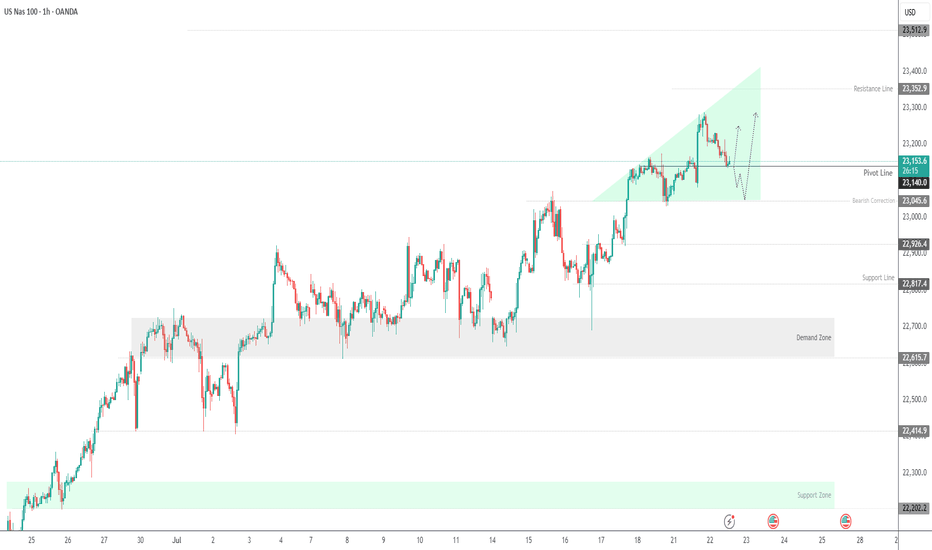

USNAS100 Eyes 23350 Ahead of Powell & Earnings StormUSNAS100

The price maintains bullish momentum, as outlined in the previous idea, with a clean rejection from the 23280 zone. Today, volatility is expected to increase ahead of Jerome Powell’s speech and a wave of key earnings reports.

As long as price holds above 23140, the outlook remains bullish toward 23230 and 23350.

A short-term correction toward 23045 is possible if we get a 1H close below 23140.

