US stocks hold near record highs on strong 2Q earnings

Despite elevated valuation pressures, US equities remain near all-time highs. While tariff concerns persist, resilient US economic data continues to support the market's upward momentum.

United Airlines reported a 1.7% YoY increase in 2Q revenue, citing easing geopolitical and macroeconomic uncertainties and a double-digit rebound in corporate demand. Meanwhile, earnings and share performance among mega-cap stocks have also been strong.

Netflix (NFLX) beat market expectations with 2Q revenue of $11.08 billion and EPS of $7.19. At the same time, Nvidia (NVDA) reached a fresh all-time high on renewed optimism over a potential resumption of exports to China.

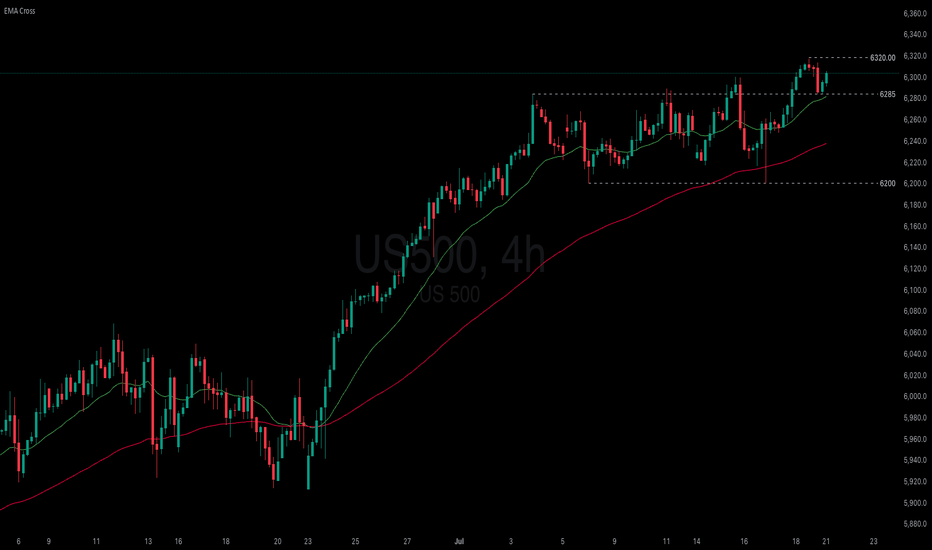

After testing the support at 6285, US500 rebounded and approached its previous high again. The index holds above EMA21, suggesting the continuation of bullish momentum. If US500 remains above both EMA21 and the support at 6285, the index could breach the 6320 high. Conversely, if the US500 breaks below the support at 6285, the index could retreat further toward 6200.

Usindex

US Dollar Index (DXY) – Testing Long-Term Channel SupportBy MJTrading:

Chart Overview:

The US Dollar Index has now approached a major technical confluence zone that could define the next directional move. Price is pressing into the Danger Zone near the lower boundary of a multi-year descending channel, with an Ultimate Oversell Target sitting just below.

🔹 Key Technical Highlights:

Long-Term Down Channel (Daily & Weekly):

The DXY has respected this structure for several years.

Price is currently challenging the lower boundary, a zone where reactions often occur.

Danger Zone (~95–96):

A historically reactive area.

Prior demand and channel floor converge here.

Ultimate Oversell Target (~89–90):

Marked as a deeper potential exhaustion area if the channel fails.

Moving Averages:

15 EMA ~97.8

60 EMA ~99.3

Price remains below both EMAs, confirming persistent bearish momentum.

🔹 Potential Scenarios:

Scenario A (Green Path):

A bounce off current support could trigger a relief rally back toward 98–100, targeting the mid-channel and EMAs.

Scenario B (Red Path):

A breakdown below ~95 could accelerate selling pressure, aiming for the Ultimate Oversell Target (~89).

🔹 How I See It:

This is a high-risk inflection zone. Any bullish setups here remain counter-trend and require confirmation via strong reversal signals. Conversely, a decisive breakdown could have significant implications for USD pairs and commodities.

💡 Notes:

This chart includes the weekly inset view for broader context.

Keep risk management tight in this volatile area.

🔹 Reminder:

This idea is for educational purposes only—not financial advice.

💬 How are you positioning around the USD? Share your thoughts and charts below!

