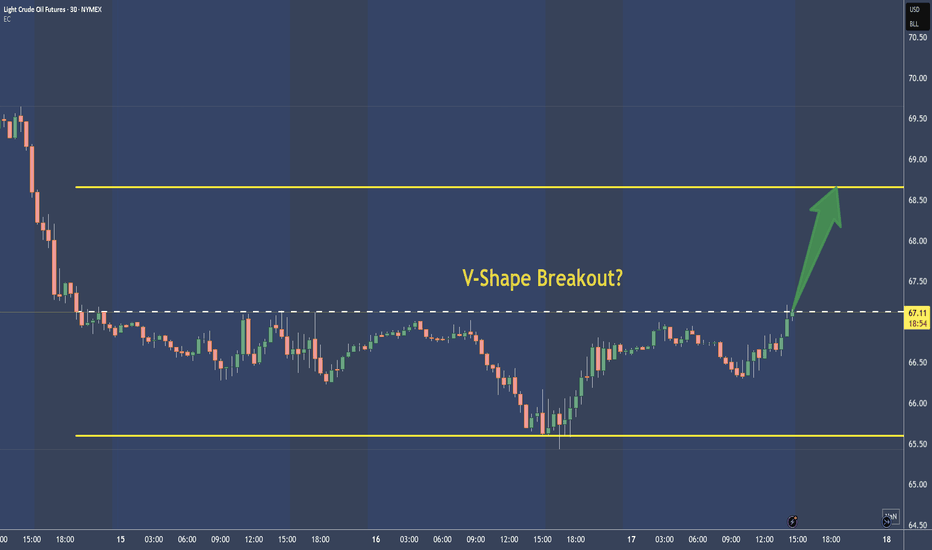

V-shape

Next Support At 1780, Bearish!Hey humans!

Aspen Grey here, hoping my transmission reaches Earth on time!

ETH is clearly in a major bearish pattern that will help fulfill the head and shoulders type pattern you can see on the higher time frames and also in the picture I have published.

In the past, the shape has stopped at the first of supports, like our 1780 line. But the price is also likely to fall if that support will not hold and most likely hit the bottom support I have depicted at 1680.

Then it's either bearish winter hell, which could push us further into the depths but let's hope these institutions keep pumping our coins and maybe we will see an ATH this winter.

Much love!

Aspen Grey

Earthquake tips SOLANA FallSolana pricing research reveals a downward trend.

The resistance level for SOL is $24.89

Support is seen at $23.50.

Recent Solana price research shows that the coin has been moving sideways over the last few days. The inverse has begun to take shape, resulting in bearish pressure. The current price of Solana is $23.61, with a small downward trend in the graph indicating that sellers currently outnumber buyers. The bearish has been in charge for the last few days, generating a headwind for the cryptocurrency.

The resistance level is $24.89, while the support level is $23.50. In terms of volume, Solana has experienced a reduction in buying momentum as well as trading activity during the last several days.

The SPY: The Case of The Mysterious M-ShapeWe have Bullish Divergence an a Bullish Gartley in the form of one of the strangiest M-shape Structures i'v ever seen. I think we will target last week's highs if this plays out and that will then solidify a partial-decline of a much bigger stucture which can be seen in the related ideas section below.

FRACTAL ANALYSIS. V SHAPE RECOVERY. 20% CHANCE. SEE DESCRIPTION.So, i have something to share with you. This is just my vision. JUST MY FANTASY. Let's speak about it now.

***WARNING*** YOU WILL BECOME A MOON BOY/GIRL, SO REMEMBER THAT IT IS ONLY 20% CHANCE.

I used fractal analysis (took a fractal from covid dump and V shape recovery that happened in 2020), to predict what can possibly happen. During Covid dump It was absolutely the same - unpredicted conditions on the markets and bad macro economic factors in general. During 2022 dip in Crypto people has been expecting the CRASH OF FINANCIAL SYSTEM, but in general we received 9.5% CPI rates and this is it. Same was with Covid dump. People has been expecting apocalypses, but economy recovered in 6 months and a lot of people who bought crypto during these dip became a millionaires just in one year (imagine ETH for $80).

According to this theory, i think, that even stock2flow model can be still correct. Just timeframes have been changed.

