Decoding Fed Rate Changes via Federal Funds Futures Index◉ What Are Federal Funds Futures?

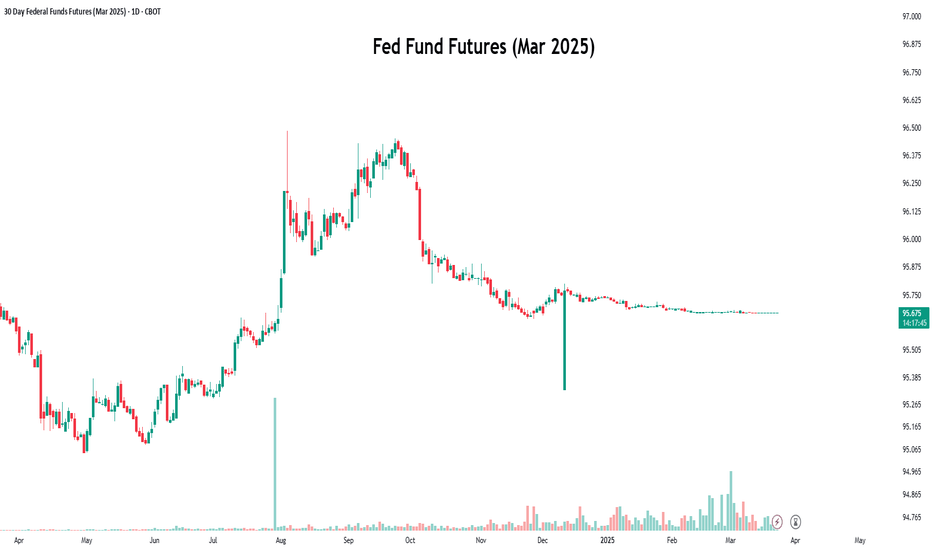

● Definition: Federal Funds Futures are financial contracts traded on the Chicago Mercantile Exchange (CME) that allow market participants to bet on or hedge against future changes in the federal funds rate (the interest rate at which banks lend to each other overnight).

● Purpose: These futures reflect the market's expectations of where the Fed will set interest rates in the future.

◉ How Federal Funds Futures Work?

● Pricing: The price of a federal funds futures contract is calculated as 100 minus the expected average federal funds rate for the contract month.

➖ Example: If the futures price is 95.00, it implies an expected federal funds rate of 5.00% (100 - 95 = 5).

● Contract Expiry: Each contract represents the market's expectation of the average federal funds rate for a specific month.

◉ Why Use Federal Funds Futures?

● Predict Fed Policy: Traders and investors use these futures to gauge the likelihood of the Fed raising, cutting, or holding interest rates.

● Hedge Risk: Institutions use them to protect against potential losses caused by interest rate changes.

● Market Sentiment: They provide insight into what the broader market expects from the Fed.

◉ Steps to Analyze Fed Policy Using Federal Funds Futures

● Step 1: Check Current Federal Funds Futures Prices

Look up the prices of federal funds futures contracts for the months you're interested in. These are available on financial platforms like Bloomberg, Reuters, or the CME Group website.

● Step 2: Calculate the Implied Federal Funds Rate

Implied Federal Funds Rate = 100 - Futures Price.

➖ Example: If the futures price for March is 95.5, the implied rate is 4.5% (100 - 95.5 = 4.5).

● Step 3: Compare Implied Rates to the Current Rate

If the implied rate is higher than the current federal funds rate, the market expects the Fed to raise rates. If it's lower, the market expects a rate cut.

● Step 4: Estimate the Probability of Rate Changes

By comparing the implied rates of contracts expiring before and after an FOMC meeting, you can estimate the probability of a rate change.

➖ Example: If the implied rate for March is 4.75% and the current rate is 4.5%, the market is pricing in a 25 basis point (0.25%) hike.

● Step 5: Monitor Changes Over Time

Track how futures prices change over time. Shifts in prices indicate changes in market expectations. For example, if futures prices drop (implying higher rates), it suggests the market is anticipating a more hawkish Fed.

◉ Practical Applications

● Trading: Traders use federal funds futures to speculate on interest rate movements.

● Economic Forecasting: Economists use them to predict the Fed's monetary policy and its impact on the economy.

● Investment Strategy: Investors adjust their portfolios based on expected rate changes (e.g., shifting from bonds to equities if rates are expected to rise).