#Hashtags:

#MJTrading #DXY #USDollarIndex #Dollar #Forex #TechnicalAnalysis #TradingView #ChartAnalysis #PriceAction #FX #USD #Majors #DollarWeakness #DollarStrength #SupportAndResistance #TrendAnalysis #MarketOutlook

U.S. Dollar Index (DXY) Weekly 2025Summary:

The U.S. Dollar Index (DXY) has corrected down to the key 38.60% Fibonacci retracement zone and is currently showing signs of a potential bullish reversal, bolstered by a clear hidden bullish divergence on the MACD. This may signal a renewed rally toward key upside targets, especially if the 93.3–99.9 support Zone holds.

Chart Context:

Current Price: 98.864

Key Fib Support: 38.60% @ 99.906, 48.60% @ 93.310, 61.80% @ 87.476

Support Zone: 93.3–99.9 USD

Hidden Bullish Divergence: Observed both in 2021 and now again in 2025 on the MACD

Trendline Support: Long-term ascending trendline holding since 2011

Fib Extension Targets (Trend-Based):

TP1: 115.000

TP2: 120.000

TP3: 126.666

Key Technical Observations:

Fibonacci Confluence: DXY is bouncing from a strong Fib cluster between 93.310 and 99.906, historically acting as a reversal zone.

Hidden Bullish Divergence: Suggests potential upside despite price weakness.

Downtrend Retest: Price may revisit 93.3–87.4 before confirming full reversal.

Breakout Pathway: Green dashed arrows outline the likely recovery trajectory toward 114–126 range.

Indicators:

MACD: Showing hidden bullish divergence and potential signal crossover.

Trendline Support: Holding intact from 2021 low.

Fib Levels: Used for retracement and trend-based extension.

Fundamental Context:

Interest Rate Outlook: If U.S. inflation remains controlled and Fed signals future hikes or sustained high rates, DXY strength may persist.

Global Liquidity & Recession Risk: If risk aversion returns, the dollar may rise as a safe haven.

Geopolitical Risks: Conflicts, trade tensions, or BRICS dedollarization efforts may create volatility.

Our Recent research suggests the Fed may maintain higher-for-longer rates due to resilient labor markets and sticky core inflation. This supports bullish USD bias unless macro shifts rapidly.

Why DXY Could Continue Strengthening:

Robust U.S. economic performance & monetary policy divergence

U.S. GDP growth (~2.7% in 2024) outpaces developed peers (~1.7%), supporting stronger USD

The Fed maintains restrictive rates (4.25–4.50%), while the ECB pivots to easing, widening the policy and yield gap .

Inflation resilience and Fed hawkishness

Labor markets remain tight, keeping inflation “sticky” and delaying expected rate cuts; market-implied cuts for 2025 have been pushed into 2026

Fed officials (e.g. Kugler) emphasize ongoing tariff-driven inflation, suggesting rates will stay elevated.

Safe-haven and yield-seeking capital flows

With global risks, capital favors USD-denominated assets for yield and stability

Why the Dollar Might Face Headwinds

Fiscal expansion & trade uncertainty

Ballooning U.S. deficits (~$3.3 trn new debt) and erratic tariff policy undermine confidence in USD

Wall Street’s consensus bearish position.

Major banks largely expect a weaker dollar through 2025–26. However, this crowded bearish sentiment poses a risk of a sharp rebound if data surprises occur

barons

Tariff policy risks

Trump's new tariffs could dampen dollar demand—yet if perceived as fiscal stimulus, they could unexpectedly buoy the USD .

Synthesis for Our Biases

A bullish DXY thesis is well-supported by:

Economic and policy divergence (U.S. growth + Fed vs. peers).

Hawkish Fed commentary and sticky inflation.

Safe-haven capital inflows.

Conversely, risks include:

Deteriorating fiscal/trade dynamics.

Potential Fed pivot once inflation shows clear decline.

A consensus that could trigger a short squeeze or reversal if overstretched.

Philosophical / Narrative View:

The dollar remains the world’s dominant reserve currency. Periodic dips often act as strategic re-accumulation phases for institutional capital—especially during global macro uncertainty. A return toward 120+ reflects this persistent demand for USD liquidity and safety.

Bias & Strategy Implication:

1. Primary Bias: Bullish, contingent on support at 93.3–99.9 holding.

2. Risk Scenario: Breakdown below 93.3 invalidates bullish thesis and targets 87.4–80 zones.

Impact on Crypto & Gold and its Correlation and Scenarios:

Historically, DXY has had an inverse correlation to both gold and crypto markets. When DXY strengthens, liquidity tends to rotate into dollar-denominated assets and away from risk-on trades like crypto and gold. When DXY weakens, it typically acts as a tailwind for both Bitcoin and gold.

