Buy oil! Target 63-65!Crude oil is currently in a short position overall, and the rebound momentum is relatively weak. However, in the short-term structure, oil has shown obvious signs of stopping the decline, and the support of the 60-59 area below is still valid.

After hitting the low point of 58.9, oil began to rebound, and the rebound low gradually shifted upward. At present, oil holds the support near 60, and is expected to build a W-bottom structure in the short-term structure, which is conducive to further rebound of oil prices.

Therefore, in terms of short-term trading, you can try to go long on crude oil in the 60.5-59.5 area, and the rebound target will first look at 63, followed by 65

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Usoilanalysis

XTI/USD "WTI Crude Oil" Energy Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XTI/USD "WTI Light Crude Oil" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (71.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (68.500) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 73.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢🔥XTI/USD "WTI Light Crude Oil" Energy Market Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XTI/USD "WTI Crude Oil" Energy Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XTI/USD "WTI Light Crude Oil" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Yellow MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (68.00) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 70.90 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢🔥XTI/USD "WTI Light Crude Oil" Energy Market Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USOILSPOT "WTI CRUDE OIL" Energy Market Heist Plan (Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USOILSPOT "WTI CRUDE OIL" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Buy above (68.000) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout Level (or) placing the Buy limit orders within a 15 or 30 minute timeframe, Entry from the most Recent or Swing low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 30mins timeframe (66.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Primary Target - 70.000 (or) Escape Before the Target

🏴☠️Secondary Target - 72.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢️ USOILSPOT "WTI CRUDE OIL" Energy Market Heist Plan (Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USOIL:Continue to move downwardAfter U.S. President Donald Trump announced tariffs and the OPEC+ decided to increase oil production, concerns about the demand outlook intensified, leading to a significant decline in crude oil prices on Thursday.

The short-term trend of crude oil has dropped sharply, with all the gains since mid-March being given back. The oil price has touched a low near 66. The moving average system diverges downward, and objectively, the short-term trend direction is downward. The bearish momentum is abundant. It is expected that after a minor adjustment at a low level in the intraday trading, the short-term trend of crude oil will mainly continue to move downward.

Trading Strategy:

buy@67.5-68

TP:66-65.5

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

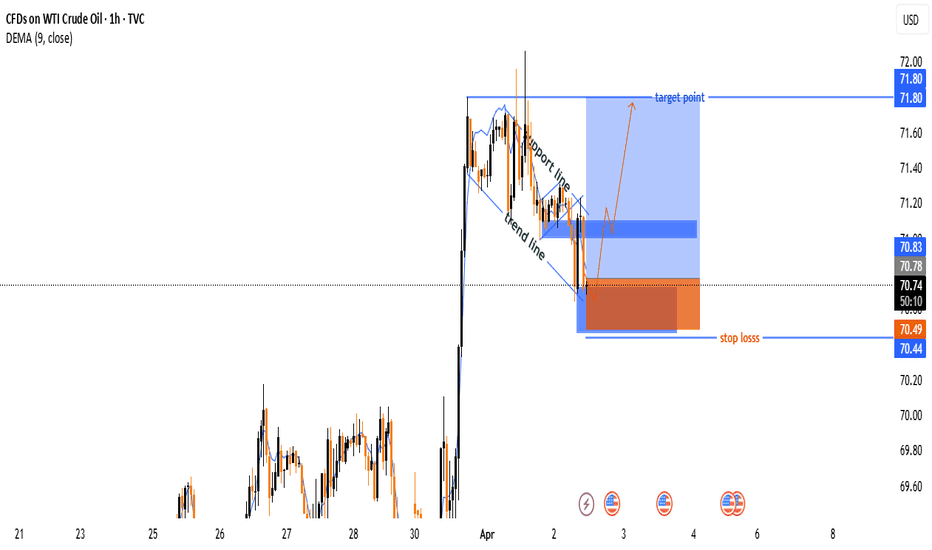

WTI CRUDE OIL TRADE SETUP : BREAKOUT OR BREAKDOWN ?📊 Key Observations:

