Decoding Fed Rate Changes via Federal Funds Futures Index◉ What Are Federal Funds Futures?

● Definition: Federal Funds Futures are financial contracts traded on the Chicago Mercantile Exchange (CME) that allow market participants to bet on or hedge against future changes in the federal funds rate (the interest rate at which banks lend to each other overnight).

● Purpose: These futures reflect the market's expectations of where the Fed will set interest rates in the future.

◉ How Federal Funds Futures Work?

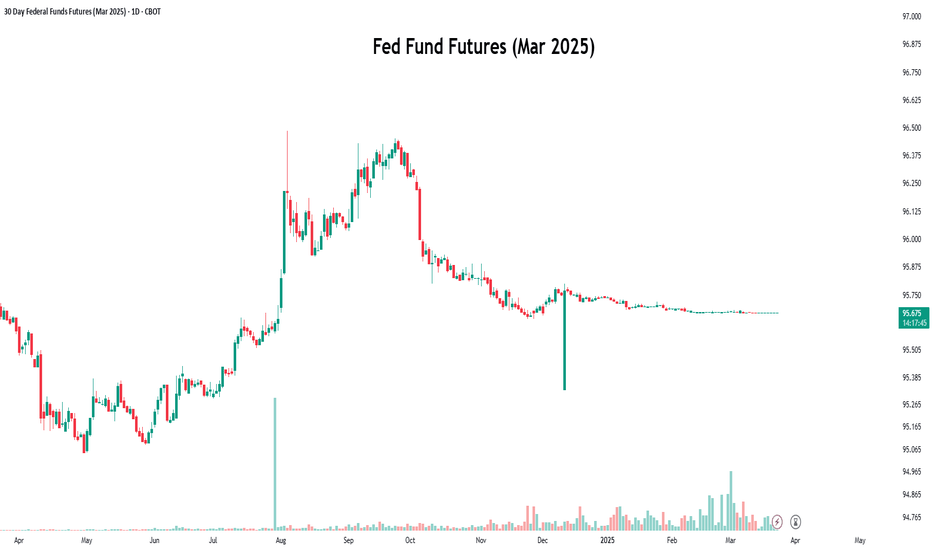

● Pricing: The price of a federal funds futures contract is calculated as 100 minus the expected average federal funds rate for the contract month.

➖ Example: If the futures price is 95.00, it implies an expected federal funds rate of 5.00% (100 - 95 = 5).

● Contract Expiry: Each contract represents the market's expectation of the average federal funds rate for a specific month.

◉ Why Use Federal Funds Futures?

● Predict Fed Policy: Traders and investors use these futures to gauge the likelihood of the Fed raising, cutting, or holding interest rates.

● Hedge Risk: Institutions use them to protect against potential losses caused by interest rate changes.

● Market Sentiment: They provide insight into what the broader market expects from the Fed.

◉ Steps to Analyze Fed Policy Using Federal Funds Futures

● Step 1: Check Current Federal Funds Futures Prices

Look up the prices of federal funds futures contracts for the months you're interested in. These are available on financial platforms like Bloomberg, Reuters, or the CME Group website.

● Step 2: Calculate the Implied Federal Funds Rate

Implied Federal Funds Rate = 100 - Futures Price.

➖ Example: If the futures price for March is 95.5, the implied rate is 4.5% (100 - 95.5 = 4.5).

● Step 3: Compare Implied Rates to the Current Rate

If the implied rate is higher than the current federal funds rate, the market expects the Fed to raise rates. If it's lower, the market expects a rate cut.

● Step 4: Estimate the Probability of Rate Changes

By comparing the implied rates of contracts expiring before and after an FOMC meeting, you can estimate the probability of a rate change.

➖ Example: If the implied rate for March is 4.75% and the current rate is 4.5%, the market is pricing in a 25 basis point (0.25%) hike.

● Step 5: Monitor Changes Over Time

Track how futures prices change over time. Shifts in prices indicate changes in market expectations. For example, if futures prices drop (implying higher rates), it suggests the market is anticipating a more hawkish Fed.

◉ Practical Applications

● Trading: Traders use federal funds futures to speculate on interest rate movements.

● Economic Forecasting: Economists use them to predict the Fed's monetary policy and its impact on the economy.

