USO

Short XLE (After next week's potential bounce)XLE has broken triangle formation. Expect it to retest the bottom trendline before further down. Short it if the retest fails to go above TL.

My OB/OS indicator has reached to the previous low level. Trade the bounce intraday or 2-3 days short term. Then resume the downside, expect it to break the previous low in my indicator.

LT TP: 41

USO! when oil starts the bear move it's one of the easiest tradeI've been doing well buying puts once the corrections are developing. Usually about 3-4 weeks out to allow the correction to develop and so I dont get slammed by theta decay. Now eventually if we're in an impulse to go down, we will need to see a bigger correction to develop. Will we get a few more pushes down before that happens, or will it start right now? Either way I'm looking to purchase another put sometime within the next week (as long as we dont breakout past the downtrend line, this will signal a deeper correction/ reversal depending on how price behaves after that)

Longterm view in the comments. (not confirmed yet, just looking that way)US

thanks for looking, and trade responsibly!

WTI $ could be in for more short-term suffering b4 NEW HIGHS!Large bearish Descending Triangle in WTI. This means we could easily test bottom again, which ultimately could mean another gut punch for Alberta. Corb Lund and the 'Hurtin Albertans' indeed!

If you read up on the descending triangle formation, it tells us it is a bearish pattern and most often a continuation pattern, however, it also can represent a reversal pattern, which clearly it does in the case of WTI, since it began from the peak price point in 2008. I believe this descending triangle will eventually break to the upside once it resolves and will eventually lead to crude oil prices at new all time highs. The formation requires two tags of the base line and two on top which have completed this month. Essentially we are not required to move back to the mid 30's range again for this to resolve, but i'd be cautious going long crude in any big (long-term) way until either we break that upper line or see a pull back to the 50 month MA (or go really deep for one more tag of the base line). Remember this is a long-term analysis (month chart) and we may not see a break out until 2020 or later.

Short XOP (After potential bounce next few weeks)XOP the same set up as XLE. My indicator has broken the upward trendline before price breaks the triangle.

I expect the price to move up a little next few weeks so as my indicator to retest the broken TL. If my indicator fails to break above, then look to short it hard.

TP: 12

New Oil Long Trade Location Previous Oil long idea did not end up reaching the target - let's try again. Along with my SPY trade idea, I believe oil is due for a nice rally, even if in a counter trend capacity.

Directional Bias: Long

Price Target: 72

Good Entry: Breakout Above 68.5 or another retest of low 66 area.

Risk/Reward: Risk no more than 100 ticks/ 300-600 tick potential reward

THE WEEK AHEAD: TWTR EARNINGS; USO, EEM, IWM, UNG, XOPTWTR announces earnings on Thursday before market open, and with a rank of 92 and a 30-day implied of 70, it presents ideal metrics for a earnings announcement volatility contraction play.

As of Friday close, the November 16th 25/34 short strangle is paying 1.57 (.79 profit at 50% max), with a net delta of .39 and a theta of 6.45, and break evens of 23.43/35.57 (wide of the expected move).

For those willing to bet a little more strongly on its not moving much more than the expected move: the November 16th 29 short straddle is paying 4.47 (1.12 profit at 25% max), with break evens of 24.26/33.74.

On the exchange-traded fund front: USO (73/30), EEM (67/25), and IWM (66/22) round out the top three underlyings when sorted by rank. UNG (42/41); EWZ (56/38); and XOP (53/32) are the top three when sorted by 30-day implied.

Possible Trades:

A USO December 21st 14.5/15 skinny short strangle* is paying 1.10 at the mid price with break evens of 13.40/16.10. Given the fact that this is basically a short straddle setup where I would shoot for 25% max, 1.10 isn't exactly compelling on a 1-contract basis (.28 at 25% max), but its small size makes it ideal for layering on setups over time in order to generate a worthwhile, multiple contract position that has some juice in it.

An EEM, December 21st 39/40 skinny short strangle is paying 2.68 at the mid price with break evens of 36.32/42.68. Go 25-delta short strangle -- the 37/42, and you bring in 1.24 in credit with 35.76/43.23 break evens. For defined risk, there's the double diagonal, (See Post Below). The December 21st 35/37/41/43 iron condor pays .70; going three-wide won't pay at least one-third unless you bring in the wings to a 35/38/41/44, which is paying 1.33.

An IWM December 21st, 16 delta, 139/165 short strangle is paying 2.43 with break evens of 136.57/167.43, which encompasses much of the last 52 week's range between 142.50 and 173.39. A delta neutral 141/145/162/165 iron condor pays 1.40; the slightly narrower 142/145/162/164 pays 1.05.

With UNG, I've had my eye on a short setup, (See Post Below), but don't want to pull the trigger too early. We're winding into winter, after all, which generally means increased natural gas usage and draw downs of current supplies. That being said, the notion behind the setup is that even if my timing is slightly off, a setup with a long-dated back month will eventually benefit as we emerge from winter, so I'm looking at putting the back month out in time and in an expiry when seasonality favors natty weakness. Unfortunately, the only available post-winter expiry is April, and I'd rather have an early to mid summer back month, so I'm fine with being patient here.