🔹 Trend:

🚀 Strong bullish move followed by a correction 📉

🔻 Price is testing a support zone

🔹 Pattern Formation:

📏 Descending channel or flag-like structure

📍 Price is near a breakout point

🔹 Trade Setup:

✅ Entry Zone: Around 70.77

🛑 Stop Loss: 70.44 - 70.49 (Risk limit ❌)

🎯 Target Point: 71.80 (Profit zone ✅)

🔹 Indicators & Confirmation:

📊 DEMA (9) at 70.92 → Price is slightly below short-term momentum

🔥 A breakout above resistance could confirm a bullish move 🚀

📌 Conclusion:

✅ If price breaks the trendline upwards → Buy 📈 aiming for 71.80 🎯

❌ If support at 70.44-70.49 fails → More downside possible ⚠️

🚀 Watch for volume & candlestick confirmation before entering!

USOIL:Give priority to go long positions on the retracementU.S. heating oil futures gave back their gains. EIA (Energy Information Administration) data showed that U.S. distillate fuel oil inventories unexpectedly increased. U.S. gasoline futures' upward momentum expanded slightly, and the EIA data indicated that the inventory was basically in line with expectations.

The commercial crude oil imports in the United States excluding the strategic petroleum reserve for the week ended March 28 reached the highest level since the week ended January 31, 2025. The EIA strategic petroleum reserve inventory in the United States for the week ended March 28 was at its highest level since the week ended October 28, 2022. The increase in EIA crude oil inventories in the United States for the week ended March 28 recorded the largest gain since the week ended January 31, 2025. The domestic crude oil production in the United States for the week ended March 28 was at its highest level since the week ended December 20, 2024. The commercial crude oil inventory in the United States excluding the strategic petroleum reserve for the week ended March 28 was at its highest level since the week ended July 12, 2024.

Crude oil showed a trend of bottoming out and rebounding on Wednesday. It stabilized and rose near 70.7. After breaking through the $71.2 mark, there might have been a bullish reversal in crude oil. The oil price is expected to test the resistance level above 72.0. Once it further breaks through, it is expected to open up the upside space. In terms of future trading operations, it is advisable to consider laying out long positions on the retracement first.

Trading Strategy:

buy@70-70.5

TP:71.5-72

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL-Sell in the 71.6-72 rangeUSOIL has also experienced a strong uptrend recently, driven by news events. However, as we all know, "what goes up must come down"—even in a one-sided market, technical corrections are inevitable. Right now, we are seeing a perfect opportunity for a pullback-based short trade after the sharp rally.

Trading Recommendation:

📉 Sell in the 71.6-72 range

USOIL:The bullish momentum demonstrates strong performanceRecently, the United States has stepped up its sanctions against Iran. It also made threatening remarks indicating that if the peace talks between Russia and Ukraine fail to reach an agreement, it will further intensify sanctions against Russia. Such actions have heightened the market's concerns about the future supply side.

Meanwhile, the short-term and phased decline in the United States' domestic oil production, combined with its temporary abstention from taking additional measures to suppress oil prices, has led to a certain increase in the supporting strength of the oil market recently. Yesterday, the upward trend of oil prices continued.

Take a long position at $71.05 for the oil price. Set a stop-loss of 30 basis points and a take-profit at $72.70.

Trading Strategy:

buy@70.8-71.05

TP:72.20-72.50

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOil Key Resistance Hit: Is WTI Crude Due for a Correction?WTI crude oil appears overextended after a strong bullish rally, trading into a key resistance level amid heightened geopolitical tensions and market volatility. The current price action suggests a potential retracement, with equilibrium around the 50% Fibonacci level being a likely target for correction 📉. Given the reactionary nature of the market, traders should remain cautious as political developments could drive further instability ⚠️. While the technical setup supports a pullback, external factors may disrupt this scenario, so risk management is essential. 📊

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research before making trading decisions.

