"US2000/Russel" Index Market Bullish Robbery (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US2000 / Russel 2000" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 3H timeframe (1888.0) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 2111.0 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"US2000 / Russel 2000" Index Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Ussmallcaps

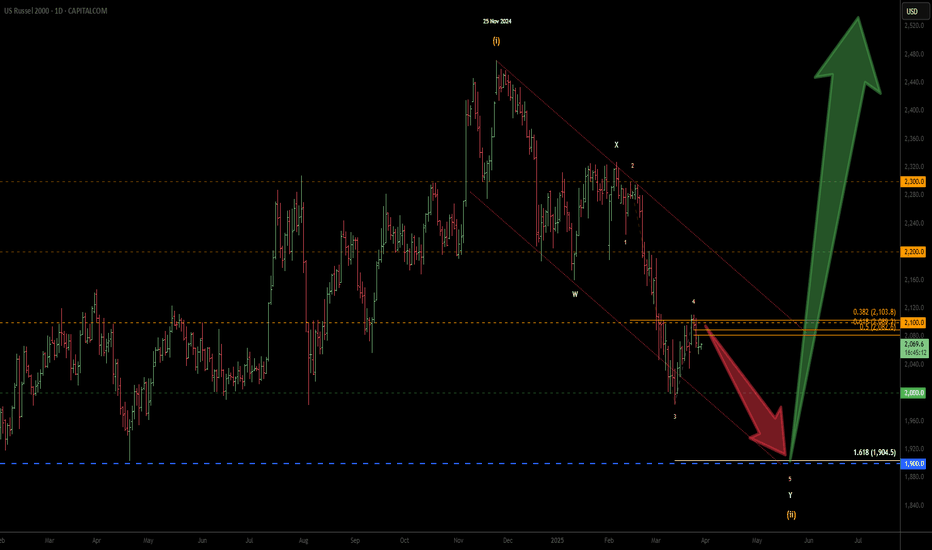

Russell 2000 - C wave to complete correction?I have been bearish on the Russell for a long time. nothing has changed. the wave count is getting clearer... at least for now.

price action as of late has been like watching paint dry on the wall, still waiting for a catalyst... coming soon, i believe.

this count would only be invalidated with a sustained break above resistance zone.

**minor change from my previous charts - i have simplified the wave counts from a (WXYZ) to (ABC).

Russell 2000 - Sell till late May & Buy in Early June?

Wave (ii) is still in progress. Slight update to the primary wave count from the previous one below.

200 & 100 SMA's are sloping firmly to the downside therefore I will continue to keep selling at technical levels. Late May or early June would be a good time to go long...

Support levels are shown in green.

Russell 2000 - 5th wave of Y leg may already be in progress... The rejection at 2100 price level also happens to be the 38.2% Fib of the decline from the 14th of February 2025. The decline from 6th of February 2025 counts beautifully as waves 1, 2, 3 & 4. If this wave count is correct, then the Russell is currently in wave 1 of 5 of Y of (ii).

This is my primary wave count as long as the 2100 resistance is not breached.

This changes my initial wave count from a complex WXYXZ to a simple WXY.

Click on the link to see the previous wave count which is still valid and is now an alternate wave count if the 2100 resistance is breached:

Only updating the wave count. My bias and direction remain the same.

Wave Y is possibly in progress. Looks like we are going to have a bearish April & possibly May as well. Selling corrective rally is still the way to trade for now. Take profit at 1905/1900, which is where technically, the Russell 2000 will possibly turn up for wave (iii).

Stop Loss can be placed above wave 4, well out of the way in case of any wild swing on this PCE Friday.

Russell 2000 Elliott Wave Analysis (WXYXZ in progress)Possible wave (ii) complex correction in the form of a WXYXZ still in progress.

Expecting corrective rally to fail around the 2200 resistance zone.

A final wave down from there should find a bottom around the 1900 support zone where wave (ii) should end.

Expecting wave (iii) to commence from there...