So lets speak about the cycle. I think, if we will see this option playing out, than overall bullish trend of 2021 was just a pre-bullrun. Real bullrun in this case should happen in 2023 when BTC will hit $300K+ price target. THE FOMO WILL BE ABSOLUTELY UNBEARABLE. And this will be the end of this cycle and we will see another bear market (apx. since september 2023 till september 2024) with an absolute bottom for 1BTC at $70k-80k.

And just enjoy how this fractal perfectly matches everything. So according to this model - we will see $60K+ for 1 BTC at the end of this year. And $300K+ for 1 BTC in the next 12 months. Crazy? yes. Possible? Yes. Will it happen? I would say yes with a 20% chance 😁

Amazon Free Game Downloads for March Gameday Happens in Madden NFL 22. Dominate with Ultimate Team rewards for Prime members and check back each month to claim your packs. All-new features like Next Gen Stats star-drive AI and immersive Dynamic Gameday deliver the most authentic gameplay experience ever.

Surviving Mars

Surviving Mars is a sci-fi city builder all about colonizing Mars and surviving the process. Choose a space agency for resources and financial support before determining a location for your colony. Build domes and infrastructure, research new possibilities, and utilize drones to unlock more elaborate ways to shape and expand your settlement. Cultivate your food, mine minerals, or just relax by the bar after a hard day’s work.

dYdX (DYDX) Buy ZonedYdX (DYDX) Buy Zone

--------------------

BIAS

Mid-Term : Neutral

Long-Term : Bullish

Risk : Medium

Spot and Low-Leverage dYdX that retested its $5.25 zone. Support before rejecting it with strength, meaning we could be heading towards our formed long-term highs in a matter of months.

--------------------

$DYDX/USDT LONG SETUP

Leverage : x3 - x5

Entry Price : 5.25 - 5.6

TP 1 : 5.75

TP 2 : 5.98

TP 3 : 6.25

TP 4 : 6.43

TP 5 : 6.6

TP 6 : 7

TP 7 : 7.8

TP 8 : 8.55

Stop Loss : 5

*Maximum 5% of Portfolio.

*Unload 12.5% at each TP. Whenever TP 2 hits, Move stop loss to entry.

--------------------

dYdX (DYDX) Buy ZonedYdX (DYDX) Buy Zone

--------------------

BIAS

Mid-Term : Bullish

Risk : Medium

After a correction of over 70% from our All Time High of $27.5 down to a low of $6. That's much deeper than initially expected, however it's probably the best move we could’ve seen before a much stronger comeback.

--------------------

$DYDX/USDT LONG SETUP

Leverage : x3 - x5

Entry Price : 7.6 - 8

TP 1 : 8.29

TP 2 : 8.76

TP 3 : 9.31

TP 4 : 9.72

TP 5 : 10.24

TP 6 : 10.76

TP 7 : 11.41

TP 8 : 12.44

Stop Loss : 6.96

*Maximum 3% of Portfolio.

*Unload 12.5% at each TP. Whenever TP 2 hits, Move stop loss to entry.

--------------------

1inch Network (1INCH) Buy Zone1inch Network (1INCH) Buy Zone

--------------------

BIAS

Mid-Term : Bullish

Risk : Medium

Retesting one of our most important long term 1inch Network supports, it's enough of an argument to short this bottom.

--------------------

$1INCH/USDT LONG SETUP

Leverage : x3 - x5

Entry Price : 2.125 - 2.25

TP 1 : 2.335

TP 2 : 2.455

TP 3 : 2.675

TP 4 : 2.87

TP 5 : 3.128

TP 6 : 3.39

TP 7 : 3.725

TP 8 : 4.29

Stop Loss : 1.925

*Maximum 3% of Portfolio.

*Unload 12.5% at each TP. Whenever TP 2 hits, Move stop loss to entry.

--------------------

$ETH / USD -- Mini-Cloud-Bank w/ V Shape RecoveryHello Traders,

Ethereum looks to have formed what I call a mini-cloud-bank patter.

Why, Mini? Because generally speaking Cloud Bank patterns take anywhere from months to years to form, which are followed by a steep 40-60% drop-off with a "V" shape recovery. Clouds usually form during or right before a Bear Market, then take a massive plunge to start a recovery.

