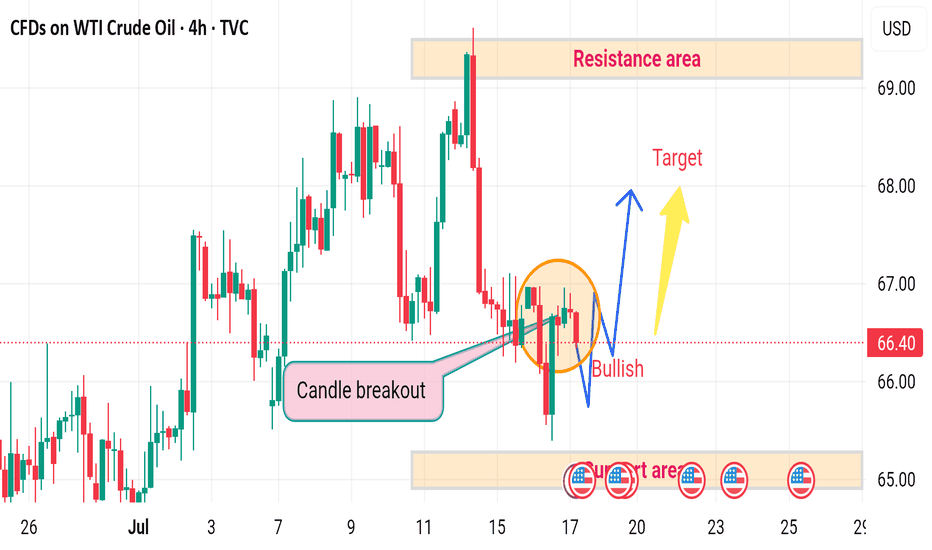

USOIL H4 bullish upward ⚠️ Disrupted Analysis – WTI Crude Oil (4H Chart)

🔻 Bearish Pressure Re-Entering

Despite a temporary candle breakout, the price failed to sustain above the breakout trendline.

The recent price action inside the orange circle shows lower highs and rejection wicks, indicating bullish weakness.

📉 Potential Breakdown Risk

If the price fails to hold above 66.00, there's a high probability of it breaking below the support area around 64.80–65.00, leading to:

Increased bearish momentum

Retesting lower demand zones, possibly around 63.50–64.00

❌ Resistance Area Still Valid

The Resistance area at 68.00–69.00 remains unchallenged.

The "Target" shown is optimistic under current momentum.

Without strong volume and bullish candles, that target remains unlikely in the near term.

🔁 Disruption Summary

The bullish breakout is likely a false breakout.

Market may be forming a bull trap.

Watch for a clean break below 65.00 for confirmation of a bearish reversal.

Usoilforecast

USOIL : What will happen to the price of oil?Hello friends

As you can see, we had support in the past, which has now become a strong resistance for the price after it was broken.

Now we need to see if the price will manage to break it at this moment when it is close to its key and sensitive resistance.

*Trade safely with us*

USOIL:Narrow trading strategy

USOIL: There is no update in the past two days, because the oil price still continues to fluctuate in a narrow range, and the space for volatility is gradually reduced, which is not very different from our overall trading idea. The original long target of 65.9-66.4 can be adjusted to 65.8-66.2 with the reduction of the space for volatility. It is expected that the trend will come out this week, and we will adjust our thinking then.

Friends who do not trade at present can refer to the interval trading strategy within a day:

BUY@64.7-65

TP: 65.8 to 66.2

SELL@65.8-66.2

TP: 64.7-65

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

USOIL:Today's trading strategy

Oil prices have been sideways for the fourth trading day, volatility began to narrow, the market is brewing a new round of trend, short-term range 64-66.4. Today you can sell high and buy low around a narrow range.

Trading Strategy:

BUY@64.7-65.1

TP: 65.9-66.4

SELL: 66-66.4

TP: 65.1-64.5

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

USoilLatest news. If the Strait of Hormuz is closed, the restrictions on the import and export of oil and natural gas will increase greatly. Because 20% of the world's oil and natural gas exports come from the Strait of Hormuz. So the trend of geopolitics will affect the closing and opening of this important checkpoint. If the increase in geopolitics really reaches this point, the price of oil may rise to 90$-100$. This is an excellent trading opportunity for investors who like to trade oil. But at present, this is an option for Iran to negotiate. Rather than a real closure, after all, the incident has not developed to this situation. If you like to trade oil. You can also follow me. Get brand new trading opportunities and make profits. Do not trade independently to avoid losses.