------

*would appreciate feedbacks and thoughts on this*

**this is not a trade recommendation, just an idea that I am working with**

"US2000 / Russell / US Small cap" CFD Index Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US2000 / Russell / US Small cap" CFD Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (2320.0) then make your move - Bullish profits await!"

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 2430.0 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The US2000 indices are currently experiencing a mix of trends. Here's a breakdown of the current market situation:

🔴Fundamental Analysis

The Russell 2000 index, which measures the performance of approximately 2,000 small-cap companies in the US, is influenced by various fundamental factors, including economic indicators, interest rates, corporate earnings, and market sentiment.

🔵Macro Economics

The US economy is expected to experience a slowdown in growth, which could impact small-cap companies. However, the Federal Reserve's decision to keep interest rates low could support economic growth and benefit small-cap stocks.

🟠COT Analysis

The Commitment of Traders (COT) report shows that institutional traders are net long the Russell 2000 index, indicating a bullish sentiment. However, retail traders are net short, indicating a bearish sentiment.

⚪Sentimental Analysis

Market sentiment for the Russell 2000 index is currently neutral, with a sentiment score of 50. The index has experienced a significant rally in recent months, and some investors may be taking profits, leading to a neutral sentiment.

🟡Institutional Trader Positioning

Institutional traders are net long the Russell 2000 index, with a positioning score of 60. This indicates that institutional traders are bullish on the index and expect it to continue rising.

Institutional Traders

- Bullish: 62% of institutional traders are holding long positions, indicating a bullish sentiment.

- Bearish: 38% of institutional traders are holding short positions.

🟢Retail Trader Positioning

Retail traders are net short the Russell 2000 index, with a positioning score of 40. This indicates that retail traders are bearish on the index and expect it to fall.

Retail Traders

- Bullish: 42% of retail traders are holding long positions, indicating a slightly bearish sentiment.

- Bearish: 58% of retail traders are holding short positions.

Please note that these percentages are approximate and based on general market sentiment. They should not be taken as investment advice.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

US2000 / Small Cap / Russell Bullish Robbery Plan To Steal MoneyHola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist US2000 / Small Cap / Russell Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 1h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

MACRO MONDAY 33 ~ U.S. NFIB Business Optimism Index MACRO MONDAY 33 ~ NFIB

National Federation of Independent Business Index (NFIB)

Released Tuesday 13th Feb 2024

Think of the NFIB small business index as a sentiment index, a sort of mood meter for small businesses. The higher the index, the more optimistic small businesses will be about spending more, expanding and increasing or maintaining employees.

The NFIB is the nation’s largest small business advocacy group, with more than 600,000 members from all 50 states. Members are typically small to medium-sized enterprises (SMEs). These small businesses account for roughly 50% of the nation's private workforce and contribute to 44% of all U.S. economic activity making them an extremely important cohort to monitor and survey for economic purposes.

The NFIB Index data

The NFIB Small Business Optimism Index (chart data) is a composite of ten seasonally adjusted components calculated based on the answers of around 620 of the NFIB members. The survey questions cover various aspects of business sentiment, such as hiring plans, sales expectations, capital expenditure plans, and overall economic outlook. The Index figure is derived from all the survey responses, weighted and aggregated to produce a composite score that reflects the sentiment and economic outlook of small business owners.

Baseline Level (100): The baseline level of 100 is often considered the neutral point on the NFIB Index. An index value of 100 indicates that small business owners are neither optimistic nor pessimistic about economic conditions. Values above 100 indicate optimism, while values below 100 indicate pessimism.

On the chart below I note the relevance of the sub 91.5 level as a breach of this level has historically preceded or coincided with recessions (grey areas).

The Chart

The chart is fairly straightforward in that the green zone illustrates the optimistic zone (>100), the pessimistic zone is orange (<100) and the recession zone is red (<91.5).

At present we are moving out of recessionary territory into the pessimism zone which is an improvement but we are a long way from the neutral level of 100. Expectations for Tuesdays release is a slight move higher towards 92.4. If we do move to 92.4 it will be the highest level recorded since June 2022.