XOP has been double whammered with broad market weakness on top of oil weakness and is now at the bottom of the range between 40 and 45.50 it's been in since mid-April and a bit above the middle of its 52-week range between 31 and 45.50 with the low set in the early February sell-off. To me, that suggests "directionally neutral": the December 21st 40 short straddle pays 4.16 with break evens at 35.84 and 44.16; the 36/44 short strangle in the same expiry pays 1.40 with break evens at 34.60/45.40.

* -- The reason I would go with a skinny short strangle here instead of a short straddle is because price was 14.72 as of Friday close, which is in between the 14.5 and 15 strikes.

THE WEEK AHEAD: AA, NFLX EARNINGS; USO, GDX, XLB, EEM, IWMWith broad market volatility ramping up over the past week here (see VIX, VXN, RVX), premium sellers can afford to be picky here, since the board is alight from here to Sunday with implied volatility ranks in the 70's for ... well ... a ton of stuff.

For earnings, my eye is on AA and NFLX with nearly ideal rank/implied metrics for volatility contraction plays.

NFLX (rank 64/implied 61), a perennial earnings-related volatility contraction fave, announces earnings on Tuesday after market close. Due to its size and its having a tendency to move bigly around earnings, I would go defined: the November 16th 285/290/385/390 is paying 1.87 with a buying power effect of 3.13; a ten-wide with the same short strikes, 3.53, with a buying power effect of 6.47.

AA, announcing on Wednesday after market close: 93/52. In my mind, small enough to go full on naked: the November 16th, 71% probability of profit 31/40 short strangle is paying 1.72 with a 50% max take profit of .86; the at-the-money skinny, quasi short-straddle -- the 35/36, 3.78, with a 25% take profit of .95.

Alternatively, it's been somewhat hammered here and is within 5% of 52-week lows which may make it suitable for a bullish assumption play: the 32/39/40 Jade Lizard is paying 1.00 on the nose with no upside risk and a low side break even of 31, a 13% discount over where the underlying is currently trading.

On the non-earnings front: the top five funds in terms of implied volatility rank are USO (81/30), GDX (71/32), XLB (68/27),* EEM (66/27),** and IWM (63/26); the top five ranked by 30-day implied: EWZ (58/44), UNG (36/41),*** XOP (52/36), OIH (56/36), and GDXJ (60/34).

* -- Possible bullish assumption directional; new 52-week low.

** -- Possible bullish assumption directional candidate: new 52-week low.

*** -- Possible bearish assumption directional candidate: new 52-week high.

The Stock Market's Anchors Ignore Over-Stretched Conditions AT40 = 38.9% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 51.6% of stocks are trading above their respective 200DMAs

VIX = 12.1

Short-term Trading Call: neutral

Commentary

Looks like I had good reason to give a tepid endorsement to the upside potential for the stock market off the over-stretched conditions on display in AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs). The S&P 500 (SPY) had every reason to rally robustly in the wake of a trade deal among the U.S., Canada, and Mexico. Instead, the index only gained as much as 0.5% or so before reversing almost the entire gain. Only a desperate bounce in the last 15 minutes of trading took the index to a 0.4% close.

The S&P 500 sustained a hollow victory with AT40 sinking on the day to close below 40% again. AT40 has not looked this bad since April. Now I think the risk of going even lower is somewhere higher than 50%.

The anchor from small caps weighed quite heavily on AT40. The iShares Russell 2000 ETF (IWM) opened up and promptly faded from resistance at its 50DMA. IWM closed with a 1.3% loss and a 6-week low. A downtrend continues from IWM’s last all-time high.

The market did not worry about the broad, underlying weakness betraying the small gains on the S&P 500. The volatility index, the VIX, closed LOWER by about 1%. I went ahead and bought a small amount of SPY call options expiring October 8th that I plan to sell on the very next bounce or a fill of Monday’s gap up, whichever comes first. Beyond that trade, I am even more wary about the market than I was in the last Above the 40. I am still keeping the short-term trading call at neutral just out of deference for the relatively low level of AT40 while the S&P 500 remains above important support at its uptrending 20DMA.

CHART REVIEWS

General Electric (GE)

Last week I made the case for waiting on GE before making a fresh trade on a bottom. Then out of nowhere, GE replaced its CEO with former Danaher (DHR) CEO and current GE board member Larry Culp. The market’s initial reaction was extremely positive and easily cleared the thresholds for more safely playing a bottom. However, the stock failed to hold the best levels at the close and thus shut the down the buy trigger. GE even closed under its downtrending 20DMA; GE went from breakout to fakeout. This sharp fade makes a more aggressive trade even more risky than it looked on Friday.

CNBC Fast Money’s Karen Finerman made a case for a GE bottom from a fundamentals perspective. Like me, she likes the January 2020 call options. She is targeting the $13 strike while I have $15 strikes from an earlier dip.

iShares 20+ Year Treasury Bond ETF (TLT)

Speaking of bottoms, TLT violated the bottom that I thought was secured with last week’s Federal Reserve announcement on monetary policy. Still, I doubled down on my TLT call options as they have suddenly become a very cheap hedge on bullishness. I fully expect TLT to soar again if the market sells off at some point this month.