What to do if crude oil rises? The latest layout strategyCrude oil futures showed volatility during the day on Monday. Prices rose sharply in early European trading, breaking through the 70.00 integer mark and then falling back, but still fluctuating at a relatively high level. Oil prices rose slightly after countries importing Russian oil imposed tariffs of 25% to 50%. Brent crude oil futures climbed and WTI also rose. However, gains were limited as traders questioned the seriousness of the proposal. ING Group pointed out that the market was "fatigued" by Washington's tariff rhetoric, indicating that the crude oil market was unlikely to react strongly without concrete actions.

Crude oil plan: Crude oil is recommended to retreat to 70.0-69.5, with a target of 71.0-72.0 and a stop loss of 0.5 US dollars.

If oil prices break below $69.0/barrel, this will stop the expected bullish trend and push oil prices to regain the main trend of volatility.

It is expected that today's oil prices will trade between the support level of $69.0/barrel and the resistance level of $72.0/barrel.

USOIL: Next Week's Blueprint for Profit Amid VolatilityDuring the US trading session on Friday, March 28th, international oil prices fluctuated slightly and declined. However, both Brent crude oil and WTI crude oil remained firmly near their one - month highs and were projected to register "three consecutive weekly gains" on the weekly chart. The ongoing tug - of - war between the supply tightness instigated by geopolitical unrest and the latent concerns regarding an economic downturn has placed oil prices in a volatile state of being "caught between a rock and a hard place".

From the perspective of the USOIL daily chart, following the medium - term trend's breach of the lower edge of the range, it has predominantly fluctuated around lower levels. The oil price has experienced consecutive short - term increases, breaking through the suppression of the moving average system, and the medium - term objective trend has entered a transition phase. Nevertheless, in terms of kinetic energy, neither the bulls nor the bears have demonstrated a clear - cut inclination to overpower the other. It is anticipated that the medium - term trend will persist in its volatile rhythm for a while, awaiting the establishment of a distinct trend direction.

The short - term (1H) trend of USOIL has not continuously set new highs and has exhibited a pattern of high - level consolidation. The short - term objective trend remains upward. In the early trading session, the oil price underwent a narrow adjustment at a high level, presenting an overall secondary rhythm with a sound internal rhythm. The fundamental objective trend during the week has been upward in sync, and it is highly likely that the short - term trend of USOIL will continue its upward trajectory next week.

USOIL

buy@68-68.5

tp:69.5-70

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USOIL: GO short positions during the oscillation at a high levelThe short-term trend of crude oil has been oscillating and declining at a high level. The oil price has broken below the moving average system, and the objective short-term trend has entered a transition period. The bearish momentum is gradually intensifying, and the oil price dropped below 70 in the early trading session. In the 4-hour chart, the objective short-term trend direction within this week still remains upward. The trading strategy for crude oil still mainly focuses on the oscillation and decline at a high level.

Trading Strategy:

Sell@69.8-70

TP:69-68.5

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

Tariffs can have a significant impact on USOILThe expiration of the extended US import tariffs on Canada and Mexico next Wednesday may impact USOIL:

Supply : Tariffs could disrupt US-Canada crude oil trade, cutting US supply and raising prices. Trade pattern changes may also affect global supply and USOIL prices.

Demand : Tariffs may slow economic growth, reducing crude oil demand and exerting downward price pressure. Uncertainty dampens consumer and business confidence, further suppressing demand.

Market Sentiment & Finance : Policy changes heighten uncertainty, making investors cautious and increasing USOIL price volatility. Capital may flow out, pressuring prices, but portfolio adjustments for hedging could support them.

Also, OPEC and non-OPEC plans to end production cuts in April may boost global supply and lower USOIL prices.