Now, my thoughts are, we have mostly seen sideways chop over the last month or so, with some peaks and valleys, before finally dropping 32% from the recent peak. Not speaking too soon, it looks as if the market has found a bottom and has formed a sharp "V" shape recovery, pending no further massive drops.

These types of patterns and market behavior can be ideal for a strong bull run over the next upcoming months for steady and consistent growth to the upside.

Take this with a grain of salt as this is not a true Cloud Bank Pattern but has all of the characteristics of being considered a "Mini" Cloud.

Good luck!

As requested, my view about CLNE! 👍As my follower @shermaine2000 requested, I’ll analyze CLNE today!

There’s a possible V-shape recovery on progress here, target at 10.97. The RSI was oversold, and this favors our idea here. What’s more, it just hit the support at 10.50.

But there’re two problems: The 20ma and the 10.68. Both points can make the price struggle, and this would ruin the V-shape thesis, if we close under these ponts today.

CLNE must quickly break these resistances, or it’ll just hit the next support, at 10.21.

The chances are that we’ll see a bullish run next, the question is: When? The RSI was oversold in the 30min, but in the daily chart it is just ok.

The 10.21 is a bottom for CLNE, and the 20ma is close to this support too. I would say that CLNE is more bullish than bearish, and I’ll set at target at 14. The challenge is in the resistances in the 30min, that could make it move erratically in the next few days.

This is my honest view about it. I hope it helps!

If you liked this trading idea, remember to click on the “Follow” button to get more trading ideas like this, and if you agree with me, click on the “Agree” button 😉.

See you soon,

Melissa.

PLTR: What's the target for us here?Hello traders and investors! Let’s see how PLTR is doing today!

First, in the 1h chart, we have a slow movement, but definitely bullish , as we have higher highs/low , the 21 ema is pointing up, and we can draw a trendline that is working as a support for us.

We can also draw another trendline connecting some of its tops, creating a channel. If PLTR defeats the black line at $ 24.84, it seems the $ 26.20 is the next target, a dual-resistance level , as it meets the upper trendline and the next top.

Now, let’s see the daily chart for a better perspective:

I’m not sure if we can call this a V-shape recovery, as the second leg was too different from the first one. Regardless of the pattern, the $ 24.26 was the first resistance on PLTR.

If it drops again, it might retest the 21 ema, or even the black line at $ 21.20 and the trend will remain bullish. In fact, if it drops to the $ 21.20 again, and if it does a good pattern around there, we might see an IH&S in the daily chart, one of the most powerful reversal patterns in technical analysis.

We shouldn’t be worried here, as PLTR is a great company. Personally, I bought PLTR in the last pullback we had, and I bought it around the $ 20s (and my group bought it as well). If it drops, let’s not panic, as pullbacks are just opportunities to buy.

The gap at $ 31.54 is a good target to aim , in the mid-term. If you liked this analysis, remember to follow me to keep in touch with my free analysis, and support this idea if it helped you!

Thank you very much!

NIO: It hit our target! What's next for us?Hello traders and investors! NIO hit our target at $ 43.13, the technical target for the V-Shape recovery , and we are trading above the target. The link to our last analysis is below this post. What’s next for us?

First, in the 1h chart, since we already defeated the resistance at $ 43.13, this point is supposed to work as a support. Notice that NIO just did an upwards breakout from a trap zone , when it was trading between the 21 ema and the resistance at $ 43.13.

All of these are good news, and NIO has no pullback/reversal sign around . Even if it drops again to the 21 ema in the 1h chart, the bullish thesis would be intact.

Now, to the daily chart:

The only thing that annoys me is the low volume . If NIO loses today’s low, then it can easily retest the 21 ema in the daily chart again. Also, it must not close under the $ 43.13, as the market might see this as a false breakout . Of course, this wouldn’t be enough to change the trend, it would just mean we’ll see a pullback, and since the trend is bullish, this means an opportunity to buy.

But for now, all we can say is that the $ 46.28 is the next target. Let’s keep our eyes open here, and stay alert to these key points.

If you liked this analysis, remember to follow me to keep in touch with my daily studies, and support the idea if you liked it!