● Investment Strategy: Investors adjust their portfolios based on expected rate changes (e.g., shifting from bonds to equities if rates are expected to rise).

◉ Limitations of Federal Funds Futures

● Market Sentiment: Futures prices reflect market expectations, which can be influenced by sentiment and may not always accurately predict Fed actions.

● External Shocks: Unexpected events (e.g., geopolitical crisis, pandemics) can disrupt rate expectations.

● Liquidity: Less liquid contracts (further out in time) may not accurately reflect expectations.

◉ Example Analysis

Let’s assume:

➖ Current federal funds rate: 4.5%

➖ March federal funds futures price: 95.5

● Step 1: Calculate the implied rate:

100 − 95.5 = 4.5%.

● Step 2: Compare to the current rate:

The implied rate (4.5%) is equal to the current rate (4.5%), suggesting the market expects no change in rates by March.

● Step 3:

If the futures price drops to 95.25, the implied rate becomes 4.75%, indicating the market now expects a 25 basis point rate hike..

◉ Why This Matters?

● For Traders: Federal funds futures provide a direct way to bet on or hedge against interest rate changes.

● For Investors: Understanding rate expectations helps in making informed decisions about asset allocation.

● For Economists: These futures offer valuable insights into market expectations of monetary policy.

◉ Conclusion

Federal funds futures are a powerful tool for analyzing and predicting the Fed's interest rate decisions. By understanding how to interpret these futures, traders, investors, and economists can gain valuable insights into market expectations and make more informed decisions. However, it's important to consider their limitations and use them in conjunction with other economic indicators for a comprehensive analysis.

Usfed

What about DXY?I haven't updated my DXY analysis for a while. So let's dust it off.

The last update was in September when the atmosphere was changing in a way that we couldn't predict the US Election clearly and for a short period, the market thought the results wouldn't be as it is today. That was why I was a bit bearish on DXY. By getting closer to Election Day the clouds were going away and it got easier for the market to see the outcome. So, it strengthened the dollar while weakening the Gold as we expected the geopolitical tensions to cool off.

What's next?

For now, I see the 10-year bond yield can show a bit more weakness to come just below 3.99%. Then after that, we should update our analysis and see what comes next. But I think ~4% is low for now and after that, I like to see a jump back up. In this short-term correction DXY would follow the 10-year bond yield and most probably come into the range of 104 to 105. That's also can be a small driver for Gold to go higher a bit.

GBPUSD Sets 2+ Year Highs as the Fed Out-Cuts its UK PeerThe pair gains nearly 5% this year and the latest round of policy decisions by the Fed and the BoE, sent it the highest levels since the first quarter of 2022. The US Fed on Wednesday made its belated pivot with an outsized 0.5% reduction and pointed to another 50 bps worth of cuts by the end of the year. The Bank of England started lowering rates earlier than its US counterpart, with the 0.25% cut of August. Still wary over price pressures though, it has maintained a cautious stance around further easing. This apprehension was reaffirmed on Thursday, as policymakers stood pat on rates.

The Fed out-cut the BoE and is on track to deliver more reductions, setting up a favorable monetary policy differential for GBP/USD. Bulls now have the opportunity to push for the 1.3483 handle, but we are cautious at this time for further strength.

The Fed may have pointed to steep rate cut path as it tries to ensure a strong labor market and a soft landing, but may have a hard time implementing it, as it could put upward pressure to prices. On the other hand, despite the BoE’s trepidation, pressure could mount for faster pace and two more cuts are not unreasonable. Furthermore, the RSI moves towards overbought conditions, so we could see pressure. Daily closes below the EMA200 (black line) would be needed for the bullish bias to pause, but that is hard to justify under current monetary policy dynamics.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (trading as “FXCM” or “FXCM EU”) (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 59% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763). Please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this video are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed via FXCM`s website:

Stratos Markets Limited clients please see: www.fxcm.com

Stratos Europe Ltd clients please see: www.fxcm.com

Stratos Trading Pty. Limited clients please see: www.fxcm.com

Stratos Global LLC clients please see: www.fxcm.com

Past Performance is not an indicator of future results.