NFIB Negative Divergences

Here is a supplemental chart that illustrates how the NFIB small business sentiment index has presented clear negative divergences against the S&P 500 during the last three recessions.

In addition to the negative divergences, thereafter the following trigger events marked the beginning of thee significant drawdown events of each recession;

1⃣ The NFIB index breached below the 100 level in Oct 2000 prior to the Dot. Com Crash

2⃣ The NFIB index breached below the 91.5 index level in April 2008 prior to the GFC capitulation event

3⃣ The NFIB index breached both the 100 (Mar 2020) and 91.5 (Apr 2020) index level during the COVID Crash.

In summary the negative divergences signaled the initial warning signs of recessions, thereafter losing key levels such as the 100 level and 91.5 level signaled the main draw down event initiation.

Not all negative divergences resulted in a recession or poor price action and not all recessions came about after a breach of the 100 level however, both in combination add weight to the probability (but no guarantee's). This chart should not be viewed in isolation but should be added to our other charts to help gauge the likelihood of negative and positive outcomes.

At present the small cap 2000 index is significantly under performing other stock indices which are breaking past all time highs. The small cap 2000 TVC:RUT adds weight to the struggling smaller businesses in the U.S. when combined with the under performing pessimistic reading of the NFIB small business index. A significantly positive reading on the NFIB could be a leading signal that small caps could start to perform again, catching up with the other indices. A negative reading might suggest the small caps 2000 will continue to lag and struggle.

Lets see how we fair on Tuesday for the release of January 2024's survey results

PUKA

Lets see how we fair on Tuesday for the release of January 2024's survey results

PUKA

US Small Cap 3000 at important levelUS Small Cap 3000 - TVC:RUA

Chart is approaching an important boundary

Pennant has clearly formed, compressing price

An upward sloping 200 SMA which is also acting as price support is a positive feature

Lets see how we deal with this diagonal resistance over coming weeks

PUKA

General Major Market Indices - An Overview of the MarketGeneral Major Market Indices

These six market indices give a very good snapshot of where we are in this difficult to discern market and why uncertainty still lingers as we continue to climb a wall of worry.

The Chart

▫️ Every index 1 - 6 below has been rejected or is struggling to make new highs on the weekly timeframe.

▫️ At the same time each chart appears to be finding support on the 200 day moving average (40 week moving average). You could argue that ascending triangles are forming, in which scenario we would await a confirmation breakout above the upper resistance line.

▫️ Charts 1 – 3 appear to be leading charts 4 – 6

- You can see that the DJ:DJT , TVC:DJI and TVC:XMI charts

(Charts 1 – 3) have all attempted to break above the

overhead resistance and have been rejected or are

struggling to break through.

- Conversely the CBOE:SPX , NASDAQ:NDX and TVC:RUA charts

(Charts 4 – 6) have made lower highs and have not

yet reached up and even tested the overhead

resistance... For this reason these charts are

showing relative weakness.

▫️ In prior Macro Mondays it was made very clear that Charts 1 – 3 can provide advance warning of recession and or bear market declines ahead of charts such as 4 – 6. Charts 4 - 6 are showing relative weakness and appear to be lagging charts 1 - 3, for this reason revisiting this snapshot would be beneficial to see can we get a lead on the S&P500, Nasdaq and US Small Caps. This in turn could give us a lead on the entire market.

▫️ At present we are above the 200 day moving average on every chart and the 200 day moving average is sloping upwards ✅

- This is positive and would reinforce an ascending

triangle thesis however at this stage, looking at all

the charts a definitive break above the overhead

resistance line would be a preferred entry with

stop losses placed under that resistance line thats

been broken.

- A revisit of the 200 day moving average could also

be another entry consideration, simply because

again you have stop placed under the 200 moving

average, defined entries with defined stops under

them.

