THE KOG REPORT - ELECTION SPECIAL THE KOG REPORT:

This week’s KOG Report is a little different this week due to the upcoming elections. For that reason, we’re going to share the levels and potential movement since we are almost guaranteed to see some extreme movement over the coming sessions. The chart was shared in Camelot together with the analysis 4yrs ago which worked well.

On the left chart you can see the 2020 reaction to the elections giving a powerful movement across the markets and gold moving over 2000pips in days. We’ve shown this chart to make new and less experienced traders aware of what can happen based on any result! Price will whipsaw, they will chop and change direction and when they move, it will really move. IF, and it’s a BIG IF, you’re going to attempt to trade it, please make sure your lot sizes are sensible, and your risk model is flexible enough to adapt to sudden changes in direction.

Now the chart on the right. We have drawn a path, but it’s based more on a potential fractal rather than set in stone. The levels however are important, and potentially if targeted can give traders opportunities to capture the bounces or, give them a better understanding of where price can go before taking a breather. We’re close to the 2800 level but as you can see, we’ve struggled to break it, this usually just means that price has travelled enough to take a slight pause in direction, and requires a pullback, which is what we analysed and traded last week. How far thought, with extreme news and volatility entails caution, our immediate support and resistance levels hardly work in these scenarios.

So, when we look at extreme levels on the chart we can see the following:

We have resistance above on the daily at 2745 which needs a daily close above to go higher. This flips our support level into the 2715 level which looks like a decent level for price to attempt in the coming sessions. Our order region is sitting at the psychological level of 2700 with the extension of the move into the 2680-5 level. This, if attempted could give traders and opportunity to take the long back up towards the 2730-35 red box level which will have also flipped into resistance. This is the level currently in play and needs to be monitored as this is the order region they’re using to propel the price in either direction. It’s also the reason they’re accumulating here and start the pre-event range. Break above, and we should see bulls’ step in and force price higher, as shown in the illustration on the chart.

The range is big, the high in sight is the 2820-34 region, which if attacked and rejected can give us opportunities to capture the larger short trade, while the 2575-65 level is sticking out for the undercut low. To be totally honest, knowing what can happen and how price can move, it’s the same strategy as trading NFP and FOMC. Don’t trade the volume driven candles, wait for price to move, use the levels and the red boxes, and then, with a risk model in place take a sensible trade if you’re going to trade it.

The above is just our view and more for educational purposes. We will continue to use our proven red box strategy, indicators and our trusted algo Excalibur to guide us through the markets.

Good luck for the week ahead!

KOG’s bias for the week:

Bearish below 2744 with targets below 2720, 2714 and below that 2702

Bullish on break of 2744 with targets above 2792 and above that 2803

Red boxes:

Break above 2744 for 2753, 2765, 2780

Break below 2730 for 2715, 2705, 2695

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Uselections2020

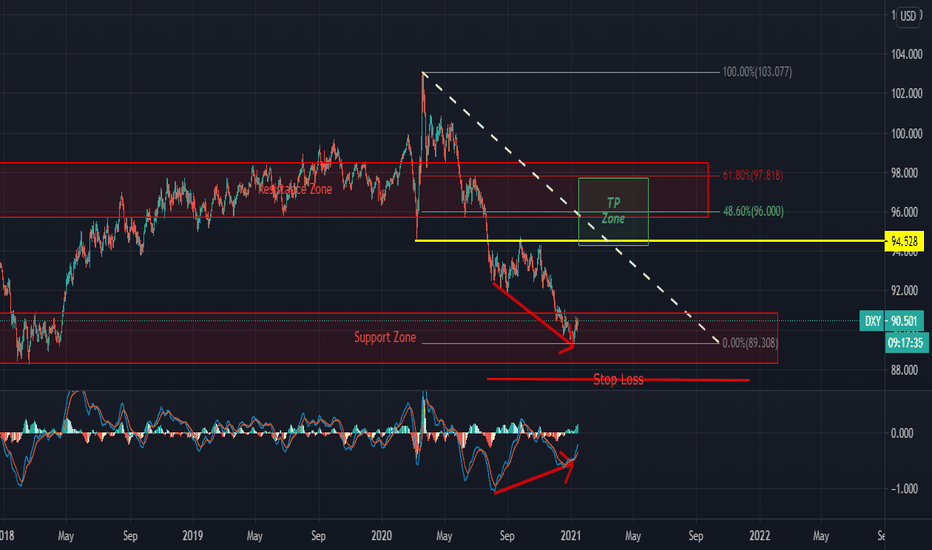

U.S. Dollar Index Bullish Divergence and US Economy Improvement here we can see DXY is showing a Bullish Divergence with MACD in Daily Time Frame

as it is a regular divergence so it can be a sign of trend reversal and start of a rally to its previews higher points and resistances

i have specified the Minimum retracement levels by Fibonacci retracement tool and the levels are combined with Price Action analysis.

we can use this data to setup our positions in may forex instruments including EURUSD and GBPUSD etc... which can be interpreted as shorting them for swing and positional Trades

i have also analyzed them so I will keep their links to the related ideas

this analysis can help us to forecast many other Asset movements and US related economic factors

please name few other uses of DXY in the Comments

and let me know how can we relate this trend change with the current US Geopolitical issues and economic status??? and obviously the US election...

USDJPY-Weekly Market Analysis-Dec20,Wk5An ABCD Pattern is not usually the setup I'm looked at, but when it is spotted, there's a good reason to look for a trading opportunity, once the candle has show confirmation of its trend.