USOIL:Continue to sell at highs tomorrowAfter breaking below the lower edge of the range, the medium-term trend of crude oil has been continuously moving in a secondary oscillation around low levels. In terms of momentum, neither the bullish nor bearish momentum has significantly overwhelmed the other, and there has been no continuation of the bullish trend.

Regarding the support level, we should first consider the 68.5 mark, which was an important resistance level that the oil price previously broke through. For tomorrow's trading operations, it is advisable to mainly consider selling at highs.

USOIL Trading Strategy:

Sell@70-70.5

TP:69-68.5

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL:Analysis of the Oil Market Trend for Next WeekAmid the anticipated trade uncertainties, concerns on the supply side have resurfaced. With the April 2nd tariff effective date approaching, the market is taking a cautious stance in the short - term. Supported by the decline in oil inventories and the prevailing concerns, oil prices have rebounded and are nearing the resistance range. In the medium - term, the market is constrained by the expected slowdown in global demand, and the focus is on waiting for the resistance test.

Strategy recommendations: Given the range - bound trading, consider short - selling at high levels and buying at low levels.

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOil:Profit realized by shorting on reboundsOn Thursday, crude oil dipped and then rallied towards the end of the trading session, reaching a low of around 69.1. Today, it rebounded to around 69.8 and then started to decline. The short-selling strategy implemented in the morning resulted in a profit.

Next, attention should be paid to whether the upper resistance level of 70 can be broken through. If it cannot be broken through in a short period of time, consider shorting again during the subsequent rebound.

USOIL Trading Strategy:

Sell@69.7-70

TP:68.5-68

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOil:When it rebounds to the resistance, continue go shortIn terms of crude oil, in the short term, with the decline in US crude oil inventories, the escalation of US sanctions against Iran and Venezuela, and the resumption of hostilities between Russia and Ukraine, efforts at reconciliation have been ineffective. Therefore, the short-term market has hyped up the reduction in crude oil supply, causing crude oil to fluctuate repeatedly at high levels without being able to decline. However, as tariffs are upgraded and concerns about the global economic downturn intensify, the demand for crude oil has further decreased. At the same time, in order to control inflation, the control of crude oil prices remains a top priority.

Therefore, the medium- to long-term downward trend remains unchanged. Currently, from a technical perspective, when crude oil rebounds to the resistance level, it is advisable to continue taking short positions as before.

USOIL Trading Strategy:

Sell@69.7-70

TP:68.5-68

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

Continue to be bearish.Supply : The United States has intensified its energy sanctions against Iran. Attacks on Saudi facilities have affected their performance. The OPEC+ will gradually lift the voluntary production cuts starting from April and may increase production for the second time in May. The 30-day ceasefire agreement between Russia and Ukraine has not been effectively implemented in substance. However, recently, the United States, Russia, and Ukraine have reached some consensus on Black Sea navigation and the protection of energy facilities.

From a technical perspective, when the price repeatedly encounters resistance below an important resistance level and fails to achieve an effective breakthrough, it is often a bearish signal. This implies that the selling force in the market is dominant. Once the price starts to retrace due to its inability to break through the resistance, it may initiate a downward trend. Therefore, based on the strong resistance level at 70.000, there is a certain basis in technical analysis for a bearish outlook.

💎💎💎 USOIL 💎💎💎

🎁 Sell@70.000 - 70.200

🎁 TP 68.5 68.0 67.5

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

USOIL:Pay attention to the short-term adjustmentCurrently, in the 4-hour time frame, the crude oil price is temporarily maintaining a high-level oscillatory consolidation. However, after consecutive periods of oscillation, there are signs that the technical pattern is gradually weakening. The short-term moving averages are beginning to gradually turn downward and diverge, and the K-line is starting to be under pressure from the short-term moving averages, maintaining a slightly weaker operating trend. It is believed that there may still be a certain room for adjustment in the short-term trend. In terms of trading operations, consider the short position opportunity around 69.7-70.

USOIL Trading Strategy:

Sell@69.7-70

TP:68

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!