◉ Limitations of Federal Funds Futures

● Market Sentiment: Futures prices reflect market expectations, which can be influenced by sentiment and may not always accurately predict Fed actions.

● External Shocks: Unexpected events (e.g., geopolitical crisis, pandemics) can disrupt rate expectations.

● Liquidity: Less liquid contracts (further out in time) may not accurately reflect expectations.

◉ Example Analysis

Let’s assume:

➖ Current federal funds rate: 4.5%

➖ March federal funds futures price: 95.5

● Step 1: Calculate the implied rate:

100 − 95.5 = 4.5%.

● Step 2: Compare to the current rate:

The implied rate (4.5%) is equal to the current rate (4.5%), suggesting the market expects no change in rates by March.

● Step 3:

If the futures price drops to 95.25, the implied rate becomes 4.75%, indicating the market now expects a 25 basis point rate hike..

◉ Why This Matters?

● For Traders: Federal funds futures provide a direct way to bet on or hedge against interest rate changes.

● For Investors: Understanding rate expectations helps in making informed decisions about asset allocation.

● For Economists: These futures offer valuable insights into market expectations of monetary policy.

◉ Conclusion

Federal funds futures are a powerful tool for analyzing and predicting the Fed's interest rate decisions. By understanding how to interpret these futures, traders, investors, and economists can gain valuable insights into market expectations and make more informed decisions. However, it's important to consider their limitations and use them in conjunction with other economic indicators for a comprehensive analysis.

Usinterestrates

Hmm... Something Interesting & Sweet is Brewing in T-Bond MarketIEF is a longer maturity, longer duration play on the US Intermediate Treasury segment. The fund focuses on Treasury notes expiring 7-10 years from now, which have significantly higher yield and interest rate sensitivity than the notes that make up our broader 1-10 year benchmark.

IEF`s average YTM is significantly higher than US-T Aggregated benchmark's. Of course, the higher yield comes with significantly higher sensitivity to changes in rates, particularly those at the longer end of the yield curve (10-year key rate duration).

The fund changed its index from the Barclays US Treasury Bond 7-10 Year Term Index to the ICE US Treasury 7-10 Year Bond Index on March 31, 2016. This change created no significant change in exposure.

IEF's narrow focus and concentrated portfolio have been popular, so the fund is stable and easy to trade.

The main technical graph represents IEF' Total return (div-adjusted) format, and indicates on developing H&S structure, as US Federal Reserve tight monetary policy seems is near to ease.

Nasdaq-100 Index. Meet and Greet March Quarter Earnings Season.US stock indices, including the benchmark American economy S&P500 index (SPX) and US BigTech Nasdaq-100 index (NDX), are retreating from their yearly highs, moving to a more aggressive decline last Friday, April 12.

Investors digest the first portion of earnings reports for March quarter 2024 - traditionally starting with financial sector Earnings reports.

New Earnings season has begun! Perfect!

Well... sounds good. Anyway...

JPMorgan (JPM), Citigroup (C) and Wells Fargo (WFC) reported first-quarter earnings that beat forecasts, but a large number of persistent inflation pressures are still building and continuing.

JPMorgan CEO James "Jamie" Dimon warned that while the stock market is healthy and most economic indicators look favorable, there are still significant risks that could arise at any time.

"Looking ahead, we remain alert to a number of significant uncertain forces. First, the global landscape is troubled, horrific wars and violence continue to cause suffering, and geopolitical tensions are rising. Second, there appear to be a large number of persistent inflationary pressures. Pressure that is likely to continue," - Dimon said on the conference call.

On the inflation front, US import prices rose for the third straight month in March, slightly above the consensus forecast of 0.4% month-on-month. Almost all of the rise in import prices was driven by the recent rise in oil prices.

The fight against inflation - which has transformed into a classic chronic illness from a relatively minor cyclical problem driven by a low Covid-19 base - appears to have reached a stalemate, and the first rate cut will not occur until December, Bank of America (BAC) now says.

Despite the fact that at the beginning of 2024, the market was almost 100% confident that at least one rate cut would take place by the June FOMC meeting, and by the December meeting, the number of rate cuts could reach three.

Monetary easing by June is looking more and more like an unattainable dream, tempered by the latest data.

Recent inflation data, while in line with expectations, doesn't give the Federal Reserve much reason to rush.

But if the central bank doesn't cut rates by June, it will likely delay any cuts until March 2025, Bank of America strategists said.