At this moment, we have an inverted ascending triangle and it is perfect for counter-trend and breakout traders to look at this trade.

If the trendline is not broken, I'll wait for a buying opportunity and if it breaks and closes above the resistance line, I will wait for a retracement to engage the trade.

USDJPY-Weekly Market Analysis-Dec20,Wk4On the 4-hourly and daily chart, the USDJPY is going for a bearish run, however, countertrend and harmonic patterns traders you can wait for a countertrend trade of a bullish bat pattern for a buying opportunity. Think twice before you engage the trade as target2 gives you only 40pips of potential profits and we have not factored in the spread.

USDJPY-Weekly Market Analysis-Nov20,Wk4The resistance line at 104.21 or the trendline setup for a shorting opportunity for trend traders. Last Thursday and Friday have a clear demonstration of a weak movement on USDJPY, on the following week it may give us more clue of the movement for this pair for the next 2 weeks.

US Elections - Trump vs Biden - Price Win ZonesThis currently shows, who might win the #USElections2020.....

USDJPY-Weekly Market Analysis-Nov20,Wk3Last week, we had shared our trade ideas with our community(check the link at the bottom), for traders who had missed the opportunity could wait for the retracement back to the bearish trendline for a shorting opportunity. In order to do that, you have to make sure that the candle does not break and close above the red trendline.

GBPUSD-Weekly Market Analysis-Nov20,Wk2GBPUSD is at the major resistance of the Daily Chart, a great consideration for a counter-trend trade, on the 1-hourly chart the same level marks the completion of the Bearish Shark pattern. I will wait for the market open to observe if there's any gap when the market open, what's caused by the US Election Results.

United States Presidential election - Trump vs BidenCurrently, I reckon Biden most likely will fall to 49, and President Trump will go up to 45. Place your bets, ladies, and gentlemen!

My watchlist for election day:

- XAU/USD

If President Trump wins, my XAU/USD sentiment is super bearish.

- US30

If President Trump wins, my US30 sentiment is super bullish.

- USD/JPY

If President Trump wins, my USD/JPY sentiment is super bullish.

ALT Party Coming?BTC.D Daily charts reached to top as I told you on other idea linked below..

If TODAYS's candle closes below 64.7 that means the rejection price action for the bull move on BTC.D and I'll open positions on Strong Alt-Coins..

Something really important that you shouldn't forget on these important US elections.. that the market is under the influence of strong fundamental news.. So I strongly recommend you if you want to open positions even on Bitcoin or ALTs.. Please consider your STOP-LOSS close to where you open your position.. this will protect you from fundamental news that will suddenly dump the price..

This is my idea.. What do you think..

FX Minors: Current Market Trends & Covid-19 / U.S. ElectionsIn this analysis, we take on the Swiss Franc (CHF) versus the Brazilian Real (BRL) to gauge the prevailing sentiment in the FX markets, in the context of U.S. Presidential Elections uncertainties around the U.S. Dollar (USD), as well as the diminishing in importance of Covid-19 globally & a generalised overextension of major currencies to the upside against FX minors (such as the BRL, HUF, PLN, HRK & so on).

A short sell-off in this CHF/BRL pair is particularly significant due to the 'safe-haven' quality of the Swiss Franc in comparison to the rather fragile Brazilian Real, which is interesting when we consider the underlying fundamental factors driving such a move, less influenced by a strengthening in the Real, but rather a global cooldown in the pandemic situation, which favours baby steps towards business as usual, portfolio diversification & a healthy profit-taking / opportunity-seeking in the markets.

When we take into account the dramatic moves to the downside across all FX minors, a global recovery from this pandemic does imply some gradual increase in demand for minor currencies such as the Real, which in turn also means the nearing of supply levels for major currencies, as the need for 'safe havens' diminish inasmuch as the generalised fear of abnormal global conditions gives way to a slow return back to normality.

Wish you guys good trading and if you enjoy this analysis, please give me a like and share your ideas on the comments section, I'll really appreciate feedback from you guys and I promise to read and reply to each and every one of them as soon as possible.

An amazing week for all of you and until the next post! :)

MORE MONEY ! Follow up analysisClick the link in the "Yellow circle" to see all the previous analyses.

It was a PERFECT swing analysis so far. Let's get more MONEY!! Currently, I reckon as long as it stays above the "potential BUY ZONE," AUD will keep climbing to the next targets. There's a possibility to fall to retest the broken trendline at 0.711, but currently, the fundamental says very unlikely. Keep your guard up, because we never know!

If Biden wins the election, most likely, AUD will keep climbing to 0.741, but if President Trump ends up wins the election, I will short AUD ALL IN.

Catalyst:

- NFP

- US Election

Reached the First Target HUGE PROFIT - Let's get MORE MONEY !Reached the First Target HUGE PROFIT - Let's get some more!

It was a Perfect trade and analysis. It has reached the first target. Currently, I reckon as long as it stays above the minor trendline, XAU will continue the rally to the next targets.

If Biden wins the election, most likely, XAU will keep climbing to the 2075 zone to make a double top. If President Trump ends up wins the election, I will short ALL IN.

Catalyst:

- ISM Manufacturing PMI

- US Presidential Election

- ISM Services PMI

- FOMC

- Average Hourly Earnings

- Non-Farm Employment Change

- Unemployment Rate