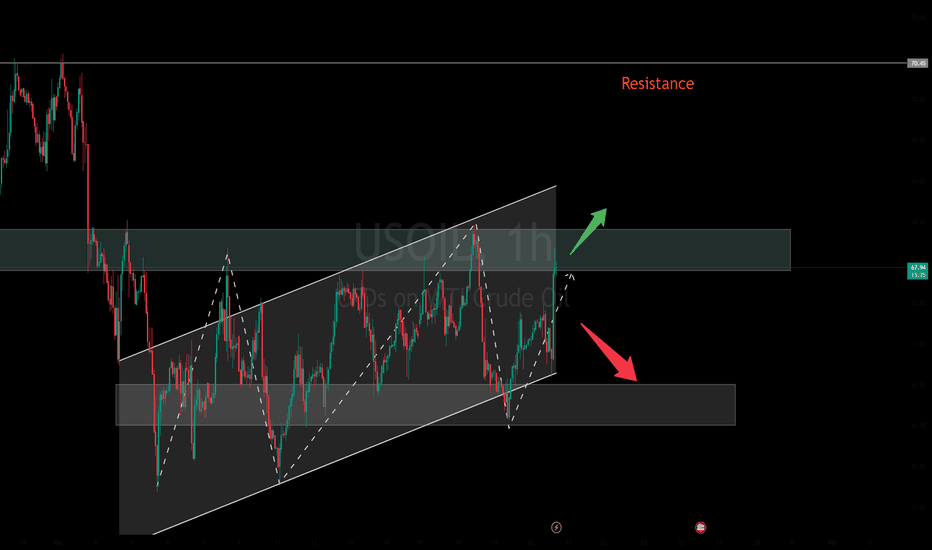

US OIL SELL...Hello friends🙌

🔊As you can see, this chart works well in forming a channel, and now that

we have witnessed a price drop, the price has reached the bottom of the channel, and given the previous heavy drop, the channel shows that the power is currently in the hands of sellers and it is likely that the specified targets will move.

🔥Follow us for more signals🔥

Trade safely with us

Usoilsell

USOIL:Narrow trading strategy

USOIL: There is no update in the past two days, because the oil price still continues to fluctuate in a narrow range, and the space for volatility is gradually reduced, which is not very different from our overall trading idea. The original long target of 65.9-66.4 can be adjusted to 65.8-66.2 with the reduction of the space for volatility. It is expected that the trend will come out this week, and we will adjust our thinking then.

Friends who do not trade at present can refer to the interval trading strategy within a day:

BUY@64.7-65

TP: 65.8 to 66.2

SELL@65.8-66.2

TP: 64.7-65

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

USOIL:Today's trading strategy

Oil prices have been sideways for the fourth trading day, volatility began to narrow, the market is brewing a new round of trend, short-term range 64-66.4. Today you can sell high and buy low around a narrow range.

Trading Strategy:

BUY@64.7-65.1

TP: 65.9-66.4

SELL: 66-66.4

TP: 65.1-64.5

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

USOIL Expected to Rebound to the 68–70 ZoneUSOIL has shown signs of short-term overselling, and a technical rebound is likely during today’s session. Traders participating in crude oil can consider buying on dips, focusing on short-term opportunities with proper position management. Quick entries and exits are recommended.

USOIL:The trading strategy of going short

USOIL: Consider shorting for now, as there are signs of a top above 74.5, but I think this is only a short-term high and will continue to surge higher. The trading idea is to sell short today and wait for the right position to be long.

Trading Strategy:

SELL@74-74.3

TP: 73.2-72.7

↓↓↓ More detailed strategies and trading will be notified here ↗↗↗

↓↓↓ Keep updated, come to "get" ↗↗↗

USOIL:Go short before you go long

The idea of crude oil is still to go long. Today, the more appropriate entry point is 72-72.3, there is still a little space at present, if you consider selling short first, then the more appropriate short point is 73-73.3 range. Give to the point to do, to wait to do more.

Trading Strategy:

SELL@73-73.3

TP: 72-72.3

BUY@72-72.3

TP: 73.7-74

↓↓↓ More detailed strategies and trading will be notified here ↗↗↗

↓↓↓ Keep updated, come to "get" ↗↗↗

USOIL 1 - Hour Chart AnalysisUSOIL 1 - Hour Chart Analysis

Key Levels

Support: ~69.50 (short - term), 67.70 (critical backup).

Resistance: 73.50 (major hurdle, tested before).

Trend, Pattern & Middle East Conflict

Price oscillates between support/resistance, with a potential “V - shaped reversal”. Middle East conflicts add high uncertainty:

Escalation: Fears of supply cuts could push price above 73.50 rapidly.

De - escalation: May pressure price down, but 67.70/69.50 still get support from lingering supply - risk worries.