Gold Trend 05/08The spot gold price is losing upward momentum despite the expectations of a Fed. Rate cut increasing

The spot gold price went up during the week but fell after Friday's US non-farm payroll report. Looking back at last week, the price broke through the 2400 resistance before the Fed—meeting on Wed. The price kept on rising after Powell's dovish speech, and tensions rose in the Middle East as Iran's leader ordered attacks on Israel in response to the assassination of a Hamas leader. The US released weaker-than-expected job data on Fri., causing gold prices to hit a weekly high and rechallenge the historical peak 2480. However, the market quickly focused on concerns that the US economy might enter a recession. US stocks rapidly fell from their highs, dragging gold prices down to a daily low of 2410, closing the week at 2442.

According to CME FedWatch, the latest interest rate futures indicate that the probability of a 50 basis point rate cut in September increased from 22% on Thursday to 95% early in the Monday Asian session. Whether in the gold or stock markets, a rate cut should boost the market. However, despite reaching twice above 2450 in the past month, the spot gold price didn't have any significant new long-buying position above 2450 but profit-taking and new short-selling positions. The market now broadly expects the first rate cut to happen in September. As the first rate cut approaches, it is almost time for investors who entered long for the 'rate cut' concept at the beginning of the year to plan their exit. 'Buy on the rumour, sell on the news' ~ gold prices may still hit a new high before September, but expect a significant correction around the first rate cut!

1-hour Chart > The price still runs within the upward wedge(2). In the S-T, gold prices are supported by the trendline(2.1). If this support is broken, a significant correction may occur, with a target of 2400. Currently, the range of 2450-53 is acting as an S-T resistance zone, while stronger resistance is expected at 2478-80.

Daily Chart > No major economic data are expected to be released this week, and gold prices are unlikely to break high. The initial expectation is to work within the range of 2410-80 established last Friday.

If you like my work, please give me a thumbs up 👍.

Feel free to leave a comment; share your thoughts 🤟.

P.To

USDJPY Pulls Back as US Labor Market CoolsAfter years of ultra-loose monetary setting that has been detrimental for the Yen, the Bank of Japan has started the normalization process, but does so slowly and remains accommodative. Its US counterpart meanwhile looks to pivot from its aggressive tightening, but persistent inflation creates apprehension. As a result, USD/JPY is having another banner year with 14% gains in the first half. The rally continues in the third quarter, as the pair reached 38-year highs last week, bringing 165.00 in the spotlight.

On the other hand, the rally raises risk for new FX intervention by Japanese authorities, which have already spent nearly ¥10 trillion this year to support the ailing Yen. The weak currency increases pressure on the central bank to tighten its policy, supported by elevated inflation and strong wages. Policymakers have signaled they will reduce the amount of bond buying and at least one more hike is reasonable this year, following the historic exit from the negative rates regime in March.

Fed officials are cautious around removing monetary restraint, due to stubborn inflation, strong economy and tight labor market. However, the disinflation process has resumed according to recent data, while Friday’s report showed that employment conditions are easing, boosting market bets for two rate cuts this year.

The shift in monetary policy dynamics is weighing on the pair after the 38-year peak and creates scope for a deeper pullback that would test the EMA200 (black line). Daily closes below it would pause the bullish momentum, but strong catalyst would be needed for that and the downside appears well-protected.

There are key events coming up this week that can shape the trajectory of the pair, namely Fed Chair Powell’s two-day Congress testimony and the US CPI inflation update.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (trading as “FXCM” or “FXCM EU”), previously FXCM EU Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763). Please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this video are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed via FXCM`s website:

Stratos Markets Limited clients please see: www.fxcm.com

Stratos Europe Ltd clients please see: www.fxcm.com

Stratos Trading Pty. Limited clients please see: www.fxcm.com

Stratos Global LLC clients please see: www.fxcm.com

Past Performance is not an indicator of future results.

Review and plan for 2nd May 2024Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Q. Why when the FED raises interest rates does the rand weaken?A. Whenever you think about a country raising interest rates, we need to consider what happens to investors and where they are more likely to deposit their money.

So, as we are expecting an increase in interest rates this month from the FED, there are a few reasons why we can expect the rand to weaken further:

Here are three to consider…

Reason #1: Investors flock to the US Dollar

When the US Federal Reserve raises interest rates, it becomes more attractive for investors to hold or buy US-dollar denominated assets.