Tesla (TSLA)

TSLA delivered major relief in line with CEO Elon Musk coming to his senses and settling fraud charges from the SEC. In keeping with the tantalizing theme, TSLA nearly perfectly filled Friday’s gap down. As is its habit, the stock even closed at an obvious technical level which in this case was 50DMA resistance.

United States Oil (USO)

I suddenly see an elephant in the room: oil. Oil prices soared today perhaps in sympathy with Canada and the U.S making nice on a trade deal that includes Mexico. Whatever the reason, oil sitting around 3-year highs is NOT good news for consumers. Moreover, inflation watchers are likely starting to worry about inflation expectations creeping higher along with oil prices. I am now watching oil a lot more closely.

— – —

FOLLOW more of Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

USOIL Short/LongInsider Bar Based the Uptrend Line Vs Down trend Line breakout

My guess would be #Short

Why ?

------------------------------------------------------------------------------------------------------------------

(1) US rig counts keep on increasing

(2) Due to Hurricane US Consumption will be less

(3) US will not allow to Increase crude price to ensure IRAN sanctions doesn't Impact

(4) Until November - Price will be under control

(5) Line break Chart ( Day ) is ready to Break out Short

(6) MACD Cross Over

(7) Put Option for 14 is very High for the week of 9/21

(8) Strong Put Volumes and PCR Ratios

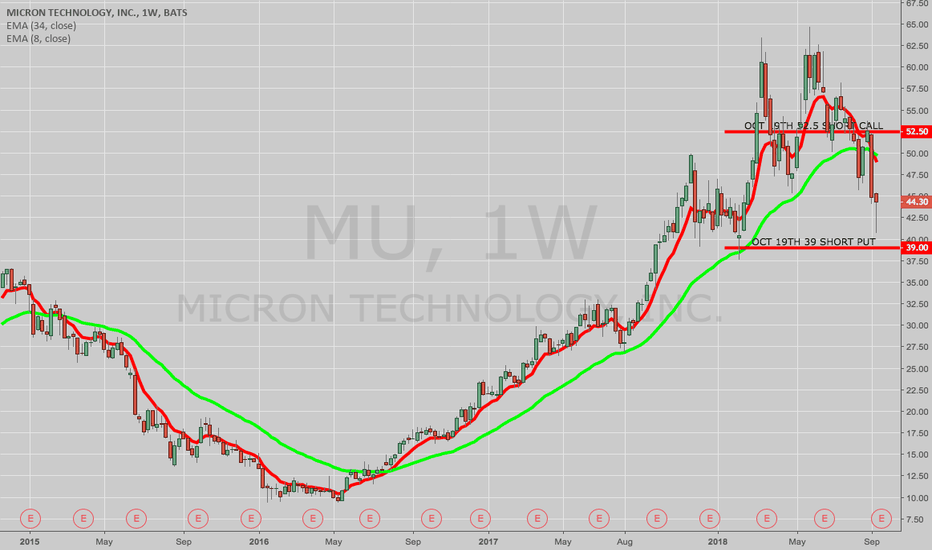

THE WEEK AHEAD: MU EARNINGS; EWZ, GDX, USOAlthough both FDX and ORCL announce earnings tomorrow (Monday) after market close, the underlying with the implied volatility metrics I generally look for in a volatility contraction play are present in MU, which announces Thursday after market close.

With a rank of 82 and a 30-day of 60%, the 70% probability of profit 39/52.5 20-delta short strangle is paying 1.66 at the mid-price. Since it's been beaten down a bit recently, I could see skewing that setup a bit to the bullish side, and or capping off call side risk via a Jade Lizard (the October 19th 39/49/50 would do the trick -- it's paying 1.13 at the mid with no upside risk above 37.87).

As far as non-earnings are concerned, implied volatility is present where it's been for a bit -- in EWZ (rank 99/implied 55) (the Brazilian exchange-traded fund), PBR (88/72) (Brazilian petro), CRON (76/124) (cannabis), GDX (66/30) (gold miners), and USO (58/27) (oil). Naturally, there's also TSLA (69/54), but with earnings in 52, you might as well wait for the full-on, earnings related volatility expansion/contraction ... .

WTI - Yearly Cycle Low - Still to Come?Oil Left translated on the last Daily Cycle but did not take out the previous cycle's low as expected. It also did not close above the 10 week MA after making a swing low last Friday. This leads me to believe we are seeing another Daily Cycle within this extended Intermediate Cycle, which should also left translate, and this time, move to a lower low, taking out the low seen on August 15th. This would then print an Intermediate Cycle Low, and likely a coinciding YCL. If we close the week in the 70's, I would be skeptical of the bearish sentiment then and have to think that the Intermediate Cycle bottom was printed on Aug 15 low; however, at this time, this is not my belief.