Trading Strategies

Bullish: If 69.50 holds (e.g., long lower shadows/bullish candles), small - size long. Target 73.50; stop - loss ~69.20. Watch for sudden conflict news.

Bearish: If 69.50 breaks (consecutive closes below), short. Target 67.70; stop - loss ~69.80. Stay alert to conflict updates.

Note: Oil prices hinge on supply - demand, Middle East tensions, and the USD. Combine tech/fundamental analysis; manage risk strictly.

⚡️⚡️⚡️ USOil ⚡️⚡️⚡️

🚀 Buy@ 70.50 - 71.00

🚀 TP 73.00 - 74.00

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Today's Crude Oil Trend Analysis and Trading RecommendationsFrom a daily chart perspective, the violent rally in USOIL driven by external factors has completely disrupted prior technical expectations. The sharp surge has also significantly exhausted future upside potential, explaining today's gap-up and subsequent decline. With minimal likelihood of near-term de-escalation in the Iran situation, USOIL is likely to remain bullish. However, severe overbought conditions on technical charts have disrupted structural expectations, necessitating a price correction.

Technically, the $70-$75 range serves as a reasonable short-term consolidation zone, contingent on no severe escalation in Iran tensions. Given the high probability of worsening tensions, USOIL may retest $75 and even challenge $80 driven by geopolitical developments.

Thus, while the market remains focused on Iran-related risks, the short-term bias remains bullish. Avoid chasing the rally recklessly. Focus on the $70.5-$71.5 pullback zone early in the week—consider long entries only after price consolidation in this area.

USOIL

buy@70.50-71.50

tp:74-76-78

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

Next Week's Crude Oil Trend Analysis and Trading RecommendationsThe continued escalation of geopolitical tensions in the Middle East remains the core driver propelling oil prices higher. With U.S.-Iran relations at a critical juncture and the Ukrainian attack on the Crimean Bridge exacerbating the Russia-Ukraine conflict, markets are increasingly concerned about potential disruptions to Black Sea crude exports. As a key channel for 2% of global crude oil supplies, risks to Black Sea exports directly threaten supply chain security, triggering a surge in short-term market risk aversion and driving oil prices sustainably higher.

Since crude oil broke through the $64.8 resistance level with a solid candlestick last week, we have maintained a consistent bullish stance. After two weeks of consolidative oscillations, prices finally broke free from the trading range, fully demonstrating the dominance of bullish momentum. When oil prices pulled back to the $71.5–$72.0 range last Friday, we once again emphasized the short-term long strategy, which was subsequently followed by a sharp rally catalyzed by news developments. With the current trend clearly defined, we advise trading in line with the momentum: short-term long positions can be initiated above $71.0 at the start of the week.

USOIL

buy@71-72

tp:75-78

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

In - depth: USOIL 1 - hr Chart - Significance of 60.00 Support In the USOIL 1 - hour chart, 60.00 acts as a strong support 💪.

Support Validation

The price twice failed to break 60.00 and rebounded 📈. Psychologically, investors see 60.00 as a key level 🔑. Approaching it, buy orders pour in as they think crude oil is undervalued 📉. Technically, it's on a support line from prior lows, and repeated tests have fortified its support 🛡️.

⚡️⚡️⚡️ USOil ⚡️⚡️⚡️

🚀 Buy@ 60.00 - 60.60

🚀 TP 62.50 - 62.80

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Crude oil: 63.00 resistance & 60.00 support keyPrices are currently testing the upper resistance at $63.00 📈. These levels are suppressing the price 🔻. A decisive breakthrough above this level may trigger a more intense upward rally 🔥. Meanwhile, recent selling pressure has pushed the price down to $60.60 📉. Watch the pivot support at $60.00, the real downward target 🎯

Crude oil surplus expanded in April, and imports increased, reaching multi - month highs from some countries 🌍. If global benchmark oil prices rise in the future, purchases may be reduced 📉.

Crude oil fell first and then rose today 📊. After a deep dive to $60.9, it stabilized and started to rise 🔼. After the previous price increase and adjustment, it remains to be seen if the upward momentum will continue and break through upwards 🔍.

Overall, on the delivery day, oil prices are volatile 🔼🔽. Watch the resistance at $63.0 on the upside and the support at $60.60 - $60.0 on the downside 👀.

⚡️⚡️⚡️ USOil ⚡️⚡️⚡️

🚀 Sell@ 62.50 - 62.30

🚀 TP 61.50 - 60.60

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Summary of the Crude Oil Market This WeekThis week, the crude oil market witnessed a significant decline. Brent crude oil dropped by a cumulative 8.3%, and WTI crude oil fell by 7.5%. Both recorded their largest single-week declines since the end of March.👉👉👉

OPEC+ convened a production meeting ahead of schedule and planned to discuss the production increase plan for June. The market bets that the probability of a production increase is as high as 70%. Previously, OPEC+ unexpectedly announced in April that it would increase daily production by 411,000 barrels starting from May, which is three times the original planned increase. This move aimed to punish member states that had overproduced oil. If production is further increased in June, it will further intensify the supply pressure on the market.

