 15% increase after bottoming out during April 2023. Unfortunately, this chart seems to be steadily increasing.

Change from inherited point to exit:

TRUMP: +36.4%

BIDEN (inherited point to current) : -39%

7) Money Supply / ECONOMICS:USM2

US M2 refers to the measure of money supply that includes financial assets held mainly by households such as savings deposits, time deposits, and balances in retail money market mutual funds, in addition to more readily-available liquid financial assets as defined by the M1 measure of money, such as currency, traveler's checks, demand deposits, and other checkable deposits. Historically, when the money supply dramatically increased in global economies, there would be a following dramatic increase in prices of goods and services, which would then follow monetary policy with the aim to maintain inflation levels low.

Trump administration inherited a steeply increasing supply which kept increasing rapidly. Currently, under the Biden administration, the M2 seems to be moving towards an equilibrium.

Change from inherited point to exit:

TRUMP: +45%

BIDEN (inherited point to current) : +7.7%

______________________

Note that these are not THE ONLY charts we can look at. In fact, I encourage you to post yours below! Which other measures are you looking at? Treasury, perhaps Bonds? Feel free to share them and lets compare!

TSLA - Weekly Inflection PointDaily is winding up to an inflection point, while the weekly is getting close as well. I'm favoring the bearish break; but there is a chance for a bullish reversal- so time will tell. What I can say is that we're approaching a conclusive point in time that will send price with signifcant momentum in either direction. When I look for an inflection point I watch for consolidating momentum. In turn I watch for breaks that releases the built up energy.

Previous Analysis:

Massive US Unemployment Move Inbound

On the FRED:UNRATE dataset, we can see that since 1953, every time the unemployment rate make a significant move above the 24 months SMA, with the sole exception of October '67, we saw a large spike in unemployment allong with a recession.

Currently, FRED:UNRATE rose above the 24 months SMA in August 2023 and has been stochastically moving higher ever since. Historically, this means that we can expect an aggressive move in unemployment in the following months.

S&P 500 - Flying high, overbought and stretched 7.2.24Weekly trend-line stretching back to November 2022, is being tested around the level of 5,000 which is also a "psychological barrier" for price action to proceed going higher.

A re-test of the breakout above the 4,800 level is expected in the near-term.

Macro Monday 31 ~ Dallas Fed Manufacturing Index (Key Levels)Macro Monday 31

U.S. Dallas Fed Manufacturing Index

This Index is compiled from a monthly survey conducted by the Federal Reserve Bank of Dallas to assess the health of manufacturing activity in the state of Texas. It provides insight into factors such as production, employment, orders, and prices, offering a snapshot of economic conditions in the region.

Why is the Dallas Fed Manufacturing Index Important?

▫️ As stated above the index covers manufacturing activity in the state of Texas, the state of Texas ranks 2nd only to California in factory production & comes in at 1st as an exporter of manufactured goods, thus Texas is an important state for gauging manufacturing & production in the U.S. economy.

▫️ Texas also contributes an incredible c.10% towards the U.S. Manufacturing gross domestic product making the index an important metric to consider towards potential GDP trends in the U.S.

▫️ The Dallas Fed Manufacturing Index (DFMI) is one of several regional manufacturing surveys that feed into the national Purchasing Managers Index (PMI). The PMI is released later this week on Thursday 1st Feb thus the DFMI on Monday will give us an early indication of the potential direction of the PMI later in the week. FYI, I will be covering the PMI for you on Thursday so stay tuned for that.

How to read the index?

A reading above 0 indicates an expansion of the factory activity compared to the previous month; below 0 represents a contraction; while 0 indicates no change.

The Chart

The chart only dates back to 2005 so we have a limited dataset however we can still see definitive levels of importance and trends over this shorter historic backdrop.

A few findings from the chart:

The + 36.8 Level

Since December 2005 any time we have hit the +36.8 level on the chart it has typically represented a peak in manufacturing and production signaling that a decline would likely follow. This has occurred 3 times and each time within 20 – 23 months of this +36.8 peak we had a recession or a financial crisis.

1) December 2005

21 Months later we had the Great Financial Crisis.

2) June 2018

20 months later we had the COVID-19 Crash.

3) April 2021

23 months later the U.S Banking Crisis occurred in March 2023 resulting in 3 small to mid size banks failing.

- The remaining banks being saved by the Bank Term Funding Program (BTFP) which appears to have successfully contained the contagion for now. The BTFP is ceasing in March 2024 👀

▫️ We can see above that in the event we reach the +36.8 level in the future, history informs us that within 20 – 23 months major economic issues will likely present. If we had known this back in April 2022. After April 2022 the S&P500 fell 15% to its recent lows.

