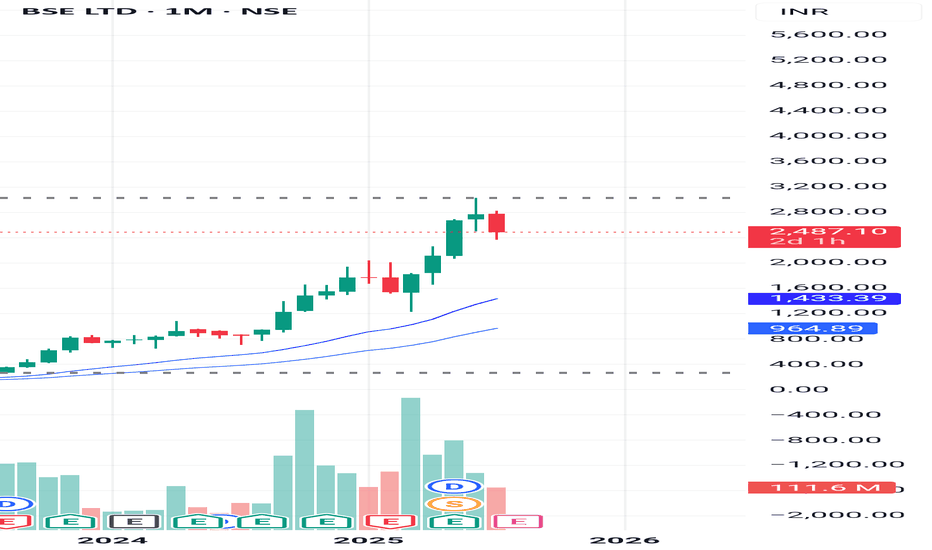

DCF VALUATION ANALYSIS OF BSEConclusion: OVERVALUED

:-OVERVIEW

BSE Limited has shown strong financial growth in recent years. Its revenue jumped from ₹924.84 crore in FY23 to ₹1,592.50 crore in FY24 (a 72% increase), and further surged to ₹3,212 crore in FY25, doubling year-on-year. EBITDA grew impressively to ₹1,779 crore in FY25 with a 60% increase, and EBIT reached ₹1,670 crore, up 56%. Net profit also rose significantly to ₹1,112 crore, with earnings per share increasing to ₹81. Dividend per share improved to ₹23, reflecting healthy returns

DCF:

-The valuation was performed using a Discounted Cash Flow (DCF) approach based purely on verified financial data and market risk parameters without relying on user-specific growth assumptions.

-The cost of equity was calculated using an adjusted risk-free rate plus equity risk premium multiplied by beta, resulting in a discount rate of approximately 13.58%. The terminal growth rate was conservatively taken as 4%. Using these reliable inputs and actual EBIT cash flows, the intrinsic enterprise value was estimated at around ₹36,839 crore, translating to an intrinsic value per share of approximately ₹1,364.

-Currently, BSE’s market price is around ₹2,480 per share, which is substantially higher than the intrinsic value derived from fundamentals, indicating the stock is trading at a significant premium. This valuation is grounded in audited company financials and globally accepted valuation methodologies, providing a trustworthy reference point for investors.

Valuationtrading

ETHEREUM EXPOSED Monthly Charts Say BUY While Weekly Charts Sell🎯 ETHEREUM EXPOSED: Monthly Charts Say BUY While Weekly Charts Scream SELL (Here's What To Do)

Monthly vs Weekly: The Battle of Timeframes

Currently, Ethereum's showing an interesting timeframe divergence that's creating perfect opportunities for different trading styles.

Monthly Timeframe: The Bull Case

- Bullish trend intact

- Currently below Monthly MAC (prime buying zone)

- Clear targets:

- Mid-MAC: $3,000

- High-MAC: $3,422

- Perfect place to buy for position builders and long-term investors

Weekly Timeframe: The Bear Case

- Bearish MAC trend signals active

- Key resistance: $2,636.73

- Valid short entries on H6 timeframe when price reaches this level and above

How to Play Both Sides

Here's the secret most traders miss: These "conflicting" signals aren't a problem - they're an opportunity. Pick your timeframe, stick to your strategy, and ignore the noise.

Ducks in a Barrel Strategy: Almost Perfect Setup

Current conditions show:

✅ Uptrending 39 & 52 Week MAs

✅ Undervalued vs gold & treasuries

⏳ Waiting for: Oversold stochastic

When that third checkmark hits, we're looking at a prime entry setup.