Although the geopolitical tensions in the Middle East region have intensified, such as the postponement of the fourth round of nuclear negotiations between the United States and Iran, which has, to a certain extent, provided support for oil prices, judging from the overall market situation this week, this supporting effect has failed to offset the impact of increased supply and decreased demand.

Overall, this week, under the intertwined influence of factors such as increased supply, uncertain demand prospects, and changes in the geopolitical situation, the crude oil market showed a significant downward trend. The market's expectations for crude oil prices are rather pessimistic, and it is expected that crude oil prices will still face certain downward pressure in the coming period. However, if OPEC+ changes its production increase plan, or if there is an unexpected improvement in the global economy, crude oil prices may rebound.

Bullish on USOILAs the chart shows, in the 1 - hour timeframe, USOIL is in an upward - trending channel 📈. The price fluctuates upwards between two trendlines. Despite pullbacks, the uptrend persists, suggesting short - term bullish dominance. Still, the frequent swings reveal ongoing bull - bear market battles.📈

⚡⚡⚡ USOIL ⚡⚡⚡

🚀 Buy@61.5 - 62.0

🚀 TP 63.5 - 65.0

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟

USOIL may continue to decline due to tariffsRestricted Economic Growth : The United States imposes tariffs, and other countries take countermeasures, intensifying global trade frictions and greatly increasing the risk of economic recession. NIESR predicts that if Trump imposes a 10% tariff on the world and a 60% tariff on China, the global GDP will shrink by 2% and the trade volume will decrease by 6% within five years 😕. The weak economy causes the demand for crude oil in various industries to decline, leading to a drop in the price of USOIL 📉.

Changes in Crude Oil Supply and Demand :

Demand Side: China imposes tariffs on U.S. crude oil, raising the import cost and reducing the import volume. The United States imposes tariffs on energy imports from Canada and Mexico, affecting the crude oil exports of these two countries to the U.S., reducing the demand for crude oil in the United States and putting pressure on the price of USOIL 😟.

Supply Side: After China reduces its imports of U.S. crude oil, it increases imports from other exporting countries, changing the global crude oil supply pattern and possibly strengthening the expectation of a supply surplus. The decrease in U.S. crude oil exports may lead to an increase in domestic inventory, exerting downward pressure on the price of USOIL 😣.

Influenced Market Sentiment :

The uncertainty of tariff policies and the escalation of trade frictions trigger market panic and speculation, intensifying the volatility of the crude oil market. Investors, being pessimistic, sell futures contracts, further driving down the price of USOIL 😨.

This upward movement has led to the clearing of many traders' accounts or significant losses 😫. You can follow my signals and gradually recover your losses and achieve profitability 🌟.

💰💰💰 USOIL💰💰💰

🎯 Sell@61.0 - 61.5

🎯 TP 59.0 - 58.0

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

USOIL-Sell in the 71.6-72 rangeUSOIL has also experienced a strong uptrend recently, driven by news events. However, as we all know, "what goes up must come down"—even in a one-sided market, technical corrections are inevitable. Right now, we are seeing a perfect opportunity for a pullback-based short trade after the sharp rally.

Trading Recommendation:

📉 Sell in the 71.6-72 range

USOIL: Next Week's Blueprint for Profit Amid VolatilityDuring the US trading session on Friday, March 28th, international oil prices fluctuated slightly and declined. However, both Brent crude oil and WTI crude oil remained firmly near their one - month highs and were projected to register "three consecutive weekly gains" on the weekly chart. The ongoing tug - of - war between the supply tightness instigated by geopolitical unrest and the latent concerns regarding an economic downturn has placed oil prices in a volatile state of being "caught between a rock and a hard place".

From the perspective of the USOIL daily chart, following the medium - term trend's breach of the lower edge of the range, it has predominantly fluctuated around lower levels. The oil price has experienced consecutive short - term increases, breaking through the suppression of the moving average system, and the medium - term objective trend has entered a transition phase. Nevertheless, in terms of kinetic energy, neither the bulls nor the bears have demonstrated a clear - cut inclination to overpower the other. It is anticipated that the medium - term trend will persist in its volatile rhythm for a while, awaiting the establishment of a distinct trend direction.

The short - term (1H) trend of USOIL has not continuously set new highs and has exhibited a pattern of high - level consolidation. The short - term objective trend remains upward. In the early trading session, the oil price underwent a narrow adjustment at a high level, presenting an overall secondary rhythm with a sound internal rhythm. The fundamental objective trend during the week has been upward in sync, and it is highly likely that the short - term trend of USOIL will continue its upward trajectory next week.