▫️ The National Bureau of Economic Research (NBER) could declare the current period we are in as a soft recession. For the last six recessions, on average, the announcement of when a recession started was declared 8 months after the fact meaning we will would only get confirmation of a recession once we are 6 - 8 months into it. Its worth noting that some recessions were confirmed by the NBER after the recession was over.

- 36.8 Level

A reading below the -36.8 level has historically confirmed a recession. We have not hit this level since the COVID-19 Crash with May 2020 being the last time we have been at this level.

Periods in Contractionary Territory

There have been 2 previous periods where we have remained in contractionary territory for greater than 6 months. These are worth reviewing as we have been in contractionary territory for the 20 months now (April 2022 - Present).

1) Sept 2007 – Nov 2009:

We fell into contractionary territory during the Great Financial Crisis for 26 months. From 2009 to 2016 the index seemed week oscillating around the 0 level and not really breaking out into persistent expansionary territory until 2017 forward.

2) Jan 2015 – Oct 2016:

We fell into contractionary territory for 21 months however there was no recession.

3) Apr 2022 – Present:

We are currently on month 20 of contraction. Now this could be just like point 2 above whereby we recover to expansionary territory in month 21 or 22 (Jan - Feb 2024) however if we do not, we are moving towards a timeline similar to point 1 which was the 26 month Great Financial Crisis. Q1 of 2024 will be very revealing in terms of what we can expect next. In the event we end up in contraction for 26 months or if we hit the -36.8 level we can presume, based on history, that we likely have a recession on our hands. And, if we recover into expansionary territory maybe we have got away with it this time 🙂

You can clearly see that the Dallas Fed Manufacturing Index is significant for assessing the U.S. economy because it provides timely insights into the health of one of the nation's key economic sectors: manufacturing & production. Since Texas is a major hub for manufacturing activity, trends observed in the Dallas Fed index can offer valuable indications of broader economic trends. It is one of several regional indices that contributes to a comprehensive understanding of the manufacturing landscape, aiding policymakers, investors such as ourselves, and businesses in making informed decisions about the state of the economy.

The current economic environment just gets more and more interesting every week

Thanks for coming along again folks 🫡

PUKA

U.S Core PCE Price Index (MoM)ECONOMICS:USCPCEPIMM

Core PCE prices in the US, which exclude food and energy,

rose by 0.2% from the previous month in December of 2023, aligned with market estimates, and picking up slightly from the 0.1% increase in November.

From the previous year,

Core PCE prices edged 2.9% higher,

undershooting market estimates of 3% to mark the lowest reading since February 2021.

The data extended the disinflation trend in prices measured by the Federal Reserve’s preferred gauge, consistent with previous signals of rate cuts to be delivered this year. Regarding the whole national PCE that includes energy and food, prices rose by 0.2% from the prior month and 2.6% from the prior year, consistent with expectations.

Prices for goods rose by less than 0.1% from 2022, while those for services remained elevated at 3.9%.

source: U.S. Bureau of Economic Analysis

The US Economy Has Flashed ResilienceThe potential for a stronger dollar looms ahead, driven by the robustness of the US economy, which enables Federal Reserve officials to pursue a more gradual reduction in interest rates compared to other major central banks.

Despite the Federal Reserve's assertive approach to raising interest rates, the US economy has demonstrated resilience, with inflation gaining momentum toward the end of 2023. This defies expectations on Wall Street, where some anticipated an earlier initiation of interest rate cuts, possibly as early as March.

Additionally, the dollar finds support in the persisting uncertainty surrounding significant global elections, particularly the impending US presidential showdown. By March, the candidates will be revealed, and unlike the scenario in 2016, the likelihood of a victory for former President Donald Trump is expected to be factored into the market well in advance.

Dollar Index ($DXY): "The next Step"At the beginning of the year I already showed my idea about the upside potential of the US dollar (see chart below), and today I can only confirm what I said earlier. If from a technical point of view, my idea continues to be bearish on stocks markets, these considerations of mine could also have a logical sense and the scenario shown on chart could really happen.

In my previous analysis (February 2023) I showed the potential dollar rally from the area around $101, hence the Price Action showed something like a "Double Bottom" Pattern on daily and intraday chart:

(Click & Play on Chart below)

If we look at the S&P500 index over the long term, from a technical point of view, it may have completed a first bull cycle that started way back in 1872:

(Click & Play on Chart below)

At the same time, this potential "Perfect Storm" should also affect the real estate sector in the mid-term, with a contraction in prices (U.S. Case Shiller Home Price):

(Click & Play on Chart below)

...what's your opinion about this analysis?

Trade with care!

Like if my analysis is useful.

Cheers!