Resistance: 23230 · 23350 · 23510

Support: 23045 · 22920

Usnas100

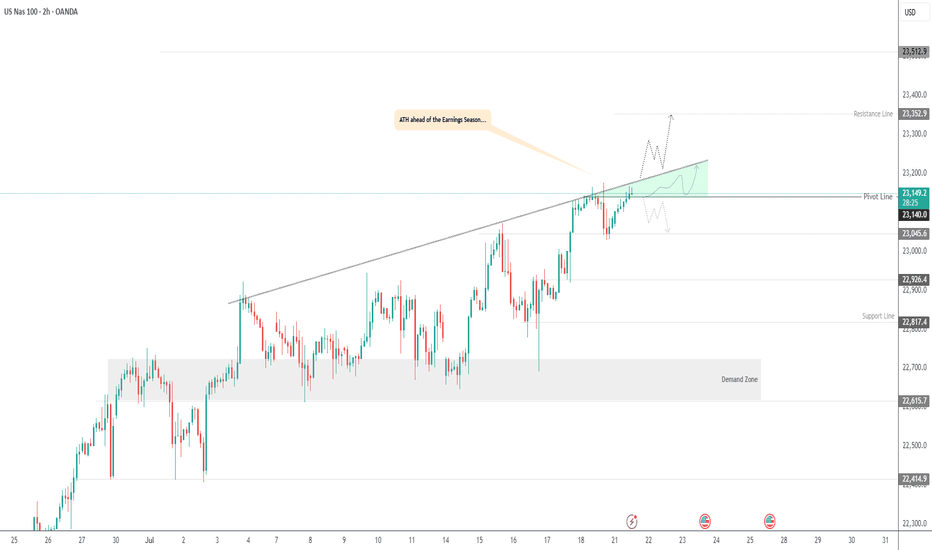

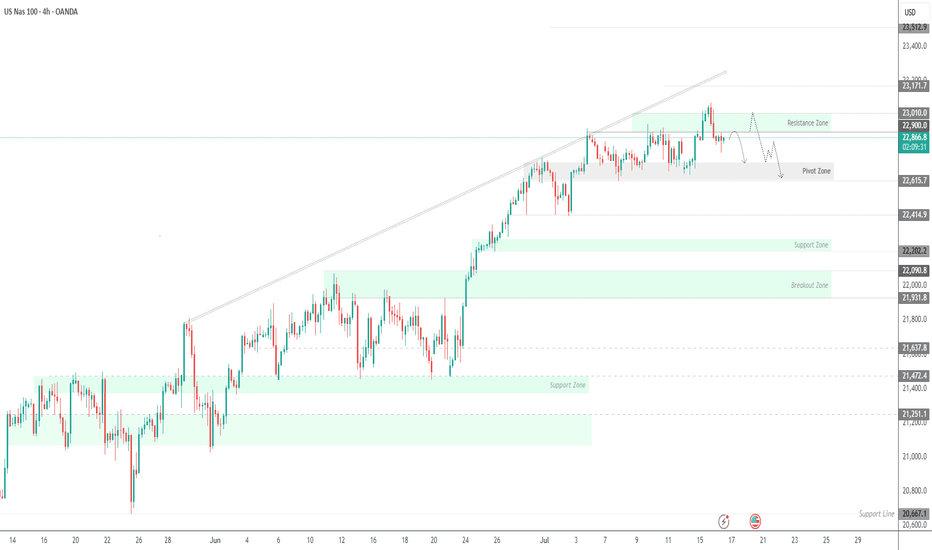

USNAS100 | Bullish Setup Ahead of Tech Earnings & Trade RiskUSNAS100 | Bullish Setup Ahead of Tech Earnings & Trade Risk

U.S. equity markets are entering a pivotal week with big-tech earnings and renewed focus on Trump’s proposed trade tariffs. Both the S&P 500 and Nasdaq are hovering near record highs, but new catalysts are required for continuation.

Technical Outlook:

The price has stabilized above 23140, breaking the pivot and confirming bullish momentum. As long as the price holds above this level, the trend remains bullish, especially if it breaks the green triangle resistance structure.

A sustained move above 23140 opens the path toward 23250 and 23350, with further extension possible to 23510.

However, a 4H close below 23140 may activate a bearish correction toward 23045, and possibly deeper toward 22920 and 22820.

Resistance Levels: 23250 · 23350 · 23510

Support Levels: 23045 · 22920 · 22820

Bias: Bullish above 23140

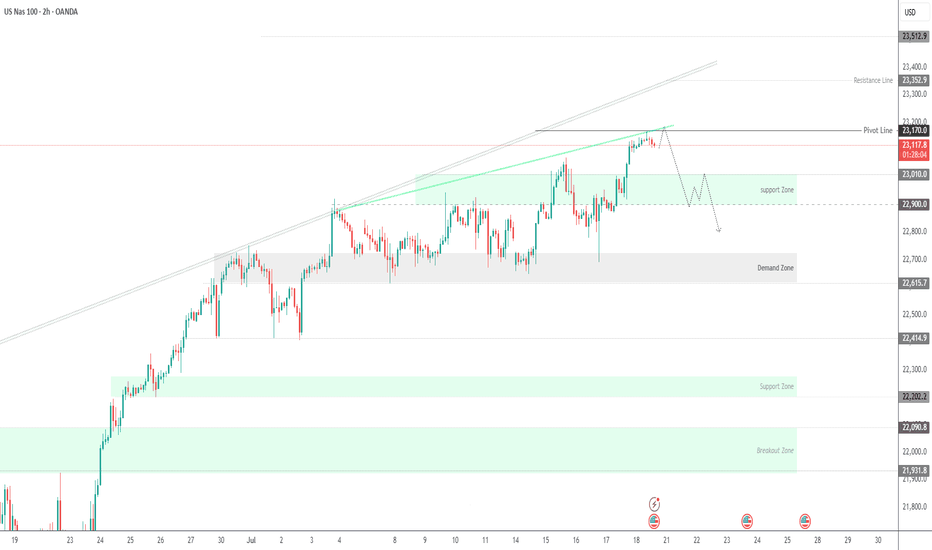

NASDAQ100 Hits Target at 23170 – Watch for Breakout or PullbackNASDAQ100 Tests ATH – Key Decision Zone at 23170

New ATH Achieved:

NASDAQ100 recorded a new All-Time High (ATH), hitting our target at 23170 precisely as projected.