USOIL:Waiting to go long

The impact of the news is still continuing, the situation did not ease in a short period of time, there is still a rise, the above large space to see 76-77, trading ideas on the long space and advantages are greater. Intraday short - term trading to consider low long.

Trading Strategy:

BUY@72.8-73.2

TP: 74.5-75

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

USOIL:The trading strategy of going short

USOIL: Consider shorting for now, as there are signs of a top above 74.5, but I think this is only a short-term high and will continue to surge higher. The trading idea is to sell short today and wait for the right position to be long.

Trading Strategy:

SELL@74-74.3

TP: 73.2-72.7

↓↓↓ More detailed strategies and trading will be notified here ↗↗↗

↓↓↓ Keep updated, come to "get" ↗↗↗

USOIL:Go short before you go long

The idea of crude oil is still to go long. Today, the more appropriate entry point is 72-72.3, there is still a little space at present, if you consider selling short first, then the more appropriate short point is 73-73.3 range. Give to the point to do, to wait to do more.

Trading Strategy:

SELL@73-73.3

TP: 72-72.3

BUY@72-72.3

TP: 73.7-74

↓↓↓ More detailed strategies and trading will be notified here ↗↗↗

↓↓↓ Keep updated, come to "get" ↗↗↗

USOIL - Near CUT n REVERSE Area? holds or not??#USOIL.. straight bounce after #IranvsIsrael war situation, and now market just reached near to his current Resistance Area / region

keep close that region and if market holds then drop expected otherwise not at all.

NOTE: we will go for cut n reverse above region on confirmation.

good luck

trade wisely

USOIL 1 - Hour Chart AnalysisUSOIL 1 - Hour Chart Analysis

Key Levels

Support: ~69.50 (short - term), 67.70 (critical backup).

Resistance: 73.50 (major hurdle, tested before).

Trend, Pattern & Middle East Conflict

Price oscillates between support/resistance, with a potential “V - shaped reversal”. Middle East conflicts add high uncertainty:

Escalation: Fears of supply cuts could push price above 73.50 rapidly.

De - escalation: May pressure price down, but 67.70/69.50 still get support from lingering supply - risk worries.

Trading Strategies

Bullish: If 69.50 holds (e.g., long lower shadows/bullish candles), small - size long. Target 73.50; stop - loss ~69.20. Watch for sudden conflict news.

Bearish: If 69.50 breaks (consecutive closes below), short. Target 67.70; stop - loss ~69.80. Stay alert to conflict updates.

Note: Oil prices hinge on supply - demand, Middle East tensions, and the USD. Combine tech/fundamental analysis; manage risk strictly.

⚡️⚡️⚡️ USOil ⚡️⚡️⚡️

🚀 Buy@ 70.50 - 71.00

🚀 TP 73.00 - 74.00

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

USOIL:Go long

USOIL:Crude oil rose sharply under the tension in the Middle East, the early repeatedly suggested that the continuous low shock after the upward breakthrough, the time of storage force is long enough, especially the watershed 64.8 break after the rising space has been opened, the trading idea is still to step back and do long.

Trading Strategy:

BUY@66.9-67.2

TP: 68.6-69

↓↓↓ More detailed strategies and trading will be notified here ↗↗↗

↓↓↓ Keep updated, come to "get" ↗↗↗

USOUL:Go long near 65.5

USOIL:Crude oil broke through the watershed 64.85 after the emergence of strong unilateral bulls, daily cycle relying on short-term average to go even Yang form, rising space has opened, pay attention to the strong will continue at least a few trading days, short-term relying on 65 defense needs to be more, pay attention to 65.5 near the long, see 66.7-67

Trading Strategy:

BUY@65.5

TP: 66.7-67

↓↓↓ More detailed strategies and trading will be notified here ↗↗↗

↓↓↓ Keep updated, come to "get" ↗↗↗

USOIL:Go short before you go long

USOIL:Crude oil trend in line with expectations to break 65, hourly level to see adjustment, trading can be done first short and then long. Here are my range trading ideas.

Trading Strategy:

SELL@65.4-65.5

TP:64.5-64.

BUY@64.5-64

TP: 65.3-65.5

↓↓↓ More detailed strategies and trading will be notified here ↗↗↗

↓↓↓ Keep updated, come to "get" ↗↗↗

USOIL Trade Setup: Watching for a Bullish Break After Pullback 📈 US OIL Trade Plan

Currently, USOIL is in a strong bullish trend 🔥 — price action has pushed into overextended territory, which opens the door for a potential pullback 🌀.