Thank you very much!

NIO: The V-shape is almost complete. What's next for NIO?Hello traders and investors! Let’s see how NIO is doing today!

First, NIO filled all the gaps we talked about last week, and it hit our target in the 1h chart , and it is trading above it right now. This movement was expected, but now NIO is close to our target in the daily chart, so, we must be careful. The link to our previous study is below this post.

The volume is good, and we have another gap today . The question is, what kind of gap is this? If it is a common gap, it’ll be filled this week, and NIO will resume the trend. If it is an exhaustion gap, it’ll be quickly filled and it’ll do a bearish reaction in the 1h chart, leading to a pullback in the daily chart.

Speaking of daily chart:

NIO is very close to our target today, the $ 43.13. This is the target for this V-Shape recovery , and again, the volume looks good.

Now, NIO is going up a lot (almost 10% today), and since we are near a resistance, this could be an exhaustion bar. This possibility is not confirmed, and I’m not sure if it will be, but if NIO drops, the 21 ema will be there to hold the price. If NIO does a good reaction around this support, it could be an opportunity to buy.

This week will be decisive for NIO! If you want to keep in touch with my daily updates, remember to follow me , and support this idea if it helped you !

Thank you very much!

BTC - Bear Cycle? Or Possible Bullish Recovery?Bottom Line : Technical indicators are mostly trending from bear towards neutral, and if that continues could flip bullish in the coming week(s); but the market is still fragile, retail investors are fearful, and whales/institutions/media can still manipulate or fud the market into another dump so set tight stoplosses. Unless there is a sudden catalyst for an earlier bullish breakout, we will assume the market is following a U shape pattern, with the earliest -possibility- of a bullish recovery between 5 and 13 June when price action potentially converges on critical moving averages that it needs to retake. Failure to close above those levels could result in deeper corrections.

Background : Starting on 10 May, Bitcoin fell over 50% from a final rejection at ~60k to the deepest part of the correction on 19 May (~28.9k). From there Bitcoin quickly bounced back to over 40k before posting additional corrections and extreme volatility, ranging between 40k to 31k in the days that followed.

This triggered a massive dump of the altcoin market, some coins lost up to 70% of their value before the market began to stabilize on 24 May. The correction also liquidated billions of dollars in overleveraged positions as fear grew to levels not seen since the COVID black swan crash. While terrifying for new traders, this isn't unprecedented in crypto markets. This correction leaves the possibility of resuming the bull market at risk, and all eyes are on Bitcoin going into June.

What is Next? I'm watching the moving averages (20/21w and 200d); I'm watching the ADX and DI (Average Directional Index) and the Stoch RSI. I did my best to forecast out what I think their future direction will be, based on their current trend angles/velocity and that gives us an idea of where the market is potentially heading. We also know that institutions and whales started to buy back into the market so confidence is growing at this price level that strengthens the possibility of this bear around the floor for the correction.

ADX/DI is currently converging into a netural trading action for buyers and sellers, this suggests we will enter a period of consolidation until either buyers or sellers break out. This also supports the U-shape recovery theory, in that the bottom of the U pattern will see price action stabilize and consolidate as traders strengthen their positions and either accumulate or distribute in anticipation of the upcoming breakout.

Stoch RSI is finally showing signs of recovery after being extremely oversold for nearly 9 days. The RSI crossed bullish and is trending up. If our theory of a U-shaped recovery holds true, we'll see the RSI bounce around within it's neutral range reflecting weaker price action- some days being red, some days green. We will watch for a departure from this neutral RSI zone to indicate an imminent movement/breakout in price and we'll validate that possible breakout with increased volume indicators.

From a fibonnacci perspective, the bull cycle's retracement (December to May) was over 70% at peak, but generally closed over the 62% level. 62% is the "golden fib" and a very healthy retracement target from a cycle peak. While further downside cannot be ruled out, this is a range that can be readily respected by the market and serve as a floor for price.

The 20/21w and 200d moving averages, on their current paths, are converging at the latter half of our possible U-shape recovery. This indicates that Bitcoin's price action will meet the bull market's bottom MA supports around 6/7 May, at the 42k resistance level. It will take considerable strength by bulls to break through that range and close over the MAs and 42k resistsance. In this analyst's opinion if we can close over that, the odds of retaking 50k drastically increase, and the odds of resuming a bull market are also greatly increased.