Currently, price is consolidating below 23170. Sustained rejection at this level could trigger a short-term bearish pullback toward 23010. A deeper correction may extend to 22900 or even 22815.

However, a clean breakout above 23170 would confirm bullish continuation, with the next target at 23350.

Key Levels

• Pivot: 23170

• Resistance: 23250 / 23350

• Support: 23010 / 22900 / 22815

Outlook:

• Bullish above 23170

• Bearish below 23170 (short-term pullback zone)

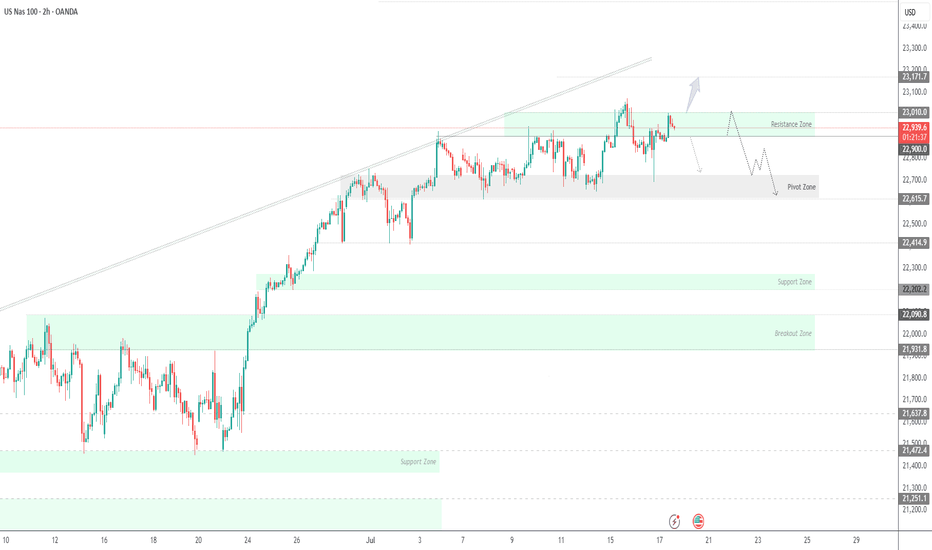

USNAS100 | Consolidation 23010 - 22900, Bearish or Not Yet...USNAS100: Cautious Consolidation as Powell Uncertainty Lingers

Following political noise around Fed Chair Powell — with Trump admitting he floated the idea of replacing him — tech markets have entered a cautious consolidation. While no immediate action was taken, the underlying uncertainty continues to weigh on sentiment, especially in rate-sensitive sectors like tech.

Technically: Consolidation Before the Break

The price is currently consolidating between 22900 and 23010.

A confirmed 1H close below 22900 would signal the start of a bearish trend, targeting 22700 and 22615.

Conversely, a close above 23010 would open the path toward a new all-time high (ATH) at 23170.

Key Levels:

Support: 22700, 22615

Resistance: 23010, 23170

USNAS100 – Bearish Below 22900 as Earnings & Tariffs Hit MarketUSNAS100 – Bearish Bias Ahead of Earnings, PPI & Tariff Tensions

S&P 500 and Nasdaq futures are slightly lower as traders weigh rate outlook, tariff developments, and major earnings reports.

📊 Earnings in Focus:

Goldman Sachs NYSE:GS , Morgan Stanley NYSE:MS , and Bank of America NYSE:BAC are set to report today.

JPMorgan Chase NYSE:JPM and Citigroup NYSE:C posted strong results yesterday, but expressed caution over U.S. tariff policies.