I'm watching for a WTI retracement into equilibrium, ideally aligning with the 50%–61.8% Fibonacci levels from the previous swing low to high 🔍📉. If price corrects into that zone and we find support, followed by a bullish break in market structure 💥 — that would be the confirmation I’m waiting for to consider a long position 🚀.

⚠️ Key Level to Watch: That structure break is the trigger — no confirmation, no trade 🧠.

⚠️ Disclaimer:

This content is for educational and informational purposes only and should not be considered financial advice. Always conduct your own analysis and consult a professional before making trading decisions. Trade responsibly.

USOIL:The strategy of going short

USOIL: Same thinking, still maintain the short strategy. Friends with short orders at 63.3-63.5 continue to wait, can increase short orders near 63.8, the target is 62.5-62.3 unchanged

↓↓↓ More detailed strategies and trading will be notified here ↗↗↗

↓↓↓ Keep updated, come to "get" ↗↗↗

USOIL LETS MAKE OIL GREAT AGAIN TO 80$HELLO TRADERS

As i can see USOIL it formaing H & S pattrent and now trading above a strong Weekly horizontal Support zone if prices hold above 65$ then given Tp can be easy target if we see a higher demand and tight supply with the War going on around the world its a huge possibilty that pricce can shoot up we have to monitor the 65$ price zone which is importat to hold bull cycle on smaller TF 4HR it is creating Wickoff pattren too and we can see Fibo levels golden ratio can hit our targers or risk reward is great for us becaus we was buying the dip in May it is just starting chart is crystal clear its just a trade idea share your thoughts we appriciate ur comments and support Stay tuned for more updates

USOIL:Long thinking, target 62.5

USOIL: Same idea, the front 61.3-61.5 has been given to the entry point, it is slowly rising, the upper target is still seen near 62.5.

So strategically, stay long and wait for the rally, TP@62.5

Tip: It is always right to sell when there is a profit, according to individual risk appetite.

↓↓↓ More detailed strategies and trading will be notified here →→→

↓↓↓ Keep updated, come to "get" Or just find me→→→

USOIL:Long at 61.3-61.5

Last week's long target has been completed, the current decline is mainly due to concerns that global supply growth may exceed demand growth, from the technical trend, the objective trend of the middle line downward, short term long and short frequently alternate, pay attention to the support point of 60.3-60.5 within the day. Considering that it has been around this point of shock and not broken, short - term trading to do more.

So the trading strategy :BUY@61.3-61.5 TP@62.5-62.7

↓↓↓ More detailed strategies and trading will be notified here →→→

↓↓↓ Keep updated, come to "get" →→→

USOIL:Go long first

Crude oil short-term trend to maintain weak shock upward rhythm, K line closed long lower shadow line, there are signs of rebound. Short - term moving average system gradually long arrangement, relying on oil prices, short - term objective trend direction to upward. It is expected that the intraday trend of crude oil will continue to extend upward, hitting around 62.8-63

Recommended Trading Strategies:

61-61.2 range to be long, short-term target to see 62, break through the target to see 62.8-63

↓↓↓ The detailed strategy club will have tips, updated daily, come and get them →→→

US-Oil will further push upside After Testing TrendlineHello Traders

In This Chart XTIUSD HOURLY Forex Forecast By FOREX PLANET

today XTIUSD analysis 👆

🟢This Chart includes_ (XTIUSD market update)

🟢What is The Next Opportunity on XTIUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Crude oil: 63.00 resistance & 60.00 support keyPrices are currently testing the upper resistance at $63.00 📈. These levels are suppressing the price 🔻. A decisive breakthrough above this level may trigger a more intense upward rally 🔥. Meanwhile, recent selling pressure has pushed the price down to $60.60 📉. Watch the pivot support at $60.00, the real downward target 🎯

Crude oil surplus expanded in April, and imports increased, reaching multi - month highs from some countries 🌍. If global benchmark oil prices rise in the future, purchases may be reduced 📉.

Crude oil fell first and then rose today 📊. After a deep dive to $60.9, it stabilized and started to rise 🔼. After the previous price increase and adjustment, it remains to be seen if the upward momentum will continue and break through upwards 🔍.

Overall, on the delivery day, oil prices are volatile 🔼🔽. Watch the resistance at $63.0 on the upside and the support at $60.60 - $60.0 on the downside 👀.

⚡️⚡️⚡️ USOil ⚡️⚡️⚡️

🚀 Sell@ 62.50 - 62.30

🚀 TP 61.50 - 60.60

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