USOIL

buy@68-68.5

tp:69.5-70

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USOil:Profit realized by shorting on reboundsOn Thursday, crude oil dipped and then rallied towards the end of the trading session, reaching a low of around 69.1. Today, it rebounded to around 69.8 and then started to decline. The short-selling strategy implemented in the morning resulted in a profit.

Next, attention should be paid to whether the upper resistance level of 70 can be broken through. If it cannot be broken through in a short period of time, consider shorting again during the subsequent rebound.

USOIL Trading Strategy:

Sell@69.7-70

TP:68.5-68

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL: Rally, Resistance, and Technical ReversalThe recent trend of USOIL has been continuously rising in a volatile manner, and the current intraday price has reached a three - week high.

Currently, the bullish sentiment in the market is greatly influenced by fundamental news, mainly due to the combined effects of the United States increasing sanctions on Iran's energy and the ineffective and substantive implementation of the 30 - day cease - fire agreement between Russia and Ukraine.

Analyzing the short - term trend from the one - hour chart of USOIL, during the US trading session last night, the crude oil price surged again, hitting the resistance of $69.5 in the market. However, after encountering resistance, part of the bullish momentum took profits and fled, and the price slightly retreated to the support of $69 without further decline.

After today's opening, the bullish momentum was obviously insufficient, and the price did not rise further. The upper track of the Bollinger Bands extended downward, exerting pressure. The moving average of the Macd indicator formed a cross at a high level and has a downward extension trend, and the momentum column began to release downward.

USOIL Trading strategy

Sell@69.5-69

tp:68-67.5

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USOIL Trading Strategy: Secrets to Consistent ProfitsThe situation in the crude oil market has been complex recently.

On the supply side, it is affected by the uncertainty of the OPEC+ production increase plan, the recovery of U.S. shale oil production, and the potential supply risks in Iran.

On the demand side, due to the weak momentum of global economic recovery and trade disputes, demand has been suppressed. However, the rising market expectations of the Federal Reserve's interest rate cut may boost crude oil demand if the loose monetary policy is implemented.

In terms of inventory, although U.S. crude oil inventories have decreased slightly recently, there is still pressure for inventory accumulation, and the decline in the geopolitical risk premium has weakened the support for oil prices.

In the short - term, the crude oil price was blocked and retraced at the upper edge of the trading range. Eventually, it rebounded and recovered, yet failed to break through to a new high. The bullish and bearish forces are locked in a stalemate. Objectively, the short - term trend direction remains unclear, while subjectively, it is biased upward. It is expected that crude oil will break through the resistance at the upper edge of the range and continue to rise today, though with limited upside potential.

USOIL Trading Strategy

sell@68.5-69

tp:67-66.5

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USOIL in Limbo: Will 66 Holdor70 Break? Next week, the trend of USOIL still remains highly uncertain. Technically, the current price is continuously fluctuating within a range. Around $70 serves as a strong resistance level, while $66.05 is a key support level.

Fundamentally, the tense geopolitical situation and the supply decisions of OPEC+ provide some support for oil prices. However, the slowdown in global economic growth, coupled with the increase in US crude oil production, exerts downward pressure on oil prices.

Barring unforeseen events, USOIL is likely to trade in the range of $66 - $70. Once the key levels are broken through, the direction of the trend will become clear. In terms of trading operations, it is recommended to adopt a "buy low and sell high" strategy within the range of $67.5 - $69.5.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USOIL Market Analysis and Tactical InsightsCurrently, USOIL is trading around $67 per barrel.

On the supply side, while OPEC+ plans to increase production, ongoing geopolitical tensions in the Middle East are adding supply uncertainties.

On the demand side, U.S. fuel demand remains resilient, but the subdued global economic outlook may limit crude oil demand growth.

Technically, the daily chart shows moving averages in a bearish alignment, though the short - term RSI suggests relative market strength.

If the price rebounds and faces resistance near $67.9, consider a light short with a target of $66.

If the price stabilizes around $66, a long could be considered, with a target of $67.

USOIL Trading Strategy

sell@67.5-68

tp:66

buy@66

tp:67

I will share trading signals daily. All signals have been consistently accurate for an entire month. If you need them, you can check my profile for more information.

USOIL: BUY

Oil prices have experienced a significant decline due to recent news, with the market oscillating within established support zones. Today's API data is bullish; however, it has not resulted in a notable price increase, nor has it breached the support levels.

As the EIA data release approaches, the likelihood of a positive impact remains high, suggesting a potential for a substantial upward movement. Our trading outlook leans towards buying, positioning for an anticipated rally in oil prices