🌍 Tariff Watch:

Trump announced a 19% tariff on Indonesian goods, with more deals anticipated ahead of the August 1 tariff deadline. The EU is reportedly preparing retaliatory measures if negotiations stall.

🔧 Technical Outlook:

The Nasdaq100 shows bearish momentum as long as it trades below 22900 and 23010, with potential downside targets:

Support: 22720 → 22615 → 22420

Resistance: 23010 → 23170

To shift back to a bullish trend, price must stabilize above 22900 and break 23010.

Key Events Today:

• Corporate Earnings

• Tariff Developments

• U.S. PPI Report

USNAS100 Outlook – CPI Data to Confirm Breakout or PullbackUSNAS100 – Bullish Momentum Holds Ahead of CPI

USNAS100 continues to show strong bullish momentum, trading above 22,905 and recently printing a new all-time high (ATH).

As long as price remains above this level, the next upside target is 23,170, followed by 23,300.

Market Focus – CPI Data Today:

• Expected: 2.6%

• Below 2.6% → bullish reaction likely

• Above 2.6% → bearish pressure expected

• Exactly 2.6% → could trigger a short-term bearish pullback

Key Risk Level:

A confirmed break below 22,905 would signal weakness and open the door for a correction toward 22,615.

NASDAQ at Risk – Tariffs Pressure Tech IndexUSNAS100 – Market Outlook

The index is currently in a sensitive zone, heavily influenced by ongoing tariff tensions. If the current geopolitical pressure continues, it may fuel bearish momentum across the tech-heavy index.

To regain a bullish outlook, we need to see signs of negotiation or de-escalation, which could stabilize the price and lead it toward 23010 and 23170.

However, as of today, the market appears to be setting up for a correction, potentially dipping to 22815, followed by a deeper bearish move targeting 22420.

Support Levels: 22615 – 22420

Resistance Levels: 22905 – 23010

Bearish Momentum Builds Below pivot zone USNAS100 Analysis

Price has reversed from its ATH and now shows bearish momentum.

Below 22705, downside targets are 22615 and 22420.

Bullish scenario only valid if price breaks and holds above 22815.

Pivot: 22710

Support: 22615, 22420

Resistance: 22815, 22910

USNAS100 Bullish Ahead of NVIDIA Milestone – 23010 in SightUSNAS100 – Outlook

The index continues its bullish momentum, supported by strong tech performance — notably NVIDIA surpassing a $4 trillion market cap.

As long as the price holds above 22880, the trend remains bullish toward:

23010 Then extended targets near 23170

However, a 1H close below 22815 would signal weakness, potentially opening the way for a retracement toward: 22705 And 22615, especially if tariff tensions escalate.

Resistance: 23010, 23170

Support: 22815, 22705, 22615

USNAS100 Consolidates Between 22815–22705 | Breakout Will DefineUSNAS100 – Technical Outlook

The NASDAQ remains under pressure amid ongoing tariff uncertainty, with traders closely watching for any progress in negotiations or signs of escalation.

Currently, the price is consolidating between 22815 and 22705, awaiting a breakout to define the next directional move.

A 1H candle close below 22705 would confirm bearish continuation, targeting 22600, with further downside potential toward 22420.

A break above 22815 would shift momentum bullish, opening the way to 22880, followed by 23010.

Key Levels:

Support: 22600 / 22420

Resistance: 22815 / 22880 / 23010

NASDAQ Bulls Defend Pivot – Can 23,000 Break Next?USNAS100

The Nasdaq 100 is currently holding above the pivotal 22,720 level, supported by market optimism amid recent tariff-related developments from the White House.

Bullish Scenario:

Sustained price action above 22,720 keeps bullish momentum intact. A break and 1H close above 22,815 would confirm strength, opening the path toward the psychological milestone and potential all-time high at 23,000.

Bearish Breakdown:

A 1H or 4H close below 22,720 would invalidate the bullish bias and strengthen downside pressure, with initial support seen at 22,615 and deeper correction likely toward 22,420.