Correlation Coefficients:

DXY vs. Gold: ≈ -0.85 (strong inverse correlation)

DXY vs. TOTAL (crypto market cap): ≈ -0.72 (moderate to strong inverse correlation)

Scenario 1: DXY Rallies toward 115–126 then, Expect gold to correct or stagnate, especially if yields rise. Crypto likely to pull back or remain suppressed unless specific bullish catalysts emerge (e.g., ETF flows or tech adoption).

Scenario 2: DXY ranges between 93–105 then Gold may consolidate or form bullish continuation patterns. Then Crypto may see selective strength, particularly altcoins, if BTC.D declines.

Scenario 3: DXY falls below 93 and toward 87 Then Gold likely to rally, possibly challenging all-time highs. Crypto could enter a major bull run, led by Bitcoin and followed by altcoins, fueled by increased liquidity and lower opportunity cost of holding non-USD assets.

Understanding DXY’s direction provides valuable insight for portfolio positioning in macro-sensitive assets.

Notes & Disclaimers:

This analysis reflects a technical interpretation of the DXY index and is not financial advice. Market conditions may change based on unexpected macroeconomic events, Fed policy, or geopolitical developments.

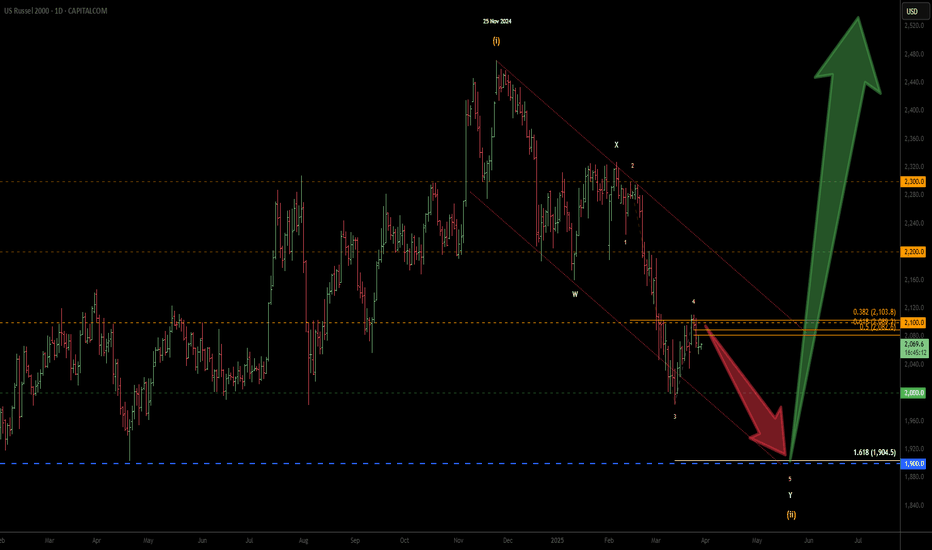

Russell 2000 - one more drop to complete the correction?Looking for the double zig zag correction to complete (Y) leg in the blue zone. Will be looking for five waves to the downside for the target.

Updated the wave count from my previous chart below...

This drop from the 25th November 2024 to the expected target zone would be more or less similar to the Covid drop in terms of percentage.

Russell 2000 - 5th wave of Y leg may already be in progress... The rejection at 2100 price level also happens to be the 38.2% Fib of the decline from the 14th of February 2025. The decline from 6th of February 2025 counts beautifully as waves 1, 2, 3 & 4. If this wave count is correct, then the Russell is currently in wave 1 of 5 of Y of (ii).

This is my primary wave count as long as the 2100 resistance is not breached.

This changes my initial wave count from a complex WXYXZ to a simple WXY.

Click on the link to see the previous wave count which is still valid and is now an alternate wave count if the 2100 resistance is breached:

Only updating the wave count. My bias and direction remain the same.

Wave Y is possibly in progress. Looks like we are going to have a bearish April & possibly May as well. Selling corrective rally is still the way to trade for now. Take profit at 1905/1900, which is where technically, the Russell 2000 will possibly turn up for wave (iii).

Stop Loss can be placed above wave 4, well out of the way in case of any wild swing on this PCE Friday.

Russell 2000 - time to Buy pullbacks...Shorts were good while it lasted... looks like a good time to buy pullbacks.

It would be wise to wait for a clear 3 wave correction though.

Elliot Wave Analysis shows a larger degree wave IV was completed in March 2020.

Since then, the Russell 2000 has been nesting within a bullish rectangle chart pattern, possibly working its way up to the larger degree wave V.

Seasonality Chart shows a bullish April with a possible correction in May.