In reality, long-term forecasting of the US Federal Reserve's monetary policy curve is not an easy task, given that only forecasts for the next FOMC meeting, which is scheduled for May 1, and for which the market does not factor in a change in interest rates, can be relatively reliable.

Of much greater significance is that the same arguments and theses that are presented in the reports of the largest American banks - the locomotive of the American economy - may find their repetition or imitation in Earnings reports for Q1'2024 of dozens and hundreds of other companies over the next two-three months.

Technically, the main chart of the Nasdaq-100 Index (NDX) featured in the idea is in a long-term positive trend of a weakly rising channel, above its 5-year SMA.

At the same time, taking into account the possibility of escalation of macroeconomic and political risks, one cannot exclude the prospect of its decline to the lower border of the channel - down to the levels of 12,500 - 13,000 points.

Also lets take into account the fact that the entire 10-12 percent Nasdaq-100 increase from Q4'21 highs to nowadays can be easily represented as the transposition of a 200% increase in the shares of only one company - Nvidia (with its near 6% allocation in the index), - which increased in price from $320 to over $960 per share over the same period of time - from Q4'21 by Q1'24.

Swing trade during the FOMC meetingThe swing in 4H time frame is still in the impulse wave of the daily swing.

The impulse of the 4H time frame swing has started(DB neckline breakout level 83.2500)

Caution :: FOMC meeting on 20 Sep'23 11:30PM IST and the current market price is at the weekly resistance of the ascending triangle pattern.

IMPORTANT! Bitcoin Long-term Price Projection Update!I have officially decided to update our long-term price projection for Bitcoin. A major key change is the elimination of the mini-bull market. Instead we are expecting the current bull market to develop into a major bull market. There is also a very high likelihood that this will be the only bull market for the 4th cycle. In this video we partially stepped outside of The Crypto Weather Channel world to explain our reasoning behind these changes. Thanks for watching!

The correlation between US Interest Rates and The US Dollar (DXYInterest rates and USD strength are positively correlated.

An increase in US interest rates will typically result in a strengthening of the USD.

The reason is...

Foreign investors tend to flock to US assets, such as bonds and fixed bank rates for higher returns.

Higher demand for US assets drives up their price, and as a result, the USD strengthens.

As for the relationship between USD strength and US stock market prices, it is more complex and can have both positive and negative effects.

On one hand, a strong USD can make US exports less competitive, reducing demand and potentially leading to a decrease in corporate profits.

This can weigh on stock prices. On the other hand, a strong USD can attract foreign investment into US stocks, driving up demand and prices.

There are other reasons for the correlation such as:

Interest rate differentials

When interest rates in one country are higher than in another, capital tends to flow to the country with the higher interest rates.

This results in an increase in demand for the currency of the country with higher interest rates, strengthening its currency i.e US Dollar.

Inflation expectations

Interest rates are also closely linked to inflation expectations.

When interest rates rise, it is generally expected that inflation will rise too, which makes the currency more attractive to investors.

Trade flows

The USD is the currency used in most international trade transactions, and as a result, changes in trade flows can have a significant impact on the value of the USD.

Market recapWith the interest rate hike correlation to US10Y Bonds, as the rates are rising we are seeing demand for risky assets drop off, people are cashing out of these asset classes and money is moving to bonds, in consequence we are seeing the USD start gaining great strength.

The US10Y market is very interesting, as we appear to have broken a downtrend on the weekly chart going back decades, trendlines are neither here or that but with such a long history does this maybe add any more validity? (Who Knows).

Going forward we could see XAU make moves from its old value area and make a move down to pre-covid inflation around $1200-$1300.

I recently posted a short in the US stock market which I have attached below of where I believe the market will price in if what we are seeing in the rates and bonds continue to occur.

Crypto being the most risk adverse of assets discussed here and the volatility involved imo holds the greatest risk yet, although we could see this obscene dollar valuations as a rare occurance? maybe a DCA approach can lead to good returns overall. However I see large falls inbound whether they happen this week or next who knows, but it is a risky asset class to hold in potential market turbulence we could see over the next few months.

More tightening till Interest Rates match 10Y Bond Yields (US)If history is any indicator we shouldn't expect any pivots in monetary policy until 10Y Bond Yields come down to Interest Rates or Interest Rates hike to the former's level.

For 10Y Bond Yields to come down we need to see lower inflation or inflationary pressure.