Key Technical Levels:

• Resistance: 22,815 · 23,000

• Support: 22,615 · 22,420

USNAS100 Key Level: 22,740 – Will the Trend Continue or Reverse?USNAS100 Update – Bullish Momentum Holds Above 22,740

USNAS100 has continued to push higher, following through as expected from yesterday’s analysis.

The index maintains bullish momentum as long as it trades above the key pivot at 22,740.

However, a 1H close below 22,730 could trigger a bearish correction toward 22,615.

A sustained break below that level may shift the trend to bearish.

Key Levels:

• Resistance: 22,870 / 23,000

• Support: 22,615 / 22,410

USNAS10 Faces Key Test at 22,615 Ahead of NFP VolatilityUSNAS100 – Key Levels Ahead of Major News

Today’s economic data releases (NFP, Unemployment Rate, etc.) are expected to drive volatility in the market. Traders should watch key levels closely.

Technical Outlook (USNAS10):

• Price is attempting to test 22,615.

• If it holds above 22,615, the bullish momentum is likely to continue.

• However, if price stabilizes below 22,615 on the 1H chart, further downside toward 22,420 is expected before a potential bullish reversal begins.

A breakout above 22,740 could trigger further upside toward 23,000

Key Levels:

• Resistance: 23,000 / 23,100

• Support: 22,420 / 22,280

USNAS100 Bullish Momentum Holds Above Key PivotUSNAS100 – Overview

The price successfully retested the 22,610 level and resumed its bullish trend, reaching 22,750 as anticipated in our previous idea.

Currently, the index needs to maintain stability above the 22,610 pivot line to sustain the upward momentum toward the next resistance at 22,790. A sustained move above this level may open the path toward 23,000.

However, a 1H candle close below 22,610 could trigger a corrective move down to 22,480. A break below this support would expose the next key level at 22,280.

Pivot: 22,610

Resistance: 22,790 – 23,000

Support: 22,480 – 22,280

USNAS100 |Bullish Trend Holds Above Pivot – Eyeing 22790 & 23000USNAS100 | Bullish Movement

The price has stabilized above the key pivot level at 22640, confirming a continuation of the bullish trend toward the next resistance at 22790.

As long as the index remains above 22640, the uptrend is expected to extend toward 22790 and potentially 23000, with minor pullbacks likely to retest the pivot.

Currently, USNAS100 is consolidating between 22640 and 22790.

A 1H candle close below 22640 would signal a bearish correction toward 22520 and possibly 22410.

Pivot Line: 22640

Resistance Levels: 22790, 23000

Support Levels: 22520, 22410

previous idea:

USNAS100 Hits New ATH | Watch 22,520 for Possible Correction USNAS100 TECHNICAL OVERVIEW

Nasdaq 100 Prints New ATH | Eyeing 22,640, But Correction Risk Builds

USNAS100 recorded a new all-time high, supported by broad bullish sentiment across U.S. indices after upbeat S&P and inflation data boosted risk appetite.

Technically, the index remains bullish, but signs of short-term exhaustion are appearing.

If the price closes below 22,520 on the 1H timeframe, a correction toward the 22,280 zone is likely.

However, a clean break above 22,640 would confirm continuation toward the next upside target at 22,790.

Key Levels

Pivot Line: 22,520

Resistance: 22,640 → 22,790

Support: 22,410 → 22,280 → 22,200

Take a look at the previous idea to see more reality...

USNAS100 Eyes New ATH as Fed Rate Cut Bets &Ceasefire Fuel Rally USNAS100 OVERVIEW

Wall Street Gains as Rate Cut Hopes and Ceasefire Boost Sentiment

U.S. indices surged on Monday as growing expectations for a potential Federal Reserve rate cut in July helped offset market concerns over Middle East tensions.

The ceasefire agreement between Israel and Iran further eased geopolitical risk, supporting bullish momentum on Wall Street.

Forward Outlook:

A combination of dovish monetary policy expectations and geopolitical de-escalation continues to support upside potential in U.S. equities.