The possibility of a bullish recovery by early /mid June will be invalidated if any of the following occur:

We close below the U-shape channel for over a day

We fail to close above 40k and continue to range/consolidate sideways beyond the U-shape.

Note for New Traders- What is a Bull Market? In my opinion - the minimum requirement for a crypto bull market is thta Bitcoin's price remains over the 20/21 week SMA/EMA, and over the 200 EMA and SMAs. If we remain over them, the market sentiment is generally bullish. When we fall under those, bearish market sentiment rises. We are going on our 10th day below those moving averages. The longest a bull market sat/ranged under these averages was around 2 weeks. The longer you remain under the averages, the greater the odds for a prolonged bear market, versus a short bear cycle within a larger bull market.

LSK Bullish MomentumPublishing this now although I've been buying since one day Ichimoku turned bullish. This appears to be another U-Shape recovery, see my other analysis that are similar on $ARDRBTC. The volume is doing okay at matching u-shape. It trended down, but after turn went way up, so not exactly a U, more like a hockey stick. We'll see if that matters.

I'll start this idea with 2-Day Ichimoku since 1) One day Ichi is full on bullish. and 2) it's trending to go bullish and we can plot bigger targets. Tenkan above Kijun. Price above cloud. Almost bullish: Lagging indicator just below cloud but above price so that a good sign. Cloud trending to bull. I could buy when all indicators turns green, or take the risk on one indicator lagging. I'll take the risk.

Target 1 is 1800 sats. Target 2 is 3260 sats, as marked by the price targets. The second target has a steeper rise because things tend to go parabolic. Also potential for cup and handle (u-shape is cup), so we can plot that when we near target 1.

OGI looking at a turnaround at sub $3Looks like we have a solid bottom on OGI. Assuming the bears don't sell at resistance and overall markets continue to show strength , OGI should rebound hard and easily retest the $3s and $4s resistance. About to break through short term downward resistance. Scaling back in and buying the dips. Cannabis is also an industry in Canada that won't be laying off anyone, it's already "clean" operations (mask, bug free). To add to the bulls, illegal weed online sites are getting shutdown. Look at the seizure of orderweedonline.ca by the RCMP. This is a GOOD time to be a licensed producers as government and law enforcement goes into the "clean up" version of the black illegal market that sells anything.

Don't catch a falling knife or falling plane. Fasten seatbeltsWell, if there was any doubts that trading was much better than investing, this recent market correction certainly proves trading outperforms the investment "buy and hold" trainwrecks! Poor little retired investors who just saw their AC investments chopped in The chart I'm providing today is simple since I'm too busy trading that creating fancy charts. It's a day chart. We are seeing a descending triangle setting up for a formidable reversal pattern when the blood stops gushing from this bird. For AC, if you can't read minute charts, best wait for a confirmed reversal before risking a penny here. Not for the faint of heart or rookies. You need very short term trading abilities to make serious money. Wild volatility makes this a very profitable trade without having to risk short selling at or near the short term lows. Seriously oversold RSI of 11 on the day chart and numerous other time scales. Dangerous both long and short. Don't buy and hold. Don't short and hold here...

Ladies and gentlemen, please fasten your seatbelts. The turbulence is far from over in the wider market and in the Canadian skies.

Stay safe and hug your neighbours in a socially distant way!

Can we expect a U-shape recovery?TVC:SPX

Just a hunch, but is it possible that the markets have baked in a recession and we see a U-shape recovery. Of course, with 2nd quarter earnings to come out, the market will continue to react bearish possibly taking us around 1950. We should expect that the next 2 quarters will show negative growth in GDP indicating the recession everyone is talking about. Hopefully, we do not see any massive layoffs during this period and the stimulus package helps the workers. This is not a financial crisis, but a health crisis that disrupted financial markets. A bull market that lasted over 10 years should help cushion some of the blow. If the market knows this and with further stimulus, I can see a slow recovery that will last through the summer and into elections. A bit of an optimistic view at the moment, but someone has to be.