Ready to Master Market Analysis?

While this analysis gives you the blueprint, successful trading requires more than just knowing the levels. I've spent years mastering these patterns and developing foolproof systems for market analysis.

Want to learn how to:

- Spot these setups before the crowd

- Execute with perfect timing

- Manage risk like a pro

- Trade multiple timeframes confidently

- Utilize Commitment of Traders to know how the Commercials (the smartest guys in the

business aka Smart Money), are positioning, and how to ride the wave with these guys.

I'm accepting a small group of serious traders into my inner circle. You'll get:

- Weekly market analysis calls

- Rules Based and Non Discretionary Trading Strategies

- Education to greatly improve your analysis and trading

DM me now if you're ready to level up your trading game. Serious inquiries only.

Trading Disclaimer

TRADING CRYPTOCURRENCIES INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS. Past performance is not indicative of future results. The information provided in this analysis is for educational purposes only and should not be considered financial advice. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change without notice. I am not a licensed financial advisor. All trading decisions and consequences are your responsibility.

Why Smart Money is BEGGING for a Bitcoin Dip (Technical Analysis📈 Why Smart Money is BEGGING for a Bitcoin Dip (Technical Analysis)

MAC Strategy: Your Dip-Buying Blueprint

Monthly and weekly Moving Average Channel indicators are bullish. Here's your shopping list:

- Weekly MAC support: $59,234

- Monthly MAC support: $55,943

These aren't dips - they're gifts. When Bitcoin touches these levels, smart money moves fast.

Ducks in a Barrel Strategy Says "Load Up"

Weekly timeframe say we want to buy the dip. :

- 39 & 52 week MAs trending up and pulling away from each other (bullish momentum)

- Strong uptrend intact in spite of the several months of consolidation..

Perfect storm setup for Ducks in a Barrel:

1. Bitcoin undervalued vs gold/treasuries

2. Stochastic hits oversold at the same time

If you see a Bitcoin dip, REMEMBER: Dips are Gifts.

Stop Missing These Setups

I'll be honest - finding and catching these dips isn't rocket science, but timing is everything. Ready to level up?

- Learn how to implement rules based & non-discretionary trading to become profitable

- Learn to interpret the Commitment of Traders data to gain a major edge in the markets

- Join live market analysis sessions

- Learn my exact entry triggers

- Master risk management

DM me for more information. Serious traders only.

Trading Disclaimer

TRADING CRYPTOCURRENCIES INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS. Past performance is not indicative of future results. The information provided in this analysis is for educational purposes only and should not be considered financial advice. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change without notice. I am not a licensed financial advisor. All trading decisions and consequences are your responsibility.

A Full Scope View of The Magnificent 7Today, we look at the Mag 7 via the following methods.

MAC (Moving Average Channel).

Valuation with Trend.

High Timeframe Divergence.

To summarize, overall, these markets are generally bullish. I outline areas of interest where I will be looking for trades to the long side.

Have a great weekend.

SOYBEANS - Are We Close to a Major Bottom? Cycles Say YES.Here is what I am currently watching for SOYBEANS.

-We need to be aware that there is a major bullish divergence setup (not trigger) developing on the quarterly & monthly charts. We need to pay close attention to this setup, because if triggered/confirmed, it implies a massive move up for Soybeans would be on the horizon.

-Interestingly, the Weekly chart has confirmed bullish divergence. The first target (1090) has not yet been hit, but in my opinion, it looks probable that Soybeans will hit that target (and possibly go as high as the second target (1179). This implies that I believe Soybeans is likely to rally at least 5% in the near future, and possibly rally as much as 10% from current price levels.

-I will be aggressive with taking profits on any short setups that present, due to the bullish weekly divergence that has triggered.

-Utilizing the Weekly MAC & Valuation methods, I note that this market is in an area where we can look for H6/Daily short trades. As mentioned in previous paragraph, I will utilize more aggressive targets.

-The cycles for Soybeans...wow, they are quite something. Decennial cycle suggests significant low being put in, APZ's suggest major low around October 4th, major 5 year cyclical low RIGHT NOW. Other temporary and permanent blended cycles suggest a major low right now. Composite of the 3 most similar years of price action also suggest a major low could happen soon, with a major rally to March 2025.

-A combination of the cycles and the major timeframe bullish divergences have me leaning somewhat towards calling a possible major bottom in the Soybeans market. I would prefer to see commercials COT positioning support this idea, which makes me think maybe we get another nice selloff into the August lows before the real bottom is in. But time will tell.