TECHNICAL OUTLOOK – (USNAS100)

The price has stabilized above 22,090, signaling strength and opening the path toward a new All-Time High (ATH) and beyond.

As long as the price holds above 22,090, the bullish trend remains in control.

A break and stabilization below 22,090 would suggest a bearish correction may be underway.

Resistance Levels: 22,210 → 22,280 → 22,460

Support Levels: 21,930 → 21,850

NASDAQ 100 Under Pressure –Watching 21470 Break for ContinuationUSNAS100 – Technical Overview

USNAS100 has reached the support level we highlighted yesterday and continues to trade within a bearish trend, especially after confirming a 1H close below 21635.

Bearish Outlook:

As long as the price remains below 21635, the next target is 21470.

A break below 21470 would confirm further downside toward the support zone at 21375 and 21250.

Bullish Scenario:

Bullish momentum may return if the price breaks above 21635 on the 1H timeframe, targeting 21780 and potentially 21930 and 22090.

• Support: 21470 / 21375 / 21250

• Resistance: 21780 / 21930 / 22090

USNAS100 | Breakout or Breakdown?USNAS100 | OVERVIEW

The price is currently stabilizing below the pivot level at 21790, suggesting continued bearish momentum.

📉 As long as the index remains below 21790, we expect a decline toward 21635. A confirmed 1H candle close below this level could extend the bearish trend toward 21470.

📈 A shift to bullish momentum will require a 1H candle close above 21820, which could open the way to 22090 and potentially a new all-time high at 22200.

Support Lines: 21635, 21470

Resistance Lines: 21930, 22090, 22200

USNAS100 | CPI Data to Drive Next Move – Key Pivot at 21790USNAS100 | OVERVIEW

The index is showing sensitive price action, especially after stabilizing above the pivot level at 21790. The release of U.S. CPI data will likely dominate today's movements.

If CPI > 2.5%:

Stronger inflation could pressure the index lower. A drop toward 21790 is expected, and a break below this level may extend the bearish trend toward 21635, and possibly 21480. However, holding above 21790 may keep the bullish structure intact.

If CPI < 2.5%:

Weaker-than-expected inflation would support bullish momentum, with potential to push higher toward 22090 and test the all-time high at 22200.

Support Lines: 21790, 21635, 21480

Resistance Lines: 22090, 22200

USNAS100 Bearish Below 21,790 – Key Levels to WatchUSNAS100 – Overview

The price remains under bearish pressure as long as it trades below the pivot level at 21,790. A continued move lower is expected toward the support at 21,635, and a 15-minute close below this level may extend the bearish trend toward 21,480.

To shift to a bullish outlook, the price must stabilize above 21,920, which could open the path toward 22,090.

Pivot: 21,790

Support Levels: 21,635 · 21,480 · 21,250

Resistance Levels: 21,920 · 22,090 · 22,200

USNAS100 – Bearish Bias Below 21780 Ahead of CPI and Trade TalksUSNAS100 – Bearish Pressure Below 21780, CPI & Trade Talks in Focus

Overview:

USNAS100 remains under downward pressure ahead of a key macro week, including US-China trade talks and the upcoming US CPI data.

Technically, price remains bearish while below the pivot level at 21780.

A break below 21635 may lead to further downside toward 21470 and potentially 21360.

On the upside, a 1H close above 21780 could invalidate the bearish view and open the path toward 21920 and the ATH at 22200.

Key Levels:

Pivot: 21780

Support: 21635, 21470, 21360

Resistance: 21920, 22200

USNAS100 – Bullish Scenario Valid Above 21640, Targeting 21920USNAS100 | Technical Analysis

The price initiated a bullish trend after breaking above 21470, as previously mentioned. It is now continuing toward the target at 21770.

Currently, price is approaching the resistance at 21775.

If it fails to break above and stabilizes below 21775, we may see a consolidation within the range of 21775–21640.

🔺 A 1H close above 21775 may trigger a continued bullish move toward 21920 and 22100.

🔻 A 1H close below 21640 could lead to a correction down to 21475.

Resistance: 21775, 21920, 22100

Support: 21640, 21510, 21370