That’s because they know they’ll receive a higher rate when they invest in it.

This will also lead to a rise in the US dollar and a drop in smaller currencies (like the rand).

Reason #2: US Dollar is still the fat cat of reserve currencies

A rise in US interest rates may lead to higher borrowing costs globally.

This is because the US dollar is still the world's primary reserve currency.

When we think of gold, Bitcoin and other precious metals, we think of how it’s priced in US dollars.

The problem with this, is that emerging market countries, like South Africa, will

face higher debt-servicing costs as the US interest rates continue to move up.

And this could continue to put pressure on their economies which will lead to a depreciation in the rand.

Reason #3: South Africa is still a big exporter

Also, South Africa remains one of the major exporters of commodities.

And the value of the rand is linked to fluctuations in commodity prices.

So, when US interest rates rise, this leads to a stronger US dollar. And can

cause commodity prices to drop (as they are generally priced in US dollars).

As South Africa is a major commodity exporter, the lower commodity prices would have a negative impact in SA’s export revenue – which can in turn weaken the rand further.

Silver underlying support, wave count, and target of $34+Thanks for viewing,

Big fan of silver as a way to gain leverage over an increasing gold price. So where to we sit currently?

- After a huge (~+150%) run-up From March to mid 2020 (depending on the chart source - some charts (like this one put the local high at Feb '21) silver entered a period of mostly sideways consolidation.

- The goldsilver ratio has swung dramatically, from over 120:1 in March 2020 to a low of 62.5 in Feb '21 and since then has had a mild up-trend and now sits at around 72:1. Of late, silver has performed unfavourably versus gold.

- The US Fed rate (which is updated tomorrow) currently sits at 0.25% - unchanged since March '20 (investing dot com forecasts no change at that next meeting).

- US monthly Inflation numbers (depending on the source) indicates inflation on the rise (fred.stlouisfed.org) Which will mean that low-yielding long-term government debt will stay neutral or below inflation and possibly move to a even greater negative real yield (Presently 1.3% US10y yield less 5% (5% taken from investing dot com) inflation is presently a -3.7% real yield)). If you take the CPI numbers (fred.stlouisfed.org) the real yield is almost exactly ZERO - not negative, but not exactly attractive (and also not protective to the holders in the eventuality of continued rising inflation)

- US Federal debt (on balance sheet anyway - off balance (or "unfunded") sheet debt is around 5 times higher) rose 21% since the start of 2020. I don't think it is a controversial statement to say that this level of debt will be a significant future challenge to service unless interest rates stay depressed medium to long-term and the principal is repaid in significantly depreciated currency).

Ok, there is more, but the general case for silver remains intact and the outlook for gold and silver remains medium to long-term bullish. So, what is next?

I put a possible wave count for silver and some possible support levels. I especially pay attention to areas where a number of different areas of support converge; e.g. peak or trough support, fib extension / retracement levels, trend-line etc. So we seem to have one of those levels approaching with;

- The 0.382 for the full 2020 move seeming to provide strong support,

- Fib extensions almost perfectly hit the 1.618 before bouncing three times now,

- Lower trend-line support isn't too far below current prices at around 23 (this isn't a strong trend-line as there are only two points - but the larger price trend forms a generally symmetrical triangle with around 6 points of contact),

- Seemingly strong level support sits at 23.781 and is coincident with other smaller areas of support,

- I don't expect we will see prices below $24.

The only reason why I don't point to Elliot Wave as indicating a local bottom at the current swing low is that I see another small wave down to end the current correction.

Importantly, I am starting to see some RSI bullish divergence on the 4hrly - which is also evident on the daily chart. I definitely pay attention when the RSI starts to form higher lows while the price heads lower. It's a good time to think about getting in or out - or at least scaling in / out / taking profit. At a minimum it shows a slowing in the price momentum.

So, to continue my Memoirs :) I am not looking to the next Fed rate decision - unless they suddenly hike it to above 3% (which is basically impossible now if the US is ever to service is current (and fast expanding) public debt) - the long-term case for gold and silver remains in place. I posted yesterday that I can see, one of the possible future scenarios being $2140 gold in the near-term (an 18.5% rise) and silver could conservatively be expected to double that % rise which would put it around $34/oz.

Best of luck everyone, and protect those funds.