Nevertheless, I will not commit to long trades till the chart clearly shows that we are out of the woods. A clear 3 waves move down closer to 1800 in the hourly/4 hourly time frame would be a good setup.

Dollar Index(DXY) Rebounds from Key Support–Is a New High Cominghello guys.

Let's see what happened for us index and what will happen:

Uptrend Support:

The price has been respecting a long-term ascending trendline since 2011, indicating a strong bullish structure.

Recent price action suggests that the index retested this trendline and bounced off it.

Key Resistance & Breakout Potential:

The index is in a consolidation phase after reaching a local high.

If the price holds above the trendline and breaks the previous high (~13,250-13,400), it could trigger further upside movement.

The next potential target is near 13,500-13,800 based on historical price action and Fibonacci extensions.

-------------------------------------------------

Possible Scenario:

Bullish Case: If the price holds above the trendline and breaks the current range resistance, it could continue toward new highs.

Bearish Case: A breakdown below the 12,800 support level could lead to a deeper correction toward 12,400-12,000.

-------------------------------------------------

Consequences of This Move:

For USD Strength:

A bullish continuation in the Dollar Index means a stronger USD, which could negatively impact commodities (gold, oil) and emerging market currencies.

Forex pairs like EUR/USD and GBP/USD could decline as the USD gains strength.

For Global Markets:

A weaker DXY (if the support breaks) would typically support equity markets and commodities like gold and Bitcoin, as a weaker dollar makes them more attractive.

-------------------------------------------------

Conclusion:

The chart suggests bullish momentum, but confirmation is needed with a breakout above 13,250-13,400.

As long as the price respects the trendline and Fibonacci support, the uptrend remains intact.

Keep an eye on macroeconomic events (e.g., Fed rate decisions, inflation data), as they can impact this movement significantly.

Combined US Indexes - Breakdown and JittersMarked out previously, the US indexes broke down a tad earlier and retested to fail only to drop further based on jitters and jitter-induced expectations.

While the candlestick is long and solid pretty much, there is an extension zone to expect more of the downside to overreach and be oversold before a bounce.

You should be able to see that the Buy Setup is pretty much done and can expect a bounce reversal soon... but only after momentum ebbs and a base support is found.

Watch for it...

US Index Bullish after the FOMC Fed rate Cut off to 4.5US index bulish after the FOMC Fed rate cut.

Now the Price is still at 108.133 and the last resistance was break on the current level and wait for the confirmations

The next level will be 109.156 and 109.954.

The USD positive impact will have a negative impact on major pairs and gold; be careful when opening the trades.

*Note:

When the USD idex is strongly bullish and sentiments also show the data will impact after the gold bullish recovery.

US INDEX (DXY) To 99 in 2025hello friends

DXY has reached or a strong daily resistance zone and creating a double TOP and rejection 2 test on trend line gold markets are show u why its dropping technically there is many other things showing weakness in $ from there are Fundamentally also something not going good for $ so we don't miss type of historical moves share Ur thoughts with us

Stay tuned

Continued fall of the dollar index DXY. H4 30.09.2024Continued fall of the dollar index DXY

The dollar index is moving downwards without changes. There was an attempt to trade, above which it was not allowed to consolidate and eventually fell. I showed this in the last analysis and now I am aiming at the support levels around 99.20. Perhaps they will just make a false update of the low and come back, it is not known in advance, but at the moment we are trading near the visible support and so far without an upward reaction. Therefore, 99.20 is the next strongest level in recent years and it is ideal to test it before a reversal.

TVC:DXY

Working off the rise in the dollar index DXY. H4 09.09.2024Working off the rise in the dollar index DXY

Last week I expected the dollar index to rise to the area of 102 and higher. We made a pullback on it, but the depth of the correction was bigger than initially expected, but it did not affect the result. Now they are making a rebound to 102, but then might correction around 102.30. On Thursday we will know the US inflation for August and the unemployment rate on Friday. On this news the main movements on the dollar will be made.

Resistance is ahead! Can the Dow Jones make a break through?

The index is clearly demonstrating a strong upward trend, consistently achieving higher highs and higher lows.

During this upward movement, it previously established a bullish Pole & Flag pattern, and after breaking out, the index has continued to rise.

At present, the index is trading just beneath its next resistance level.

If the Dow Jones manage to break through and hold above this breakout point, it is likely to initiate a new rally.

DXY Long Term MovingDear All,

I see something about DXY which is more sophisticated than I thought, Maybe The Great Recession is on the way to the American economy!!!

See if they could recover the USD strength before 79-81 or we should face it as firm reversal support in next four to eight years !!!