In summary, charts 1 – 3 can act as leading indicators of where price will go next in the general market. Charts 4 – 6 are showing relative weakness, potentially making lower highs however this could change in coming weeks as a strong green candle is challenging the recent highs. Ideally we want to see a definitive break above the overhead resistance levels and we would rather not see further overhead rejections or a breach below the 200 day moving average.

The beauty of Trading View is that you can revisit this exact chart on my page, press play and see if we have we broken through the resistance lines or fallen below the 200 day moving average, all at a glance. Be sure to make use of it to save you the time and effort of reviewing every chart. You can get a the jist of these major indices all with a glance. Regardless I will do my best to update you here on X.

If you like these broader analysis covering multiple stocks in particular index's or in particular sectors, please let me know.

What are the components of each index?

- This is for those of you who are unsure what each index is made up of and what they represent.

1. Dow Jones Transportation Index - DJ:DJT

- The Dow Jones Transportation Average (DJT) is a price-weighted average of 20 key transportation stocks traded in the United States.

- The transportation sector acts as a leading indicator as it is further up the value chain ahead of the final products being sold by companies in Dow Jones Industrial Average $DJI. For this reason, in some circumstances we can use the DJT as a helpful leading indicator for the direction of the economy

2. Dow Jones Industrial Index – SDJI

- The Dow Jones Industrial Average, Dow Jones, or simply the Dow, is a stock market index of 30 prominent companies listed on stock exchanges in the United States. The DJIA is one of the oldest and most commonly followed equity indexes

3. Arca Major Markets Index - TVC:XMI

- The XMI is an overlooked chart often utilized by OG traders has been referenced by Sentiment Trader as a leading market index. XMI is a price weighted index consisting of 20 blue chip U.S Industrial Stocks, 17 of which are also in the Dow Jones Industrial Average. Within the index there is surprising blend of stocks that include transport, travel, food, pharma, energy and technology.

4. S&P 500 - CBOE:SPX

- The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices.

5. NASDAQ 100 - NASDAQ:NDX

- The technology index, the Nasdaq-100 is a market index made up of 101 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It is a modified capitalization-weighted index and includes the likes of NVIDIA and the MAANG stocks (Meta, Amazon, Apple, Netflix and Google)

6. US SMALL CAP 3000 - TVC:RUA

- Small-cap stocks are defined as having a market capitalization between $300 million and $2 Billion. Examples would be Upstart and Victoria's Secret.

Thanks guys

PUKA

US Small Cap 2000 - Bears are in controlUS2000 - Intraday - We look to Sell at 1785 (stop at 1805)

Buying pressure from 1720 resulted in prices rejecting the dip. The current move higher is expected to continue. The bias is still for lower levels and we look for any gains to be limited. We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

Our profit targets will be 1730 and 1630

Resistance: 1780 / 1830 / 1875

Support: 1725 / 1630 / 1530

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

US Small Cap 2000 - Bears are in controlUS Small Cap 2000 - Intraday - We look to Sell at 1790 (stop at 1810)

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible. A higher correction is expected. With the Ichimoku cloud resistance above we expect gains to be limited. We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

Our profit targets will be 1730 and 1630

Resistance: 1780 / 1830 / 1875

Support: 1725 / 1630 / 1555

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Selling rallies on US2000USDUS2000USD - Intraday - We look to Sell at 1880 (stop at 1910)

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible. We are trading at oversold extremes. The bias is still for lower levels and we look for any gains to be limited. We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

Our profit targets will be 1790 and 1730

Resistance: 1830 / 1935 / 2025

Support: 1785 / 1730 / 1640

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.'

The bias is still for higher levels on US Russ 2000US Russ 2000 - Intraday - We look to Buy at 1870 (stop at 1845)

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible. We are trading at overbought extremes. A lower correction is expected. The bias is still for higher levels and we look for any dips to be limited. Preferred trade is to buy on dips.

Our profit targets will be 1940 and 2020

Resistance: 1950 / 2020 / 2140

Support: 1890 / 1830 / 1760

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.'