The US Small Cap Stocks Are Gearing Up for a Bull Run

After a sharp decline in March 2020, the index showed resilience and made a significant upward move, approaching the 3,250 level.

Following that, Russel 2000 went into a period of consolidation and traded within a narrow range.

A bullish Pole & Flag pattern was identified on the chart during this consolidation phase.

Despite breaking out of the pattern, the index faced strong resistance and subsequently declined.

After finding support around 1,650, the index consolidated around this level for an extended period.

With a recent breakout, Russel 2000 appears to be strong at the moment and preparing for the next upward movement.

U.S. Stock Indices, signs of Relief? 🏛️hello traders.. the U.S. stock indices have been getting pounded by bearish sentiment related to new war conflicts. Also, they were due for a pullback as things have been quite bullish the last few months. Price currently is testing a Daily support level on Nasdaq at 17,500. The NYSE 1hr candle just closed strong bearish below our Daily support level and we are currently retesting structure to continue bearish. A 4hr zone at 17,410 may be the last hope for bears before another selloff takes place to retrace another 2 percent to 17,164 Daily support level. We currently have bearish momentum in the Risk-On stock markets. We had retail sales come out much better than expected earlier this week but this didnt do much at all for price. Strong jobs data and increasing inflation in recent months have increased price a decent amount and this looks like a healthy pullback for profit taking and liquidations.

S&P Bearish after Retail Sales.. Israel/Iran conflict abroad? 🤨The S&P futures is quite weak after strong USD retail sales data. This move opposes a rational reaction to data that came out better than forecasted by a good margin. The market is pulling back and continuing the bearish momentum from the previous week. This may have to do with the conflict between Israel and Iran, this retracement back down. Oil is pushing up and Gold is pushing up late in the NY session here on Monday April 15th.. Money is being shifted to those Risk-On assets rather than stock indices such as S&P

US Dollar index⚠️Reaction From Hedger Premium Zone OutUS Dollar index hit the important price areas in all USD related assets

✔️DXY is expected to rise

✔️Recommended to consider buying

🟢 Try to BUY🔼 all the Dips !!!

✔️Confirmation Buyer Limit Area Zone

Now try to go up with new buyers...

✔️Buy the dips!!!

DXY BUYING ON DIPS TILL 104 HELLO TRADERS

As I can see DXY is tested a strong support zone and now it can move up again to test the trend line till 104 with more good data for US this Week CPI and Inflation rate can boost the dollar again from this given support our risk reward is great on this trade it's just a trade idea share Ur thoughts with us it helps many other traders Stay Tuned for more updates

Dow Jones Industrial Averages Weekly Technical Analysis(1) We have witnessed a sharp fall from 29,500 level in Feb’20. This was almost 38% fall from the top. Market had gone in a oversold zone.

(2) Around 18,300 level, price found a support and bounced back from this level.

(3) With an upside rally, price managed to breakout its previous resistance.

(4) After the breakout, we have seen a sharp upside rally further and the price reached at 36,950 level.

(5) A corrective decline has been seen from there and the price started making lower highs and lower lows at reached to 28,800 level.

(6) Price again bounced back from there and gave a upside move.

(7) In this entire consolidation phase, a Cup & Handle chart pattern has been formed, which gave us positive indication.

(8) With a strong breakout of the Cup & Handle pattern, price started its journey upside.

(9) Currently the price is standing near its All Time High. More upside move is expected from here.

DXY BULLISH H & S SHAPE!! HELLO FRIENDS!!

As i can see DXY is creating a head and shoulder pattern this can be next move for DXY if US inflation data is good for $ Technically it is clear view for bull move till design levels friends it's just a trade idea we are looking forward for Ur thoughts in comment session it helps alote of other traders Stay Tuned for more updates.

NASDQ100 THE 2024 CRASH SHORT POSITION MEGAPHONE PATTERNNasdaq100 after a big up move. end big AB=CD+FIBO E LEVEL+ Bollinger Band+ Pivot

I choose to show the MegaPhone pattern in the photo but there are many other tools.

Fed wants to cut the rate this year, so I think he will do that only after a big down movement in the stock market.

US500 M15 / Expecting a rise until the price of 5000 💲Hello traders!

This is my idea related to the US500 M15. The sellers' sentiment is still strong, and I expect a new ATH until the price of 5000 after that, I will look for a shot trade entry.

It represents a good opportunity to look for a long trade entry.

Traders, if you liked my idea or if you have a different vision related to this trade, write in the comments. I will be glad to see your perspective.

____________________________________

Follow, like, and comment to see my content:

www.tradingview.com